Risk sharing across Eurozone countries falls short of the level achieved in other federations – such as Canada, Germany, and the US – by a wide margin. This observation has been documented in various studies, such as Sala-i-Martin and Sachs (1991), Bayoumi and Klein (1997), Sorensen and Yosha (1998) and Von Hagen and Hepp (2013). Updates and refinements of this work (Alcidi et al. 2016, Furceri and Zdzienicka 2015, Rogantini Picco 2015, Milano 2016) confirm these findings and offer some answers to the following key questions. To what extent is the lack of risk sharing within the Eurozone a consequence of:

- the limited role of centralised fiscal authorities,

- the effort of peripheral countries to comply with the rules of the growth and stability pact, or

- the lack of a developed and internationally integrated financial market?

These are the basic findings that we derive from more recent contributions:

- The US federation achieves more intensive risk sharing largely because of a more integrated financial market.

- Public (national and super-national) institutions have a larger role in providing risk sharing in the Eurozone than in the US, especially after the implementation of the ESFS, ESFM and the ESM.

- The contribution of these institutions to risk sharing after the Great Recession more than compensated for the de-smoothing caused by a pro-cyclical fiscal consolidation and by households' increased precautionary savings.

The procedure introduced by Asdrubali et al. (1996) gives rise to the estimation of an index (which we call ‘total risk sharing’) representing the percentage of idiosyncratic country-specific GDP shocks that are not smoothed via the available instruments in a sample of countries over a time interval. This is roughly equivalent to the sample covariance between the growth rates of country-specific consumptions and GDP as a ratio to the sample variance of GDP growth rates. In turn, the degree of risk sharing can be decomposed into the sum of four components, each one representing the percentage of GDP shocks that are smoothed on average (across the sample) via four channels: factor income flows (i.e. insurance via capital income from cross border asset ownership), capital depreciation, net international transfers, and national savings. A further decomposition of these channels into sub-components is provided in Milano (2016).

Comparing the Eurozone with the US

Some earlier estimates provided by Demyank et al. (2007) and Afonso and Furceri (2008) suggest that overall consumption smoothing through international credit markets has slightly declined in the Eurozone following the introduction of the euro and up to the big recession. This is mostly a consequence of a more modest role of private credit (as compared to public savings), less counter-cyclical credit flows, and large inflows of capital in the periphery (from the core) up to 2006, due to a perception that the adoption of a common currency limited country risks.

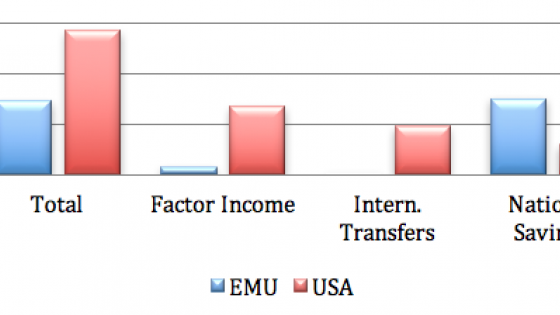

Ten years after the big recession, the situation has changed significantly in terms of investors’ behaviour and because of a significant overhaul of the Eurozone architecture and ECB interventions. As shown in Figure 1, country-specific GDP shocks are only partially smoothed, both in the Eurozone and the US, but much more so in the US. Within the time interval 1999-2014, total risk sharing is about 29% in the former and about 57% in the latter. Moreover, the introduction of the common currency has generated some limited benefits in terms of risk sharing. The estimated value of total risk sharing was about 22% in the interval 1970-1999. Figure 1 also shows that, in the Eurozone, risk sharing is almost entirely accomplished through the savings channel (internal and external borrowing and lending by the private and the public sector), smoothing about 30% of idiosyncratic shocks, whereas, in the US, it is accomplished through a diversified range of mechanisms: factor income flows (smoothing about 27% of shocks), direct transfers from the Federation (19%) and savings (12%). In turn, risk sharing from the savings channel in the Eurozone is almost entirely generated through the government budget. Between 1999 and 2014, Eurozone government savings smoothed about 28% of shocks, compared to 11% from corporate saving and -7% from households (although this estimate is not significant). Quite interestingly, since the smoothing capacity of the net factor income channel is a proxy for the efficiency of international financial markets in providing insurance (within the union or federation), we conclude that the Eurozone lags behind the US by a wide margin. If these markets in the Eurozone were as developed as in the US, the degree of risk sharing in the former region would be roughly comparable.

Figure 1. Risk sharing in the Eurozone and the US, 1999-2014

Before and after the Great Recession

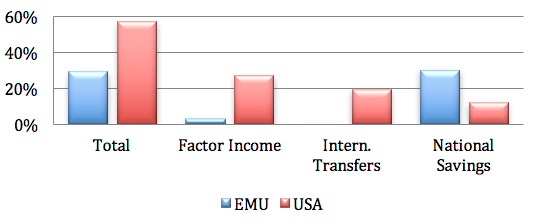

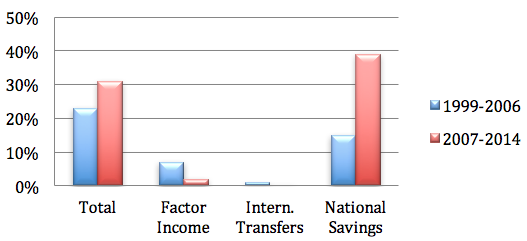

From Figures 2 and 3, we see that, after the Great Recession (i.e. in the 2007-2014 period), the percentage of idiosyncratic national GDP shocks smoothed through the available channels increases substantially in the Eurozone (from 23% in the 1999-2006 period to 31% in the 2007-2014 period), whereas it falls in the US (from to 70% to 60%). Furthermore, these changes hide some notable modifications in the way risk sharing is achieved. In both areas the percentage smoothed through factor income flows falls dramatically – from 7% to 2% (i.e. by 71%) in the Eurozone (although these estimates are insignificant) and from 40% to 22% (i.e. by 45%) in the US. In other words, capital markets failed to provide more insurance during the crisis. In the US, the contribution to income smoothing of direct transfers and savings increases by a modest amount – from 19% to 22% and from 10% to 15%, respectively. In the Eurozone, instead, the amount of risk sharing achieved through savings jumps up from 15% to 39%, whereas that achieved through direct transfers remains very close to zero. Since risk sharing through corporate savings does not change significantly and households’ savings contributes negatively after 2007, the increase in the degree of risk sharing achieved in the Eurozone in this period is entirely achieved via government saving.

Figure 2. Risk sharing in the Eurozone, before and after the recession

Figure 3. Risk sharing in US, before and after the recession

The role of public institutions

To assess the amount of risk sharing provided by public institutions, we can lump together into a single estimate the risk sharing provided by international (interstate) transfers and net lending of country’s (states’) governments. Notice that risk sharing through government net lending is almost zero for the US, as US states have a balanced budget rule. On the other hand, international transfers within the Eurozone provide almost no risk sharing because of very limited centralised fiscal transfers for insurance purposes. Then, in the period 1999-2014, total risk sharing provided by public institutions (central and local) was about 28% in the Eurozone (through government savings) and 19% in the US (through transfers). The same numbers for the post-recession period (2007-2014) are 38% and 22%, respectively. In other words, the contribution of public institutions to risk sharing is much higher in the Eurozone than in the US. Notice that these measures do not take into account the amount of loans from the ECB to banks after the recession and, then, the contribution to risk sharing of public institutions in the Eurozone is probably higher than estimated.

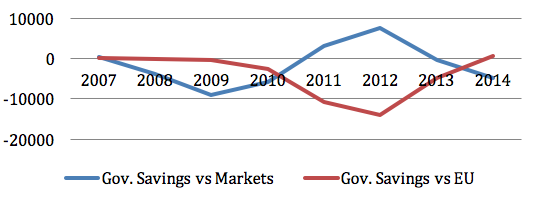

By splitting the net borrowing of national governments into that obtained through markets (including central banks) and through centralised public European institutions – i.e. the ESFS, the ESFM and the ESM – we observe that the latter have played a very important role in the post-recession period (Figure 4), smoothing about 55% of shocks. As mentioned in the previous point, this figure probably underestimates the contribution of the centralised public institutions of the Eurozone, because it does not include the lending facilities provided by the ECB to national banks at below market rates. One may conjecture that these loans explain why the percentage of shocks smoothed via corporate savings increased from 13% in the pre-recession period (1999-2006) to 16% in the post-recession period (2007-2014). In any case, the reason why the effective net percentage of shocks that were smoothed overall after the recession in the Eurozone is only 38% is that two channels played a significantly negative role: government net borrowing from markets (whose contribution to risk sharing has been -17%) and household savings (-12%). Not surprisingly, the magnitude of these numbers is almost entirely driven by the behaviour of the periphery (Greece, Ireland, Portugal, Spain), which faced fiscal consolidation and reduced access to credit markets. For this group of countries, in the 2007-2014 period, the beta related to government net borrowing from markets is about -63% and that related to government borrowing from centralised public European institutions is about 86%. On the other hand, for the core countries in the Eurozone these numbers are, respectively, 73% and 3%. Figure 5 shows the patterns of the government net lending to centralised public European institutions (EU net lending) and to markets.

Figure 4. Risk sharing in the Eurozone, 2007-2014

Figure 5. Government savings versus EU and markets in the periphery

Some concluding remarks

Public institutions in the Eurozone play an important role, although this poses more than a challenge to the overall stability of the currency union. Precisely because the US is a federal political union, states are subject to strict fiscal discipline in exchange for more direct transfers. In contrast, the lack of a political union in the Eurozone implies that transfers contribute very little to risk sharing and that there is less fiscal discipline at the country level. The latter is, in turn, responsible for pro-cyclical fiscal expansions and contractions, contributing negatively to the risk sharing obtained through public savings. In other words, the reason why the Eurozone needs more fiscal transfers to withstand idiosyncratic shocks is not because public (local and centralised) institutions should do more to improve risk sharing, but because delegation of risk sharing to national governments threatens the stability of the Eurozone.

References

Alcidi, C, P D’Imperio and G Thirion (2016) “Intertemporal risk sharing in the EMU: Disentangling the role of international credit markets and of the governments”, Mimeo.

Afonso, A and D Furceri (2008) “EMU enlargement stabilization costs and insurance mechanisms”, Journal of International Money and Finance, 27(2): 169–87.

Asdrubali, P, B Sorensen and O Yosha (1996) “Channels of interstate risk sharing: United States 1963-1990”, Quarterly Journal of Economics, 111: 1081–1110.

Bayoumi, T and M Klein (1997) “A provincial view of economic integration”, IMF Staff Papers, 44: 534–556.

Demyank, Y, C Ostergaard and B Sorensen (2007) “Risk sharing and portfolio allocation in EMU”, European Commission, Working Paper, Brussels.

Furceri, D and A Zdzienicka (2015) “The Euro area crisis: Need for a supranational fiscal risk sharing mechanism?”, Open Economies Review, 26: 683–710.

Milano, V (2016) “Risk sharing in the Eurozone: The role of European institutions”, mimeo., LUISS G Carli.

Rogantini Picco, A (2016) “International risk sharing in EMU”, Mimeo.

Sala-i-Martin, X and J Sachs (1991) “Fiscal federalism and optimum currency areas: Evidence for Europe from the United States”, NBER, Working paper 3855.

Sorensen B and O Yosha (1998) “International risk sharing and European monetary unification”, Journal of International Economics, 45: 211-238.

Von Hagen, J and R Hepp (2013) “Interstate risk sharing in Germany: 1970-2006”, Oxford Economic Papers, 65(1): 1–24.