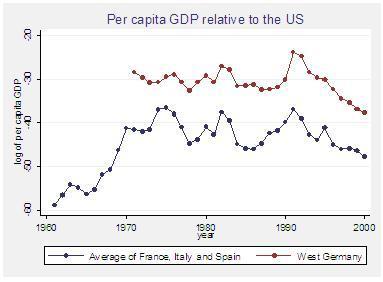

The comparison of economic success in different countries is invariably based on the analysis of per capita GDP. In particular, the recent economic decline of continental Europe is predicated on the observation that, starting in the early nineties, the gap in GDP per capita between the large countries in continental Europe and the United States started widening again. This gap had remained roughly constant since the early seventies, while it had narrowed during the decades of the postwar “economic miracle”, the fifties and sixties (see Figure 1).

But GDP is poorly measured, because two major items are left out: home production, namely goods and services not produced in the market, and intangible investments, namely accumulation of knowledge useful in the production that increases future profits and future productivity. If we considered these two items, how would continental Europe compare to the US? In particular, is it possible to revise upward the recent European economic performance relative to that of the US?

Consider first the issue of home production. It is difficult to measure what is work and what is leisure; think of cooking, child care or reading a book: they are a bit of both. Child care is especially striking: if my wife takes care of the children of another woman as a babysitter and the other way around, two salaries of baby sitters enter into GDP. If they took care of their own children nothing would be recorded. Thus, a low participation of men and especially women in the labour force may lead to underestimate GDP per capita, because the hours spent working at home are not part of market measured GDP. The good cooking of Italian mothers does not enter into Italian GDP, bad McDonald's meals enter in US GDP! But how much of the difference in patterns of GDP per capita growth between US and continental European countries can we explain with this?

Right when economic convergence (as measured by GDP per capita) seemed to have stopped, from the early seventies onward, Europeans started to work less and less in the market. This is particularly true in France, Germany and Italy. While in the fifties Europeans worked more than the Americans, today the number of hours worked per person in working age is about 25 per week in the US versus an average of about 17 in France, Germany and Italy. But this reduction in working time did not all go into leisure. When Europeans do not work, they are not only enjoying the good life. A good portion of time spent away from the market is spent working at home, more so in Europe than in the US. This suggests that the catch-up of Europe did not stop in the early seventies, but continued throughout the seventies and eighties. What happened in the early seventies was not an interruption of true economic convergence, but rather a progressive and sustained switch from market work to home work in Europe; this switch did not take place in the US.

The European trend of more work at home and less in market has not changed in recent years, but the reduction of hours per person worked in the market has slowed down. More people are also entering the labour market. From 1996 to 2006 there were exactly the same number of new jobs created in the EU as in the US, about 18 million. This suggests that the second turning point depicted in Figure 1 - the widening of the gap with the US since the nineties - is not a statistical artifact and cannot be explained by an increase in home production in Europe. If anything, when we take into account the patterns in home production, the turning point in the early nineties in terms of per capita GDP growth in the US versus continental Europe appears even more pronounced.

Next, consider intangible investments. Examples are spending in R&D or the purchase of new software, but also spending by firms to improve or innovate products, to consolidate its brand, or to reorganize production. These items are often classified as intermediate expenses, but from an economic point of view, they are really investments that increase future profits and future productivity. This is a crucial difference, because investment is part of GDP, while intermediate expenses are not. Moreover, the numbers are big. Recent estimates suggest that, for the US economy, intangible investments are now larger than traditional tangible investments. A correct classification of these items might increase the level of US GDP by as much as 10%.

The importance of intangible investment increased over time, with the transformation towards a knowledge-based economy. This suggests that also growth rates, and not only levels, are underestimated. For the US, it is estimated that actual growth was higher than official growth by about one third of a percentage point every year since the early seventies. Since intangible investments retained a fairly constant trend over this period, the addition to growth is also uniformly distributed between the early seventies and now.1

Much less is known about the size of intangible investment in continental Europe, but common sense suggests that they are likely to be smaller. First, spending on software and R&D is smaller than in the US. Moreover, the transformation towards a knowledge-based economy started later, and the service sector remains smaller than in the US. If so, both the level and the growth rate of GDP might be less underestimated than in the US. Further confirmation of this conjecture comes from the analysis of total factor productivity growth (the residual increase in labour productivity that cannot be explained by accumulation of physical capital). In the US, this residual component of productivity accelerated sharply in the last decade, a sign that other (intangible and harder to measure) investments were taking place. This did not happen in continental Europe, where instead almost all productivity growth can be fully accounted for by tangible investment.2

From the point of view of the patterns of convergence and divergence described in Figure 1, taking into account intangible investments might lead to the following conclusion: the catch-up of continental Europe with the US is less pronounced, and the widening of the gap since the early 1990s even more worrying, than the official data portray.

Altogether, these considerations point to an unequivocal conclusion. The economic decline of continental Europe relative to the US since the early nineties is not a statistical artifact. In fact, if GDP were measured correctly, the relative economic decline might be even more pronounced than what is recorded in the official statistics.

See “Intangible Capital and Economic Growth”, by C. Corrado, C. Hulten and D. Sichel, NBER working paper N. 11948, 2006

2 For instance, according to the OECD productivity data base, between 1995 and 2005 the residual component of labour productivity grew on average by 1.5% per year in the US, while by only 0.5% in France, Germany, Italy and Spain (on average).