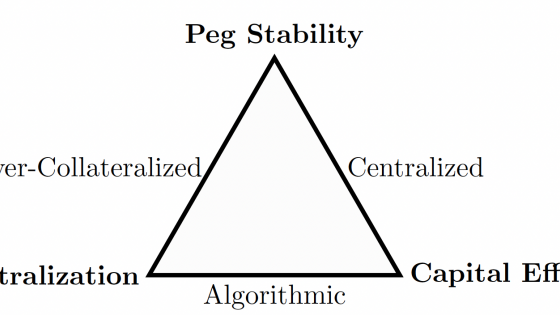

Stablecoins operate on the blockchain and are pegged at parity to the US dollar. They serve as vehicle currencies for trading cryptoassets generally due to a reduction in intermediation costs by operating on the blockchain. To understand stablecoin designs, we use the framework in Figure 1. Out of three objectives – peg stability, decentralisation, and capital efficiency – only two can be met by a given design.

Figure 1 The stablecoin trilemma

The most common stablecoin type is centralised stablecoins, led by Tether, the balance sheet of which includes commercial paper and less liquid assets (Lyons and Viswanath-Natraj 2020a). Decentralised (over-collateralised) stablecoins are led by MakerDAO’s DAI. In this design, individuals issue DAI tokens through over-collateralised positions in which they deposit cryptocurrency collateral (typically, ETH). While they are decentralised, they are less capital-efficient than their centralised counterparts (Kozhan and Viswanath-Natraj 2021). The third type is algorithmic stablecoins, led by TerraUSD, which are typically under-collateralised. While this is a more capital-efficient design, it has the drawback that they are prone to speculative attacks and can trade at a large discount (Eichengreen 2019).

TerraUSD creation and arbitrage

Luna is the native token of the Terra blockchain, and users can create US$1 worth of TerraUSD stablecoins by burning $1 of Luna. The Luna token is used to pay fees for validating transactions on the blockchain, staking tokens in governance votes, and earning yields on DeFi lending protocols.

The TerraUSD is pegged to $1 through a simple arbitrage mechanism (Lyons and Viswanath-Natraj 2020b). For example, consider the case where the TerraUSD price is above parity. In this instance, an investor can sell $1 worth of Luna and buy TerraUSD for $1. They can then sell TerraUSD in the secondary market. Conversely, when the dollar price of TerraUSD is below one, an investor can buy TerraUSD at the exchange and sell TerraUSD for $1 worth of Luna tokens.

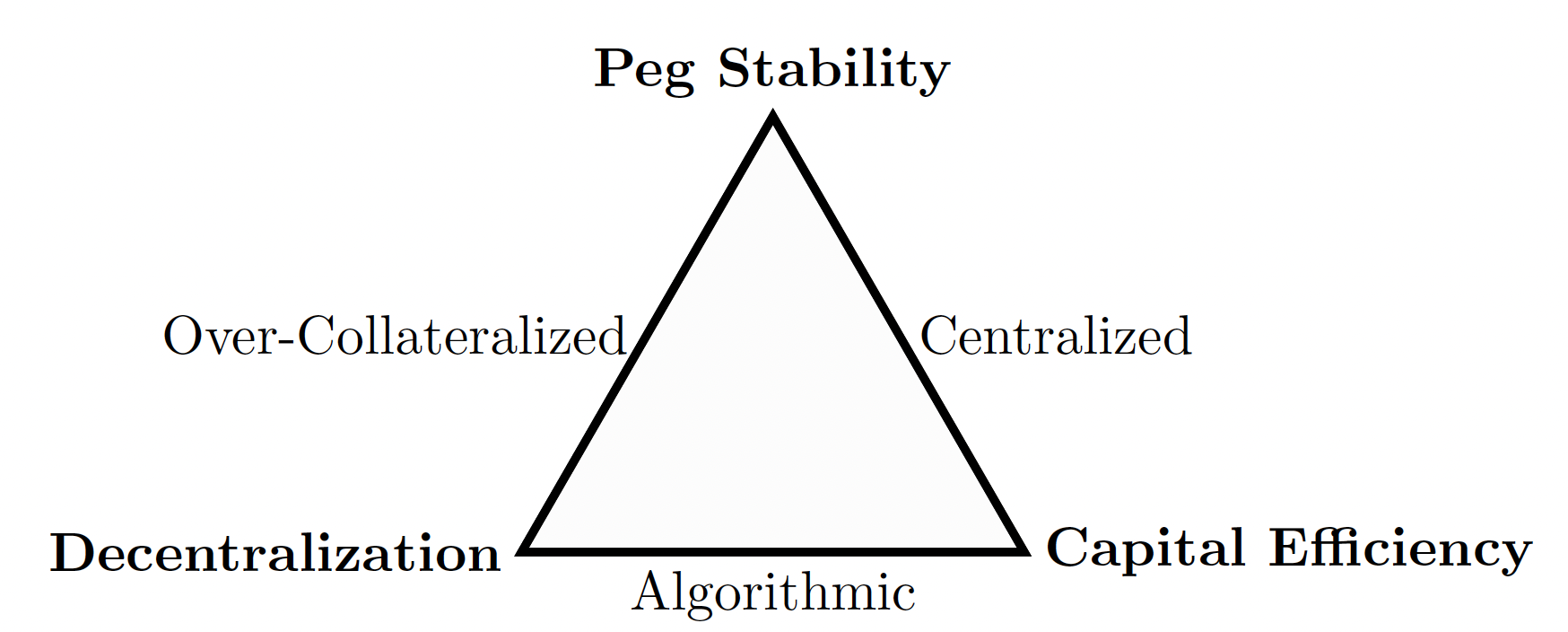

A major concern with the arbitrage mechanism is that it is not risk-free; investor profits are driven by expectations of the valuation of the governance token. Another issue is that the system is under-collateralised. As an insurance against peg discounts, the TerraUSD treasury has a Bitcoin reserve that it can use to support the TerraUSD peg if there is insufficient Luna to meet redemptions (Li and Mayer 2020). We plot the total reserves held in Bitcoin in Figure 2. When bitcoin reserves were at their peak of $1.8 billion in early May, they reached approximately 10% of the TerraUSD market cap of approximately $18 billion. However, the Bitcoin reserves became fully depleted as they were sold off to defend against a speculative attack on 10 May 2022.

Figure 2 Bitcoin reserves to maintain the TerraUSD peg

Note: Bitcoin reserve transactions obtained from https://bitinfocharts.com/bitcoin/address/ bc1q9d4ywgfnd8h43da5tpcxcn6ajv590cg6d3tg6axemvljvt2k76zs50tv4q

A tale of two equilibria

We show that the under-collateralised system features two equlibria. In one equilibrium, user growth on the blockchain grows strongly. This increases the value of the governance token Luna and simultaneously the demand for the TerraUSD stablecoin, which is used in all of the applications built on the Terra blockchain. In this scenario, the upward pressure on TerraUSD relies on the following arbitrage mechanism: Luna holders burn $1 of Luna to mint $1 of Terra token and sell it at a profit.

Now consider the opposite case: a large drop in the value of Luna. The TerraUSD peg is now unstable. Weak fundamentals trigger a speculative attack on the peg, as there is not enough Luna to redeem the outstanding value of all TerraUSD in circulation at par. When the TerraUSD peg is broken, this triggers a loss of confidence in the blockchain and the governance token. This feedback can generate a spiral of falling Luna and TerraUSD prices. The arbitrage loop of redeeming TerraUSD at $1 and buying Luna tokens fails as investors lose confidence in the peg stabilising mechanism.

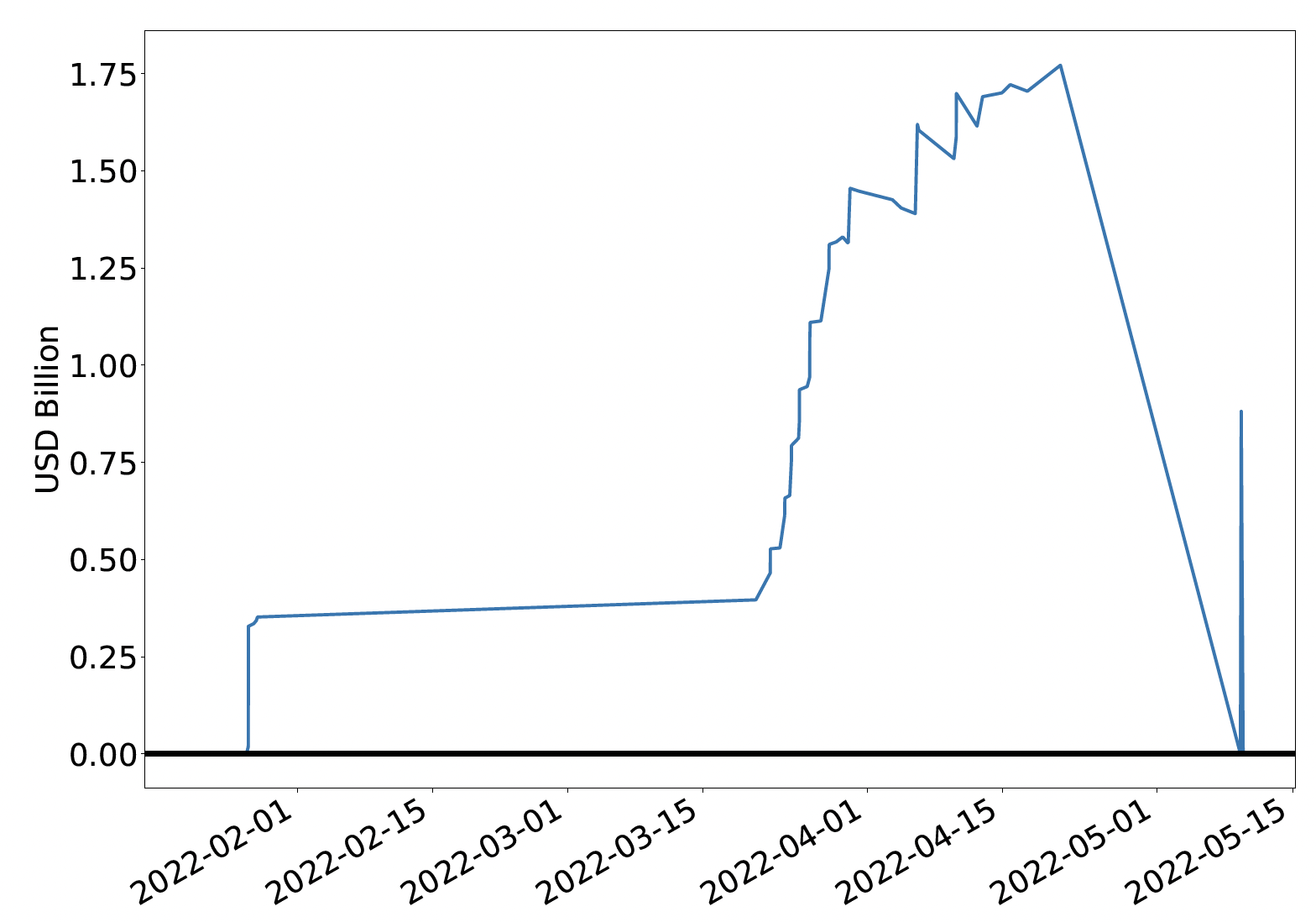

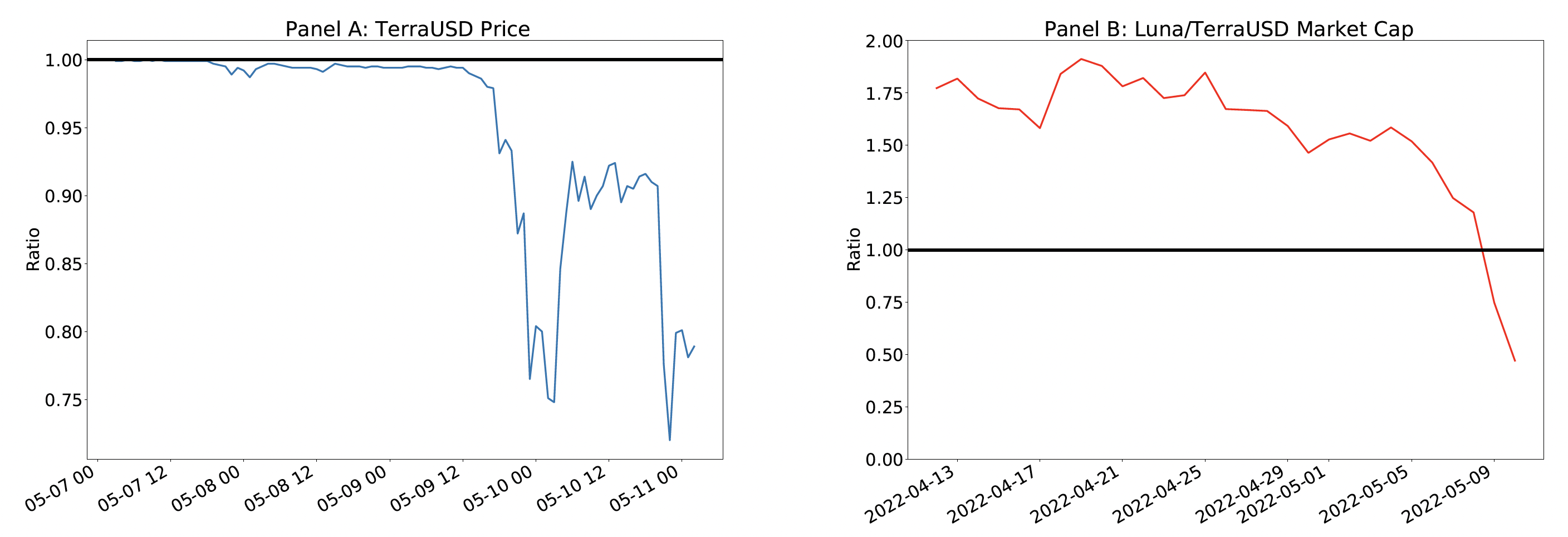

The peg devaluation on 10 May 2022

We find support for devaluation risk in Panel A of Figure 3. There are three events in the lead-up to the large peg discounts observed on 10 May 2022, in which TerraUSD traded at a low of 60 cents. A large decline in Bitcoin coincided with a decline in the value of the Luna token as investors liquidated all cryptoassets.

The ratio of the value of Luna to the circulating supply of TerraUSD is plotted in Panel B of Figure 3. For most of the peg’s history, the ratio is above one, which means that investors can always redeem TerraUSD tokens at par. On 10 May, the ratio of Luna to TerraUSD market cap declines to less than 0.5. Therefore, there is no feasible way to redeem all TerraUSD at par. Weak fundamentals of the peg triggered a speculative attack (Routledge and Zetlin-Jones 2021). The arbitrage mechanism also breaks down when Luna prices keep falling; investors are not redeeming TerraUSD tokens and buying Luna.

Figure 3 TerraUSD price on 10 May 2022

Note: Market cap of TerraUSD and Luna obtained from coinmarketcap. Price data for UST/USD is obtained for the Coinbase exchange from coinapi.

What lessons can we learn?

What are the lessons from this episode? First and foremost, algorithmic stablecoins are prone to devaluation risk and speculative attacks when they are under-collateralised. One natural solution is for TerraUSD to be backed fully by stable collateral, ideally liquid US dollar reserves, or its equivalent in stablecoins on the blockchain. Another solution is to maintain over-collateralisation through smart contracts. For example, if the ratio of collateral to stablecoin falls below a threshold, the system requires liquidation of the stablecoin to preserve full collateralisation and peg stability. In fact, as of writing this column, the founder of the Terra blockchain has publicly stated that Terra will move to a collateralised system.1

Conclusion

This column answers a series of questions relevant to whether algorithmic stablecoins are vulnerable to speculative attacks. We find support for devaluation risk in a case study of the algorithmic stablecoin TerraUSD on 10 May 2022. The stablecoin is vulnerable to a speculative attack when it is under-collateralised. Devaluation risk is amplified when the stablecoin supply is linked to valuation of the governance token of the blockchain. We suggest alternative solutions, such as being backed by liquid stable collateral types or a system of over-collateralisation through smart contracts to achieve peg stability.

References

Eichengreen, B (2019), “From commodity to fiat and now to crypto: what does history tell us?”, Technical Report, National Bureau of Economic Research.

Eichengreen, B and G Viswanath-Natraj (2022), “Stablecoins and Central Bank Digital Currencies: Policy and Regulatory Challenges”, Asian Economic Papers 21(1): 29–46.

Kozhan, R and G Viswanath-Natraj (2021), “Decentralized stablecoins and collateral risk”, WBS Finance Group Research Paper, forthcoming.

Li, Y and S Mayer (2020), “Money creation in decentralized finance: A dynamic model of stablecoin and crypto shadow banking”, Fisher College of Business Working Paper 2020-03.

Lyons, R K and G Viswanath-Natraj (2020a), “What keeps stablecoins stable?”, Technical Report, National Bureau of Economic Research 2020.

Lyons, R K and G Viswanath-Natraj (2020b), “Stable coins don't inflate crypto markets”, VoxEU.org, 17 April.

Routledge, B and A Zetlin-Jones (2021), “Currency stability using blockchain technology,” Journal of Economic Dynamics and Control, 104155.

Endnotes

1 https://twitter.com/stablekwon/status/1524331190995484672?t=pf-Gfwt5D-zdjIo_2AOzCg&s=19