The long-lasting effects of a financial crisis on the real economy are not well understood, as the crisis, by nature, is a short-run event. As Kozlowski et al. (2016) argue, the existing explanations assume that the shocks triggering a persistent recession are continuous. They also explain that a one-time crisis changes people’s expectations of tail risks indefinitely. In this column, I focus on another persistent change in the real economy due to short-run financial crises – the accumulation of huge amounts of excessive debt by firms and households. In a recent paper, my co-author and I argue that a one-time build-up of excessive debt can depress the economy interminably even if there is no change in financial technology (Kobayashi and Shirai 2017).

Whether or not the buildup of debt can cause a persistent recession is of practical importance when we assess policy recommendations. If persistent stagnation is due to exogenous technological shocks (Gertler and Kiyotaki 2010, Christiano et al. 2015) or an unwavering change in expectations of tail risks (Kozlowski et al. 2015), policymakers can mitigate a recession simply by accommodative monetary and fiscal policies. In contrast, they can do nothing to directly eliminate exogenous shocks or expectations of tail risks. If, on the contrary, a recession is due to the accumulation of excessive debt, they can tackle it by simply reducing debt. Debt reduction is not necessarily the liquidation of overly indebted borrowers, but may involve debt forgiveness or debt-for-equity conversions. Even in this case, unconventional monetary and fiscal policies may mitigate the severity of a recession, but ultimately, they only buy time and cannot provide a solution to the recession itself. At the very least, we can say that if excessive debt is the problem behind an episode of persistent stagnation, it may be necessary to expand choices for policymakers. Choosing among monetary easing, fiscal policy, and ex ante macro-prudential regulations may not be a satisfactory framework for policy debate, but we may need to explicitly compare them with ex post policy measures in order to accelerate debt reduction in the private sector.

Why does excessive debt cause persistent stagnation?

Our model is based on an economy where an excessive amount of inter-temporal debt works as debt overhang that tightens the borrowing constraint for working capital, i.e. intra-temporal debt. Debt overhang (Myers 1977) has not been considered as an issue of macroeconomic policy because it is usually resolved quickly through the bankruptcy process at the firm level. Lamont (1995) shows that debt overhang can cause a recession when it creates an externality, but it should be short-lived and the problem would resolve itself fairly quickly. In our model, debt overhang is potentially permanent at the firm level, and can cause a persistent recession at the aggregate level, which can be interpreted as ‘secular stagnation’.

Our model is similar to Jermann and Quadrini’s (2012) theory, with the important difference that the lender can seize a portion of output unilaterally from the defaulted borrower before starting renegotiation during the bankruptcy procedures. This difference enables the lender to make working capital loans to the borrower even when he or she already holds the maximum amount of debt. The banks are willing to lend small amounts of working capital to debt-ridden firms, because the loans are secured by their ability to seize unconditionally a portion of output when the borrowers default. In Jermann and Quadrini’s (2012) model, the borrower who owes the maximum amount of debt cannot borrow working capital, so it stops production and exits the market immediately. In this way, the inefficiency of debt overhang disappears quickly in their model, while it may continue indefinitely in our model. This is because firms with maximum debt can continue production, albeit inefficiently, by borrowing a small amount of working capital. We call such a firm debt-ridden.

A large number of debt-ridden borrowers emerge as a result of a financial crisis. This is because a financial crisis is typically associated with plummeting asset prices in real estate and stock markets. These assets have been used as collateral to secure debt, and low prices make a substantial part of the debt unsecured, which works as debt overhang. The emergence of a huge number of debt-ridden firms may lower productivity growth at the aggregate level, as the tightened borrowing constraints depress R&D activities by the firms.

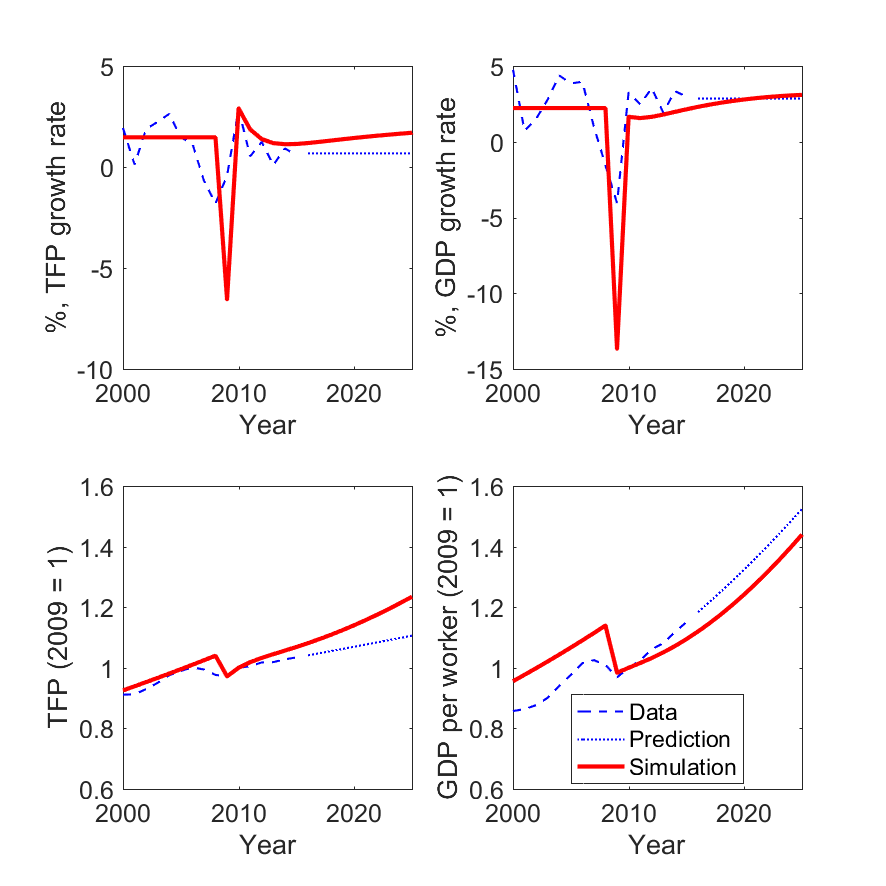

Our model can replicate the levels and the growth rates of GDP per capita and total factor productivity (TFP) of the US, as we see in Figure 1. In this numerical experiment, we assume that 60.7% of firms became unexpectedly debt-ridden in 2009. Figure 1 shows that the buildup of excessive debt can account fairly well for the persistent economic slowdown in the aftermath of the Global Crisis.

Figure1 US economy (GDP per capita and TFP, levels and growth rates)

Sources: Kobayashi and Shirai (2017); Fernald (2012)

Note: The data exist until 2015, and we extend the observed GDP and TFP to 2025. We posit that the variables grow in future periods by constant growth rates, which equal the average growth rates in 2011-2015. This extension is based on the implicit assumption that the US economy has fallen into a decade-long stagnation.

Debt reduction as a macroeconomic policy

Pointing out the long-lasting ineffectiveness of monetary policy, Sims (2016) proposes another unconventional monetary-fiscal policy tool – using deficit financing of government spending to push up the price level. The persistent weakness in the real economy after a financial crisis is one factor behind the ineffectiveness of monetary policy. Our study indicates that relief from excessive debt for debt-ridden borrowers can strengthen the real economy, which can then create an environment where conventional monetary policy works well. Eventually, reducing excessive debt could make unconventional monetary policy unnecessary. This line of thought may lead to a notion that debt reduction after a financial crisis can work as a macroeconomic policy that restores economic growth. Debt reduction here does not necessarily mean physical liquidation of debt-ridden firms. Our model implies that relief of debt-ridden borrowers from excessive debt can improve their own efficiency, thus helping aggregate productivity in the overall economy.

Our theory implies that when borrowers are debt-ridden, banks have no incentive to forgive excessive debt burdens. This is because banks are satisfied with repayments from debt-ridden borrowers, even though the borrowers themselves suffer from inefficiency due to debt overhang, which in turn depresses the aggregate economy. In the ‘laissez-faire’ environment, debt-ridden firms stay in the market once they emerge, and the aggregate inefficiency becomes persistent. Thus, the excessive debt does not resolve itself in the market. This implies that the wait-and-see strategy of the government, which essentially is just buying time using unconventional monetary and fiscal policies, does not work. Active interventions by the government are therefore necessary to restore economic growth in a timely manner by promoting debt restructuring or wealth redistribution from lenders to borrowers.

Policy measures may include regulatory reforms to make bankruptcy procedures less costly and more debtor-friendly, promoting debt-for-equity conversions to reduce outstanding debt, and the injection of subsidies (or equity) in the banks that forgive debt and write off non-performing loans. Using bank subsidies or equity is usually interpreted as bank recapitalisation, because banks often become insolvent when a substantial number of their borrowers become debt-ridden. This policy implication is straightforward and seems reasonable based on our experience of recent financial crises in Japan (1990s) and in the US and Europe (since 2008), whereas existing theories do not spell out clearly whether borrowers' relief from excessive debt is good for a crisis-hit economy.

Editor’s note: This column was reproduced with permission from the Research Institute of Economy, Trade and Industry (RIETI).

References

Christiano, L J, M S Eichenbaum and M Trabandt (2015), “Understanding the Great Recession’’, American Economic Journal: Macroeconomics 7(1): 110-167.

Gertler, M and N Kiyotaki (2010), “Financial intermediation and credit policy in business cycle analysis’’, Handbook of Monetary Economics 3(3): 547-599.

Jermann, U J and V Quadrini (2012), “Macroeconomic effects of financial shocks’’, American Economic Review 102(1): 238-271.

Kobayashi, K and D Shirai (2017), “Debt-ridden borrowers and economic slowdown’’, CIGS Working Paper 17-002E.

Kozlowski, J, L Veldkamp, and V Venkateswaran (2016), “The tail that wags the economy: The origin of secular stagnation’’, VoxEU.org, 11 September.

Kozlowski, J, L Veldkamp, and V Venkateswaran (2015), “The tail that wags the economy: Belief-driven business cycles and persistent stagnation’’, NBER Working Paper No. 21719.

Lamont, O (1995), “Corporate-debt overhang and macroeconomic expectations’’, American Economic Review 85(5): 1106-1117.

Myers, S C (1977), “Determinants of corporate borrowing’’, Journal of Financial Economics 5(2):147-175.

Sims, C (2016), “Fiscal policy, monetary policy and central bank independence.’’ Jackson Hall lunch-time talk, August 26.