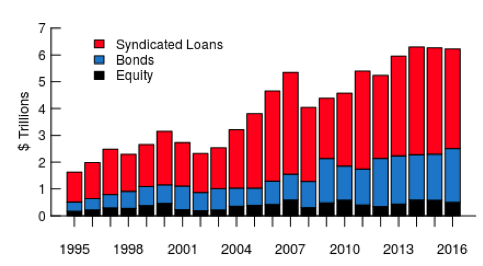

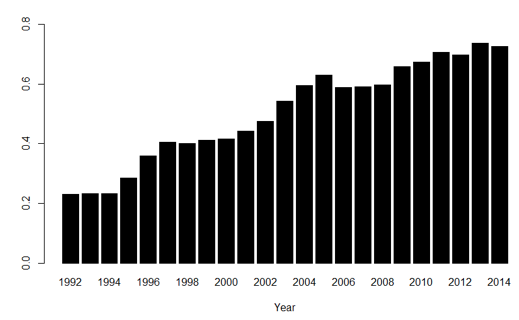

Syndicated loan issuance – in which banks partner with other financial institutions to originate large loans – has grown dramatically over the last 25 years. In 2016, non-financial corporations borrowed $3.4 trillion worldwide from the syndicated loan market, making this source of funding significantly larger than the issuance of bonds and equity (see Figure 1). Much of the expansion in syndicated lending has been driven by fundamental changes in the syndicated term loan market. In the early 1990s, a bank that arranged a syndicated loan partnered with other banks to form the term loan syndicate, and the arranging banks kept a substantial share of the loan (20–30%) on its books. With the rise of the originate-to-distribute-to-nonbanks model and the secondary market for syndicated loans, institutional investors such as mutual funds and collateralised loan obligations started to provide additional funding for the syndicated term loan market (Bord and Santos 2012). By the end of 2014, the institutional investors’ share in the syndicated term loan market exceeded 70% (see Figure 2).

Figure 1 Source of financing of non-financial firms worldwide

Source: Dealogic, ThomsonONE.

One consequence of these changes in the syndicated loan market is that the arranging bank nowadays aims to distribute as much of the loan as possible to these institutional investors, and keep very little or nothing on their banks. Currently the arranging banks retain, on average, only about 5% of a term loan.

The shift in the syndicated loan business model has also affected the nature of the associated risks that arrangers are now exposed to. While a large literature studies the consequences of loan syndication on the incentives to monitor borrowers (e.g. Sufi 2007), in a recent article we argue that while the sharp decrease in ultimate retention of syndicated loans has reduced the arranging banks’ exposure to traditional credit risk, the shift in the business model generates what we call pipeline risk (Bruche et al. 2017). This is the risk associated with marketing the loans during the syndication process. It stems from the need to underwrite loan syndications, and uncertainty about how much of the loan can actually be placed with institutional investors.

Figure 2 Institutional investor share in syndicated term loans

Source: Shared National Credit Program.

Two episodes in the last ten years illustrate that pipeline risk. In 2008, lacking demand from institutional investors for new syndicated loans, the banks arranging syndicated loans for leveraged buyout of Harrah’s Entertainment were forced to take $14 billion of very risky debt onto their balance sheets, at a time when banks already had substantial exposure of about $150 billion of unsyndicated, mostly LBO-related debt on their balance sheets.1 Similarly, in the fall of 2015, the loans financing the leveraged buyout of Veritas failed to attract sufficient investors, sending new shockwaves through the syndicated loan market. At the end of 2015, banks had about $40 billion of mostly LBO-related debt stuck in their syndication pipelines.2 Many arranging banks incurred sizable losses when they sold these loans later with large discounts.3

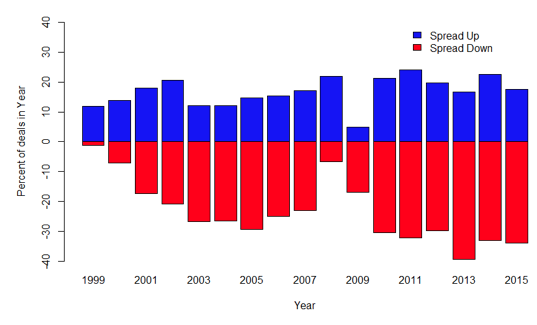

Figure 3 Annual share of loans with changes in the effective spread during leveraged loan syndication

Source: S& P Capital IQ's Leveraged Commentary and Data (LCD).4

What are the economic mechanisms behind this pipeline risk? We show that the role of an arranger in the new model of syndicated lending is to elicit institutional investors’ willingness to pay a share of the loan, to decrease the interest rate spread when possible, and increase it when necessary to place the loan. Figure 3 shows that spreads are adjusted either up or down for about 50% of the syndicated leveraged term loans. To induce institutional investors to truthfully reveal their willingness to pay, the arranger must also allocate less of the loan to investors with low reported willingness to pay and more to investors with high reported willingness to pay (Benveniste and Spindt 1989).

This second aspect generates risk about how much of the loan can be placed with investors. In practice, borrowers often have little flexibility over the total loan amount, and therefore will require guarantees from the arranger that the necessary funds will be raised (e.g. when a syndicated loan finances an LBO). Consequently, arrangers will often explicitly or implicitly underwrite loans and assume this.

Using data from S&P and the Federal Reserve, we show that arrangers retain larger shares in loans for which the spread was increased because investors indicated a low willingness to pay. If the loan spread increased by 100 basis points, the arrangers’ loan share is up to 3.3 percentage points larger. This is a large effect when compared to the average arranger loan share of 5.3%. In extreme cases, a loan is not syndicated at all, and banks have to provide bridge loans. In such bridge loans the arranging bank typically holds a much larger share.5

Pipeline risk is the risk that arranging banks have to hold much larger initial shares in very risky syndicated term loans that institutional investors find unattractive. Such ‘unfortunate’, larger-than-expected retention of a syndicated loan reduces the bank capital available for lending and causes banks to approach their internal risk or concentration limits. Consequently, we also find that unfortunate retention subsequently results in reduced lending of the affected arranging bank, not only in the syndicated term loan market but in other markets as well.

Hence, pipeline risk exposes arranging banks to having to hold much large shares of very risky syndicated term loans, which reduces bank capital available for lending and causes banks to approach their internal risk or concentration limits. Consequently, we also find that when banks have to hold much larger shares, they subsequently reducing lending not only in the syndicated term loan market but in other markets as well.

To be clear, from a risk-sharing perspective, the shift to the originate-to-distribute model may still be considered an improvement, as institutional investors rather than highly-levered, systemically important banks now hold most of the very risky term loans. However, this shift has also increased the vulnerability of those banks to pipeline risk. If too many banks engage in this type of risk-taking, and pipeline risk materialises for many of them at the same time (as happened in the financial crisis, for example, or towards the end of 2015), they could have a significantly reduced ability to engage in other lending, which may affect aggregate credit supply. For this reason, pipeline risk in the syndicated loan market bears watching, not just for micro-prudential reasons, but potentially also because of its macro-prudential implications.6

Authors’ note: The opinions expressed here are those of the authors and do not necessarily reflect the view of the Board of Governors or members of the Federal Reserve System.

References

Benveniste, L M and P A Spindt (1989), “How investment bankers determine the offer price and allocation of new issues”, Journal of Financial Economics 24: 343-361.

Bruche, M, F Malherbe and R R Meisenzahl (2017), “Pipeline risk in leveraged loan syndication”, Federal Reserve Board, Working paper 2017-048.

Bord, V and J A C Santos (2012), “The rise of the originate-to-distribute model and the role of banks in financial intermediation”, Economic Policy Review 18: 21–34.

Sufi, A (2007), “Information asymmetry and financing arrangements: Evidence from syndicated loans”, Journal of Finance 62: 629–68.

Endnotes

[1] “Loan market in `disarray' after Harrah's upset" Financial Times, 4 February 2008.

[2] “Buyout firms lose leverage with backers" Financial Times, 21 January 2016.

[3] “Underwriters on the hook after botch" Reuters, 20 November 2015.

[4] Disclaimer: “S&P and its third-party information providers expressly disclaim the accuracy and completeness of the information provided to the Board, as well as any errors or omissions arising from the use of such information. Further, the information provided herein does not constitute, and should not be used as, advice regarding the suitability of securities for investment purposes or any other type of investment advice.”

[5] Unfortunately, we do not observe all bridge loans, which mostly likely causes us to underestimate the severity of pipeline risk.

[6] Regulators in the US and Europe have recognised this risk and have issued leveraged lending guidance that explicitly consider pipeline risk.