Labour’s share of global income has been on a downward trend for over half a century (Karabarbounis and Neiman 2014). After peaking at some 55% of global income in the early 1970s, labour’s share drifted down about five percentage points, reaching its lowest level of the last 50 years just prior to the Global Crisis.

Two facts lie behind this evolution:

- The first, which is well known, is that the global trend mirrors the evolution of labour shares in advanced economies (Blanchard 1997, Harrison 2002, Elsby et al. 2013, Karabarbounis and Neiman 2014).

Explanations for this trend have ranged from technological progress and globalisation, to falling unionisation rates, corporate tax competition and the emergence of ‘superstar’ firms (Elsby et al. 2013, Karabarbounis and Neiman 2014, Rognlie 2015, Autor et al. 2016).

- The second fact is more obscure – the global trend also mirrors the labour share evolution in developing economies, coinciding broadly with their integration into the global economy beginning in the 1990s (Figure 1).

This is not just a less-known fact, but presents an important puzzle for two reasons. First, it contradicts the predictions of classical trade theory that the globalisation of trade would raise demand for the labour-intensive products of these labour-abundant economies and, with it, their labour share of income. Second, falling labour shares in developing economies are unlikely to reflect a substantial substitution of capital for labour from technological advancement – a key explanation for the decline of the global labour share in Karabarbounis and Neiman (2014) – as these economies have experienced a far milder decline in the relative price of investment goods than in advanced economies (Figure 2 and Dao et al. 2017).

Figure 1 Evolution of labour’s share of income

Sources: National authorities; OECD; Karabarbounis and Neiman (2014); IMF, World Economic Outlook database; and Authors' calculations

Note: Figure 1 shows year fixed effects from regressions that also include country fixed effects. The regressions are weighted by nominal GDP in current U.S. dollars. Fixed effects are normalized to reflect the respective levels of the labor share in the year 2000.

Figure 2 Relative price of investment (% change relative to 1990)

Sources: World Economic Outlook, National authorities and Authors’ calculations

Notes: The figure shows fixed effects from regressions that also include country fixed effects. The regressions are weighted by nominal GDP in current US dollars.

In a recent paper, we present a mechanism that can reconcile declining labour shares in both advanced and developing economies (Dao et al. 2017). At the centre of our explanation are two major trends of the last quarter century. The first is the ‘routinisation’ of tasks – that is, the automation of tasks where labour is most substitutable by capital, particularly ICT capital (Autor et al. 2003) – and the second is globalisation of trade, in particular the offshoring of tasks that has accompanied the rise of production value chains. The intuition for this mechanism is as follows.

With wage costs far lower in developing economies, falling barriers to trade have presented advanced economies with strong incentives to offshore tasks that are relatively labour-intensive (thus, those with high labour shares) to developing economies. Compounding this, the contemporaneous sharp fall in the relative price of investment goods has also presented advanced economies with strong incentives to automate ‘routine’ tasks, leaving tasks with lower factor substitutability more likely to be offshored. The implications for advanced economies are straightforward: both greater automation and more offshoring have skewed the composition of their production to become more capital-intensive, and a decline in the labour share of income has ensued.

A key insight is that in developing economies – the recipients of offshoring – insofar as tasks offshored to them have limited substitutability between capital and labour, offshoring has made tasks more capital-intensive than the average existing task in these economies. Why is this so? This is because in an environment of high local relative cost of capital – precisely the environment in capital-scarce developing economies – tasks with high substitutability between factors will have lower capital shares than the average task, as firms exploit low relative labour costs to substitute labour for capital. It follows that as offshoring raises the proportion of tasks with lower factor substitutability, it shifts the composition of production to tasks with higher capital shares, lowering the average labour income share in these economies.

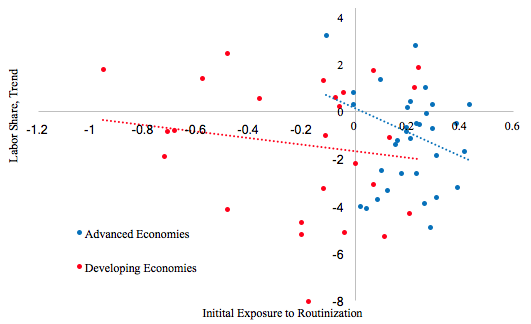

The data bear these predictions out. Empirically, we find that the globalisation of trade is the predominant factor in lowering the labour share of income in developing economies, while technological advancement is the key factor in advanced economies. We develop a measure of the exposure to routinisation and find a strong negative relation between initial exposure (earliest available measure between 1990 and 1995) and the subsequent decline in labour shares (see Figure 3 and Das and Hilgenstock 2017).

Figure 3 Relationship between initial exposure to routinisation and changes in the labour share (%)

Sources: Autor and Dorn (2013); European Union Labor Force Survey; Integrated Public Use Microdata Series International; Integrated Public Use Microdata Series USA; International Labour Organization; Authors’ calculations.

Estimating a long-difference regression that relates labour shares to long-term changes in technology (measured by the change in the relative price of investment goods), the country’s initial exposure to routinisation, changes in both its trade and financial integration, as well as reforms to policies and institutions, our results paint a picture that reveal important commonalities, but also some striking differences underlying the decline in labour share across countries.

In advanced economies as an aggregate, technology has been the largest contributor to the decline in labour shares, accounting for almost half of the overall decline. Importantly, for a given change in the relative price of investment, economies with high exposure to routinisation experienced about four times the decline in labour income shares than those with low exposure. Global integration – in particular, participation in global value chains and financial integration – is estimated to have contributed about half as much as technology. The results for advanced economies as a group are generally also true for individual economies. For example, jointly, technology and global integration can explain roughly three-quarters of the decline in labour shares in Germany and Italy and more than half the decline in the US. For emerging markets, technology has played a negligibly small role in the aggregate, due to both the milder decline in the price of investment goods in these economies and their significantly lower exposure to routinisation to begin with. Instead, the forces of global integration have had large effects, as participation in global value chains has lowered the labour share of income (partially offset by financial integration), consistent with our theoretical mechanism.

We complement the aggregate analysis with an examination of labour shares at the industry-country level using a newly assembled dataset on industry-level labour shares. The industry level analysis sheds light on the forces whose impacts may naturally be expected to differ across sectors, such as the plausibly large role of global trade integration in the tradable sectors.

Sectoral analysis confirms the large role of technology in advanced economies – declines in the relative price of investment have been associated with declines in labour shares, more so for sectors with higher initial exposures to routinisation. Estimating the model separately for the tradable and nontradable sectors reveals that rising participation in global value chains is associated with declines in labour shares only in the tradable sectors. This is in line with the predictions of the mechanism outlined earlier – as labour-intensive tasks are offshored, labour shares in tradable sectors are expected to decline as production becomes more capital-intensive.

The decline in labour shares has coincided with increases in inequality, not just due to the concentration of capital income at the top of the income distribution, but also due to diverse impacts across workers of different skill levels. We document that the labour income share of high-skilled workers has been rising while that of middle- and low-skilled workers has been declining, and that decline in labour shares driven by technology and global integration has been particularly sharp for middle-skilled labour. Moreover, countries with higher initial exposure to routinisation and a greater increase in participation in global value chains have experienced stronger declines in the middle-skilled labour income share. This is consistent with evidence for the US and European economies, where declining costs of automating routine tasks have caused a polarisation of employment and wages along the skill spectrum, as highlighted by Autor and Dorn (2013) and Goos et al. (2014).

References

Autor, D H, F Levy and R J Murnane (2003), “Computer-based technological change and skill demands: Reconciling the perspectives of economists and sociologists”, in Low-Wage America: How Employers Are Reshaping Opportunity in the Workplace. New York, NY: Russell Sage Foundation.

Autor, D H and D Dorn (2013), “The growth of low-skill service jobs and the polarization of the US labor market”, American Economic Review 103(5): 1553–97.

Autor, D H, D Dorn, L F Katz, C Patterson and J Van Reenen (2017), “Concentrating on the fall of the labor share”, NBER, Working paper 23108.

Blanchard, O (1997), “The medium run”, Brookings Papers on Economic Activity (2): 89–158.

Dao, M C, M Das, Z Koczan and W Lian (2017), “Why is labor receiving a smaller share of global income? Theory and empirical evidence”, IMF, Working paper WP/17/169.

Das, M and B Hilgenstock (2017), “Labor market consequences of routinization in developed and developing economies”, manuscript.

Elsby, M W, B Hobijn and A Şahin (2013), “The decline of the US labor share”, Brookings Papers on Economic Activity (2): 1–63.

Goos, M, A Manning and A Salomons (2014), “Explaining job polarization: Routine-biased technological change and offshoring”, American Economic Review 104(8): 2509–26.

Harrison, A (2002), “Has globalization eroded labor’s share? Some cross-country evidence”, University of California, Berkeley, and NBER.

Karabarbounis, L and B Neiman (2014), “The global decline of the labor share”, Quarterly Journal of Economics 129(1): 61–103.

Rognlie, M (2015), “Deciphering the fall and rise in the net capital share: Accumulation or scarcity?”, Brookings Papers on Economic Activity (1): 1–69.