When the Great Recession hit with full force in 2008, many countries experienced a sharp decline in their economic output. However, the accompanying decline in international trade volumes was even sharper, and almost twice as big. Globally, industrial production fell 12%, and trade volumes fell 20% in the twelve months from April 2008 – shocks of a magnitude not witnessed since the 1930s (Eichengreen and O’Rourke 2010). In addition, the decline was remarkably synchronised across countries.

Standard models of international trade fail to account for the severity of the event now known as the Great Trade Collapse. The workhorse model of international trade – the gravity equation – typically cannot explain the disproportionate decline in trade. It can only match the trade collapse if it incorporates increases in bilateral trade frictions such as tariff hikes (Eaton et al. 2011). However, most evidence indicates that trade policy barriers moved little during the recession (Evenett 2010 Bown 2011, Kee et al. 2013), while freight rates actually declined for most modes of shipping, given the slackening of trade flows and surplus capacity.

Trade and uncertainty shocks

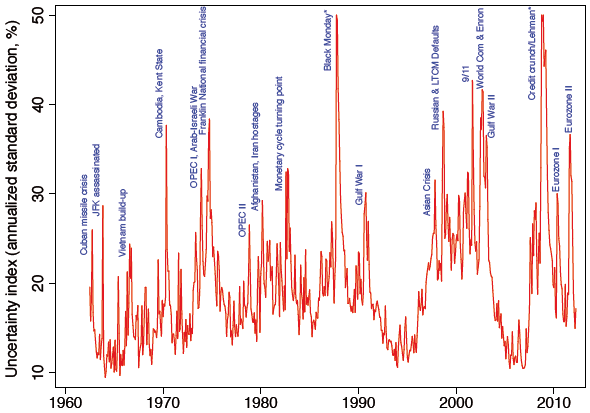

In a recent paper we offer a new explanation as to why international trade is so volatile in response to economic shocks, in the recent crisis as well as in prior episodes (Novy and Taylor 2014). We combine the ‘uncertainty shock’ concept due to Bloom (2009) with a model of international trade. Bloom’s approach is motivated by high-profile events that trigger an increase in uncertainty about the future path of the economy, for example the 9/11 terrorist attacks or the collapse of Lehman Brothers. Figure 1 plots an uncertainty index based on stock market volatility (see Bloom 2009). The major spikes are labelled in blue text and classified as ‘uncertainty shocks.’

Figure 1. The Bloom (2009) uncertainty index: Monthly US stock market volatility, 1962-2012.

In the wake of such events, firms adopt a ‘wait-and-see’ approach, slowing down their hiring and investment activities. Bloom shows that bouts of heightened uncertainty can be modelled as second-moment shocks to demand or productivity, and that these events typically lead to sharp recessions. Once the degree of uncertainty subsides, firms revert to their normal hiring and investment patterns, and the economy recovers.

We extend the uncertainty shock approach to the open economy. In contrast to Bloom’s (2009) closed-economy set-up, we develop a framework in which firms import intermediate inputs from foreign or domestic suppliers. This structure is motivated by the observation that a large fraction of international trade now consists of capital-intensive intermediate goods such as car parts and electronic components or capital investment goods – a feature of the global production system which has taken on increasing importance in recent decades (Campa and Goldberg 1997, Feenstra and Hanson 1999, Engel and Wang 2011).

In our model, due to fixed costs of ordering associated with transportation, firms hold an inventory of intermediate inputs, but the costs are larger for foreign inputs. We show that in response to a large uncertainty shock in business conditions, whether to productivity or the demand for final products, firms optimally adjust their inventory policy by cutting their orders of foreign intermediates more strongly than orders for domestic intermediates.

In the aggregate, this differential response leads to a bigger contraction and, subsequently, a stronger recovery in international trade flows than in domestic trade. Thus, international trade exhibits more volatility than domestic economic activity.

- In a nutshell, uncertainty shocks magnify the response of international trade, given the differential cost structure.

The differential impact of uncertainty on trade and the domestic economy

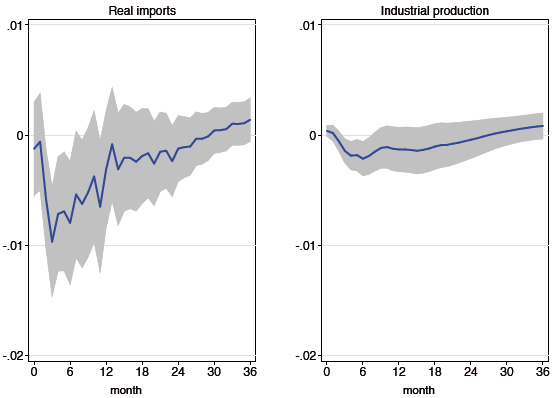

To motivate our approach, we first showcase the simplest possible evidence on the importance of uncertainty shocks. Using data for the US, we let uncertainty shocks hit two key data series: imports on the one hand, and industrial production (which is more representative of the domestic economy) on the other. We compute the impulse response of these two series based on a simple vector autoregression (VAR) with monthly data from 1962 through 2012. Figure 2 presents the results.

Figure 2. The impulse response for uncertainty shocks at the aggregate level (real imports in the left panel, industrial production in the right panel.

The bottom line from Figure 2 is clear. In response to the uncertainty shock, both industrial production and imports decline. But the response of imports is considerably stronger, about 5 to 10 times as strong in its period of peak impact during year one. The response of imports is also highly statistically significant.

Some industries react more to uncertainty shocks

Our model generates some additional predictions that we confirm in the data. For instance, we find that the magnified effect of uncertainty shocks on trade should be more muted for goods characterized by higher depreciation rates. Perishable goods are a case in point: the fact that such goods have to be ordered frequently means that importers have little choice but to keep ordering them frequently, even if uncertainty rises. Conversely, durable goods can be considered as the opposite case: they have very low depreciation rates, which allows less frequent ordering and a wait-and-see response to shocks. We find strong evidence of this pattern in the data when we examine the cross-industry response of imports to elevated uncertainty.

Can uncertainty shocks explain the Great Trade Collapse?

Could our model, which takes second-moment uncertainty shocks as its main driver, provide a plausible account of the Great Trade Collapse of 2008/09? We use a simulation exercise to argue that it could.

The four months following the collapse of Lehman Brothers – from September to December 2008 – were characterized by strong increases in uncertainty as measured by the index in Figure 1, with elevated volatility persisting into the first quarter of 2009. To simulate this shock we feed the model with a series of uncertainty shocks that generate a path of volatility similar to that actually observed.

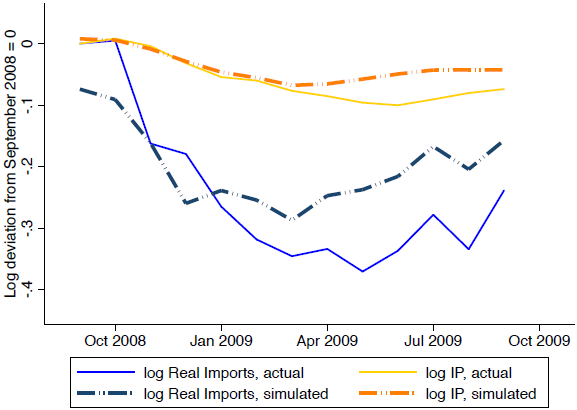

Figure 3. Actual and simulated real imports (blue) and industrial production (orange) in the crisis

Figure 3 presents the model-implied and the actual observed responses of industrial production and real imports. The model is capable of explaining a large fraction of the actual observed industrial production response, especially up to six months out (compare the dashed orange line to the solid orange line). The model is also capable of explaining most of the real import response over a similar horizon (compare the dashed blue line to the solid blue line). The sharp difference between the two actual series, which reflects the amplified response of international trade flows compared to domestic flows, is well captured by the simulated paths.

Conclusion

Our results offer an explanation for the Great Trade Collapse of 2008/09 and previous trade slowdowns in a way that differs from the conventional static trade models. The simulations show that our model can, on average, explain over three-quarters of the imports collapse. But of course, there might have been other factors at work, for instance financial frictions and the drying up of trade credit (Amiti and Weinstein 2011). We see these approaches and ours as complementary.

References

Amiti, M and D Weinstein (2011), “Exports and Financial Shocks”, Quarterly Journal of Economics 126(4): 1841–1877.

Bloom, N (2009), “The Impact of Uncertainty Shocks”, Econometrica 77(3): 623–685.

Bown, C (ed.) (2011), The Great Recession and Import Protection: The Role of Temporary Trade Barriers, London: Centre for Economic Policy Research and World Bank.

Campa, J and L Goldberg (1997), “The Evolving External Orientation of Manufacturing Industries: Evidence from Four Countries”, NBER Working Paper 5919.

Eaton J, S Kortum, B Neiman, J Romalis (2011), “Trade and the Global Recession”, NBER Working Paper 16666.

Eichengreen, B and K H O’Rourke (2010), “A Tale of Two Depressions” VoxEU.org, 8 March

Engel, C and J Wang (2011), “International Trade in Durable Goods: Understanding Volatility, Cyclicality, and Elasticities”, Journal of International Economics 83(1): 37–52.

Evenett, S (ed.) (2010), Tensions Contained ... For Now: The 8th GTA Report, London: Centre for Economic Policy Research.

Feenstra, R C and G H Hanson (1999), “Productivity Measurement and the Impact of Trade and Technology on Wages: Estimates for the US, 1972–1990”, Quarterly Journal of Economics 114(3): 907–940.

Kee H, C Neagu, A Nicita (2013), “Is Protectionism on the Rise? Assessing National Trade Policies During the Crisis of 2008”, Review of Economics and Statistics 95(1): 342–346.

Novy, D and A M Taylor (2014), “Trade and Uncertainty”, NBER Working Paper 19941.