Despite considerable progress over time, female labour force participation remains low in developing countries. Women face a range of barriers, cultural norms, and other constraints that affect their labour choices. However, patterns in the data suggest that female entrepreneurship trends may play a powerful role in female employment.

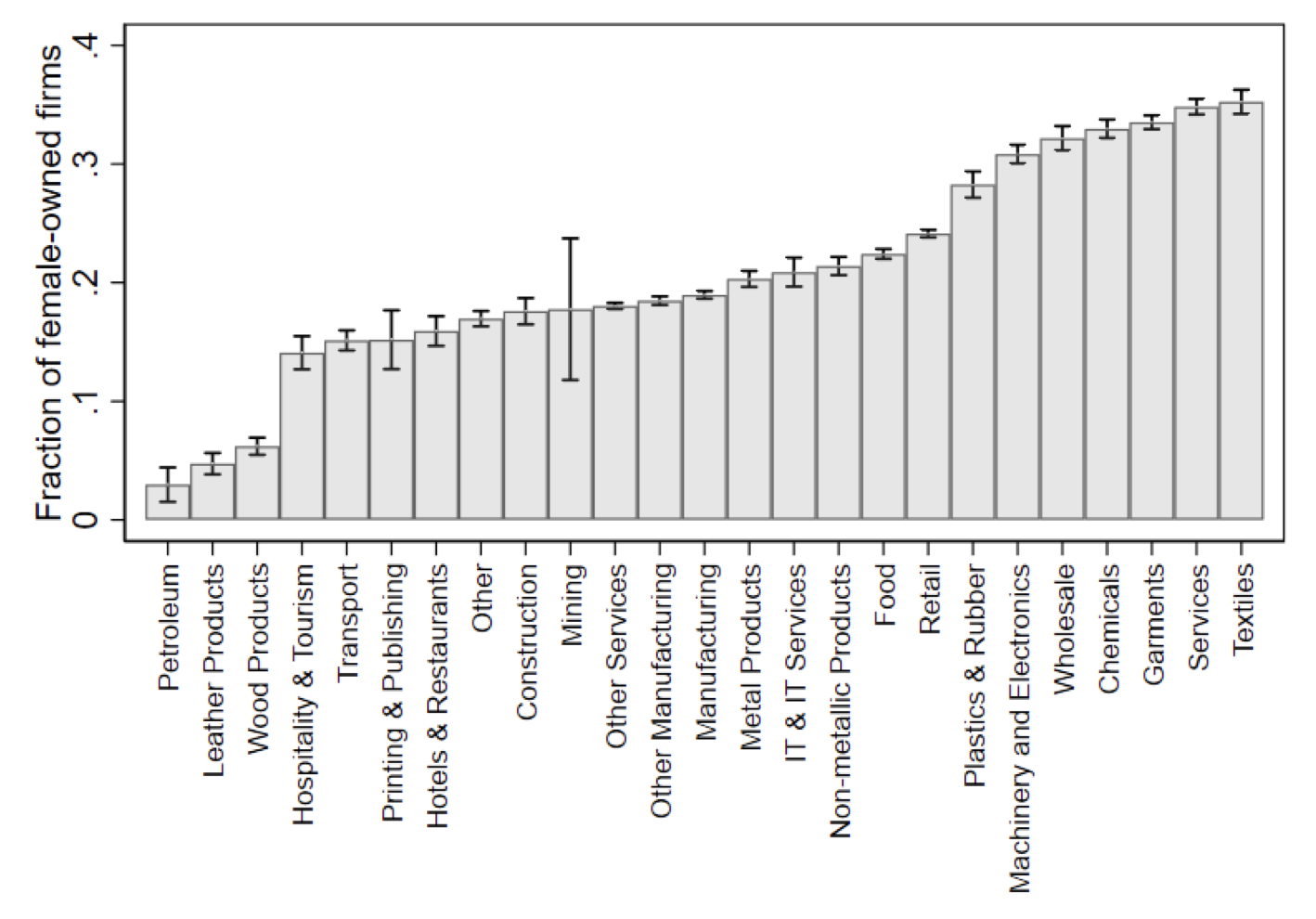

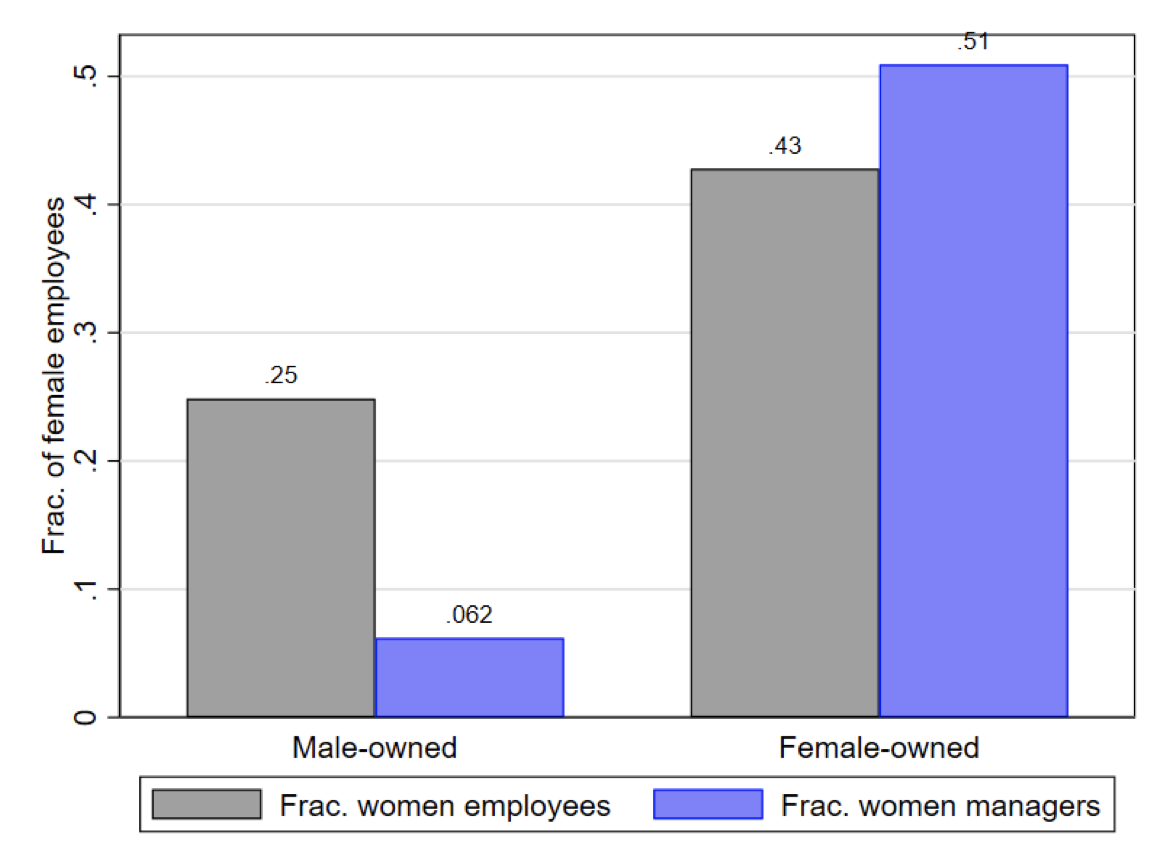

According to the World Bank’s Enterprise Surveys, an estimated 22.5% of firms globally are owned by women, with significant heterogeneity across sectors. Among petroleum firms, for example, women’s share of ownership is just 3%, while textile firms have the highest share at 35% (Figure 1). Female ownership appears to be linked with women’s employment: in male-owned firms, the average share of female workers is just 25%, while in female-owned firms it is 43%. Even more striking is the apparent link between female ownership and women’s leadership within firms: only 6.2% of male-owned firms have a woman as their top manager, compared to more than 50% of women-owned firms (Figure 2).

Figure 1 Average fraction of female entrepreneurs across industries

Source: World Bank (2020).

Figure 2 Average fraction of women employees and managers

Source: World Bank, 2020.

Given that around half of the world’s population is women, such gender disparities may entail significant economic costs, including the failure to benefit from complementarities between male and female labour (Lagarde and Ostroy 2018). But while the literature on gender inequality and its potential causes is voluminous, studies focusing on the macroeconomic consequences are relatively scarce. In advanced economies, recent work has shown that eliminating gender gaps in labour and other distortions can improve the efficient allocation of talent, resulting in sizable productivity and welfare gains (Hsieh et al. 2019, Bento 2020). Eliminating such distortions could entail even larger gains in developing countries, many of which are characterised by resource misallocation, low productivity, and low per-capita income levels (Hsieh and Klenow 2009, Cuberes and Teignier 2016, Restuccia and Rogerson, 2017). If these aggregate effects could be realized, policies to promote gender equality would be more than human rights initiatives; they would contribute to economic development.

To better understand the macroeconomic implications of gender-based distortions that affect female entrepreneurship, in a new paper we develop a framework for analysing the barriers to entry, operation, and expansion faced by female-owned firms (Chiplunkar and Goldberg 2021). To quantify these implications, we pair our model with data from India, where female labour participation and entrepreneurship are particularly low (Fletcher et al. 2019, Lahoti and Swaminathan 2016).

Female labour participation and entrepreneurship in India

Despite impressive economic growth, India’s total female labour force participation has stagnated for three decades. However, female entrepreneurship has shown signs of progress. Since women entrepreneurs are more likely to hire other women as employees, this progress suggests that expanding female entrepreneurship could help promote women’s labour force participation more broadly. It is therefore useful to better understand the challenges faced by India’s women entrepreneurs.

To estimate the entry and operation costs faced by India’s female-owned firms, we pair our model-based approach with primary data from two waves of India’s Economic Census. In contrast to World Bank Enterprise Surveys, the Census data are nationally representative and include the informal sector. This latter feature is important, given that the informal sector commands a large share of economic activity in developing countries (LaPorta and Shleifer 2008, 2014, Ulyssea 2018, 2020) and most female-owned businesses are informal (World Bank 2012).

Our final sample comprises 12.5 million firms from the Census round in 1998 and 38.8 million firms in 2005. More than 99% of total firms are informal, and female-owned firms account for less than 10% of total firms. Between 1998 and 2005, the average firm size decreased for all categories, suggesting declines in entry and formalisation costs – consistent with a package of policy reforms implemented in India in the early 2000s. While the fraction of female employees remained relatively stable for male-owned firms, the fraction of female-owned firms increased substantially, both in the formal and informal sectors.

Modelling the aggregate implications of gender-based barriers

Our analysis is guided by a simple, stylised model that captures some important features of developing economies. It features an economy with multiple industries, each with a formal and an informal sector. All firms must pay an entry cost to operate; while firms in the formal sector must also pay registration costs and taxes, the model penalises informal-sector firms for the penalties they may have to pay if caught evading taxes and for the implicit costs of lacking access to formal finance. The model’s only input is labour, and firms make hiring decisions conditional on entry. We assume perfect competition in both product and labour markets.

Gender enters our model in several general ways, which together cover many of the factors that the literature has offered as potential explanations for gender inequality. We allow for male and female workers to be imperfect substitutes in the production function; we allow for the productivity distributions of men and women entrepreneurs to be different; we allow men and women entrepreneurs to face different entry and registration costs; and we assume that there are hiring frictions in the labour market that prevent firms from expanding, and allow these frictions to differ by gender.

Women entrepreneurs face substantial barriers compared to men

Using our model in conjunction with Census data, our results suggest that female-owned firms in India face substantially higher barriers than male-owned firms.

- Female-owned firms face substantial barriers to entry and operation, though these barriers decreased between the two Census rounds. Fixed costs (for entry and formalisation) are nearly twice as high for women entrepreneurs than for men, and the costs of expanding their business through hiring are about double.

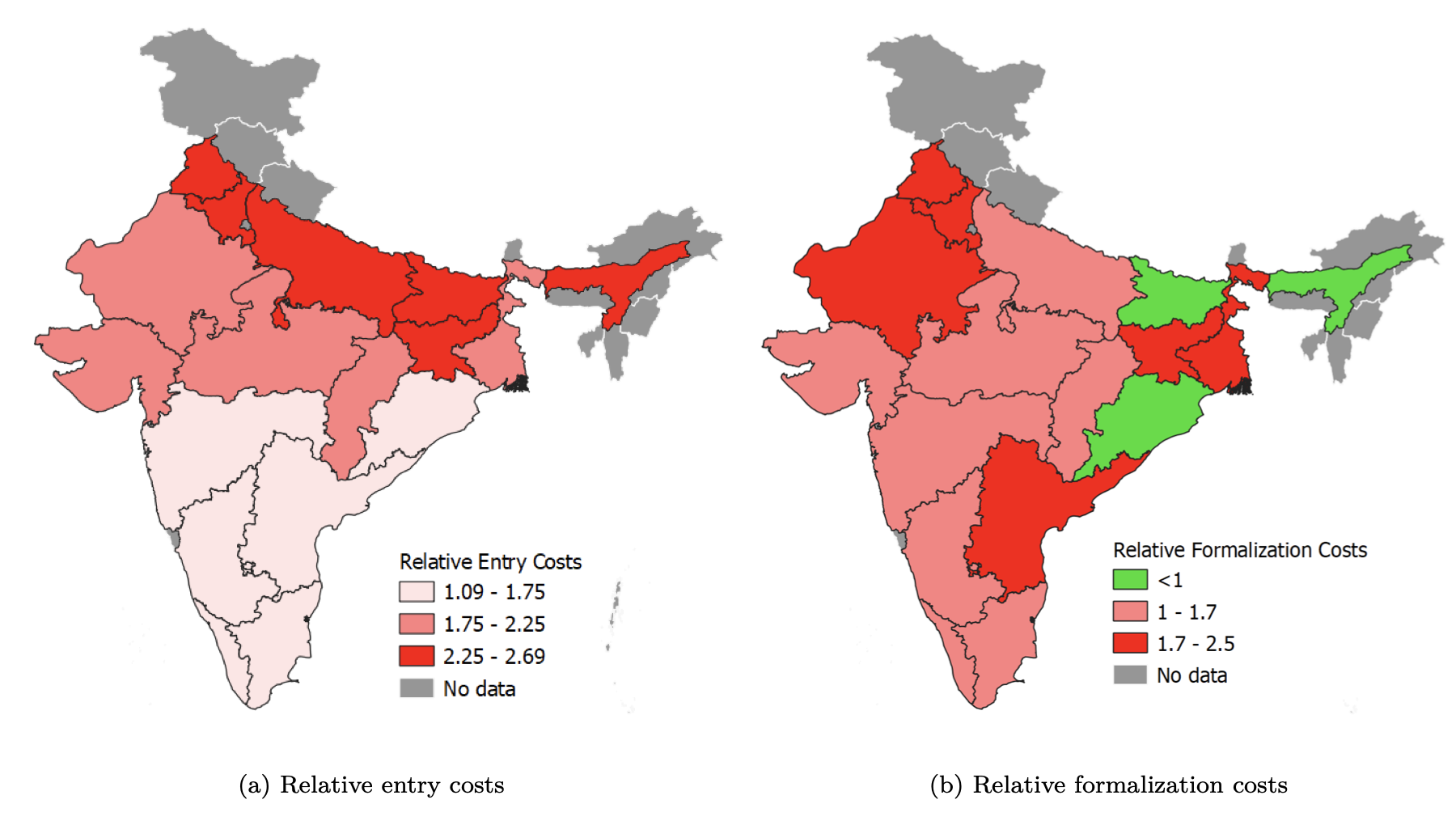

- These averages mask substantial heterogeneity across industries and regions. For example, the excess fixed costs for women entrepreneurs are especially large in manufacturing and services, and the excess entry barriers are especially large in India’s Northern and Central states (Figure 3) – while the excess hiring frictions are especially high in the services sector.

- The only area where female entrepreneurs seem to have a significant advantage over their male counterparts is in hiring female workers. This advantage is not driven by sectoral effects, as it holds even within narrowly defined industries.

Figure 3 Distribution of excess entry and formalization costs faced by female entrepreneurs across Indian states (2005)

Source: Authors’ analysis.

Estimating the aggregate gains from removing barriers to female entrepreneurship

Given these results, we investigate the potential gains to the economy through a series of counterfactual scenarios where each of the barriers are eliminated. Specifically, in all industry-regions where women entrepreneurs face higher costs than men, we sequentially remove the excess costs – though in the one case where women have an advantage over men (i.e. hiring female workers), we do not eliminate the advantage. While we do not address the question of which specific policies would be most effective at reducing such barriers, our analysis explores the implications of various potential ‘affirmative action’ policy interventions.

Our counterfactual simulations lead to four policy-relevant insights:

- Removing the excess barriers faced by women-owned firms meaningfully expands female entrepreneurship. Specifically, eliminating excess formalisation and entry costs nearly doubles the fraction of women-owned firms, while eliminating hiring frictions expands female entrepreneurship more than five-fold. Removing all excess barriers results in a nearly ten-fold increase, such that just over half of firms in the economy would be women-owned.

- Eliminating these excess barriers disproportionately helps female workers. Under all counterfactual scenarios, the increase in real wages for women workers is greater than for male workers (which is intuitive, given India’s low female labour force participation coupled with the fact that women entrepreneurs are more likely to hire female workers).

- Counterfactual simulations highlight the presence of low productivity male-owned firms that operate only because they do not face competition from female-owned firms (which cannot enter or expand because they face excessive barriers). Removing the excess barriers results in high-productivity women entrepreneurs entering the economy and displacing low-productivity male entrepreneurs.

- This improves the efficiency of talent and resource allocation in the economy, resulting in substantial gains in aggregate productivity and welfare (as measured by real wages). Eliminating excess formalisation and entry costs leads to modest productivity and welfare increases, while eliminating hiring frictions results in more substantial gains. Removing all excess barriers increases aggregate productivity by nearly a tenth and welfare by nearly a fifth.

These results demonstrate that promoting gender equality in entrepreneurship is beneficial not only to women, but to the entire economy. Further research should assess which specific policy interventions are most effective in reducing the barriers to entry, operation, and expansion faced by female-owned firms. A key challenge is that several of these barriers are not due to legal constraints, but to norms and attitudes that are more difficult to measure. Combining case studies of specific interventions to empower women with our framework would be a fruitful approach towards assessing not only whether such interventions are successful, but also their aggregate impacts.

References

Bento, P (2020), "Female Entrepreneurship in the U.S. 1982 - 2012: Implications for Welfare and Aggregate Output," Working Papers 20201201-001, Texas A&M University, Department of Economics.

Chiplunkar, G and P K Goldberg (2021), “Aggregate Implications of Barriers to Female Entrepreneurship,” February.

Cuberes, D and M Teignier (2016), “Aggregate Effects of Gender Gaps in the Labor Market: A Quantitative Estimate,” Journal of Human Capital 10(1): 1–32.

Fletcher, R, R Pande, and C M Troyer Moore (2019), “Women and Work in India: Descriptive Evidence and a Review of Potential Policies”.

Hsieh, C-T and P J Klenow (2009), “Misallocation and manufacturing TFP in China and India,” The Quarterly Journal of Economics 124(4): 1403–1448.

Hsieh, C-T, E Hurst, C I Jones, and P J Klenow (2019), “The Allocation of Talent and US Economic Growth,” Econometrica 87(5): 1439–1474.

Lagarde, C and J D Ostry (2019), “The macroeconomic benefits of gender diversity”, VoxEU.org, 5 December.

Lahoti, R and H Swaminathan (2016), “Economic Development and Women’s Labor Force Participation in India,” Feminist Economics 22(2): 168–195.

LaPorta, R and A Shleifer (2008), “The Unofficial Economy and Economic Development,” Brooking Papers on Economic Activity 105(3): 473–522.

Restuccia, D and R Rogerson (2017), “The causes and costs of misallocation,” Journal of Economic Perspectives 31(3): 151–74.

Ulyssea, G (2018), “Firms, Informality, and Development: Theory and Evidence from Brazil,” American Economic Review 108(8): 2015–47.

World Bank (2012), World Development Report 2012 : Gender Equality and Development. Washington, DC.

World Bank (2020), “World Bank Enterprise Surveys” (http://www.enterprisesurveys.org).