There remains considerable debate regarding the causes and consequences of recessions. Two views that are often presented as opposing, and which created controversy in the recent recession and its aftermath, are:

- The liquidation perspective of Hayek; and

- The aggregate demand perspective of Keynes.1

The Hayekian perspective is generally associated with viewing recessions as a necessary evil. According to this view, recessions mainly reflect periods of liquidation resulting from past over-accumulation of capital goods. Some refer to this view as the hangover theory of recessions (see Paul Krugman 1998). In a situation where it is widely recognised that the economy has over-accumulated capital in the past, it is not hard to see why this can lead to depressed spending on investment and consumption by individuals.

The more controversial aspect of the Hayekian perspective is to argue that government spending aimed at stimulating activity is not warranted in such a situation since it would mainly delay the needed adjustment process and thereby postpone the recovery. US Secretary of the Treasury A. Mellon held a variant of this view during the great depression.2 Some considered this to be an appropriate description of the Asian crisis of 1997 and of the two most recent US recessions.

In contrast, the Keynesian view suggests that recessions reflect periods of deficient aggregate demand. Here, the economy is not effectively exploiting the gains from trade between individuals. According to this view, policy interventions aimed at increasing investment and consumption are generally desirable, as they favour the resumption of mutually beneficial trade between individuals.

Not as different as you might imagine

In a recent research paper (CEPR discussion paper No. 9966), we argue that those two views may not be as conflicting as they first appear. They may simply reflect two sides of the same coin.

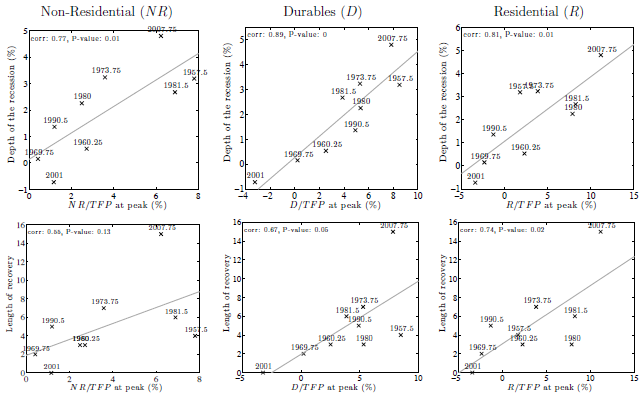

To motivate this discussion, we begin by documenting that over the last 70 years US recessions have generally been longer and more severe when they have been preceded by periods of particularly high accumulation of physical capital goods, durable goods, or houses. This is illustrated in Figure 1, where we plot two measures of the severity of a recession against a measure of capital ‘over-accumulation’ prior to the recession.

Figure 1. Depth of recession and length of recovery vs. cumulated investment

Note: Horizontal axis is capital ‘over-accumulation’, defined as cumulated investment over past 10 years, divided by TFP and detrended using a cubic trend. Vertical axis is either depth of recession, measured as percentage difference in real GDP from peak to subsequent trough, or length of recovery, measured as the number of quarters it takes for real GDP to reach again the peak level. Data are from the US postwar National Accounts, and business cycle dates are from the NBER.

As can be seen in this figure:

- There is a very strong positive correlation between our measure of capital over-accumulation prior to a recession and either of our two measures of the subsequent severity of the recession.

This evidence provides support to the first premise of the liquidationist view. It shows that severe recessions have generally been preceded by periods of very high investment relative to the economy’s needs, as measure by the economy’s level of productivity (TFP).

- Severe recessions were generally preceded by high accumulation of all three classes of capital: housing, durables, and physical capital.

This pattern would be consistent, for example, with over-accumulation caused by periods of excessively lax credit. However, these ‘Hayekian’ facts do not necessarily imply that liquidation without public intervention is desirable.

We believe that the process of liquidation has a natural tendency to put the economy into a ‘Keynesian’ regime, characterised by excessive unemployment and deficient aggregate demand. It is in this sense that we view the liquidation and aggregate demand perspectives as closely linked.

Our approach

To reconcile the Hayekian and Keynesian perspectives, we focus on how the economy adjusts when it inherits from the past an excessive amount of capital goods, which could be in the form of houses, durable goods, or productive capital. The main starting part of our analysis is the recognition that in a market economy not all relevant trades are conducted simultaneously. Instead, economic participants often have to bear the risk of not being able to trade in a subsequent market. For example, someone may be required to make a consumption decision before knowing whether he will keep his job or be unemployed. Hence, if he perceives unemployment risk to be high, he may refrain from consuming, which will depress aggregate demand, which in turn can increase unemployment risk.

In this analysis, we do not focus on the question of why the economy may have over-accumulated in the past, but instead concentrate on understanding how it reacts to an over-accumulation once it is realised.3 As suggested by Hayek, such a situation can readily lead to a recession as less economic activity is generally warranted when agents want to deplete past over-accumulation. However, we argue that the liquidation process has the side effect of igniting unemployment risk and inducing excessive precautionary savings behaviour. As a result:

- The size and duration of the recession induced by the need for liquidation is generally not socially optimal.

- The reduced desire to trade during a liquidation period creates a multiplier process that leads to an excessive reduction in economic activity.

Although prices are free to adjust, the liquidation process creates a period of deficient aggregate demand where economic activity is too low because people spend too cautiously due to increased unemployment risk.

To understand the argument, it is helpful to divide the process into rounds.

- In a first round, individual spending is lowered because economic agents need to liquidate their excess stock of capital, durable goods, or houses.

This first round is an efficient response to the past over-accumulation, and the Hayekian view generally stops here.

- In the second round, now that spending is low, this increases the risk of being unemployed, which boosts precautionary savings and further reduces demand.

This second round, and similar subsequent rounds of adjustment, are inefficient and lead to an excessive fall in economic activity. This reflects a type of multiplier process associated with Keynesianism.

In this sense, we argue that liquidation and deficient aggregate demand should not be viewed as alternative theories of recessions, but instead should be seen as complements, where past over-accumulation may be the key driver of later periods of deficient aggregate demand.

Trade-offs faced by policy

Our perspective highlights the trade-offs faced by policy. In particular, a policymaker in our environment faces an unpleasant trade-off between the prescriptions emphasised by Keynes and Hayek.

- On the one hand, a policymaker would want to stimulate economic activity during a liquidation-induced recession because precautionary saving is excessively high.

- On the other hand, the policymaker also needs to recognise that intervention will likely postpone recovery, since it slows down the needed depletion of excess capital. In our framework, both of these forces are present and can be compared.

Although it is not a priori clear why one force would always dominate, we find that during liquidation periods, stimulative aggregate demand policies are generally socially optimal, as the laissez-faire economy produces a recession that is excessively deep and painful. However, the cost of this intervention is that it prolongs the recession, as suggested by Hayek, rather than stimulating a quick recovery, as some Keynesians may want to believe.

Given this reasoning, one should not be surprised that full recovery is delayed as a result of intervention during a liquidation-driven recession, but that does not mean that the intervention was undesirable. In fact, the intervention is desirable precisely because the laissez-faire economy will tend to liquidate too much and too quickly.

Secular stagnation

This research also sheds some light on the recent debate on secular stagnation, as put forward by Lawrence Summers. The type of decentralised market economy that we consider functions quite efficiently in growth periods when it is far below its balanced growth path, while simultaneously functioning particularly inefficiently when it is near its balanced growth path.

- When the economy is far below its balanced growth path level of capital, demand for capital is very strong and unemployment risk is therefore minimal.

- When the economy is close to its balanced growth path, it will generally be in an unemployment zone because investment demand will be low.

The associated unemployment risk then causes households to increase precautionary savings, which in turn sustains excessive unemployment, giving rise to a permanent paradox of thrift situation in which abundance creates scarcity.

Concluding remarks

While the main mechanism in our theory has many precursors in the literature,4 we believe that our setup illustrates most clearly:

- Why recessions may reflect periods of liquidation;

- Why liquidations may be associated with an inefficient adjustment process induced by unemployment risk and precautionary savings; and

- Why policy aimed at stimulating the economy during a recession may be desirable even if it delays the full recovery.

References

Beaudry P, D Galizia and F Portier (2014), “Reconciling Hayek's and Keynes' views of recessions”, CEPR Discussion Paper 9966, NBER Working Paper 20101.

Beaudry, P and F Portier (2004), “An exploration into Pigou’s theory of cycles,” Journal of Monetary Economics, 51(6), 1183–1216.

Bordo, M D and J Landon-Lane (2013), “Does Expansionary Monetary Policy Cause Asset Price Booms; Some Historical and Empirical Evidence,” NBER Working Papers 19585, National Bureau of Economic Research, Inc.

Guerrieri, V and G Lorenzoni (2009), “Liquidity and Trading Dynamics,” Econometrica, 77(6), 1751–1790.

Heathcote, J and F Perri (2012), “Wealth and Volatility,” Meeting Papers 914, Society for Economic Dynamics.

Krugman, P (1998), “The Hangover Theory”, Slate, December.

Mian, A and A Sufi (2010), “The Great Recession: Lessons from Microeconomic Data,” The American Economic Review, 100(2), 51–56.

Mian A, A Sufi and F Trebbi (2010), “The Political Economy of the US Mortgage Default Crisis,” The American Economic Review, 100(5), 1967–98.

Wapshott, N (2012), Keynes Hayek, The Clash that Defined Modern Economics, W. W. Norton & Co.

1 See Wapshott (2012) for a popular account of the Hayek-Keynes controversy.

2 Andrew W. Mellon is famous for his policy advice to President Hoover: “liquidate labour, liquidate stocks, liquidate the farmers, liquidate real estate…. It will purge the rottenness out of the system.”

3 There are several reasons why an economy may over-accumulate capital. For example, agents may have had overly optimistic expectations about future expected economic growth that did not materialize, as in Beaudry and Portier (2004), or it could have been the case that credit supply was unduly subsidised either through explicit policy, as argued in Mian and Sufi (2010) and Mian, Sufi, and Trebbi (2010), or as a by-product of monetary policy, as studied by Bordo and Landon-Lane (2013).

4 Our model structure is closely related to that presented in Guerrieri and Lorenzoni (2009), and also shares many features with Heathcote and Perri (2012).