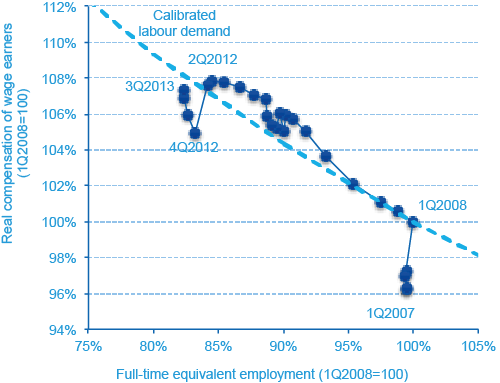

With its huge unemployment rate, if there is a country in need of assessment of labour markets reforms and wage moderation, it is Spain. In the third quarter of 2013 the unemployment rate reached 26% of the labour force, more than twice the Eurozone’s 12.1%. As shown in Figure 1, since the beginning of the crisis in the first quarter of 2008, Spain has lost 17.5% of its employment (22.8% in the private sector), while the average real wage increased 7.6% until the second quarter of 2012.

Figure 1 Employment and real wages in Spain, 2007-2013

Two events occurred in 2012 that changed the behaviour of real wages. The first was the agreement on employment and collective bargaining for 2012-14 between major trade unions and firms’ organisations (CEOE, CEPYME, CCOO and UGT) to promote internal flexibility and wage moderation. The second was a new labour market reform with advances on three fronts:

- Decentralisation of collective bargaining and elimination of indefinite job security.

- Reduction of firing costs.

- Greater internal flexibility of employment in the organisation of production at the firm level.

As a result, real wages fell by 0.4% between the first quarter of 2012 and the third quarter of 2013, ending the trend of increasing real wages during the crisis (seen in Figure 1). Given this evidence, this column tries to answer two relevant questions:

- Which are the short- and long-run effects of this wage moderation on employment?

- What would have occurred in the second half of 2008 and in 2009 if wages had performed as they did since 2012?

The estimation methodology

To answer these questions, we estimate a structural VAR in which we extend the aggregate supply and demand model proposed by Blanchard and Quah (1989), with a model of structural unemployment based on Layard et al. (1991), where both firms and workers have market power in product and labour markets, respectively.1

The endogenous variables in our VAR are the share of wages in GDP, the unemployment rate, and logarithms of real wages, GDP, and prices. In order to identify the five structural shocks we assume the following long-run restrictions:

- The aggregate demand shock has long-run effects only on prices.

- The labour supply shock does not affect real wages, the unemployment rate or the wage share of GDP in the long run.

- The productivity shock increases real wages in the long run, with no effects on the unemployment rate or the wage share.

- Both the mark-up and wage push shocks increase the unemployment rate in the long run but have opposite effects on the wage share in GDP.

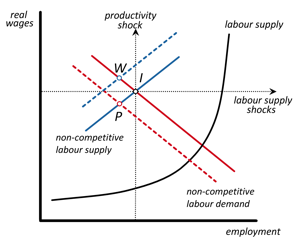

Figure 2 Structural shocks and their effects on real wages and employment

In Figure 2 we represent the identifying assumptions that we impose in our structural VAR. A permanent positive wage push shock shifts upwards the non-competitive labour supply, increasing both the unemployment rate and the real wage from I to W. In contrast, a positive mark-up shock reduces both the real wage and employment, from I to P. A positive productivity shock shifts upwards supply and demand curves with long-run effects on the real wage and no effects on employment (a movement along the vertical line crossing I). A positive labour supply shock increases employment in the long run with no effects on the real wage (a movement along the horizontal line crossing I) and on the unemployment rate. Finally, aggregate demand shocks have only short- and medium-term effects on unemployment and real wages, with no effects in the long run (the economy returns to I).

Results

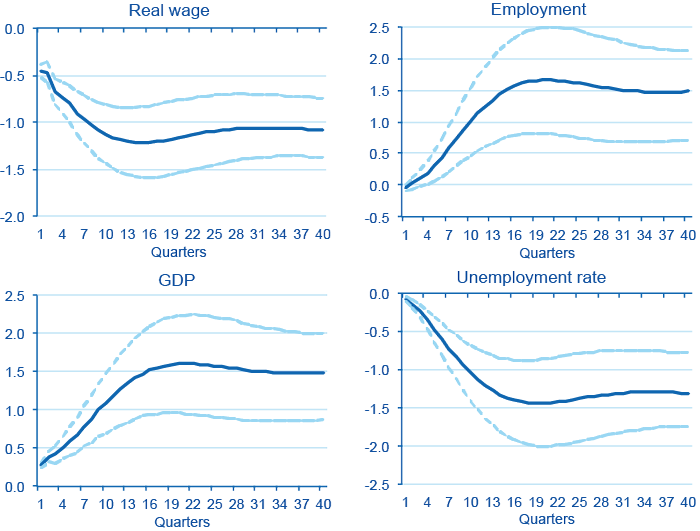

In Figure 3 we present the estimated impulse-response functions of real wages, employment, GDP, and the unemployment rate after a negative wage push shock. According to these results, a wage push shock that reduces the real wage by 1% in the long run increases employment and GDP by around 1.5%.

We have also identified the structural shocks and their effects on the endogenous variables in our SVAR. According to the results, the wage push shock explains between 43% and 50% of the accumulated increase in the unemployment rate from the first quarter of 2008 to the first quarter of 2011.

The identification of structural shocks also allows us to estimate the effects of wage moderation from 2012 onwards. We compute the counterfactual scenario, removing the wage shocks and maintaining all other estimated shocks. Wage moderation has prevented around 76,000 job losses up to the second quarter of 2103 (measured in terms of full-time equivalent workers), or 79,100 if we take into account the increase in part-time work). As the dynamic effects also accumulate over time, the observed wage moderation up to now will probably prevent 320,000 job losses after three years, that is, 1.94% of employment.

Figure 3 Impulse-response function of a negative wage-push shock that reduces the real wage by 1%

(deviations from the baseline, in percentages)

Finally we have estimated how the Spanish economy would have performed during earlier years of the crisis with the same degree of wage moderation as that observed since the first quarter of 2012. In this exercise we substitute the wage shocks estimated in 2008 and 2009 (mainly positive) with those observed after the first quarter of 2012 (mainly negative), maintaining all other estimated structural shocks. The results of this exercise indicate that wage moderation in the first part of the crisis could have prevented the loss of one million jobs (or 5.2% of 2008 employment).

Conclusions

Inefficiencies in goods and services markets and the labour market have largely been behind the rise in Spain's unemployment rate over the past three decades, and especially during the Great Recession.

However, in 2012 the labour market reform and the new agreement on employment and collective bargaining between trade unions and firms marked a significant step towards achieving a less rigid wage-setting mechanism. This is a significant event since, according to Calvo et al. (2013), strong adjustments in real wages seem to be required to avoid jobless recoveries after a financial crisis. Therefore, in the absence of high inflation, downward nominal wage flexibility is needed to guarantee job creation during the upturn. An example of the impact that a more flexible wage-setting mechanism could have going forward is that, according to our estimations, if the reduction in real wages observed in 2012 had happened in 2008 and 2009 (when real wages went up), the loss of around one million jobs could have been prevented (around one third of total job destruction between 2008 and 2012).

In addition to new labour market measures (to reduce duality, increase the efficiency of active labour market policies, and reduce inefficiencies in passive policies), structural reforms are needed to make goods and services markets more competitive and efficient, which in turn would increase labour demand and real wages. Correctly implemented and accompanied by appropriate policies at the European level (to reduce financial fragmentation, restore the transmission mechanism of monetary policy, and boost aggregate demand), these could be the solution to the anomalously high unemployment rate in Spain.

References

BBVA (2013), “Persistent unemployment and wages in Spain,” Spain Economic Outlook, May, pp. 22-31.

Blanchard, O J and D Quah, (1989), “The Dynamic Effects of Aggregate Demand and Supply Disturbances,” The American Economic Review 79(4), pp. 655-673.

Calvo, G, F. Coricelli and P Otonello, (2013), “Jobless Recoveries During Financial Crises: Is Inflation the Way Out?” Working Paper 19683, National Bureau of Economic Research.

Dolado, J J and J F Jimeno, (1997), “The causes of Spanish unemployment: A structural VAR approach,” European Economic Review 41(7), pp. 1281-1307.

Fabiani, S., A. Locarno, G. P. Oneto, and P. Sestito, (2001), “The sources of unemployment fluctuations: an empirical application to the Italian case,” Labour Economics 8(2), pp. 259-289.

Layard, R, S Nickell, and R Jackman (1991), Unemployment: Macroeconomic Performance and the Labour Market, Oxford University Press.

1 In the Appendix of BBVA (2013) we present the complete structure of the econometric model, which is based on the work of Fabiani et al. (2001), and it is slightly different to the model estimated by Dolado and Jimeno (1991), both in the variables included in the SVAR and in the long-run identifying assumptions.