Student debt has increased rapidly in the US over the past 20 years and currently totals over $1.3 trillion. A rising number of students are taking out loans, and today, roughly half of students borrow to pay for the tuition and living expenses associated with a college education. This trend has led some to question whether we are facing a student debt ‘crisis’, and a growing body of research has assessed the validity of this claim (e.g. Avery and Turner 2012, Looney and Yannelis 2015). A new report by the Council of Economic Advisers (2016) offers a comprehensive perspective on the economic benefits and challenges of student loans. Drawing on current research and new data from the Department of Education, it shows that on average, student loans facilitate very high returns for college graduates in the form of a high earnings premium, and most borrowers are able to make progress paying back their loans. But, borrowers who attend low quality schools or fail to complete their degree face real challenges with repayment. And even students whose lifetime return far exceeds their debt can have trouble with repayment at the start of their careers, when they are starting out and are not reaping the full earnings benefit of their additional education. Addressing these challenges has been a high priority of the Obama Administration, and policies to help students make better enrolment choices, better regulate for profit educational institutions, and make repayment more flexible, particularly through models allowing payments to vary with income, have begun to show results.

The benefits of higher education greatly outweigh the costs, on average

The college earnings premium has grown steadily over the past several decades and reached historical levels in recent years. Compared to high school graduates, bachelor’s degree recipients typically earn $500,000 more in present value over their lifetime – well above the roughly $30,000 of debt that borrowers accumulate on average for that degree. With such high returns, higher education is typically a strong investment, and most who borrow are able to repay their debt.

Figure 1 Present value of added lifetime earnings and cumulative student debt

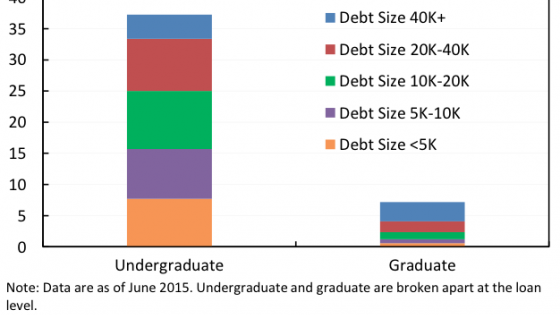

While part of the increase in total student debt is due to the increase in the number of students who enrol in college, there has also been an increase in the typical amount of debt that borrowers accumulate. One explanation for this is increasing college costs, in part due to a decline in state funding for public colleges. However, while published costs have risen sharply over the past couple of decades, a doubling of investments in Pell Grants and tax credits has helped to moderate the impact on the net price that students pay. Indeed, most students accumulate only modest amounts of debt: 59% of borrowers owe less than $20,000 in debt, with the undergraduate borrowers holding an average debt of $17,900 in 2015. Similarly, large-volume debt remains more prevalent among graduate loans.

Figure 2 Graduate and undergraduate outstanding loan balance sizes

All this suggests that, on average, the benefits of borrowing to invest in a college education continue to far exceed the costs.

But many students still face debt challenges, especially due to variation in college quality and completion

While the earnings premium is typically very high, the returns students see after they leave school vary significantly. Students who fail to complete a degree or attend a low-quality institution that does not strengthen their labour market prospects can see lower returns (e.g. Hoekstra 2009, Cellini and Turner 2016) and face difficulty in repaying loans.

Figure 3 Variation in earnings by educational attainment

One important predictor of repayment difficulty is the failure to complete a degree. This relationship is so strong that it leads to a counterintuitive pattern in repayment outcomes: students with the smallest loan balances actually struggle the most with repayment. These students typically have lower balances because they have spent less time in school and are also the least likely to have completed a degree. In fact, the data show that loan size, for the most part, is positively related to the ability to repay. Large-volume debt is far more prevalent among graduate students, who have the higher earnings and thus a lower probability of default.

Figure 4 Share of borrowers who default by Year 3 by loan size and graduate status, 2011 repayment cohort

Similarly, among undergraduate borrowers, those with the largest debt size are more likely to have completed a degree, which decreases the probability of default regardless of debt size. Among those who complete a degree, undergraduate borrowers who graduated with less than $5,000 in debt have similar likelihoods of defaulting as those who graduated with larger amounts of debt. However, fewer than 1 in 6 undergraduate borrowers with only $5,000 of initial debt completed college, compared to nearly 2 in 3 borrowers with over $20,000 in debt.

Figure 5 Relationship between undergraduate default and debt size by completion status, 2011 repayment cohort

Another related correlate of repayment is college sector. In particular, compared to students who attend community colleges or other non-selective schools, students at for-profits institutions tend to have lower earnings but hold larger amounts of debt (Deming et al. 2012, 2013). More rigorous research confirms that for-profit colleges offer lower returns than other sectors (Cellini and Turner 2016, Cellini and Chaudhary 2013). Consistent with this research, data from the Department of Education show that for-profit students face high rates of default – which is especially concerning in light of the high borrowing rate at these schools. Low-income borrowers and those who attend part-time are also more likely to default, in a pattern consistent with the type of schools they attend and their propensity to complete a degree.

Figure 6 Relationship between undergraduate default and sector by completion status, 2011 repayment cohort

While a challenge for some people, the aggregate macroeconomic effects of student debt are limited

Additional college education, even if financed by student debt, is a big net positive for the economy – increasing skills, productivity, earnings and output. Conditional on a certain amount of college education, additional debt can be a small negative for the economy through reduced expenditures such as home purchases – although, to date, it has not had a large macroeconomic effect in part because as student debt has risen other debt has fallen.

The evidence is clear that the rise in student debt differs in important ways from the rise in mortgage debt. Although student debt has risen to be the second largest category of consumer debt, it continues to make up a small share of aggregate income. In 2015, total student loan debt was 9% of aggregate income, up from 3% in 2003. At its peak in 2007, total mortgage debt was 84% of aggregate income, up 25 percentage points in less than five years. Additionally, the private financial system is not exposed to student loan defaults in the way it was to subprime mortgages since the vast majority of student loans are explicitly guaranteed by the US government.

Figure 7 Household debt outstanding by type

Some recent research has found that higher student loan balances – conditional on the same amount of education – can lower homeownership rates. However, these estimates can explain less than a quarter of the decline in homeownership among young households over the last decade and do not incorporate the positive impact of higher education levels. Research that takes into account the positive impact of college highlights that education levels drive home ownership more than debt levels. A study by Mezza et al. (2014) has shown that while early in life those with a college education and no student loan debt are more likely to be homeowners than those with debt, by age 34, their homeownership rates are nearly identical and more than 10 percentage points higher than for those without a college education.

Figure 8 Home ownership rates, ages 23 to 35

The Obama Administration’s policies are also helping

To help more students gain the economic benefits of higher education while minimising the risks of failing to complete a degree and receiving a low-quality education, the Obama Administration has implemented a number of evidence-based policies. To address information barriers about the return to individual colleges, the Administration has improved information about college cost and quality through the new College Scorecard, and it has protected students from low-quality schools through landmark regulations that will cut off federal aid to career college programmes consistently failing accountability standards. Recent improvements to the Free Application for Federal Student Aid (FAFSA) are helping to reduce procedural complexities that can prevent students from applying for aid. And increases in Pell Grants and tax aid have offset much of the rise in college tuitions.

Finally, the Administration has made significant progress toward making debt repayment more manageable by providing borrowers with more flexibility in their repayment options. Data show that the college earnings premium increases substantially over time. Yet the standard repayment plan requires fixed level payments over ten years – imposing constraints that may lead to needless repayment difficulties. The expansion of flexible income driven repayment plans such as the President’s Pay as You Earn (PAYE) plan has lifted these constraints for millions of borrowers. These plans better align the timing of loan payments with the timing of earnings benefits by allowing borrowers to make smaller payments early in their careers and to adjust their payments as their earnings grow.

Figure 9 Lifetime earnings by educational attainment

Today, about 5 million borrowers are enrolled in PAYE and other income driven repayment plans, representing a dramatic increase over the past four years. Data presented in CEA’s report show that these plans disproportionately help borrowers from lower income families, and those who have struggled to repay their debt. Still, more work remains to increase enrolment in these plans by all those who could benefit from them.

Figure 10 Borrowers in IDR over time

References

Avery, C. and S. Turner (2012), “Student Loans: Do College Students Borrow Too Much — Or Not Enough?” The Journal of Economic Perspectives 26(1): 165-192.

Cellini, S. and L. Chaudhary (2013), “The Labor Market Returns to a For-Profit College Education.” Working Paper.

Cellini, S. and N. Turner (2016), “Gainfully Employed? Assessing the Employment and Earnings of For-Profit College Students Using Administrative Data.” NBER Working Paper No. 22287.

Council of Economic Advisers (2016), Investing in Higher Education: Benefits, Challenges, and the State of Student Debt.

Deming, D. J., C. Goldin, and L. F. Katz (2012), “The For-Profit Postsecondary School Sector: Nimble Critters or Agile Predators?” Journal of Economic Perspectives 276(1): 139-164.

Deming, D. J., C. Goldin, and L. F. Katz (2013), “For-Profit Colleges.” Future of Children 23(1): 137-163.

Hoekstra, M. (2009), “The Effect of Attending the Flagship State University on Earnings: A Discontinuity-Based Approach.” The Review of Economics and Statistics 91(4): 717-724.

Looney, A. and C. Yannelis (2015), “A Crisis in Student Loans? How Changes in the Characteristics of Borrowers and in the Institutions they Attended Contributed to Rising Loan Defaults.” Brookings Papers on Economic Activity.

Mezza, A., K. Sommer, and S. Sherlund (2014), “Student Loans and Homeownership Trends.” FEDS Notes October 15. Board of Governors of the Federal Reserve System.