Introduction

A central part of President Obama’s 2013 State of the Union address is a proposal to gradually raise the federal minimum wage from $7.25 to $9 per hour. Proponents have argued that raising the minimum wage may provide fiscal stimulus by putting money in the hands of people who are likely to spend it (see The New York Times 2013). This argument is sometimes based on findings from our research (Aaronson, Agarwal and French 2012), where we estimate the spending, income, and debt responses to minimum-wage hikes, as well as calibrations presented by the Economic Policy Institute (Hall and Cooper 2012). In this article, we describe our results and discuss the implications for policy.

The estimates

We regress household income, spending, and debt on the household’s applicable minimum-wage rate, controlling for a full set of time and household fixed effects. Time indicators control for the possibility that both the minimum wage and household spending rise in response to strong aggregate income growth. We also control for household fixed effects, and in so doing, the fact that households have different time-invariant resources. In addition, we include controls for changes in family composition to account for distinctive family circumstances, such as divorce or the birth of a child, which are relevant for spending and debt.

Our data spans 1980-2008, a period where many states had minimum wages above the federal minimum. Indeed, today, 19 states plus the District of Columbia and several cities have a minimum wage above $7.25. Our estimated minimum-wage responses are identified by comparing a minimum-wage household residing in a state receiving a state-level minimum-wage hike to another minimum-wage household at the same time who resides in a state that did not receive a hike.

Importantly, we focus only on households with adult minimum-wage workers when we first observe the household. That is, we omit two groups, teenagers and low-skilled workers without jobs prior to the minimum-wage increase, which arguably might face more difficult labour-market conditions as a result of the minimum-wage increase.

Income

We use data from the outgoing rotation files of the Current Population Survey, the Survey of Income and Program Participation, and the Consumer Expenditure Survey to estimate the impact of a $1 increase in the minimum wage on household income. The weighted average income response to a $1 minimum-wage hike across all three datasets is roughly $250 per quarter for the first year. These results are limited solely to households with adult workers very close (60% to 120%) to the old minimum wage. Workers that are just above this threshold (e.g. 120% to 300% of the minimum wage) experience no statistically or economically significant increase in their income, even when they too reside in a state with a minimum-wage hike. We view this result as providing evidence that our estimates are not driven by omitted variables common to low-income workers in general.

To put these estimates in perspective, adult minimum-wage employees work, on average, roughly 300 hours per quarter. Under three assumptions:

- There is no disemployment due to the minimum-wage hike;

- All workers paid close to the minimum wage are covered by minimum-wage laws;

- There is no measurement error: we would anticipate a $1 minimum-wage hike increasing quarterly earnings by $300. Statistically, we cannot reject this possibility in the data.

Unfortunately, we know little about the long-run earnings responses to minimum-wage changes. Given data limitations, we can only reliably estimate the income response for the year following the minimum-wage hike. Nevertheless, we document that only 64% (or 53%) of workers who make between 60% and 120% of their state's effective minimum wage are still within that range one (or two) years later. This suggests that minimum-wage hikes do not have large effects on income more than two years after the hike for most minimum-wage workers.

Spending

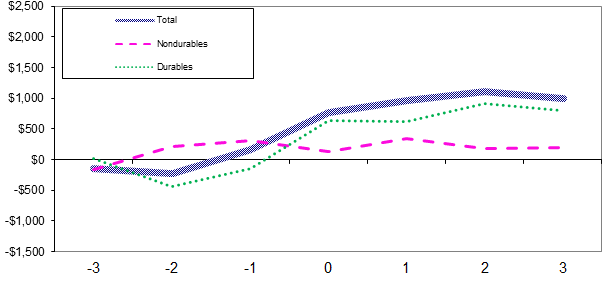

To estimate the spending response to a minimum-wage hike, we use data from the Consumer Expenditure Survey. In the year following a $1 minimum-wage hike, we find that spending rises, on average, approximately $700 per quarter for households with minimum-wage workers. As with the income responses, we find no spending response for households without minimum-wage workers, including households with adults paid just above the minimum wage. Virtually all the additional spending is on durable goods. Specifically, spending on new cars and trucks rises by $500 per quarter, of which the majority is debt-financed.

Figure 1 presents the dynamics of the estimated spending response. The chart highlights two key facts. First, the initial total spending increase (thick line in Figure 1) happens primarily in the quarter of the minimum-wage change. There is little evidence that total spending increases prior to the minimum-wage change, even though minimum-wage hikes are typically passed into law six to 18 months prior to the time of the hike. Second, spending does not immediately revert back to pre-hike levels after the initial increase. Rather, it bounces around $1,000 per quarter in the near term before starting to slowly decline.

Figure 1. Decomposition of CEX spending response to a change in the minimum wage

Note: Quarters around minimum-wage increase at t=0.

Debt

If spending rises more than income immediately after a minimum-wage increase, it follows that net financial assets decline. Although we do not have panel data on assets, we have panel data on debt from a large financial institution.

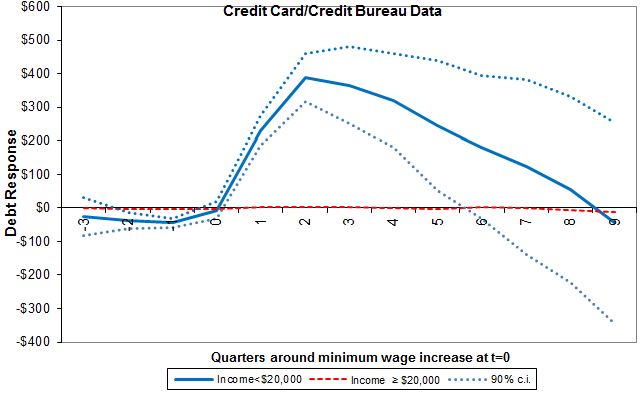

Using the same estimation procedures for income and spending, we find that auto loan debt rises by $200 per quarter and the sum of auto, home equity, and credit-card debt rises by $440 per quarter following the minimum-wage hike. Figure 2 displays the dynamics of household debt (auto, home equity, and credit card) in the nine quarters that follow a minimum-wage increase. The figure clearly shows total debt rising in the first year after a minimum-wage increase for households with income below $20,000 (blue line) who probably include minimum-wage workers, but not for higher-income households (red line). In subsequent quarters, debt rises by less, to the point that by the end of the second year, we cannot reject that debt among low-income households is beginning to fall. This pattern provides direct evidence that much of the early consumption response is in fact debt-financed, and corroborates the independent CEX measures of debt-financed vehicle spending and the large spending estimates.

Figure 2. Debt (auto, home equity, and credit card) response to a change in the minimum wage

Models of consumer behaviour

The simplest version of the certainty equivalent permanent income hypothesis predicts a spending response an order of magnitude smaller than our estimates. For example, we ‘shocked’ the standard permanent income hypothesis model with a $300 per quarter income gain that dissipates over 10 quarters, to mimic the influence of a $1 minimum-wage gain. The predicted spending response averages slightly over $30 per quarter in the year following the hike, or one twentieth the size of our spending estimate. Augmenting the model to account for purchases of durables goods has minimal impact on the calibrated spending response. Thus, low-income households do not appear to behave in accordance to the standard permanent-income model.

But an augmented model that allows for realistic income risk and the ability to borrow against durable goods can fit the observed spending response fairly well. Indeed, in some reasonable versions of the calibration, we can almost perfectly match the observed spending response, including the fact that most of the new spending is on durable goods. The intuition for this result is simple. Suppose a household must make a 20% downpayment on an auto purchase. The existence of this borrowing opportunity implies an extra $250 per quarter in income can be leveraged up to $1,250 in additional spending. This is well beyond what we actually find in the data, consistent with the fact that not all minimum-wage households are borrowing constrained and households cannot debt-finance non-durable purchases.

Policy implications

It has been argued recently that a minimum-wage hike can have a significant stimulative impact on the economy. We believe that there might be some truth to this assertion, as there is clear evidence that the minimum wage increases the income of adult minimum-wage households, who in turn tend to have high marginal propensities to spend.

However, a few words of caution are in order.

- First, our analysis is restricted to households with adult minimum-wage workers who had a minimum-wage job before the hike.

There is some evidence that minimum-wage hikes might make it harder to get a job, especially for teenagers, who represent 23% of the minimum-wage labour force (BLS 2011).

- Second, teenagers are very unlikely to have access to the credit required to purchase a vehicle.

- Third, for those with low income and poor credit scores, it may be harder to purchase cars on credit post-financial crisis than it was during our sample period of 1980-2008.

- Fourth, the added income must be paid by firms that employ minimum-wage workers. Aaronson (2001) and Aaronson et al. (2008) find that these higher firm costs are pushed onto consumers in the form of higher prices1.

In this sense, the minimum wage works as a tax on above-minimum-wage workers combined with a transfer to minimum-wage workers. Thus, aggregate spending rises only if minimum-wage households have higher spending propensities than everyone else. Of course, our estimates strongly suggest this is the case.

- Finally, our estimates are short-run. In the longer run, households must pay off their debt by spending less.

Thus, while a minimum-wage hike may provide stimulus for a year or so, ultimately spending will be tied to the minimum wage’s impact on permanent income.

For these reasons we should be somewhat suspicious of claims that the minimum wage will significantly boost the economy. Nevertheless, our results, as well as the results of other many other papers (a small recent list includes Parker et al 2010, Adams et al 2009, Browning and Crossley 2009, Krueger and Perri 2008), provides compelling evidence that putting money into the hands of consumers, especially low-income consumers, leads to predictable increases in spending.

References

Aaronson, Daniel, Sumit Agarwal, and Eric French (2012), “The Spending and Debt Response to Minimum Wage Hikes”, The American Economic Review, 102(7), 3111-3139.

Aaronson, Daniel, Eric French, and James MacDonald (2008), "The Minimum Wage, Restaurant Prices, and Labor Market Structure", Journal of Human Resources 43(3), 688-720.

Aaronson, Daniel (2001), "Price Pass-Through and the Minimum Wage", The Review of Economics and Statistics 83(1), 158-169.

Adams, William, Liran Einav, and Jonathan Levin (2009), “Liquidity Constraints and Imperfect Information in Subprime Lending,” The American Economic Review 99(1), 49–84.

Browning, Martin, and Thomas Crossley (2009), “Shocks, Stocks, and Socks: Smoothing Consumption over a Temporary Income Loss”, Journal of the European Economic Association 7(6), 1169–92.

Bureau of Labor Statistics (BLS) (2011), “Characteristics of Minimum Wage Workers: 2011”.

Hall, Doug, and David Cooper (2012), “How Raising the Federal Minimum Wage would help working families and give the economy a boost”, 14 August, Economic Policy Institute.

Krueger, Dirk, and Fabrizio Perri (2008), “How Do Households Respond to Income Shocks? Evidence, Theory, and Implications”, working paper, University of Pennsylvania.

The New York Times (2013), “From the Bottom Up”, editorial, 17 February.

Parker, Jonathan, Nicholas Souleles, David Johnson, and Robert McClelland (2011), “Consumer Spending and the Economic Stimulus Payments of 2008”, NBER working paper 16684.

1 We estimate that the president’s federal minimum-wage proposal would raise the aggregate price level by roughly 0.3%.