Many empirical studies use cross-section data to estimate Mincer regressions of log earnings on years of schooling and (potential) experience (see the review articles by Card 1999, Harmon et al. 2003, Psacharopoulos and Patrinos 2004, and Heckman et al. 2006). The problem of selection bias can be addressed by controlling for correlated determinants of earnings or with an instrumental variable for schooling. However, it is not clear how the coefficient on schooling should be interpreted.

One possibility is to view the Mincer model as a pricing equation for labour market characteristics and interpret this coefficient as the growth rate of earnings with schooling (the education premium). A more ambitious interpretation is that the coefficient gives the discount rate that equates the present value of potential income streams for different schooling levels. This internal rate of return is a fundamental economic parameter that is often used to assess the private profitability of additional schooling, or whether expenditure on education should be increased or decreased.

A number of strong assumptions must hold in order to interpret the coefficient on schooling as the internal rate of return (see e.g. Heckman et al. 2006, 2008). While many of these assumptions turn out to hold in the data that Mincer (1974) analysed, they are now at odds with a large body of evidence (Heckman et al. 2006). Even interpreting the coefficient as an education premium requires assumptions that no longer receive support in the data. In particular, several studies show that wage patterns have changed substantially over time across cohorts (see e.g. MaCurdy and Mroz 1995, Card and Lemieux 2001). As a result, cross sections no longer approximate the life-cycle earnings or schooling returns of any particular individual (Heckman et al. 2006). The use of data that follows actual cohorts over the life cycle is therefore essential to accurately measure their true earnings pattern and estimate the education premiums experienced by individuals.

New evidence

In recent work, we provide a detailed picture of the causal relationship between schooling and earnings over the life cycle, following individuals over their working lifespan (Bhuller et al. 2014). We exploit a unique source of population panel data containing records for every Norwegian from 1967 to 2010. Our analysis focuses on males. To account for the endogeneity of schooling, we apply three identification strategies that are currently in use in the literature: compulsory schooling reform as an instrument for education, controls for ability test scores, and within-twin-pair estimation.

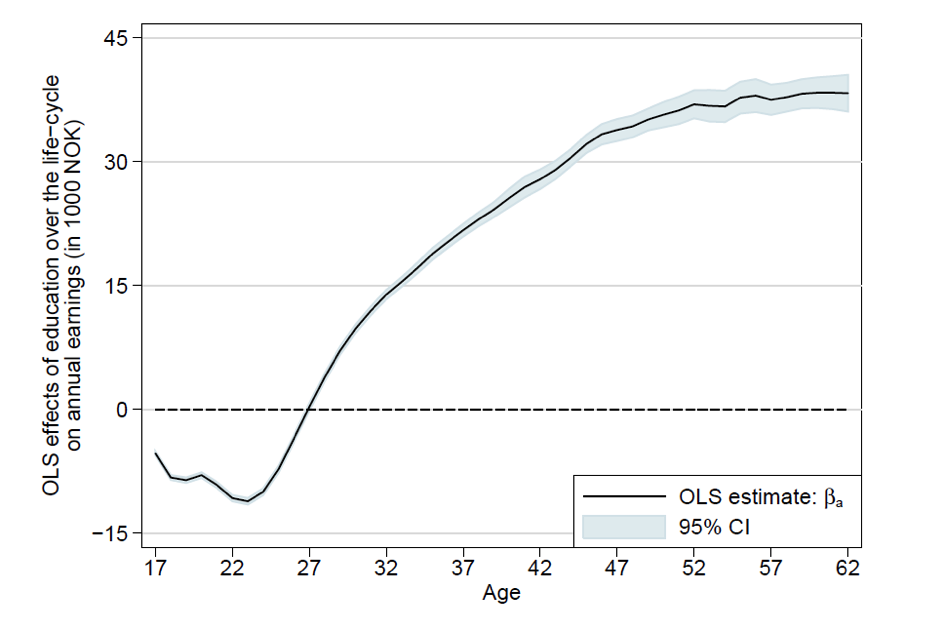

Figure 1. OLS estimates of age-specific education premiums

Notes: This figure graphs OLS estimates of the age-specific education premiums for Norwegian males born 1943–1963. All regressions include fixed effects for childhood municipality and birth cohort. Standard errors are heteroskedasticity robust and clustered at the municipality level. The 95% confidence intervals are drawn in shaded areas.

We begin by estimating education premiums at each age. We find that additional schooling gives higher lifetime earnings and a steeper age-earnings profile, in line with predictions from human capital theory. Figure 1 illustrates this finding by displaying OLS estimates of the education premium in earnings at every age. The estimates start out negative when these men are young, reflecting that some individuals taking higher education are still in school, and that low-educated workers have considerably more work experience early in their careers. The education premiums rise quickly until individuals are in their late forties. A similar age profile in education premiums is evident when we account for the endogeneity of schooling.

Equipped with education premiums at each age, we compute the corresponding internal rate of return. Our preferred estimates of the age-specific education premiums imply an internal rate of return of around 10%, after taking into account income taxes and earnings-related pension entitlements.

Comparison with Mincer regressions

Our analysis relaxes many of the strong assumptions that are typical in the literature. Heckman et al. (2006, 2008) examine the role of taxes, tuition, and a flexible relationship between earnings, schooling, and experience in the estimation of the internal rate of return. However, these studies assume that schooling is exogenous and also require a method for extrapolating the earnings function to work experience levels not observed in the data. Importantly, we can estimate education premiums experienced by individuals over their life cycle and the corresponding rates of return, without assuming multiplicative separability between schooling and experience or a stationary environment. Our approach also relaxes Mincer’s assumption of no earnings while in school and exogenous post-schooling employment. Unlike most of the literature, our estimated rates of return take into account income taxation and earnings-related pension entitlements.

In the empirical analysis, we explore how the returns to schooling are affected by incorporating these income components, and we compare our estimates of internal rate of return to those produced by Mincer regressions. We find that accounting for income taxation reduces the internal rate of return estimates by around 10–15%, whereas earnings-related pension entitlements play a minor role for the incentives to invest in education. Our estimates also reveal that Mincer regressions understate substantially the rates of return. When exploring the reasons for this downward bias, our results point to Mincer’s assumptions of no earnings while in school and exogenous post-schooling employment.

Discussion

Under standard conditions, our internal rate of return estimate of around 10% suggests it was financially profitable to take additional schooling because the rate of return was substantially higher than the market interest rates typically observed. This raises an important question about why more individuals don’t take additional schooling. Earning while in school is common in many countries. For example, data on college students in the US suggests that many full-time (45%) and part-time (83%) students were employed during college (NCES 2013). By comparison, time use surveys from the US suggest that 14% of high-school students were employed while in school (Kalenkoskia and Pabilonia 2012; see also Hotz et al. 2002 and Dustmann and Van Soest 2007). While there is virtually no pecuniary cost of schooling (such as tuition or fees) in Norway, we abstract from any psychic costs of education. Alternative explanations include credit-market constraints (see e.g. Carneiro and Heckman 2002, Lochner and Monge-Naranjo 2011) or uncertainty about future earnings gains from additional schooling (see e.g. Cunha et al. 2005, Heckman et al. 2006).

References

Bhuller, M, M Mogstad, and K G Salvanes (2014), “Life Cycle Earnings, Education Premiums and Internal Rate of Return”, NBER Working Paper 20250.

Card, D (1999), “The causal effect of education on earnings”, Handbook of Labor Economics, 3(1): 1801–1863.

Card, D and T Lemieux (2001), “Can falling supply explain the rising return to college for younger men? A cohort-based analysis”, Quarterly Journal of Economics, 116(2): 705–746.

Carneiro, P and J Heckman (2002), “The evidence on credit constraints in postsecondary schooling”, Economic Journal, 112(482): 705–734.

Cunha, F, J Heckman, and S Navarro (2005), “Separating uncertainty from heterogeneity in life cycle earnings”, Oxford Economic Papers, 57(2): 191–261.

Dustmann, C and A Van Soest (2007), “Part-time work, school success and school leaving”, Empirical Economics, 32(2): 277–299.

Harmon, C, H Oosterbeek, and I Walker (2003), “The returns to education: Microeconomics”, Journal of Economic Surveys, 17: 115–155.

Heckman, J, L Lochner, and P Todd (2006), “Earnings functions, rates of return and treatment effects: The Mincer equation and beyond”, Handbook of the Economics of Education, 1: 307–458.

Heckman, J, L Lochner, and P Todd (2008), “Earnings functions and rates of return”, Journal of Human Capital, 2: 1–31.

Hotz, V J, L C Xu, M Tienda, and A Ahituv (2002), “Are there returns to the wages of young men from working while in school?”, Review of Economics and Statistics, 84(2): 221–236.

Kalenkoski, C M and S W Pabilonia (2012), “Time to work or time to play: The effect of student employment on homework, sleep, and screen time”, Labour Economics, 19(2): 211–221.

Lochner, L J and A Monge-Naranjo (2011), “The nature of credit constraints and human capital”, American Economic Review, 101(6): 2487–2529.

MaCurdy, T and T Mroz (1995), “Measuring macroeconomic shifts in wages from cohort specifications”, mimeo, Stanford University and University of North Carolina.

Mincer, J (1974), Schooling, Earnings and Experience, New York: Columbia University Press.

NCES (2013), “The Condition of Education 2013”, US Department of Education, Institute of Education Statistics, National Center for Education Statistics 2013-037.

Psacharopoulos, G and H A Patrinos (2004), “Returns to investments in education: A further update”, Education Economics, 12(2): 111–134.