World leaders, after a false start, have made decisions that at least give us a chance of getting past this crisis. Now is the time to start thinking about how to reduce the risk of finding ourselves in the same situation in the future.

Many troubled intermediaries violated no rule or regulation. It is certainly right to replace greedy managers. The same decision should be taken for those responsible for designing the wrong rules for bank capital, rating agencies, and accounting standards. The same approach should be taken for supervision: those who did not abide by the rules must be severely punished, along with those who were not able to supervise.

Who is in charge?

The crisis calls into question the efficacy of both the “horizontal” allocation of competencies among different authorities (fragmentation in the US or the single regulator in many EU countries) and the “vertical” distribution of competencies, where only national entities appear to be in charge of supervision (in the US there is a mix of federal and state competencies on banks while only states supervise insurance; in Europe, lacking a political and fiscal union, the agencies are basically all at the member state level). The central banks’ role swings from monetary policy to lender of last resort to policy-maker, as we have observed over the last year and more so in the past few weeks.

In the beginning, UK central bankers panicked in the face of a textbook bank run. Then, all authorities hysterically moved to restrict short selling. Late night meeting of EU ministers to bail out transnational banks, frantic decisions across Europe to raise deposit insurance coverage beyond credible levels, and guarantees for all interbank loans followed. Looking at the ways such policies have been used for recent bailouts has raised doubts about their efficacy. All the traditional instruments have been exploited (sometimes in a creative way or mixed together): direct government intervention, central bank intervention, deposit insurance, and other guarantees. All kinds of intermediaries are involved: commercial and investment banks, investment and hedge funds, investment firms, and insurance firms. The traditional three-way division of the financial system into banks, capital markets, and insurance has been finally defeated by the events.

The huge need for fresh capital (through direct injection of capital or loans, the purchase of toxic assets, new rules on deposit insurance, etc.) remind us of a simple concept: bailouts must ultimately be the responsibility of the government, only possibly assisted by the authority and the central bank (which are independent agencies). On the contrary, bail out decisions are often taken by central banks, as lenders of last resort, or competent authorities (sometimes central banks), who should have been, on the contrary, supervising the entity so that it did not go bankrupt. Furthermore, no lender of last resort has the access to the money needed for direct intervention in extreme cases: the net result of the Fed’s intervention in the AIG case is its loss of independence from the US Treasury.

Central banks and competent authorities already have too many conflicts of interest in carrying out different objectives (macroeconomic stability, prudential supervision, investor protection or competition). They are worse if those objectives are those of the policy maker (national interest, bailing-out of a big intermediary). Furthermore, national and international coordination among authorities is slow and cumbersome, with hundreds of bilateral and multilateral memoranda of understanding or colleges of supervisors on financial conglomerates. The Level 3 Committees (Cebs, Cesr and Ceiops), in spite of excellent but limited permanent staff, depend wholly on their constituent authorities and have rigidly tripartite competence (banks, securities and insurance) according to an obsolescent framework.

In spite of progress in recent years, the system is still unable to effectively respond to the challenges of a largely integrated market. This has two regrettable consequences. It offers inadequate protection for investors and citizens (taxpayers) and it creates an extra regulatory burden entailing a loss of competitiveness for financial industry.

It is too early for one (or more) central regulator (s) and supervisor (s) at the European level. Lacking a political union, still too many different rules exist (commercial codes, company laws, failure procedures, corporate governance) and policy-makers and taxpayers remain national. But is certainly too late to keep only national authorities.

Reorganising financial supervision into four peaks

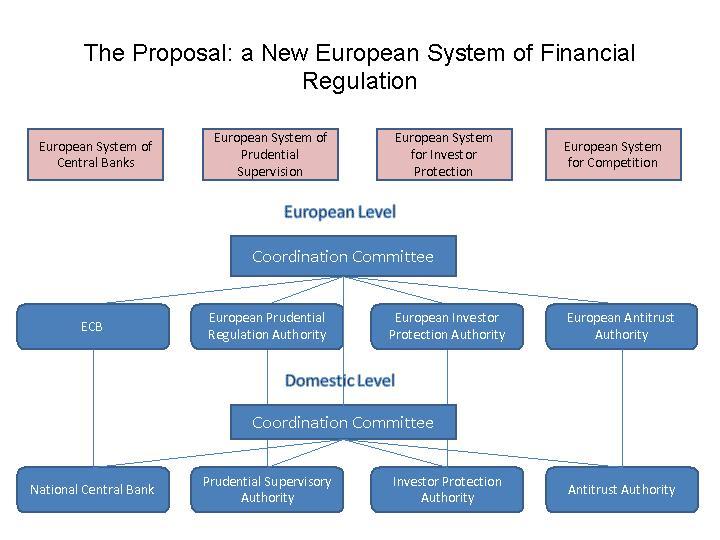

Something can be done. A feasible solution, already suggested some years ago1 and identified as the optimal long-term regulatory structure by the Paulson report2, is the four-peak model (see Figure 1). Regulation and supervision should be arranged horizontally by objective – separate agencies should be in charge of macroeconomic stability, microeconomic stability, investor protection and competition for all intermediaries including insurers. Each of these objectives should also have a federal structure, with a structure similar to the one established for the European System of Central Banks (ESCB).

Figure 1 The proposal: a New European System of Financial Regulation

The ESCB should have responsibility for macrostability issues and lending of last resort throughout the EU – not just the Euro area, so to avoid awkward meetings with UK fellows.

Then a European System of Prudential Supervisors should be established, using possibly the expertise of the ECB, national central banks, Cebs and Ceiops. The system should denote a central entity in charge of the prudential regulation of all intermediaries and of the coordination of the national authorities, possibly designed by objective in each country. The national prudential supervision authorities should be in charge of all supervision but not regulation.

The third peak should be a European System for Investor Protection. The structure should be similar as above. A central entity, exploiting Cesr expertise, should be in charge of all regulation of conduct-of-business rules of all intermediaries, including insurance and pension funds, transparency of all financial products (from banking deposit to insurance contracts), and issuers and markets. Some supervision should be exercised in case of multinational intermediaries or issuers. National authorities should focus only on supervision.

The fourth peak, that of competition, already exists with a central entity (DG Competition) supervising relevant operations while national authorities supervise smaller operations.

Apart from this vertical form of coordination, cooperation would be also desirable horizontally, at both the European and national levels. This coordination, and resolution of eventual controversies could be provided by special Commissions for the Supervision of the Financial System established at the EU Council Level (with the Commission, too) and at national treasuries.

How to implement it? Many difficulties are obvious. Treaty changes are complicated (but why not explore the route of intergovernmental agreements?). Commission or EU regulation must be carefully analysed, as well as the possibility offered to the Council by Article 352 (ex Article 308 TEC) of the Treaty3. The opposition of existing central bank and national supervisors to some centralisation and redesign of competencies at national level is enormous.

The existing crisis offers the (hopefully last!) occasion to act in order to increase the efficacy of financial supervision, simplifying the complex architecture of existing authorities. In the US, Secretary Henry Paulson did not dare to put a single word of his Blueprint in the TARP. And in Europe? The "financial crisis" cell4 created by the European Council two days ago is not sufficient; let's do something more!

Footnotes

1 Di Noia e Di Giorgio (1999), Should Banking Supervision and Monetary Policy Tasks be Given to Different Agencies, International Finance; Di Giorgio e Di Noia (2001), Financial Regulation and Supervision in the Euro Area: A Four-Peak Proposal.

2 Department of Treasury (2008), Blueprint for a modernized financial regulatory structure.

3 If action by the Union should prove necessary, within the framework of the policies defined in the Treaties, to attain one of the objectives set out in the Treaties, and the Treaties have not provided the necessary powers, the Council, acting unanimously on a proposal from the Commission and after obtaining the consent of the European Parliament, shall adopt the appropriate measures.

4 See http://www.consilium.europa.eu/ueDocs/cms_Data/docs/pressData/en/ec/103441.pdf