A familiar script has played as the global financial crisis has spread, picking up speed and intensity. The drama has three acts that have been written out in the historical record for as long as there have been open financial markets.

- Act One: Unbounded Enthusiasm. Some markets find favour with global investors.1 Credit becomes readily available, asset prices percolate, and many categories of spending are buoyed.

- Act Two: Day of Reckoning. Recognition that some of that enthusiasm was overdone spreads among investors. New credit flows cease, collateral is sought, asset prices crash, and prominent private-sector icons crumble.

- Act Three: Restoration. Here governments pick up the pieces, typically passing on the cost to future generations by issuing a vast volume of debt. The cost can be punishing because investors pull away from the governments of emerging market economies as forcefully as they do from private creditors.2

American exceptionalism

But there has been one prominent exception to this classic tale. With fitting irony, the US, which is the epicentre of the crisis, has avoided Act Three. The US enjoyed a capital inflow bonanza that funded yawning current account deficits, and asset prices spiralled upward only to crash. While the crash has constricted credit and is redrawing the financial landscape, the US has not been punished by investors in typical Act-Three fashion.

If this had happened to any other government in the world whose national financial institutions were in as deep disarray as those of the US, investors would have run for the hills – cutting off the offending nation from global capital markets. But for the US, just the opposite has happened.

Rather than facing prohibitive costs of raising funds, US Treasury Bills have seen yields fall in absolute terms and markedly in relative terms to the yields on private instruments. This has been called a “flight to safety”.3 But why do global investors rush into a burning building at the first sign of smoke?

The answer lies in part with the exchange market practices of key emerging market economies.

Since the last global market panic, the Asian Financial Crisis of 1998, many governments have stockpiled dollars in their attempts to prevent their exchange rates from appreciating. At the same time, the long upsurge in commodity prices has swollen the coffers of many resource-rich nations. As a result, and as shown in the latest forecast in the World Economic Outlook of the International Monetary Fund, international reserves of emerging market economies are expected to have increased $3.25 trillion in the last three years. According to the Fund’s survey of the currency composition of those holdings, the bulk is in dollars (see Figure 1).

Figure 1

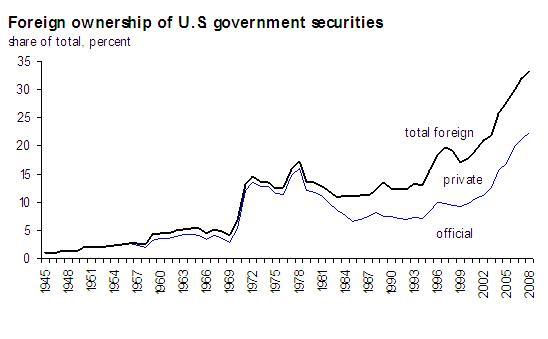

The dollar portion of these reserves is most often invested in US government securities, which offers excellent market liquidity, and US government debt is also considered as safe as anything (following a precedent laid down by the first Secretary of the Treasury, Alexander Hamilton).4 All this explains the dollar’s popularity with foreign investors who might otherwise be expected to shun the US. As the Figure 2 indicates, foreign official entities now own almost one-quarter of outstanding government securities (the upper panel). These holdings of securities constitute about 10% of non-US nominal GDP (the lower panel).

Our currency, your problem

Herein lies the special status of US government securities. For a few of the world’s key decision makers, it is not in their economic interest to stop, or even slow, the purchase of Treasury Bills. As Keynes once said: “If you owe your bank a hundred pounds, you have a problem. But if you owe a million, the bank has a problem.” Potential capital losses on existing stocks keep foreign investors locked into US government securities.

Figure 2

Figure 2 also shows a precedent for recent financial market strains. The last time foreign official purchases bulked so large in the US government’s financing was from 1968 to 1973, when the Bretton Woods system of managed exchange rates broke down.5 At that time, keeping the system going required increasing support from abroad, primarily from Europe. This time around, the source of that support has shifted to Asian-Pacific economies and Middle East exporters. In both cases, the message from the US seems best summarised in the words of then-Treasury-Secretary John Connolly, who famously advised, “the dollar is our currency, but your problem.”

As the tone of those words suggests, another lesson from the earlier experience is that foreign resentment with a US-dominated arrangement grows over time. That America could be a source of financial instability and a haven of sovereign financial security seems to some, to quote Valerie Giscard d'Estaing, to be an “exorbitant privilege.”

In this episode, Treasury yields have fallen and the foreign exchange value of the dollar has appreciated recently. Moreover, many European financial firms have had funding difficulties associated with a lack of access to dollar liquidity. This has made it necessary for European officials, caps in hands, to seek swap arrangements with the Federal Reserve to acquire dollars to re-lend to their national champions.

Recent enthusiasm in Europe for fundamental reform of the international monetary system finds its roots, in part, in this resentment. They do not want our dollar to be their problem, and they want to erode some of that privilege. Put it those terms, however, it seems clear that this will mostly be a one-way conversation. US officials must recognise that their nation’s funding advantage rests on the unrivalled, for now, position of US government securities in global financial markets. Thus, they will listen and agree to work-streams for groups to report back in the future. But whether it is this Administration or the next, advantages to the US, unfair as that may seem as viewed from abroad, will seem worth preserving.

An exorbitant privilege that comes with a cost and a responsibility

These advantages come with a cost and a responsibility. Open access to markets probably allowed US officials to drift in their response to the financial crisis. They initially mistook a solvency problem for a liquidity one. When action was ultimately forthcoming, Treasury officials failed to articulate a clear sense of principles and priorities for intervention. This ad hoc improvisation has probably stretched out and intensified the crisis. In a crisis in an emerging market economy, the sudden stop of credit to the government forces painful adjustment to be done quickly.6 These adjustments may have been painful, but a quick response tends to reduce the overall bail-out cost.

As for responsibility, officials must recognise that investors have granted the US its reserve-currency status for reasons. Size matters, but other reasons include a respect for the rule of law and for contract enforcement and the predictability and transparency of the policy process.

When US officials move to the next stage of the crisis – the search for legislative protections to prevent a recurrence – it will be important to preserve these attractive aspects of US markets.

References

Michael P. Dooley , David Folkerts-Landau, Peter Garber, “The revived Bretton Woods system,” International Journal of Finance & Economics Volume 9 Issue 4, 2004, pp. 307 – 313.

Reinhart, Carmen and Vincent Reinhart “Capital Flow Bonanzas: Past and Present,” (with Vincent R. Reinhart) in Jeffrey Frankel and Francesco Giavazzi (eds.) NBER International Seminar in Macroeconomics 2008, (Chicago: Chicago University Press for NBER, forthcoming 2008a).

Reinhart, Carmen and Vincent Reinhart, “From capital flow bonanza to financial crash,” VoxEU (2008b).

Reinhart, Carmen and Kenneth Rogoff, “The Forgotten History of Domestic Debt,” NBER Working Paper 13946, April 2008.

1 In Reinhart and Reinhart (2008a and b), we refer to this act as a “capital flow bonanza.”

2 Such funding strains have frequently been sufficient to compel governments to default. This is why we find in Reinhart and Reinhart (2008a) that episodes of capital flow bonanzas help to predict sovereign defaults.

3 Following market practice and legal convention, government securities include those of the US Treasury and the government-sponsored enterprises.

4 The history of US debt is not unblemished. Reinhart and Rogoff (2008) report that the US never defaulted on its sovereign external debt but that the abrogation of the gold clause in 1934 constituted a domestic default.

5 Dooley, Folkerts-Landau, and Garber (2004) have dubbed this latest period Bretton Woods II, in part exactly because of the role of foreign official purchases in facilitating US current account deficits. They pose plausible reasons why it might be in the self-interest of foreign officials to do so. Another possibility, as discussed earlier, is that existing portfolio holdings are so large that officials are in a self-fulfilling trap.

6 In this regard, the current US situation is more akin to that in Japan in the 1990s, when policymakers delayed addressing the fundamental problem of non-performing loans and favoured half-measures for some time. The Japanese government could tap a large pool of domestic saving to fund its equivocations so that the opinion of global creditors was not relevant. The lesson is market discipline does not apply either if a nation is too big to fail or saves too much to care.