Across many countries, the cost of publicly funded healthcare, retirement, and other welfare programmes are forecast to put rising pressure on government budgets. As a result, many nations are seeking to reform their welfare states so that costs to the government can be reduced, quality of outcomes increased, and the plight of low- and middle-income earners improved. Regrettably at present, there are at least three problems concerning many of the debates about reform of the welfare state.

- First, disagreements are often focused around two opposing ideological viewpoints. One side is demanding more welfare spending and higher taxes, whereas the other is arguing for less welfare spending and lower taxes.

- Second, even when economists and others propose a welfare reform that appears promising in theory, designing the transition so as to be politically feasible is often overlooked.

- Third, the debates are typically quite narrow. They seldom focus on a comprehensive reform that would rewrite the rules governing the entire welfare and tax system, with the aim of making them work more fairly and efficiently.

This column shows how a nation can change from a publicly funded welfare system to one that relies largely on private funding, coming from compulsory savings accounts. The novel reform that it proposes attempts to resolve the above problems.

- First, our ‘Savings not Taxes’ reform keeps total welfare funding, from both private and public sources, similar to its pre-reform level.

- Second, our reform has features that help to make it politically feasible, especially the use of tax cuts to fund the savings accounts.

- Third, it takes a unified approach to the funding of health, retirement and risk-cover (for job-loss) and rewrites the tax code. We use New Zealand, a country with which we are familiar, as a case study, although the reform can easily be adapted to other nations.

How does it work? Taxes currently paid on personal earnings up to NZ$50,000 for single tax-payers go directly into the accounts. A drop in the corporate tax rate helps to fund employer contributions. The government retains sufficient revenues to act as ‘insurer of last resort’, paying for people who cannot meet their own welfare expenses out of their savings accounts.

Our ‘Savings not Taxes’ reform offers the scope for large efficiency gains, particularly in health-care. A reason for optimism is that Singapore uses compulsory accounts and maintains one of the highest quality services in the world yet presently spends, in total, 4.8% of GDP on health (compared to 17.2% in the US, 9.3% in the UK and 9.5% in NZ).

Whilst we believe these kinds of efficiency gains are plausible upon implementation of our reform, they have not been factored into our estimated national budgets, which consequently probably understate the benefits.

The ‘Savings not Taxes’ reform

The problem

Large publicly funded welfare states are under threat. The ‘dependency ratio’ – the proportion of elderly to younger, economically active, workers – is expected to rise all over the world. Severe pressures will be brought to bear on pensions and, in particular, public health systems.

Solving the problem: Some background

Having recognised the welfare state problems that face almost every developed nation, we ask ourselves, “What can we do about it?”

First, we need to quantify the problem in a way that politicians, economists, the news media and others cannot ignore. One way is to forecast health and pensions spending as a fraction of GDP over the next several decades. The OECD (2013) reports strongly rising trends. Another way is to measure the ‘fiscal gap’ which is the present value of projected future government expenditures net of the present value of future taxes. Using this approach, Kotlikoff (2013) argues that the true US fiscal debt is not the US$13 trillion usually reported by the government, but instead is over US$200 trillion.

Alternatively, one can bring the gross value of unfunded liabilities into the government accounts using accrual accounting principles. The Public Finance Act 1989 in New Zealand promoted a move in this direction. Including an allowance in the New Zealand budget for the accrued cost of health and pensions incurred by the increased number of retirees implies a fiscal deficit of 4% of GDP in 2015 (instead of the cash surplus mostly reported).

Second, we need to set aside traditional myths and return to fundamentals. This involves adopting several principles related to successful structural change (Douglas 1989).

- Only medium-term quality decisions, not quick-fix solutions make a difference. We spent time getting the framework right to help ensure everyone acts more effectively.

- Quality decisions relating to welfare recognise and exploit economic and social linkages, so that every action improves the working system as a whole, instead of treating problems separately.

- Only large packages provide the flexibility needed to demonstrate that any losses suffered by a group of people from one policy would be offset by gains for the same group in some other area. Opportunity, incentive and choice are vital in order to mobilise the energy of the people to accept fundamental change.

An overview of the solution: The ‘Savings not Taxation’ Reform

In getting the framework right, we needed to adjust the tax system so that the vast majority of New Zealanders of working age could provide for themselves.

The first step is to build up compulsory savings accounts (for health, pensions and risk- cover) via the transfer into them of current tax paid on income up to NZ$50,000, supplemented by employer contributions, whose corporate taxes are reduced in lieu. The result is that most individual New Zealanders would save NZ$17,500 per year (and couples $30,000 to $35,000 per year) enough to look after their own welfare needs. Of this total, $7,875 is paid into a health account, $3,500 into a risk account and $6,125 goes toward superannuation. Mandatory ‘catastrophic’ health and risk-cover insurance is funded from the savings accounts.

The second step is to lower personal tax rates by 42% on income between NZ$50,001 and $70,000 and by 30% on income above $70,000. Offsetting these lower rates is the fact that individuals in these brackets become responsible for any additional superannuation, health and risk-cover beyond what they have on their first $50,000 of income. In other words, help stops at $50,000 except for single-income families (where it extends to $65,000).

The third step is to reduce government expenditure largely via the removal of privilege (corporate welfare and high-income earners’ welfare grants or benefits). It is this change that allows the above tax cuts to be deep enough to enable most people to establish significant savings balances (on top of paying a share of their own welfare costs and retaining pre-reform disposable incomes).

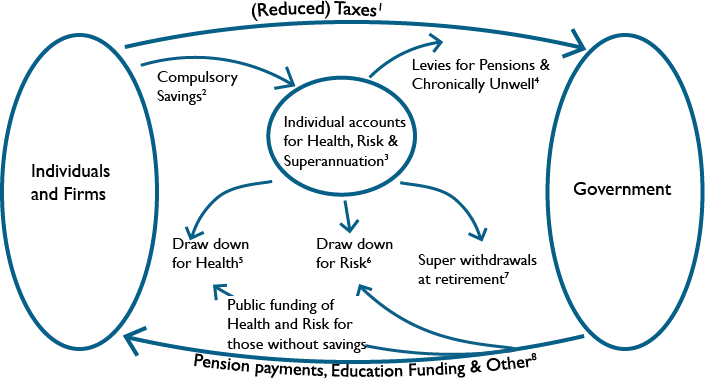

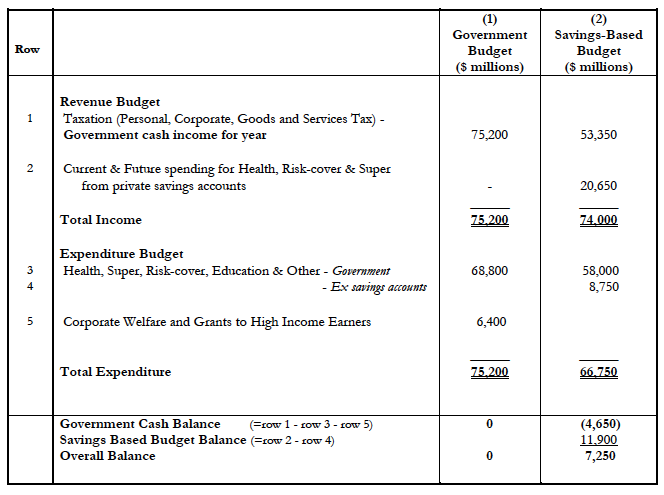

Figure 1 gives a graphical depiction of the ‘Savings not Taxation’ system. Table 1 summarises the changes using our New Zealand case study. In the 2015-16 financial year, the New Zealand government received NZ$75.2 billion in tax revenues and spent the same amount of cash, mainly on the welfare state.

Figure 1 Financial flows in the ‘Savings not Taxation’ system

Taxes are reduced and contributions made to compulsory savings accounts in lieu. Funding for health-care & risk is publicly supported for those with insufficient savings.

Notes: (1) Taxes are cut by $21.9 billion, comprising a $21.0b cut in personal taxes, $4.1b cut in company taxes and $3.2b rise in Goods and Services Tax. (2) Compulsory Savings equal $28b. (3) Of this total, $12.6b is paid to health a/c’s, $5.6b to risk-cover and $2.5b is held as a levy for a State pension (making $20.7b available for current & future welfare spending). The remaining $7.3b is paid into individual retirement a/c’s. (4) Levy for chronically ill is $1.6b; the pension levy of $2.5b is paid on retirement. (5) Drawdown on Health a/c is $7.5b and the Gov’t funds $8.1b. (6) Drawdown on Risk a/c is $1.5b and the Gov’t funds $8.4b. (7) Super withdrawals are 0 in year 1 of the reform. (8) Pension, Education & Other Spending is $10.6b, $11.9b and $19b, respectively.

Table 1 New Zealand government and savings-based budgets for 2015-2016

The existing ‘Taxes Only’ system is reported in Column 1 and the effect of the ‘Savings not Taxation” System is reported in Column 2

Source: NZ Treasury (2016a).

Under the new regime, tax revenues fall to NZ$53.4 billion. However, $20.6 billion of the tax cuts is paid into the savings accounts, yielding $74 billion of funds available for welfare spending by government and private individuals. In the first year of the reform, $58.0 billion of mainly health, pensions, risk and education spending is funded by the government, and $8.8 billion is private. The funds that are not spent out of the accounts in the current year become savings for future welfare expenditures.

For a full set of current and forecast budgetary accounts, showing the fiscal impact of the reform, as well as a details of the policy changes, see Douglas and MacCulloch (2016).

Reform outcomes and conclusion

What kinds of outcomes can we expect from the new regime?

- First, consumers now spend their own money (for health and risk cover) and save for their own retirement. A culture of greater personal responsibility should develop, helping to control costs and increase quality. Consumers become the principal buyers of welfare services, as they are for other goods and services, instead of third-party government agencies. Choice becomes available for most people, not just the rich, creating a sense of empowerment.

- Second, transparent price comparisons now become possible, particularly in the health- services area, which should improve efficiency.

- Third, the role of government changes from funder and provider to regulator, information-provider and insurer of last resort.

- Fourth, the personal goals of disadvantaged people are recognised. Low income families, both working, on a combined income of NZ$82,000 would have $13,000 for health-care, $6,000 for out-of-work cover and be able to save $10,000 for retirement each year.

- Fifth, the government and compulsory savings accounts for the first year of the reform show an improvement of revenues over expenditures of 3% of GDP compared with the current system. By 2050, the balance sheet improves by NZ$300 billion plus (or 125% of the present year’s GDP).

In summary, a reform of this type has the potential to lead to large efficiency gains. It should also help secure the future of the welfare state, whilst at the same time retaining the necessary tax revenues to ensure universal coverage and equitable outcomes.

Editors’ note: This column is based on CEPR Policy Insight No. 98, available here.

References

Douglas, R (1989), “The Politics of Successful Structural Reform”, Paper to the Mont Pelerin Society, Christchurch, 28th November, 1989.

Douglas, R and R MacCulloch (2016), “Welfare: Savings not Taxation”, Economics Department Working Paper No. 31890, University of Auckland.

Kotlikoff, L (2013), “Assessing Fiscal Sustainability”, Mercatus Centre, George Mason University.

OECD (2013), “What Future for Health Spending?” OECD Economics Department Policy Notes, no. 19.

NZ Treasury (2016a), “Financial Statements of the Government of NZ for the year ended 30 June 2015”, Wellington.

New Zealand Treasury (2016b), New Zealand: Economic and Financial Overview 2016, Wellington.