Despite strong economic recovery after the Global Crisis, inflation remains below central bank targets or objectives in many countries, despite expansionary monetary policy. Indeed, inflation seems almost impervious to monetary stimulus in a long list of economies, including Japan, the Eurozone, Switzerland and, until recently, the US and Sweden. Missing the target is always awkward for a central bank, and being below it for a long period is doubly awkward. First, with interest rates at the zero lower bound, central banks are forced to rely on unconventional policies that are difficult to calibrate, and whose long-run effects are largely unknown. Second, these policies are contentious. They attract the attention of politicians, which raises risks to central bank independence.

Why is inflation so low? One possibility, emphasised by Blanchard et al. (2015) is that the Phillips curve has flattened. If true, the recent improvement in economic conditions in many countries – as captured by a decline in unemployment rates – has less impact on inflation than previously. The authors arrived at this conclusion after analysing data for 20 economies, which showed that the slope declined from the mid-1970s to the early 1990s.

This raises two questions. First, how steep was the Phillips curve before the 1970s? That is, is the Phillips curve unusually flat now, or was it unusually steep in the 1970s? Second, how common are changes in the shape of the Phillips curve? Does the Phillips curve undergo occasional breaks, between which it remains stable for decades, or is it continuously shifting?

In a recent paper, I study these questions using 100 years of Swiss data (Gerlach 2016).[1] To do this I estimate a standard backward-looking Phillips curve of the 'triangle model' type pioneered by Robert Gordon (see Gordon 2013 for a recent exposition), but measuring the state of the business cycle using the output gap. The research focuses on whether the Phillips curve has shifted in this time and, if so, how. This research extends the analysis in Baltensperger and Jordan (1998), who studied the inflation-output trade-off using annual Swiss data between 1948 and 1993. They found that the Phillips curve had become steeper over time. This implies that policy-induced shifts in aggregate demand increasingly spilled over into inflation during the sample period.

Lessons from a century of Swiss data

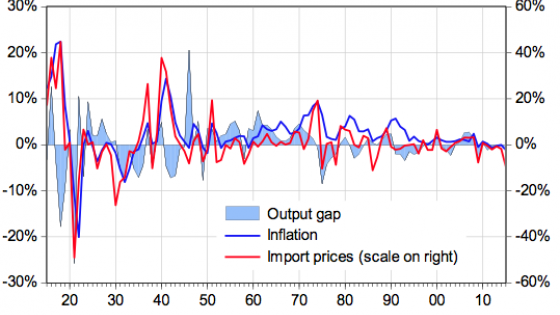

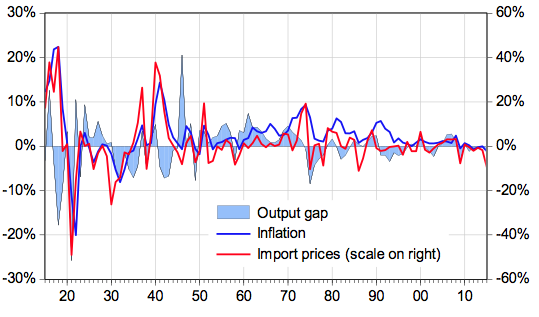

Figure 1 shows the data. Inflation is measured by consumer prices. Imported inflation is captured by the wholesale price index for imported goods (note the difference in scaling), and the output gap is computed as the deviation of real GDP from trend, which is computed using the method recently proposed by Hamilton (2017).

Figure 1 Inflation, import prices and the output gap in Switzerland, 1916-2015

Source: Gerlach (2016).

Several aspects of the figure are interesting. First, the three series move strongly together, particularly before 1960. For instance, inflation, the rate of change of import prices and the output gap were all high just before 1920, and all negative in the early 1920s. There was a similar episode around the start of the WW2 in 1939. The three series spike up together in 1951 during the Korean War boom. Strong positive co-movements occur in the first half of the 1970s and around 1990.

Second, the correlation of current inflation with the lagged output gap was higher (0.30) than with the current output gap (0.17), suggesting that there was a time lag between movements in the business cycle and inflation. I therefore lagged the output gap by one year in the econometric analysis.

Third, the amplitude of fluctuations in the three series declined over time. Thus, before 1950, inflation moved in the range of ±20%, the rate of change of import prices in the range of ±40% and the output gap in the range of ±15%. These fluctuations dwarf those we have recently observed.

Several factors may explain why the economy has become more stable. Changes in the structure of the economy, including the expanding size of the service sector and the growing using of active stabilisation policy are surely important. The shocks in the first part of the sample – for example the start and end of the two World Wars and the Great Depression in the early 1930s – were extraordinarily severe. Finally, the measurement of the price level has evolved over time, reducing the volatility of inflation (Kaufmann 2016).

Estimated Phillips curves

I estimate Phillips curve models in which CPI (headline) inflation depends on a constant, last year’s inflation as a crude measure of expected inflation, the rate of change of import prices (which capture energy price shocks), and the output gap. Formal tests for structural breaks at unknown times indicate that the data can be divided into four sub-periods or inflation regimes: 1916-1936, 1937-1970, 1971-1993 and 1994-2015.

The first structural break occurs in 1936-37. The estimated Phillips curves indicate that inflation became much more inertial, as evidenced by the fact that the parameter on lagged inflation more than doubled.

The second break occurs in 1970-71, that is, just before the oil price shocks of the 1970s and at about the time identified by Baltensperger and Jordan (1998). While the sensitivity of inflation to the output gap essentially doubles, other parameters are broadly unchanged. This impies that the Phillips curve steepened sharply in the 1970s.

The third break occurs in 1993-94, at about the time identified by Blanchard et al. (2015). The parameter on the output gap falls to zero and becomes insignificant. The parameter on lagged inflation also falls sharply and loses significance. This implies that between 1994 and 2015 inflation in Switzerland was insensitive to the output gap and displayed little persistence, and seems to have fluctuated only in response to changes in import prices.

A changing Phillips curve

Overall, these findings suggest that the change of the slope of the Phillips curve between the 1970s and 1990s, as emphasised by Blanchard et al. (2015), was an abrupt fall from an above-average to a below-average slope, not a collapse from some historically 'normal' slope to almost zero. If so, the current flat Phillips curve may be merely a temporary phenomenon that will soon increase in slope.

The analysis also raises questions for future work. First, how country-specific are the observed changes in the slope of the Swiss Phillips curve, and to what extent are they also present in data from other economies? It would be interesting to know if Phillips curves elsewhere were unusually steep in the 1970s.

Second, to what extent can we separate different hypotheses for changes in the slope of the Phillips curve? Consider the most recent period: the Phillips curve hay have indeed flattened, but we might have confused shifts in the level and the slope of the Phillips curve. This could happen if, for instance, we have underestimated the amount of slack in the economy.

References

Baltensperger, E and T J Jordan (1998), “Are there shifts in the output-inflation trade-off? – The case of Switzerland”, Swiss Journal of Economics and Statistics, 134, pp. 121-132.

Baltensperger, E and P Kugler (2015), Swiss Monetary History since the Early 19th Century, forthcoming, Cambridge University Press.

Blanchard, O, E Cerutti and L Summers (2015), “Inflation and Activity – Two Explorations and their Monetary Policy Implications”, IMF Working Paper WP/15/230.

Gerlach, S (2016), “The Output-Inflation Trade-Off in Switzerland, 1916-2015”, CEPR Discussion Paper No. 11714.

Gordon, R J (2013), “The Phillips Curve is Alive and Well: Inflation and the NAIRU during the Slow Recovery”, NBER Working Paper 19390.

Hamilton, J D (2017), “Why You Should Never Use the Hodrick-Prescott Filter”.

Kaufmann, D (2016), “Is Deflation Costly After All? Evidence from Noisy Historical Data”, KOF Working Papers, No. 421.

Endnotes

[1] For a review of economic developments in Switzerland in this period, see Baltensperger and Kugler (2015).