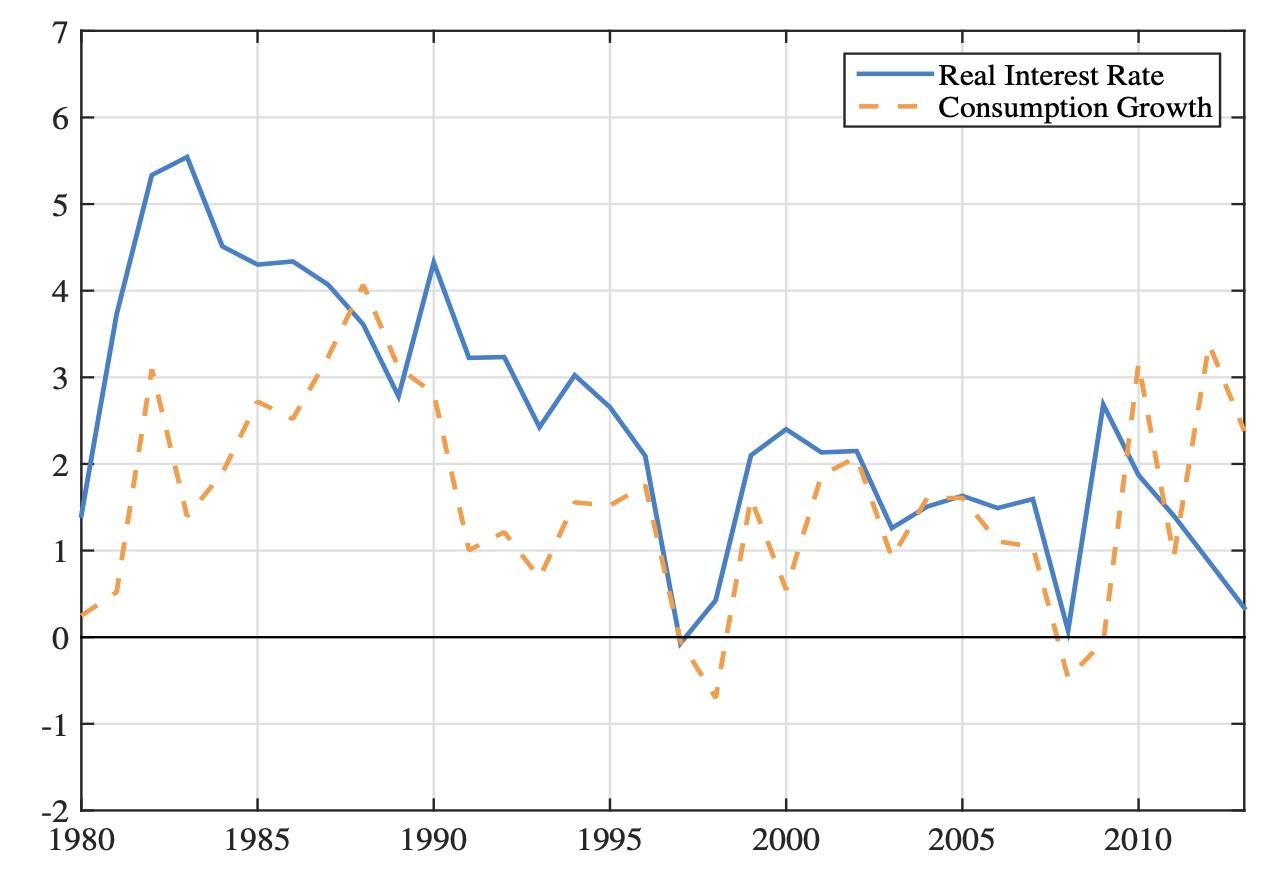

Japan’s labour force has been ageing rapidly. Since the early 1980s, the average age of its workforce has risen by roughly three years (Figure 1a). The level of the labour force had been falling between the late 1990s and the early 2010s (Figure 1b). At the same time, the Japanese economy has experienced a prolonged slowdown in growth and persistent declines in the real interest rate (Figure 2).

Figure 1 Average age and size of the labour force in Japan

Source: Labour Force Survey.

Figure 2 Real interest rate and consumption growth

Several papers discuss the potential causal relationship between the declining real interest rate and ageing. Bean (2015) and Rachel and Smith (2016) offer comprehensive views behind the declining real interest rates including demographic factors. Carvalho et al. (2016) relate the declining real interest rate in Japan to ageing through heterogeneity in consumption/saving between young and old people. The driving force in their model is a longer life expectancy, which increases the supply of saving through the ‘saving for retirement’ motive. The declining trend in the real interest rate in the US has also received considerable attention. For example, the secular stagnation hypothesis – à la Teulings and Baldwin (2014), Eggertsson and Mehrotra (2015), Eggertsson and Summers (2016) and Eggertsson et al. (2019) – posits that a decline in the birth rate eventually leads to the oversupply of saving and a decrease in aggregate demand, resulting in the lower real interest rate. Using an overlapping generations model, Gagnon et al. (2016) conclude that a decline of 1.25 percentage points in the equilibrium interest rate can be accounted for by the demographic factors in the US.

Our recent study (Fujita and Fujiwara 2021) tackles this problem from a new and different angle. By using a search and matching framework that incorporates heterogeneities in the worker’s age and skill, we explore a novel causal link between the ageing labour force and the low-frequency declining trend in the real interest rate since the 1970s. None of above papers recognises this ‘labour productivity channel’ stressed in our paper.

The main driver of Japan’s ageing workforce is the end of the baby boom. The birth rate fell precipitously in the 1950s, which translated into a similarly sharp drop in labour force entry in the 1970s. This caused low-frequency movements in key macroeconomic variables.1 We feed the model the exogenous labour force entry path that mimics the data. The transition to the new steady state takes more than 50 years, and during the transition, the economy exhibits low-frequency fluctuations that are consistent with the overall behaviour of the Japanese economy.

There are two key features in our model. First, the model incorporates the empirical regularity that older workers are more productive than younger workers. In the model, a worker enters the labour force as a young worker with no experience. The worker gains their experience as they become old. Experienced workers enjoy higher productivity. Second, we also incorporate into the model what we believe is the salient feature of the Japanese labour market – namely, the importance of firm-specific skills.2 The (old) worker’s skill associated with their experience in the labour market tends to be firm specific. When the worker loses their job, they could lose the productivity premium associated with being an experienced worker. When an old worker loses their experience premium, they need to look for a job in the labour market where young (inexperienced) workers are also looking for their entry-level jobs.

In our model, we abstract away from the consumption/saving heterogeneity of workers with different ages and their employment status by assuming that all sources of incomes are pooled and consumed equally across the existing household members. One may view this assumption as being restrictive, given the motivation of our paper. But we make this assumption deliberately to highlight the key mechanism of our paper – namely, skill (productivity) heterogeneity in the workforce. In our model, the evolution of the demographic structure leads to changes in the aggregate skill mix of the workforce, resulting in low-frequency movements in aggregate labour productivity, per capita consumption, and thus the real interest rate. The relationship between consumption/saving heterogeneity and ageing has already been studied in several papers as mentioned above, but this productivity channel has so far been largely overlooked. Adding consumption/saving heterogeneity to our model is likely to only strengthen our results.

We show that the equilibrium transition path of the economy replicates important low-frequency features of the Japanese economy observed between 1970 and 2010. According to the model, the first decade of this 40-year period is characterised by rising per capita consumption, labour productivity, and the real interest rate (Figure 3). This period, however, is followed by a prolonged period of a gradual slowdown of the economy. In the data, per capita consumption growth and the real interest rate fell 1.3 percentage points and 2.3 percentage points between the 1980s and the 2000s, respectively. Our experiment indicates that work-force ageing (driven by the decline in the labour force entry in the 1970s) accounts for roughly 40% of the decline. The model economy exhibits the low-frequency swing for the following reasons. First, the initial phase is characterised by the environment where more young workers are gaining experience and per capita consumption is growing faster. But as more workers reach a high-productivity state, there is less room to grow further. This, together with fewer entry flows of young workers, implies a slowdown of per-capita growth. In addition, the firm-specific nature of the workers’ skill plays a role of putting a further downward pressure on labour productivity and thus the real interest rate in the latter part of the transition path.

Figure 3 Perfect foresight equilibrium paths

Feyrer (2007) provides the strongest empirical evidence that supports the main idea of our paper. In his cross-country panel regression, he finds a strong correlation between the age structure of the workforce and aggregate productivity growth. He notes, “[w]hile emphasizing the importance of demographics, this paper is agnostic as to the mechanisms through which demographic change and productivity are related.” We provide a mechanism that supports his evidence.

We also find that the contribution of search frictions to the overall impacts of ageing on the real interest rate and other aggregate variables such as the unemployment rate is relatively small. Bean (2004) discussed the potential channels through which the natural rate of unemployment can be affected by the economy’s demographic structure. In our model, as ageing progresses, the share of inexperienced workers within the old cohort increases over time. This leads to a negative externality that eventually lessens young workers’ job opportunities, as they compete for the same entry-level jobs. This externality channel, however, turns out to have a relatively minor impact on aggregate variables. The largest impacts originate from the changing composition of workers itself rather than the equilibrium effects through search frictions.

While the focus of our paper is on the effects of ageing, the Japanese economy has experienced other long-term changes as well. Among them, we consider (1) declines in total factor productivity (TFP) growth (see Hayashi and Prescott 2002 and the related subsequent literature); (2) increases in female labour force participation; and (2) increases in non-regular workers (e.g. Esteban-Pretel et al. 2011). Regarding (1), we augment the model with exogenous TFP growth and assume that it shifts to a permanently lower level in 1990, based on the evidence from Fukako et al. (2007). This change carries a straightforward implication that the real interest rate responds proportionately to the shift in TFP growth by a factor of roughly the value of the constant relative risk aversion (CRRA), which is set to two in our model. We find that slower TFP growth explains a significant portion of the decline in the real interest rate.

To study the impacts of (2) and (3) above, we add to our baseline model another dimension of heterogeneity – namely, gender heterogeneity. Although we do not explicitly model non-regular workers, our model is rich enough that we can associate inexperienced workers in our model with non-regular workers in the data. Using this extended model, we conduct quantitative experiments in which we replicate the increasing shares of female workers and non-regular workers through exogenous parameter changes. The experiments show that both of these developments have made some contributions to slower labour productivity growth, and thus stagnation of real wage and the lower real interest rate since the early 1990s. In summary, these other long-term changes of the Japanese labour market over the last few decades only enhance our story of the effect of ageing.

References

Bean, C (2004), “Global Demographic Change: Some Implications for Central Banks,” in Federal Reserve Bank of Kansas City Economic Symposium Conference Proceedings.

Bean, C, (2015), “Causes and consequences of persistently low interest rates”, VoxEU.org, 23 October.

Carvalho, C, A Ferrero and F Nechio (2016), “Demographics and real interest rates: Inspecting the mechanism”, European Economic Review 88: 208-226.

Eggertsson, G B and N R Mehrotra (2015), “A Model of Secular Stagnation”, IMES Discussion Paper Series 15-E-09, Institute for Monetary and Economic Studies, Bank of Japan.

Eggertsson, G B and L Summers (2016), “Secular stagnation in the open economies: How it spreads, how it can be cured”, VoxEU.org, 22 July.

Eggertsson, G B, N R Mehrotra and J A Robbins (2019), “A Model of Secular Stagnation: Theory and Quantitative Evaluation”, American Economic Journal: Macroeconomics 11: 1-48.

Esteban-Pretel, J, R Nakajima and R Tanaka (2011), “Are contingent jobs dead ends or stepping stones to regular jobs? Evidence from a structural estimation”, Labour Economics 18: 513-526.

Feyrer, J (2007), “Demographics and Productivity”, Review of Economics and Statistics 89: 100-109.

Fujita, S and I Fujiwara (2021), “Aging and the Real Interest Rate in Japan: A Labor Market Channel”, CEPR Discussion Paper No. 16127.

Fukako, K, S Hamagata, I Tomohiko, K Ito, H Kuwon, T Makino, T Miyagawa, Y Nakanishi and J Tokui (2007), “Estimation Procedures and TFP Analysis of the JIP Database”, RIETI Discussion Paper Series 07-E-003.

Gagnon, E, B K Johannsen and J D Lopez-Salido (2016), “Understanding the New Normal: The Role of Demographics”, Finance and Economics Discussion Series 2016-080, Board of Governors of the Federal Reserve System.

Hashimoto, M and J Raisian (1985), “Employment Tenure and Earnings Profiles in Japan and the United States”, American Economic Review 75: 721-735.

Hayashi, F and E Prescott (2002), “The 1990s in Japan: A Lost Decade,” Review of Economic Dynamics 5: 206-235.

Kambayashi, R and T Kato (2017), “Long-Term Employment and Job Security Over the Past 25 Years: A Comparative Study of Japan and the United States”, ILR Review 70: 359-394.

Rachel, L and T Smith, (2016), “Towards a global narrative on long-term real interest rates”, VoxEU.org, 15 January.

Teulings, C, and R Baldwin, (2014), “Secular Stagnation: Facts, Causes and Cures”, VoxEU.org, 15 August.

Endnotes

1 Although the baby boom ended long ago, the birth rate kept falling. For example, the total fertility rate reached the bottom in 2005 at around 1.3. This steady decline in the birth rate has received much attention because it exemplifies the aging of Japanese society. However, the end of the baby boom is much more important quantitatively for the gradual progress of the labor force aging observed in the data.

2 The importance of firm-specific human capital in Japan was first pointed out by Hashimoto and Raisian (1985). Their main point is that firm tenure plays a much more important role in earnings profiles in Japan than in the US. The authors link this finding to the lifetime employment practice in Japan. Kambayashi and Kato (2017) study whether the lifetime employment practice remains common in Japan and find that prime-age male workers, in particular, still enjoy job stability much more so than in the US.