Following their suspension in mid- 2006, and their resuscitation in early 2007, the multilateral trade negotiations of the WTO’s Doha Development Agenda appear once more to be on the brink of collapse. Several reasons have been advanced for their lack of success, such as the increased membership of the WTO and supposed insignificance of the negotiations compared with the growth of China.1 But high on everyone’s list is the central role of agriculture, with the EU and US unwilling to make deep cuts in their farm support and the developing countries reluctant to encourage them by offering deep tariff cuts of their own. We ask why a sector that contributes so little to rich countries’ GDP should be able to sabotage global economy-wide trade talks.

The modern apology for preserving rich countries’ agricultural protection is that it supports poor farmers in the North and that liberalisation would benefit only rich landowners in the South. Both assertions contain grains of the truth, but combining, for the first time, a model of the world economy with detailed data on household incomes and expenditures in the USA and fifteen key developing countries, we find that the predominant effects are the very opposite.2 The “average” farm household in the United States is little affected by the trade reforms currently being contemplated in Geneva, but these reforms imply significant losses primarily for the very richest households involved in production of highly protected commodities. Meanwhile, in the developing world, many of the benefits of rich country agricultural liberalisation are translated into reduced poverty. Beyond these primary impacts of rich country agricultural liberalisation, we find that developing country liberalisation of agricultural products also has an important role to play in poverty reduction.

In the rich economies of the world, not only are relatively few households involved in farming, these same households earn an ever-diminishing share of their income from agricultural activities. For example, in the United States, farm income accounts for less than 10% of total income of farm households. In Canada and Japan, these figures are little more than 10%. The EU stands as an exception, with as much as two-thirds of agricultural household income arising from farming in some member states.3 The diversification of household income helps to insulate these families from reductions in agricultural support. For example, our findings indicate that proposed rich-country agricultural reforms under the WTO’s Doha Agenda deteriorate farm earnings by as much as 16%, but boost farmers’ nonfarm earnings by 0.6% in Japan. The net effect is an income loss of just 1.4% of total household income, because non-farm earnings provide nearly 90% of total earnings for the average Japanese farm household. In the case of the US, our estimates of the impact of Doha on the average farm household’s income suggest that it is statistically indistinguishable from zero! If this is the case, then what is the source of such strong opposition to reform? We explore this issue by digging more deeply into the structure of farm household income using detailed household data for the US.4

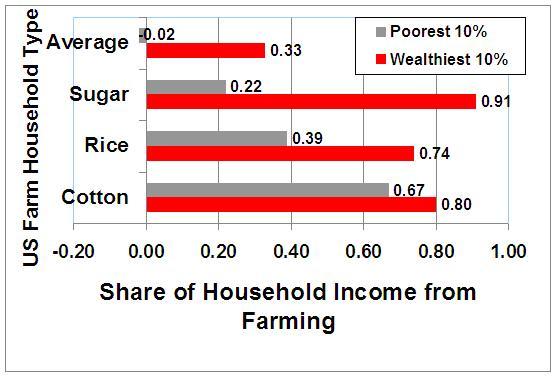

Figure 1. US Farm Households Share of Income from Farming

Source: Authors’ calculations using 2004 Agricultural Resource Management Survey data.

In the United States, most farm households earn relatively little from farming, but those large farms producing sensitive products tend to be specialised, with the richest deriving up to 90% of their income from agriculture. Figure 1 illustrates this point. It shows the share of farm income in total household income for both the poorest and wealthiest households across four groups of farms. The first three farm groups are specialised in producing highly protected crops: cotton, rice, and sugar, while the last shows the average for all US farm households. The wealthiest US rice-specialised households derive twice the share of their income from farming as do the poorest decile. For sugar, the top decile earns four times as large a share of its income from farming as does the bottom decile. In all cases, the households identified as specialised in a particular commodity are much more dependent on farm income for household earnings than is the average farm household.

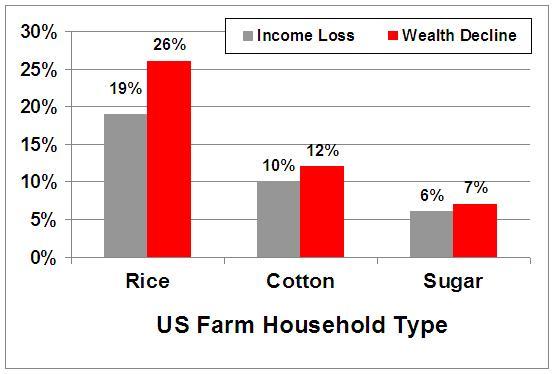

Figure 2. Predicted Income and Wealth Declines for the Wealthiest US Farm Households following Complete Agricultural Liberalisation

Source: Authors’ simulations.

Big subsidies, specialisation and great wealth are toxic for reform

In contrast to the negligible impacts on the average US farm household, full agricultural trade liberalisation would cut the total income of the wealthiest rice farmers by about 19% and that of cotton farmers by 10% (Figure 2). Depending on the households’ distribution of assets, the percentage loss in farm household wealth could be much larger, with the wealthiest rice farms losing more than a quarter of their total wealth (second set of bars in Figure 2). It is these wealthy, highly specialised households in a few heavily protected sectors that stand in the way of serious agricultural reform in the US. Indeed, around one half of producer revenue in the US rice and sugar sectors over the period 2001-2005 were attributable to farm programs., while more than a third of cotton revenues are directly attributable to government programs.5 This sharp concentration of potential losses among a relatively small number of influential households has made reform in the US difficult indeed. While we do not have comparable data for the EU and Japan, we believe that a similar concentration of losses is likely to be found there as well.6

A primary reason cited by the US for not reducing its domestic farm subsidies continues to be the failure of developing countries to reduce import barriers in non-agricultural sectors. It is conceivable that, if the developing countries were to offer deep cuts in their own tariffs, export interests in the rich countries would find it worthwhile to mobilise their political resources to overcome the protectionist agricultural lobbies.7 However, after seeing relatively few of the promised gains under the Uruguay Round materialise, developing countries have been reluctant to offer any significant concessions before they see that the rich countries are serious themselves about reform. The situation is further complicated by developing countries’ inordinate focus on rich countries’ export and production subsidies – as opposed to market access (tariff cuts). Most of the early Doha Round negotiating efforts by developing countries focused on the removal of agricultural export subsidies, which received a great deal of attention following a high profile study of cotton subsidies by Oxfam.8 However, many commentators, including ourselves, have observed that the emphasis on eliminating industrial countries’ agricultural export and production subsidies is not particularly poverty-friendly beyond the special case of cotton. This is because subsidies for staple food products tend to reduce food prices and many of the developing world’s poor are heavy net purchasers of these.9 Agricultural tariff reductions in the rich countries have been shown to be much more beneficial to developing countries as a whole10 as well as more poverty friendly,11 yet these continue to receive less attention from the developing countries in the Doha negotiations.

Doha’s impact on the world’s extremely poor citizens

There remains the important question: Are there measures that developing countries, acting as a group, could undertake in order to promote development within the context of the current, or future, WTO rounds? We believe the answer to this question is a resounding yes. To underscore this point, we have examined the likely impact of developing country agricultural trade reforms on extreme ($1/day) poverty in a sample of 15 developing countries. Of course, as formulated, the Doha Round will not require developing countries to undertake substantial agricultural trade liberalisation, and the least developed ones (the poorest) need undertake none. It turns out that this significantly curtails the ability of the round to reduce poverty in developing countries, despite the fact that among negotiating parties, it is the developing countries and their advisors in the development community who are insisting on such exemptions.

Because of the patterns of protection involved, our analysis12 suggests that developing country poverty could be reduced both by liberalising industrial countries’ agricultural trade, which will increase agricultural prices in developing countries, and by liberalising developing countries’ trade, which will reduce food prices. We decompose the effects of the various trade liberalisations on poverty into impacts on earnings, tax burden (from reduced tariff revenues), and consumer prices. Our examination of these impacts is conducted at a disaggregate level by sorting the population into seven earnings defined household groups in each country. We find that rich country liberalisation reduces poverty mainly in rural areas via its strong positive effect on the earnings of agricultural factors and this is generally not offset in the aggregate by the adverse effects of higher consumer prices on non-farm poverty. Developing countries’ agricultural liberalisations operate quite differently. These generate mixed-earnings effects (partly because some countries export to other developing countries) and adverse tax burden effects, but are generally more than offset by the price reductions for food which are poverty-friendly for net food buyers. Indeed, since these two types of reforms benefit different groups of households (net agricultural sellers in the case of rich country reforms, and net buyers in the case of poor country reforms), combining both rich and poor country agricultural reforms is the road to maximum poverty reductions under the Doha Agenda.

In summary, if current – or future – WTO negotiations wish to have a significant impact on poverty, both rich and poor countries will need to undertake agricultural reforms. One of the great failings of the Doha Development Agenda, as currently formulated, is the absence of tariff cuts on staple products of interest to the poor. This, combined with rich countries’ inability to engage in significant agricultural reforms has resulted in a Doha Round that has failed to deliver on its fundamental premise, namely that it be the first WTO “Development Round”.

Footnotes

1 See e.g. VoxEU discussions by Simon Evenett and Joseph Francois and at greater length, ‘Reciprocity and the Doha Round Impasse: Lessons for the Near-Term and After’, CEPR Policy Insight No. 11.

2 The research methodology and results presented here are available in detail in Hertel, T.W., R. Keeney, M. Ivanic and L.A. Winters (2007). “Distributional Effects of Agricultural Reforms in Rich and Poor Countries”, Economic Policy, April, pp. 289-337. Those authors use a static general equilibrium model with the GTAP database to analyse different scenarios of reform on US and developing country households.

3 Estimated shares of agricultural household income from farming are derived from OECD’s (2003) report Farm Household Income: Issues and Policy Responses. In our empirical modeling we adopt estimates of 8%, 10%, and 12% for the US, Canada, and Japan respectively. For the twenty-five member European Union we use an estimate of 60% of income from farming.

4 Access to US farm household data allow us to look more closely at the distribution of income within the farm population. Data for the year 2004 are used in our modeling analysis drawing on the Agricultural Resource Management Survey (ARMS) (USDA-ERS, 2005). This comprehensive survey of US farm households is conducted over a sample of around 15 000 households using economic and geographic sampling frames. Extensive information on this data source are available at www.ers.usda.gov/Briefing/ARMS/.

5 OECD’s Producer Support Estmate data are used to calculate the share of producer revenue due to policy interventions. OECD’s PSE database can be accessed here. The PSE for cotton is not available from OECD data and is calculated by D. Sumner in K. Anderson and W. Martin’s 2006 World Bank volume on the Doha Round and Agrculture.

6 For information on the European Union’s Common Agricultural Policy and how those payments are distributed the reader is referred to www.farmsubidy.org.

7 Indeed, it is just such cross-sector lobbying by export-oriented manufacturing interests that led to significant reforms in Japanese beef and citrus imports in the 1990’s.

8 Accessble at http://www.ictsd.org/issarea/ag/resources/Oxfam1.pdf.

9 See e.g. Hoekman, Bernard, Francis Ng and Marcelo Olarreaga (2004). “Agricultural Tariffs or Subsidies: Which Are More Important for Developing Countries?” World Bank Economic Review 18(2): 175-204.; Anderson, K., W. J. Martin and E. Valenzuela (2006). “The Relative Importance of Global Agricultural Subsidies and Market Access. Policy Research Working Paper 3900, World Bank.; or Hertel, Thomas, W., Roman Keeney, Maros Ivanic and L. Alan Winters (2007) “Distributional effects of WTO agricultural reforms in rich and poor countries,” Economic Policy, April.

10 This is a primary finding in Hertel, T.W., and R. Keeney. 2006. “What is at Stake: The Relative Importance of Import Barriers, Export Subsidies, and Domestic Support,” Chapter 2 in Agricultural Trade Reform and the Doha Development Agenda, K. Anderson and W. Martin eds., Palgrave Macmillan and The World Bank, New York.

11 This is a summary finding of the disparate country studies contained in Hertel, Thomas W. and L. Alan Winters (2006). Poverty and the WTO: Impacts of the Doha Development Agenda, World Bank and Palgrave.

12 Hertel, T.W., R. Keeney, M. Ivanic and L.A. Winters (2007). “Why isn’t the Doha Development Agenda more Poverty-friendly?”, GTAP Working Paper #37,