The potential influence of public wages on private sector wages is a key issue. The public sector is an important player in the labour market, employing some 20% of the labour force in an average OECD country. The factors determining public sector wages do not necessarily follow the same rules as in the private sector. Public employees provide public goods and services arising from social preferences that are not normally oriented to market activities. In this sense, their productivity, and the link between productivity and wages, is more difficult to assess than the productivity of workers linked to market-oriented activities.

The wage setting of the public sector can delay or spur labour market adjustments in the overall economy, as seen in the recent financial crisis. If public wages do adjust, private sector wages may follow. In the fallout of the financial crisis, most Eurozone countries are now considering fiscal consolidation plans, which hinge heavily on the wage bill of the public sector. Wage moderation to help keep government accounts under control may have an effect on the growth-friendly labour market relations in the private sector.

Existing research

The empirical literature on public or private sector wage leadership is relatively scarce. Against the framework of the Scandinavian model of inflation – the tradable goods sector would be, by definition, the wage setting leader and the other sector would follow – a rich set of papers for the Swedish economy have exploited the issue. Among others, Lindquist and Vilhelmsson (2006) find evidence in favour of private sector leadership. Lamo, Pérez and Schuknecht (2008) look at a broad set of OECD countries, and find that influences from the private sector to the public sector appear on the whole (for most countries) to be stronger than the opposite. However, there is some evidence of feedback effects from public wage setting to the private sector in a number of – mostly European – countries as well. This has important implications for public wage policies, especially in the Eurozone and in small open economies.

A visual inspection of public and private sector labour market indicators

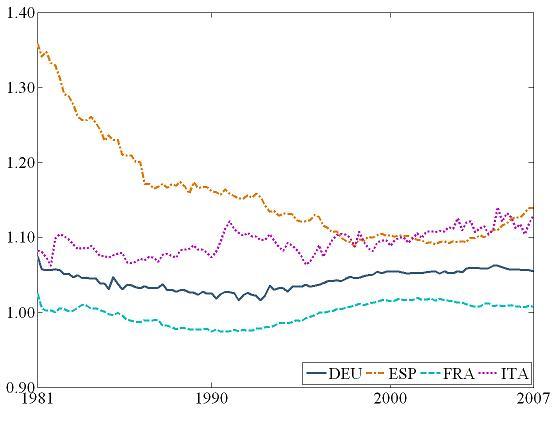

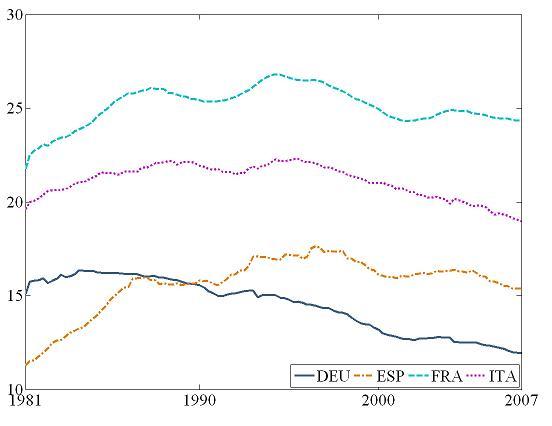

Figure 1 shows the evolution of public and private sector labour market indicators along the period 1980-2007. Different patterns are observed for each country despite the general adjustment of public employment observed since the late nineties. Germany shows a very regular pattern with respect to wages per employee (the wage premium of public employees is almost constant at around 10%) but it clearly shows a sizeable adjustment of personnel expenditures via employment. The French case is quite different as there is no significant wage premium but the number of public employees has increased significantly over this period.

Figure 1. Comparison of public and private sector labour market indicators

(I) Nominal compensation per employee, relative public to private sector

(II) Employment, relative percentage public sector to total

New evidence from Germany, France, Italy, and Spain

To further explore this relevant issue, in a recent study (Pérez and Sánchez 2010) we expand the available literature on public-private sector wage leadership for the biggest euro area countries – Germany, France, Italy, and Spain – highlighting the intra-annual influences across sectors – in other words, the signalling effects. The main novelty of the study is the use of newly available quarterly data over the period 1980-2007. This allows us to look at intra-annual linkages across sectors. In addition, we isolate the 1991-2007 period to analyse the potential break due to the launch of the euro.

A VAR empirical model is set up that can be rationalized theoretically along the lines of the public-private union competition models of Maffezzoli (2001) and Ardagna (2007). The empirical model includes nominal public and private sector wages, other endogenous variables (productivity and prices), and exogenous variables (institutional features1). In addition, to the standard interpretation of Granger-causality tests in a VAR framework we look at our results through the lenses of the literature on causal graphs (see Eichler 2007 among others).

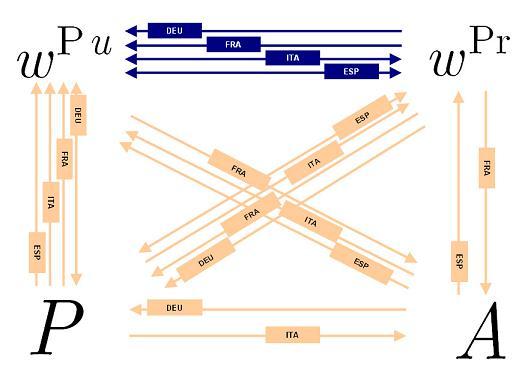

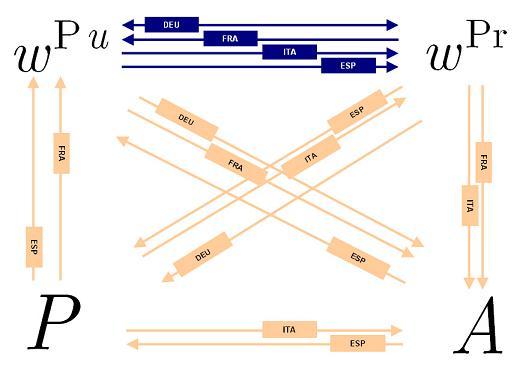

Figure 2 shows the results for our baseline model. Some heterogeneity of results emerges when looking in detail at country specific results. In the cases of Germany and France, when the 1980s are included in the estimation sample the private sector leads clearly the wage setting process. By contrast, when the sample period starts in the 1990s, the public sector leads. In the case of Italy and Spain, by contrast, the evidence seems to point either to private sector leadership or to bi-directional linkages between both sector wages, for both sample periods. In addition, we find strong evidence of persistence in public and private sector wages. By this we mean that the past of each sector wages shows predictive power for the future of wages in the same sector. This can be seen as evidence in favour of wage stickiness. Finally, we find robust evidence of wage price indexation for the whole set of countries but this effect is less important for the sample starting in the 1990s. Second, wages exert pressures on prices, especially for Germany and France.

Figure 2. Causal maps (baseline estimation)

sample period: 1981–2007

sample period: 1991–2007

Notes: (1) wPu and wPr are public sector and private sector compensation per employee respectively, P denotes the price level and A labour productivity. Institutional features are included as described in footnote 3. (2) The level of significance used in causal maps is 10 %.

“Within-the-year” effects

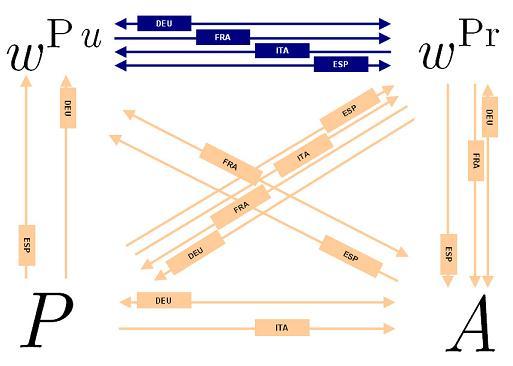

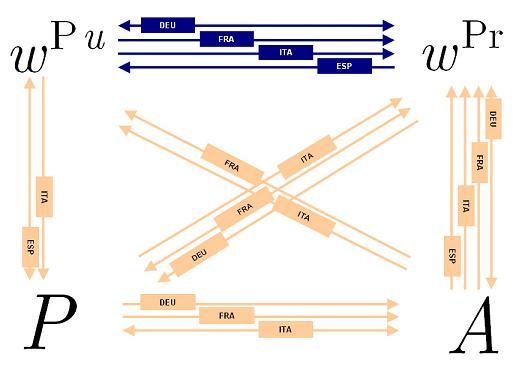

In order to assess the existence of intra-annual signalling effects we also consider a restricted estimation which leaves out some quarterly information in order to isolate links due solely to within-the-year linkages, as a proxy to standard wage negotiation practices (see Khun and Gu 1999 among others). Figure 3 summarises the results in this case. For Germany, the public sector gains relative importance when only these effects are considered, while in the French case the conclusions of the baseline estimation remain valid. In the case of Italy, the public sector leads under these circumstances. Finally, for Spain, there is evidence of public sector leadership when the sample period includes the eighties, while for the EMU period (1991-2007) the private sector seems to prevail. Overall, for the Eurozone, the results of our “restricted estimation” seem to unveil a signalling role of public sector wages in the wage negotiation phase.

Figure 3. Causal maps (restricted estimation)

sample period: 1981–2007

sample period: 1991–2007

Notes: (1) wPu and wPr are public sector and private sector compensation per employee respectively, P denotes the price level and A labour productivity. Institutional features are included as described in footnote 3. (2) The level of significance used in causal maps is 10 %.

The role of institutional features

Some interesting conclusions emerge also from the analysis of institutional control variables:

(i) the size of the government decreases the probability of public sector wage leadership, especially in the case of Spain, and to a lesser extent in Germany and Italy;

(ii) public ownership of strategic sectors firms negatively affects worker productivity;

(iii) employment protection legislation damages labour productivity in the case of Spain, while it seems to have a positive effect in Germany in the 1990s;

(iv) union density increases the probability of public wage leadership in Germany and Spain in the whole sample, that disappears when the 80s are excluded from the sample;

(v) the variable measuring globalisation exerts a positive effect on productivity developments.

Footnotes

1 Institutional features are included by considering the following set of variables: (i) the size of the public sector (as employer); (ii) an indicator which measures public sector ownership; (iii) a globalization index; (iv) employment protection legislation; (v) union density; (vi) union coverage; and (vii) wage bargaining coordination and centralization (for most of the indicators see Nickell 2006).

References

Ardagna, Silvia (2007), “Fiscal policy in unionized labour markets”, Journal of Economic Dynamics and Control, 31:1498-1534.

Eichler, Michael (2007), “Granger causality and path diagrams for multivariate time series”, Journal of Econometrics, 137:334-353.

Lamo, Ana, Javier J Pérez and Ludger Schuknecht (2008), “Public and private sector wages: co-movement and causality”, European Central Bank Working Paper Series, No. 963, November.

Lindquist Mathew J and Roger Vilhelmsson (2006), “Is the Swedish central government a wage leader?”, Applied Economics, 38:1617-1625.

Maffezoli, Marco (2001), “Non-Walrasian Labour Markets and Real Business Cycles”, Review of Economic Dynamics, 4: 860-892.

Nickell, William (2006), “The CEP-OECD Institutions Data Set (1960-2004)”, CEP Discussion Papers, dp0759. Centre for Economic Performance, London School of Economics.

Pérez, Javier J, Antonio Sánchez (2010), “Is there a signalling role for public wages? Evidence for euro area based on macro data”, European Central Bank Working Paper Series, No.a 1148, January.