Europe’s trade with China is characterised by two trends. First, it has been steadily growing in recent years. Europe is China’s largest export market and is the fourth most important destination for EU exports. That is the good news. Second, the bad news: China has been building up a huge bilateral trade surplus towards the European Union.

Is that really bad news? The speed at which this deficit has grown has triggered criticism, increasingly alarmist in tone, and demands for actions to be taken to correct this imbalance. According to Peter Mandelson, ”the current imbalance… reflects structural realities in the Chinese economy that are not sustainable.”

Trade deficits have always been widely and emotionally debated. Since the heydays of mercantilism, selling abroad has been considered superior to purchasing abroad. A surplus in the trade balance is taken as an indicator of superior competitiveness. A trade deficit, however, is rarely perceived as proof of foreign competitiveness, but rather as the result of “unfair competition”. On the face of it, China seems as a standard example of a country boosting its competitiveness by an undervalued currency, the renminbi. Therefore, diagnosing the soaring bilateral deficit is an easy task: it only requires some basic knowledge in measuring currency depreciation.

But the case is less straightforward than it seems. In fact, just reflecting on the evidence needed to substantiate such a link makes the case rather weak. It disregards knowledge about fundamental trade patterns as well as basic balance-of-payment theory.1

Is the soaring deficit a problem?

China’s trade pattern has changed fundamentally in the last twenty years. Export of ‘hard’ manufactures – consumer electronics, apparel, et cetera – has increased considerably while there has been a significant decline in export share of agricultural produce and soft manufacture, such as textiles. This shift has led to a significant presence of processing trade – China needs to import a significant share to be able to export. In fact, the share of processing trade in China’s export appears to have grown over the last decades – from 47 percent in 1992 to 55 percent in 2005.

We also need to consider the plausibility that exports from China to Europe have replaced other countries’ exports to Europe. Europe has a rising deficit with China but not with other emerging markets. In the same years as Europe’s bilateral deficit with China has grown, trade with other important trading partners in Asia and the emerging world has reversed from a deficit to a trade surplus, or, as in the case with Japan, been reduced. In particular, the trade balance with Russia – excluding fuels – turned from almost minus six billion EUR in 2000 to a surplus of €25 billion in 2006. Accordingly, the bilateral trade balance with Japan, Mexico, India, Hong Kong and South Africa shows the tendency to rise.

Thus, there are indications that the surge in Chinese exports to Europe (and the United States) is part of a global structural change: China appears to be leveraging its comparative advantage. Trade statistics, and analysis of comparative advantage, strongly suggest that EU-China trade has grown most significantly in areas where the comparative advantages of the two entities can be exploited. Many studies confirm that China’s comparative advantages are in low-tech and medium-tech products. In both product categories, China runs a trade surplus with the EU of more than €55 billion.

Comparative advantage is important in the context of the alleged link between the soaring deficit and currency undervaluation. If China exports to the EU in sectors where it has comparative advantages, it is difficult to make the claim that, in the first place, the sharp export increase is determined by currency undervaluation and that, in the second place, this increase is at the expense of Europe. If Europe can exploit China’s comparative advantages, it is of benefit to Europe.

Is there evidence of Chinese currency manipulation against Europe?

China is considered by many to promote exports and discourage imports by fixing its exchange rate towards the US dollar (as part of the basket China has been using since July 2005) below the renminbi’s ‘real’ value. The support for the view that China’s currency manipulation explains its trade surplus (plus foreign investments and reserve accumulation) largely comes from exercises to determine the “right” exchange rate. The theoretical framework of such analyses is based on the assumption that currency de- or revaluation can influence the exports and imports by inducing expenditure switching. The effectiveness of the policy depends on price elasticities (the Marshall-Lerner condition).

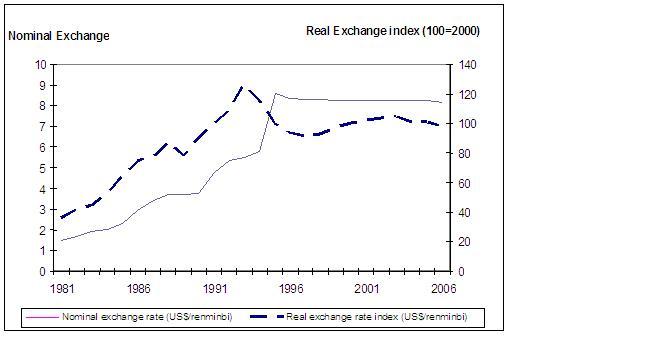

Figure 1 shows the development of the nominal and real exchange rate of the Chinese currency towards the US dollar since 1980. Until 1994, the renminbi depreciated (especially sharply in 1994), both in real and nominal terms. Since then, the real exchange rate appreciated until 2000 and depreciated until 2004. Since 2005, another period of appreciation can be observed. The nominal exchange rate remained constant for almost a decade. Mid-2005, the Chinese government switched from a dollar peg to a basket peg. It has also incrementally and cautiously been appreciating the renminbi since then.

Figure 1. Nominal and real exchange rate of the renminbi 1980 -2006

Several authors argue that the renminbi is undervalued against the US dollar on the order of 25 to 40 percent.2 However, there are several analyses of similar stripe that challenge the claim that the renminbi is undervalued.3 A simple count of the number of papers arguing in favour of or against considerable currency misalignment in China would probably point to the former as a winner. But is this a meaningful exercise? The discussion about China’s ‘correct’ exchange rate reveals serious shortcomings. There are significant differences with respect to the methods as well as the exact specifications used by different authors, leading to different and conflicting conclusions. The robustness of the estimations of equilibrium real exchange rates must therefore be questioned.4 Furthermore some authors tend to dissimulate the details of their approach, and this particularly applies to those who claim significant undervaluation. The level of speculation in these models is very high.

An alternative explanation: The trade balance as an adjustment parameter for China’s macroeconomic policies

What does economic theory predict about countries’ international macroeconomic balances? In general, the balance of payments of a country is zero. Imbalances can only occur in the current account (i.e. the trade balance), the capital account and/or the balance of foreign reserves. Such imbalances do not automatically reflect disequilibrium. On the contrary, international capital flows are widely accepted as a means to foster a more efficient international allocation of capital. China balances show that savings are very high, domestic investment is lower, and the trade balance is positive. These savings are partly invested abroad, partly invested in China and partly used to build up foreign reserves. In particular, the increase of foreign reserves (amounting to roughly 1.6 trillion US dollar) is remarkable.

The causal relationships are of interest for the question of what drives China’s trade surplus. Let us begin with the decision to save. A saver takes an intertemporal decision on what share of her income to consume immediately and what share to consume later. In theory, she follows a utility-maximising calculus.5 In aggregate, domestic saving is driven by the intertemporal calculus. Next comes the decision on how to invest the savings.6 On the national level, three options are available: investment at home, investment abroad, or an increase in domestic reserves. Economic rationality and opportunity costs are the main drivers of this decision.

Let us now apply this theory to the case of China. If China exports capital, this leads to a capital account deficit, and second – everything else equal – to an excess demand for foreign exchange. The consequence is a depreciation of the remninbi and an appreciation of the currency of the capital-importing country. This (real) revaluation of the foreign currency allows for the transfer from the capital account to the current account. Chinese exports become cheaper and its imports more expensive. Its trade balance will be affected, and it will show a surplus. The size of the real currency depreciation depends on price elasticities for demand and supply. The higher the elasticities, the lower are the potentially necessary exchange-rate adjustments.

Savings preferences are symmetric in foreign countries. For China, there is a potential destination in the United States, which has a preference for consumption or investment beyond savings. Accordingly, this country runs a trade deficit and a capital account surplus.

The capital account can be interpreted as the intertemporal budget constraint. A bilateral trade deficit builds up and reaches an equilibrium point if, and only if, the lender (i.e. trade surplus) country is willing to grant credit to the borrower (i.e. trade deficit) country. Contrary to the Marshall-Lerner condition approach based on price elasticities outlined in the previous sections, the role of the (real) exchange rate is different in this context: it is not a policy variable but an adjustment parameter.

When approaching, from this balance-of-payment perspective, the issue of Europe’s bilateral trade deficit with China, it is clear that there is no normative implication as such for any particular current-account balance. It cannot be said in advance if a current-account deficit is undesirable or not. How rational and sustainable is the Chinese trade surplus viewed from this perspective?

- First, the domestic capital market in China is not fully liberalised and sufficiently sophisticated to absorb domestic savings effectively. This leads economists like Max Corden (2007a) to suggest that the Chinese government is parking its savings abroad until the capital market works better. It is not an unrealistic conclusion. This also implies that as soon as domestic investment opportunities improve, China’s capital flows will be redirected from the current low-yield US- or EU-bonds towards domestic investments.

- Second, risk considerations may play a role. The Chinese banking system is fragile and full of risks due to continued politically-motivated corporate lending.7 In such a circumstance, foreign reserves can operate as an insurance against a future banking crisis.

- Third, China may build up reputation by accumulating reserves.

- Finally, trade surpluses at an early stage of a country’s economic development tend to be used to buy knowledge in order to foster the ability to specialise on medium- and high-tech goods in the long run.

Is change due?

This is an explanation of China’s decision to run a considerable capital account surplus. It uses trade as an adjustment variable. It is now increasingly recognised that this policy is no longer in the interest of China. China’s capital-market performance, in combination with industrial-policy preferences, forces the government to build up huge international reserves. In the long run, it is certainly more rational for China to develop its internal capital market and to end interventions in the domestic financial markets in favour of certain industries. Yet as long as the government is conducting industrial policy, foreign reserves serve as insurance against the risks associated with it.

Is China’s policy met with the expected symmetry with its main economic partners, the EU and the US? Until recently, it was justified to analytically consider the United States as a young (quasi-emerging) country, which needs more capital than it can provide with own savings. As long as capital imports are used for capital formation, current-account deficits can be considered sustainable.8 The European situation is not as simple. Firstly, its member countries differ considerably with respect to their development status. The transition economies typically run current account deficits and attract foreign direct investment; the mature, established EU members tend to run current-account surpluses. Secondly, as the EU trade balance on average is much lower than the American, the problem of sustainability is negligible.

Considering the current rise of inflation, it can be expected that China’s policies will change. Depreciation can only be accompanied by an increase in money supply, which leads to higher inflation and, in turn, a real appreciation of the currency. This typically drives capital out of the country because the real interest rates diminish. The result is certainly a trade surplus, but it comes at the expense of welfare losses induced by inflation. Cheap exports due to a weak currency lead to an increase in foreign exchange, and therefore to a rise in international reserves. This causes money growth to be faster than in partner countries, whose currencies are in the currency basket to which the renminbi is pegged. This causes domestic, i.e. Chinese, inflation to rise further.

The Chinese government could try to sterilise the increase in reserves and to stop money growth (and actually does so). The sterilisation, however, leads to an increase in the interest rate, followed by an inflow of capital, which either causes even higher inflation or needs to be sterilised again. Higher inflation is also a factor that affects price competitiveness in the export industry: exports are reduced and imports are stimulated. The trade surplus is diminished or even reversed.

From this perspective, and taking account of the latest increase in Chinese inflation to more than 7 per cent, the next question for China is whether it should let the renminbi appreciate. But whether the appreciation will lead to a reduction in the trade balance, as implicitly expected by European and US policy-makers, remains an open question. As long the savings-investment ratio and Chinese reserves do not change, it is not likely that there will be a change in the trade balance. At best, expectations of a ‘correcting’ EU-China trade balance should be moderate.

There is neither a case for being concerned about the bilateral deficit with China nor for enjoining China to revalue its currency to address the matter. To a certain extent, China does behave in the way economic theory as well as Western politicians always have recommended. Internal (moderate) reform was backed by external liberalisation and export orientation. For this policy development, China should be applauded. China has been careful with external capital-market liberalisation, which is also one (of several) textbook recommendation(s).

References

Amighini, Alessia (2005), China in the International Fragmentation of Production: Evidence from the ICT Industry, The European Journal of Comparative Economics, Vol.2, No 2, pp. 203-219.

Amiti, Mary & Freund, Caroline (2007), An Anatomy of China’s Export Growth. Mimeo, July 13, 2007

Cheung, Yin-Wong, Menzie D. Chinn, and Eiji Fujii (2007) The Overvaluation of Renminbi Undervaluation, NBER Working Paper 12850, Cambridge, MA.

Corden, W. Max (2007a), Exchange Rate Policies and the Global Imbalances: On China and the IMF, Paper for the James Meade Centenary Conference, Bank of England and National Institute of Economic and Social Research, July 2007, revised September 2007.

Corden, W. Max (2007b), Those Current Account Imbalances: A Sceptical View, The World Economy, pp. 363-382.

Dean, Judy, Fung, K.C., & Wang, Zhi (2007), Measuring the Vertical Specialization of Chinese Trade. Unpublished mimeo

Dluhosch, Barbara, Andreas Freytag und Malte Krüger (1996), International Competitiveness and the Balance of Payments: Do Current Account Deficits and Surpluses Matter?, Edward Elgar, Cheltenham (UK) und Brookfield (US).

Dunaway, Steven, Lamin Leigh, and Xiangming Li (2006), How Robust Are Estimates of Equilibrium Real Exchange Rates for China?, IMF Working Paper 06/220, Washington D.C.

Freytag, Andreas (2008), That Chinese “juggernaut” – should Europe really worry about its trade deficit with China?, ECIPE Briefing Paper No.2/2008.

Goldstein, Morris (2007), A (Lack of) Progress Report on China's Exchange Rate Policies, Peterson Institute, Working Paper 07-5, Washington D.C.

Goldstein, Morris and Nicholas Lardy (2006), China’s Exchange Rate Policy Dilemma. American Economic Review Vol. 96, No 2, pp. 422–426.

Isard, Peter (2007), Equilibrium Exchange Rates: Assessment Methodologies, IMF Working Paper 07/296, Washington D.C.

Obstfeld, Maurice and Rogoff, Kenneth (1994) 'The Intertemporal Approach to the Current Account' NBER Working Paper 4893, Washington D.C.

Siebert, Horst (2007), China – Opportunities of and Constraints on the New Global Player, CESifo Forum, Vol. 8, No 4, pp. 52-61.

The Economist (2007), Lost in translation, Briefing : China and UDS Trade, The Economist of May 19th 2007, pp. 67-69.

Yajie, Wang, Hui Xiofeng and Abdol S. Soofi (2007), Estimating Renminbi (RMB) Equilibrium Exchange Rate, Journal of Policy Modeling, Vol. 29, pp. 417-429.

1 This column is based on ECIPE Briefing Paper No.2/2008, That Chinese “juggernaut” – should Europe really worry about its trade deficit with China?

2 See Goldstein and Lardy (2006), Goldstein (2007) and Frankel (2006).

3 See e.g. Cheung, Chinn and Fujii (2007), The Economist (2007) as well as Yajie, Xiofeng and Soofi (2007).

4 For China, see Dunaway, Leigh and Li (2006); for a general overview, see Isard (2007).

5 See e.g. Corden (2007b), Obstfeld and Rogoff (1994) as well as Dluhosch, Freytag and Krüger (1996).

6 Both decisions may be made simultaneously and interdependently, but for reasons of logic, we simply assume this sequencing.

7 See e.g. Siebert (2007, pp. 53f).

8 Recent developments on the capital markets cast heavy doubts on the sustainability of the US current account deficit. In addition, the low saving rate poses a threat on the sustainability.