Even some staunch defenders of international trade have long been sceptical of the benefits of financial globalisation (e.g. Bhagwati 1998). Rodrik (1998) famously wrote that letting capital flow freely across the world would leave economies “hostage to the whims and fancies of two dozen or so thirty-somethings in London, Frankfurt and New York”. Arteta et al. (2001) concluded that any evidence of a positive impact of capital account liberalisation on growth is “decidedly fragile”, a finding that has largely held up in the literature that has followed.

Our recent work takes a fresh look at the effects of policies to liberalise international capital flows for a group of nearly 150 countries over the period 1970-2015 (Furceri et al. 2019). There are two novel aspects of our work.

- First, we look at the impact on both average (or aggregate) income as well as the distribution of income. While the potential for international trade to generate ‘winners and losers’ has long been recognised – and has been the source of much recent debate – financial globalisation has tended to go scot free of similar scrutiny.

- Second, we use industry-level data to identify some of the causal mechanisms through which financial globalisation has aggregate and distributional impacts.

Baseline effects

Our measure of financial globalisation is based on the Chinn-Ito index, which provides the largest country and time coverage of the capital account restrictions maintained by countries (Chinn and Ito 2008). To infer the timing of major policy attempts to liberalise the capital account, we use large increases in the Chinn-Ito index (specifically, changes that exceed by two standard deviations the average annual change over all the observations). This criterion identifies 228 episodes of financial globalisation.

We then trace out the response of output, the Gini coefficient, and the labour share in the aftermath of these episodes. Our main findings are that capital account liberalisation episodes, on average, have had a limited effect on output but have led to a significant increase in inequality. As shown in the left panel on Figure 1, even five years after liberalisation, the output effects are weak and not statistically distinguishable from zero. In contrast, the Gini coefficient goes up by about 4% (middle panel). This effect is statistically and economically significant, as it corresponds to about one standard deviation of the average increase in the Gini coefficient in our sample. Following liberalisation episodes, the labour share of income also declines significantly by about 4.5% in the medium term, which again is a fairly large effect.

Figure 1 Impact of financial globalisation on output, inequality, and labour share

Note: The solid lines indicate the response of output (Gini and labour share) to a capital account liberalisation episode. The dotted lines correspond to 90% confidence bands. The x-axis denotes time. t=0 is the year of the reform.

‘Institutions’ matter

What accounts for the weak impact of financial globalisation on output and the strong effects on inequality? Our work investigates two key channels.

- First, while liberalisation should expand the access of domestic borrowers to sources of capital, the depth of domestic financial institutions plays a crucial role in the extent to which this takes place. In countries with low financial depth and inclusion, liberalisation may improve financial access mostly of those who are well-off, which could dampen the output effects while exacerbating the impact on inequality.

- Second, opening up to foreign capital flows can be a source of volatility. Since 1980, about 150 episodes of surges in capital inflows have taken place in more than 50 emerging market economies – about 20% of these episodes ended in financial crises (Ghosh et al. 2016), which typically negatively affect income distribution (de Haan and Sturm 2017).

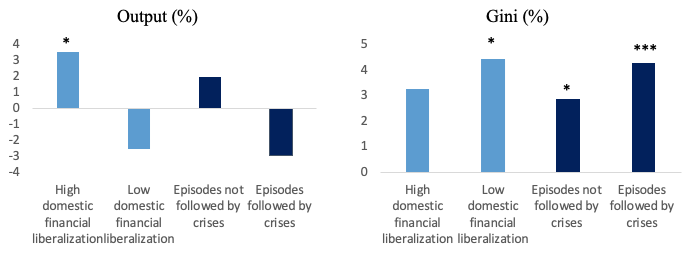

Figure 2 The impact of financial globalisation – the role of institutions and crises

Note: the charts show the medium-term response (that is, five years after) to a capital account liberalisation episode. *** and * denote that differences are significant at 1% and 10%, respectively.

We find evidence in favour of both channels. In countries with high financial depth, liberalisation is followed by output gains, but in countries with low financial depth no statistically significant effects are detectable – point estimates suggest that output falls (Figure 2, left panel). A similar pattern holds for cases in which liberalisation does not trigger a crisis compared to cases when it does trigger a crisis. The increases in inequality in the aftermath of liberalisation are higher when financial depth is low and when liberalisation is followed by a crisis (Figure 2, right panel).

In sum, it is true that institutional pre-conditions are needed to make financial globalisation work. Without these safeguards, as Stiglitz (2000) warned some two decades ago, the effects of capital account liberalisation can be like “putting a race car engine into an old car and setting off without checking the tires or training the driver”.

Causal mechanisms

In our work we investigate some causal mechanisms through which such distributional effects could arise. Rodrik (1997) conjectured that capital account liberalisation would tilt the playing field in favour of capital, the more mobile of the factors of production. At the aggregate level, Jayadev (2007) found that “the imminent and plausible threat” by capital to relocate abroad leads workers to lose power and labour share.

Additional evidence using industry-level data for 23 advanced economies corroborates these findings and helps shed light on some of the causal mechanisms behind the results. We find that industry-level output gains associated with capital account liberalisation are small and not statistically different between sectors with low external financial dependence (Figure 3, left panel) – a key channel through which financial globalisation may enhance firms’ investment (Rajan and Zingalez 1998).

In contrast, the declines in industry labour shares following liberalisation are economically and statistically significant and long-lasting. Specifically, we find that the decline in labour shares is higher the more substitutable are labour and capital in the production process (Figure 3, middle panel), and the greater are firms’ natural layoff rates – a proxy for the (lack of) bargaining power of labour – in response to idiosyncratic shocks (right panel, Figure 3).

Figure 3 Financial globalisation, sectoral-level effects

Note: The left chart shows the differential output effect of capital account liberalisation episodes between a sector with high external financial dependence (at the 75th percentile of the distribution) and a sector with low external financial dependence (at the 25th percentile of the distribution). The middle (right) chart shows the differential labour share effect of capital account liberalisation episodes between a sector with high elasticity of substitution (natural layoff rate) and a sector with low elasticity of substitution (natural layoff rate). Solid lines denote estimated response and dotted lines indicate the 90% confidence. The x-axis denotes time. t=0 is the year of the reform.

Moving forward

Our findings suggest that charges levelled against free trade might be better directed at its sibling, free capital mobility. As expressed by Krugman (2017), the claim that financial globalisation confers benefits akin to those of free trade is “a very hard case to make”. Our results underscore that freer capital mobility on average has failed to deliver strong increases in average incomes but has raised income inequality and lowered labour’s share of income.

The lure of financial globalisation among policymakers thus remains something of a puzzle (Subramanian and Rodrik 2019). Several developing economies today are still far from full capital account liberalisation and policymakers there have a choice on how to move ahead. Our results on the efficiency and equity effects of liberalisation suggest a common-sense policy prescription – countries should consider tilting away from types of flows (notably carry-trade flows or flows that give rise to unhealthy asset price or credit booms) that generate adverse equity/efficiency trade-offs and toward less fickle flows that generate durable increases in investment and growth such as greenfield investments (Ostry et al. 2012). In addition, institutional pre-conditions – in terms of financial inclusion and resilience to financial flows – are needed to make financial globalisation work.

References

Arteta, C, B Eichengreen and C Wyplosz (2001), “When Does Capital Account Liberalization Help More than It Hurts?”, NBER Working Paper no. 8414.

Baldwin, R (2016), The Great Convergence: Information Technology and the New Globalization, Harvard University Press.

Bhagwati, J (1998), “The Capital Myth: The Difference between Trade in Widgets and Dollars”, Foreign Affairs, May/June.

Chinn, M, and H Ito (2008), “A New Measure of Financial Openness”, Journal of Comparative Policy Analysis, 10 (3), 309–22.

De Haan, J, and J Sturm (2017), “Finance and Income Inequality: A Review and New Evidence”, European Journal of Political Economy, 50, 171-195.

Furceri, D, P Loungani, and J D Ostry (2019), “The Aggregate and Distributional Effects of Financial Globalization: Evidence from Macro and Sectoral Data”, CEPR Discussion Paper no. 14001.

Ghosh, A, J D Ostry, and M Qureshi (2016), “When Do Capital Inflow Surges End in Tears?”, American Economic Review 106 (5), 581–85.

Jayadev, A (2007), “Capital Account Openness and the Labour Share of Income”, Cambridge Journal of Economics, 31 (3), 423–43.

Krugman, P (2017), “What Do We Know About Capital Mobility?”, Managing Capital Flows: Challenges for Developing Economies, May.

Ostry, J D, A Ghosh, M Chamon, and M Qureshi (2012), “Tools for Managing Financial-Stability Risks from Capital Inflows”, Journal of International Economics, 88, 407–21.

Rajan, R, and L Zingales (1998), “Financial Dependence and Growth”, American Economic Review 88 (3), 559–86.

Rodrik, D (1997), Has Globalization Gone Too Far?”, Peterson Institute for International Economics, March.

Rodrik, D (1998), “Who Needs Capital Account Convertibility?”, Essays in International Finance, 207, Princeton.

Stiglitz, J (2000), “Capital Market Liberalization, Economic Growth, and Instability”, World Development, 28 (6), 1075-86.

Subramanian, A, and D Rodrik (2019), “The Puzzling Lure of Financial Globalization”, Project Syndicate, September 25.