There is a general perception in the policy debate that Eurozone imbalances are not adjusting. Deficit countries are stuck in an unsustainable equilibrium and surplus countries’ growth is mostly based on exports. The most pressing concern is that a symmetric evolution of competitiveness between surplus and deficit countries is needed for rebalancing to be complete and durable. This will be something that is hard to achieve, most notably because the competitive disinflation processes that are required in deficit countries are painful. Further, strong incentives are not always in place to encourage surplus countries to reduce their excess savings (cf. Krugman 2011).

Heartening evidence

Recent evidence, however, provides some encouragement. External imbalances are coming down and labour cost developments are increasingly supportive of more rebalancing down the road. Most importantly, recent reforms in a number of Eurozone countries appear to be bearing fruit, although the extent of necessary adjustment for some deficit countries is still considerable. It now seems that there could be light at the end of the tunnel. provided the process is supported by reforms that boost non-tradeable production, consistent wage developments in surplus countries, and a recovery in productivity growth in deficit countries. For this to happen, private capital will have to start flowing downhill again, and thus overcome the current fragmentation of financial markets. In order to achieve all this, a fast and effective adoption of a Single Supervisory Mechanism and – eventually – moving towards a banking union will be crucial steps.

Wage and competitiveness adjustment, where do we stand?

Since the euro’s inception – and until the debt crisis – the adjustment to asymmetric shocks within the Eurozone worked, but at the cost of growing external imbalances (European Commission 2006, 2009). Conversely, following the debt crisis the sudden stop in private capital flows led to a prompt reduction in current account imbalances. This redirection of financial flows was a major driver of the recessions in the Eurozone periphery; capital flows stopped being a shock absorber and contributed instead to the widening of output divergences.

Looking forward, competitiveness will play a key role both in redressing external imbalances on a sustainable basis and in reducing the major output and unemployment divergences that have emerged within the Eurozone since the crisis.

Is competitiveness adjusting?

Recent developments are somewhat encouraging. Current account deficits are forecast to be below 3% of GDP in all Eurozone countries in 2012, with the exceptions of Greece, Cyprus, and Portugal (European Commission 2012a). Unit labour costs (ULCs) have fallen substantially in 2010 after having increased in all EU countries after the great recession because of productivity losses linked to labour hoarding.

Since 2011, a decoupling is observed; growth is stronger in surplus than in deficit countries (Figure 1)1. This is in clear contrast to the pre-crisis situation. The recent subdued growth rate of unit labour costs in deficit countries was not entirely linked to productivity gains from job shedding. Indeed, since 2010, wage growth started being slower in deficit countries by about one percentage point. Moreover, the deceleration in nominal compensations in deficit countries appears stronger in non-tradable sectors. This contrasts with the pre-crisis situation, and supports the argument for labour relocation from the non-tradable to the tradable sector (cf. Buti and Turrini, 2012).

Figure 1. ULC and nominal compensation per employee, % change

Source: DG ECFIN AMECO database, Autumn 2012 European Commission Forecast update.

When assessed across countries, since the start of the crisis the downward adjustment in unit labour cost compared with competitors – the ULC-based real effective exchange rate (REER) – seems proportionate to the external adjustment channel. More pronounced reductions in the REER were recorded in countries that were characterised by a wide gap between their underlying current account and that which is consistent with a sustainable position in the Net International Investment Position (Figure 2). Figure 2 suggests that for some countries, notably Greece and Portugal, the magnitude of the adjustment challenge is such that further competitiveness improvements will be needed. Symmetrically, despite some sizeable positive current account gaps in countries like Germany or the Netherlands, competitiveness in these countries has not changed substantially since the start of the crisis. Indeed, competitiveness gains were the rule rather than the exception.

Figure 2. Competitiveness gains and current account gaps

Source: European Commission, DG ECFIN, Autumn 2012 European Commission Forecast update. The underlying current account includes both cyclical effects and lags in the impact of REER changes (Salto and Turrini 2010). The NIIP-stabilising current account is defined as the current account that stabilises the NIIP at the 2011 value on the basis of medium-term projections for potential growth.

What’s next?

The answer depends most notably on two factors; the working of the market-based response of wages to the labour market slack-tightness and the impact of current and forthcoming labour market reforms.

Current wage bargaining

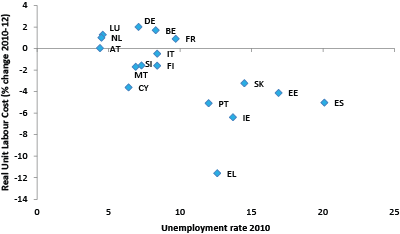

The market-based adjustment of wages appears to be currently working in a fashion that supports external adjustment. While in countries with low unemployment, real wages are growing above productivity, the opposite is occurring in countries characterised by high unemployment (Figure 3). This pattern of adjustment is consistent with the expected market reaction of wages to the labour market slack. It also contributes to a correction adjustment of output and unemployment divergences within the Eurozone. Since the countries with the lowest (or highest) unemployment rates also correspond to those with largest current account surpluses (or deficits), the process is expected to continue contributing to rebalancing until the large unemployment divergences are fully offset.

Figure 3. Real unit labour costs (% change 2010-2012) and unemployment rates, 2010

Source: DG ECFIN AMECO database, Autumn 2012 European Commission Forecast update.

For low-unemployment countries, there is no reason to think that wages cannot adjust upward in the absence of countervailing policies. For instance, the most recent evidence on collective contract negotiations in Germany suggests rather strong wage dynamics, looking forward. In May 2012, IG Metall, the German trade union for the mechanical and engineering sector that traditionally plays a leading role in wage negotiations, negotiated the highest pay increase in 20 years, with the renewed collective contract stipulating a 4.3% wage increase over 13 months (Sackmann 2012). Conversely, for high-unemployment countries, downward rigidities could kick in and hamper downward wage adjustment. This is where labour market reforms matter.

Other labour market reforms

In this respect, things do not look too gloomy. EU countries, notably those more severely hit by the debt crisis and major fiscal consolidations, have in recent years engaged in a number of courageous labour market reforms (Buti and Padoan 2012, European Commission 2012b). In particular, compared with years before the crisis, pro-competitive reforms aimed at revisiting the wage setting system became much more frequent (Figure 4).

Figure 4. Selected measures affecting the wage setting system carried in EZ countries since 2010

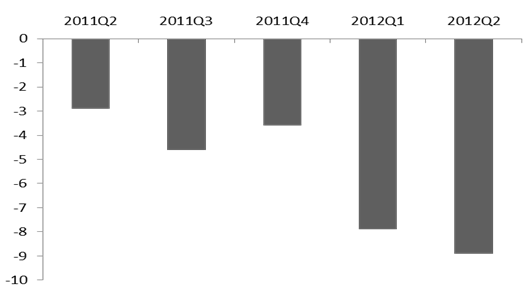

Greece is the country where wage setting reforms were implemented first and where they went deeper. The decentralisation of wage bargaining was facilitated by firms being granted the ability to derogate from sectoral agreements and via the suspension of the faculty of extending collective contracts to non-signatory parties. The minimum wage negotiated at national level was cut, and measures were taken to reduce the inertia in the renegotiation of collective contracts. The most recent evidence from quarterly labour cost data suggests that these reforms are producing effects, as the speed of wage reduction was accelerating over the past year, reaching levels above 10% on an annual basis (Figure 5).

Figure 5. Labour cost index growth (% change compared with same quarter of previous year – working day adjusted)

Wage setting reforms in other Eurozone countries have not yet produced comparable effects to those carried out in Greece, but it can be reasonably expected that most recent and forthcoming reforms in a number of countries, including Portugal, Spain, Italy and Ireland, will bear fruit.

What is missing?

Are ongoing trends and the current reform measures sufficient? The answer depends on four conditions:

- First, the improvements in cost competitiveness need to have an impact on current account balances.

Relative unit labour costs have started adjusting, but this needs to be matched by a reduction in relative prices as well. Unfortunately, the evidence indicates that the recent improvements in labour cost competitiveness in deficit countries was not accompanied by proportionate gains in relative price competitiveness (cf. European Commission 2012b).

- Second, to be sustainable, competitiveness gains cannot be based uniquely on wage and price restraints.

Productivity and non-price export competitiveness need to grow again. This is the key pre-requisite to stabilise the high share of net foreign liabilities in a number of Eurozone countries. During the process of rebalancing, growth is inevitably subdued for some time because domestic demand needs to be moderate to favour the expenditure shift away from imports and non-tradables. However, if recessions are protracted for too long, the sustainability of external positions could be compromised and we risk turning competitive disinflations into a negative spiral of external debt deflation.

- Third, competitive disinflations in deficit countries may need to be sustained over a relatively long period of time.

This raises the general issue of competitive disinflations’ sustainability from a social and political perspective.

- Fourth, the adjustment needs to be symmetric, underpinned by consistent developments in surplus countries.

In most surplus countries, it is only recently that wage growth has accelerated despite persistently high current account surpluses and largely positive net international investment positions. Looking forward, it is important that rebalancing implications of ongoing market-driven responses of wages to the tightening labour markets operate fully and unrestricted. Reforms raising productivity in the non-tradeable sector would help further help rebalancing in surplus countries, as well as a fiscal stance which is not unduly restrictive.

Conclusions

A more supportive role of financial markets appears to be the single most important prerequisite for the fulfilment of the conditions for rebalancing . The re-direction of cross-border private capital flows away from deficit countries and towards surplus countries that followed the financial and debt crises contributed to narrowing current account deficits. However, this withdrawal of financial resources also implied reduced investment rates and reduced room for total factor productivity improvements. Moreover, by increasing non-labour costs, reduced investment rates contributed, together with lack of progress on product market reforms, to the incomplete pass through of labour cost competitiveness gains into price competitiveness gains. Fragmented financial markets also imply delayed and reduced benefits from structural reforms in vulnerable countries. This is because part of the future gains from reforms can accrue much sooner, provided efficient and developed financial markets help bring forward these gains in terms of higher asset values (Buti et al. 2009). Going forward, orderly investment conditions will be needed to compensate for the loss of capital and to get total factor productivity growing again. Orderly investment conditions are also needed for a durable adjustment of unit labour costs and for the political sustainability of protracted wage moderation.

Completing the monetary union with a Single Supervisory Mechanism for the banking sector – and eventually a banking union – will help redress the the interwoven nature of sovereigns and banks, a relationship that segments financial markets and could permit capital flowing downhill again. An effective framework for macroprudential policy as well as structural reforms in recipient countries will be needed to ensure that, unlike the pre-crisis period, capital is channelled towards productive uses.

References

Buti, M., and P. C. Padoan (2012), “From Vicious to Virtuous: A Five-point Plan for Euro-zone Restoration”, CEPR Policy Insight 61.

Buti, M., A. Turrini, P. van den Noord, and P. Biroli (2009), "Defying the ‘Juncker curse’: Can Reformist Governments be Re-elected?", Empirica, Springer, 36(1), 65-100.

Buti, M., and A. Turrini (2012), "Slow but Steady? Achievements and Challenges in Competition Disinflation within the euro Area", ECFIN Economic Brief, forthcoming.

European Commission (2006), “The EU Economy Review”, European Economy, 6.

European Commission (2008), “EMU@10: Successes and Challenges after 10 Years of Economic and Monetary Union”, European Economy, 2.

European Commission (2012a), “Economic Forecast” European Economy, 1, Autumn.

European Commission (2012b), “Labour Market Developments in Europe”, European Economy, 5.

Krugman, P (2011), "Can Europe be Saved?", The New York Times, January 12.

Sackmann, H (2012), "IG Metall Gets Highest Pay Rise in 20 Years", Reuters, 19 May.

Salto, M, and A Turrini (2010), "Comparing Alternative Methodologies for Real Exchange Rate Assessment", European Economy Economic Papers, 427, Directorate General Economic and Monetary Affairs, European Commission.

1 The classification between deficit and surplus countries used in the paper is such that, all surplus countries recorded a surplus over the 1999-2012 period (the only exceptions being DE and AT before 2002 and FI after 2010), while deficit countries recorded a deficit on average starting from 2000.