Countries around the world compete fiercely to attract foreign direct investment (FDI). Their interest in attracting FDI is motivated by the belief that foreign investors not only create jobs, but are also a channel of knowledge transfer across international borders. The nature of these benefits and transfers matters profoundly for policy. Foreign investors are often given tax incentives or tax holidays, in the hope that their affiliates will become a source of knowledge spillovers to indigenous firms.

Indeed, many studies have documented superior performance of foreign affiliates, with a few being able to establish a causal effect. Among the latter, Arnold and Javorcik (2009) found that foreign acquisitions of Indonesian plants resulted in a 13.5% productivity boost after three years under foreign ownership. The rise in productivity was a result of restructuring, as acquired plants increased investment outlays, employment and wages. Foreign ownership also enhanced the integration of acquired plants into the global economy through increased export and import intensity. A similar result was established in the Spanish context where Guadalupe et al. (2012) showed that foreign acquisitions resulted in more product and process innovation and adoption of foreign technologies, leading to higher productivity. The superior performance of foreign affiliates is not surprising given that only the most productive firms are able to incur the fixed cost of undertaking FDI (see Helpman et al. 2004).

But how persistent are the benefits of foreign ownership? Is the superior performance of foreign affiliates due to a one-time knowledge and know-how transfer, or does it depend on the continuous flow of knowledge and headquarter services from the parent firm?

The answer to this question enters the cost-benefit calculation. The length of the tax incentives is usually prescribed by law, and tax incentives cannot be awarded after the foreign parent leaves. But we know little about the horizon over which the benefits accrue. If foreign affiliates retain their productivity advantage even after the foreign parent leaves, the value proposition of such tax policies is much greater than if the advantage evaporates with the parent’s exit.

To shed light on these issues we examine developments in foreign affiliates that were sold by their parents to local owners (Javorcik and Poelhekke, 2016). We use plant-level data from the Indonesian Census of Manufacturing covering the period 1990-2009 and consider cases of foreign affiliates whose ownership was transferred to Indonesian hands. More specifically, we focus on plants that were at least 50% foreign owned and whose foreign ownership dropped to less than 10% (a standard threshold used in the literature to denote foreign direct investment) and remained so for at least three years. We are able to consider 157 cases of divestment where a large set of plant characteristics are observed two years before and three years after divestment and for which observationally similar control plants exist.

To examine the effect of the ownership change we combine a difference-in-differences approach with propensity score matching. To create a missing counterfactual of how foreign plants would have performed in the absence of divestment we use as a control group foreign affiliates similar in terms of observable characteristics, operating in the same narrowly defined industry in the same year, which remain in foreign hands. Then we compare changes in various aspects of plant performance between the year prior to divestment and years following the ownership change among the treated (divested) plants and the control group.

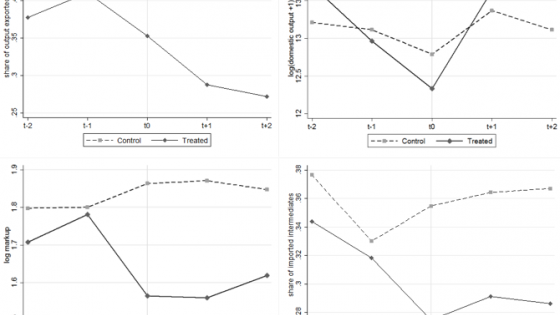

The results indicate that the effects of divestment are not only statistically significant but also economically meaningful. Divestment is associated with a 0.038 log point productivity drop between the year prior to the shock (t-1) and the year of divestment (t0). The decline registered in the year of ownership change persists, as shown in Figure 1, which tracks the level of TFP for both groups of firms over time.

Figure 1. Trajectories of divested and control plants: TFP (left) and output (right)

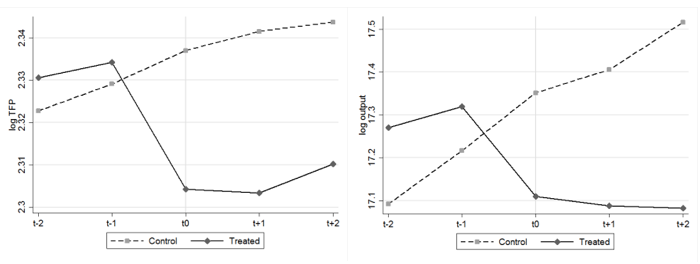

A large and growing gap in output emerges between the divested plants and the control group. It ranges from 0.35 log points in the year of divestment to 0.54 log points two years later. This gap is driven by export sales, as shown in Figure 2. The decline in output is accompanied by lower mark-ups and lower reliance on imported inputs.

Figure 2. Trajectories of divested and control plants: export share, domestic sales, mark-ups, and imported inputs (clockwise, from top-left)

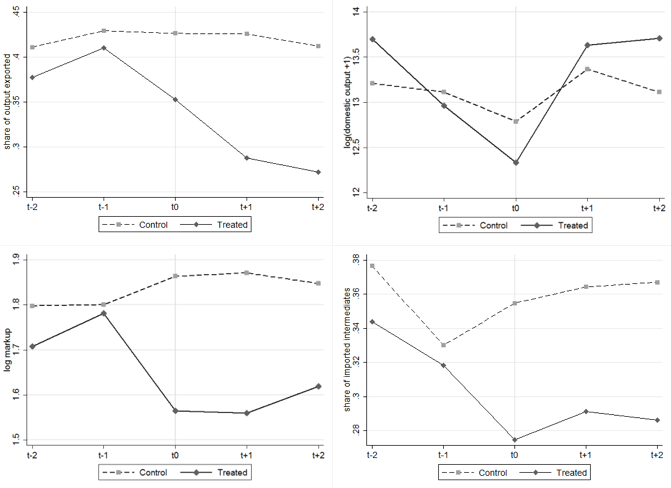

Perhaps to compensate for the smaller scale of production, divested plants lower their employment by shedding production workers (see Figure 3). Blue-collar employment goes down by 0.153 log points in the year of divestment relative to the control group, although in the subsequent years the difference between the treated and the control plants ceases to be statistically significant. Interestingly, we do not find statistically significant effects of divestment on the probability of exit, investment or access to various sources used to finance investment (except for reinvested earnings). However, we do find that affiliates initially set up as greenfield projects experience a larger negative effect on their performance after divestment.

Figure 3. Trajectories of divested and control plants: Total, blue-collar and white-collar employment, and wages (clockwise, from top-left)

The observed pattern is consistent with sold affiliates being partially cut off from the distribution network of their former parent company which results in a negative demand shock. However, the negative effect of divestment on productivity and output is also present in affiliates that did not export prior to divestment. This suggests that the worsened performance may also be due to the loss of access to knowledge and know-how provided by the headquarters of the former parent as well as by possible departure of expatriate managers employed by the former foreign parent.

In sum, our findings are broadly consistent with the view that the superior performance of foreign affiliates observed around the world is driven by continuous injections of headquarter services from the parent company to their overseas affiliates. To the best of our knowledge, this is the first study to document this pattern.

Our findings have implications for the design of FDI incentives. They suggest that any externalities associated with the presence of foreign affiliates are likely to fade away after foreign owners leave.

References

Arnold, J. and B. S. Javorcik (2009). “Gifted Kids or Pushy Parents? Foreign Direct Investment and Firm Productivity in Indonesia.” Journal of International Economics, 79(1), 42-53.

Guadalupe, M., O. Kuzmina and C. Thomas (2012). “Innovation and Foreign Ownership.” American Economic Review, 102(7), 3594-362.

Helpman, E., M. J. Melitz and S. R. Yeaple (2004). “Export versus FDI with Heterogeneous Firms.” American Economic Review, 94(1), 300-316.

Javorcik, B. S. and S. Steven Poelhekke (2016). “Former Foreign Affiliates: Cast Out and Outperformed?” Journal of the European Economic Association, forthcoming.