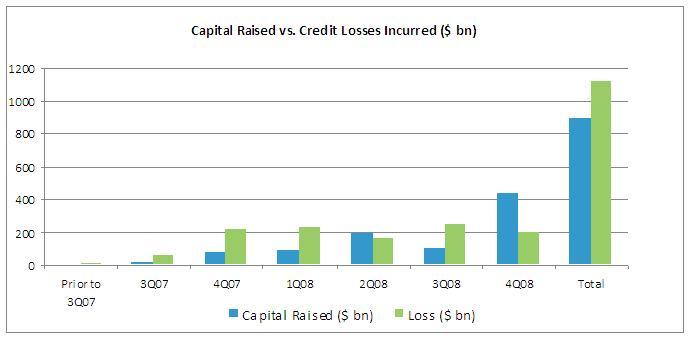

The accumulated losses in the current crisis (at $1.11 trillion since August 2007) have been very large, but so have the headline figures for the amount of new capital raised ($900 billion) as can be seen in Figure 1. However, a closer look at the numbers reveals a much less sanguine picture of the state of the banking sector and raises serious questions about governance of the banking sector more generally.

Figure 1. Capital raised and losses, billions USD

Source: Bloomberg WDCI, updated 23 Feb 2009

Three features in particular warrant closer scrutiny. The evidence in Figures 2-4 below is based on data from 21 large banks from the US, the UK, and Europe. Details are in Acharya, Gujral and Shin (2009).1

First, Figure 2 shows that the composition of bank capital has changed, with most of the new capital being raised in the form of debt and hybrid claims such as preferred equity. The issuance of common equity has been rare. In total, these banks issued $1.76 trillion of capital during 2000-2008, but a staggering $1.64 trillion (93.2%) was raised in the form of debt. More than 6.8% of the remaining capital was issued in the form of preferred equity, especially during the crisis period of 3Q 2007 to 4Q 2008, implying that from 2000 to 2008, banks were in fact net buyers of common equity rather than issuers – that is, they were buying back shares to the tune of $24.1 billion.

Figure 2. Annual net capital raised

Net Capital has been defined as Capital raised by Net issuance of common stock + Net issuance of Preferred Stock + Net issuance of Long Term Debt – Dividends paid (Source: Cash Flow Statement (Financing Activities) from Annual statements of Banks, SEC Filings and Bloomberg).

Interestingly, while JPMorgan, the relatively better performer during the crisis, issued four times as much debt as common equity, Citigroup’s debt to equity issuance ratio was thirteen. Although Wells Fargo and Bank of America were also net buyers of common equity, they did not issue too much debt (they grew far less rapidly than Citigroup). HBOS, one of the beleaguered UK bank during the crisis, had a ratio of 29. And, in another salient example, UBS was net buyer of common equity but issued $135 billion of debt. Even with the benefit of hindsight, the relationship between the type of capital issued and the ex post performance of banks is striking.

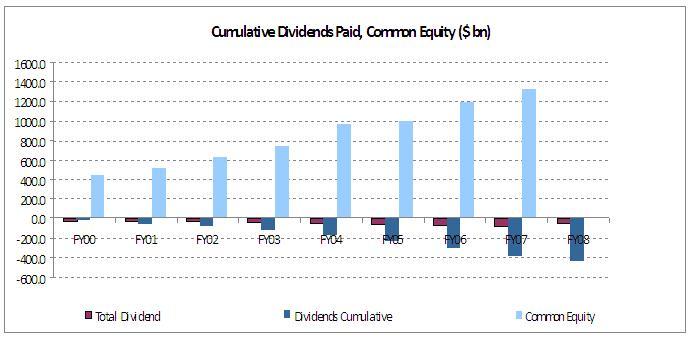

Second, even as the banking system has suffered the depletion of common equity through losses on the asset portfolio, banks have continued to pay dividends throughout the crisis. Figure 3 shows that bank dividend payouts increased from 0.4% of assets in 2000 to 1.1% of assets in 2007 and were still at 0.7% of assets through the first three quarters of 2008 in spite of the gathering storm. It is perhaps hard to believe, but bank management hardly reduced their dividends in the first fifteen months of the worst crisis since the Great Depression. While the crisis essentially knocked out most of the market value of bank equity from 2007 to 2008, the cumulative dividends of over $400 billion still represent around one-third of the 2007 market capitalisation of $1.3 trillion.

Anecdotal evidence is consistent with a reluctance to cut dividends or even reduce their amount. Lehman Brothers Holdings announced a 13% increase in its dividend and a $100 million share repurchase in January 2008, Citigroup cut its dividend close to zero only in November 2008, JPMorgan and Wells Fargo, while recipients of the TARP capital in Fall 2008, cut dividends as late as February and March 2009, respectively, and even as the Federal Reserve is urging banks receiving bailout funds to cut dividends, Goldman Sachs and Morgan Stanley have yet to do so. This is to be compared to the fact that 61 members of the Standard & Poor’s 500-stock index cut their dividends during 2008.2

Figure 3. Cumulative dividends paid and common equity, billions USD

Source: Annual statements of Banks, SEC Filings and Bloomberg

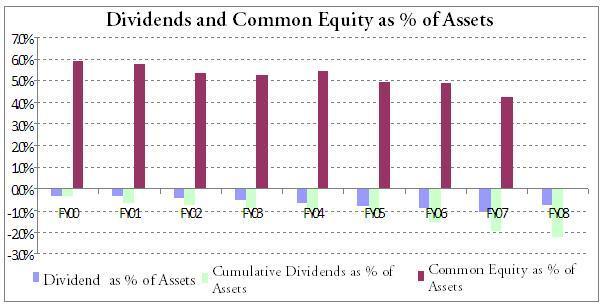

It is also notable in Figure 4 that while the total market value of common equity rose throughout 2000 to 2007, when viewed as proportion of total bank assets, it in fact fell from 6% in 2000 to just over 4% in 2007. The cumulative dividends amounting to over 2% of assets between 2000 and 2007 thus represent a negative capital issuance of a fairly significant magnitude relative to banking sector’s capital base.

Figure 4. Annual dividends paid (Flow) and common equity (Stock) as a percentage of assets

Source: Annual statements of Banks, SEC Filings and Bloomberg

This outflow of dividends has deprived the banking system of common equity capital precisely when it was most needed. The erosion of common equity through dividends points to the breakdown of the priority of debt over equity. Banks that have received public funding support and are in serious risk of failure have continued to pay out dividends. For banks that anticipate losses, dividends were paid to equity holders at the expense of the debt holders (including the taxpayers funding the bailouts). This is a pure transfer in violation of the priority of debt over equity. Such a pattern has arguably been allowed to continue only because of the slow-moving nature of book equity that has allowed banks with dwindling market capitalisations to be deemed safe from a regulatory (book) capital standpoint. In effect, the inertia in bank accounting has enabled substantial transfers in violation of priority of debt over equity.

In particular, we believe that the dwindling pool of common equity has been an important reason for the continued reluctance of banks to extend credit in spite of the large-scale injection of bailout capital. Most of the public injections of bank capital in the US in particular have taken the form of preferred equity rather than common equity. As a consequence, banks’ leverage relative to common equity has increased relentlessly. This has left banks unwilling to take up the slack in intermediation left by the collapse of the securitisation market.

A recent speech by Bill Dudley (2009), the new President of the Federal Reserve Bank of New York, notes that executives at banks and government-sponsored enterprises told regulators “repeatedly over the past 18 months” that “now is not a good time to raise capital”. He goes on to say:

“This desire to postpone capital raising stems in part to the fact that bank executives often do not want to dilute existing shareholders, which of course include themselves. […] The self-interested thing to do is avoid the dilution and hope for a good state of the world.”

The fear of dilution – since most benefit of new capital injection accrues to creditors – leads incumbent shareholders to under-invest in raising new common equity capital, an agency problem that is a variant of the Myers (1977) debt overhang problem. On a related point, since many of the equity holders are also employees of the bank, the diversion of funds from debt holders (including taxpayers) to equity holders is related to the thorny and politically charged issue of employee compensation in banks. In this sense, payment of dividends to bank shareholders even in the midst of a severe crisis can be seen as a part of the larger debate on compensation issues.

These corporate finance problems pose difficult questions for crisis resolution. While manifestations are many, we view the continued payment of dividends by banks as the quintessential reflection of a failure of governance of banks. In such a world, what good is served by the Anglo-Saxon view on corporate governance that emphasises shareholder value? It has the unintended and adverse consequence of depleting capital even further, deepening insolvency and endangering any swift resolution of failing banks. Some commentators had urged the cutting of dividends as the first step in the resolution of a banking crisis. Although the opportunity has been lost in this crisis, lessons must be learned for the future. Forcing bank management to cut dividends should be the first step in a banking crisis.

Footnotes

1 U.S: JP Morgan, Wells Fargo, Lehman Brothers, Wachovia Corp. , Citigroup, Washington Mutual, Merrill Lynch, Morgan Stanley, Bank of America, Goldman Sachs

U.K: Royal Bank of Scotland, HSBC, Barclays Plc., HBOS, Lloyds TSB

Europe: IKB, UBS, Credit Suisse, Deutsche Bank, Fortis, BNP

2 Some commentators have argued for a stop on bank dividends right around the TARP announcement in the US (see Scharfstein and Stein, October 2008). See also the column by David Wessel in March 2008 (Wessel 2008).

References

Acharya, Viral V., Irvind Gujral and Hyun Song Shin (2009) Dividends and Bank Capital in the Financial Crisis of 2007-2009, Working Paper, www.ssrn.com.

Dudley, William C. (2009) Financial Market Turmoil: The Federal Reserve and the challenges ahead, Remarks at the Council on Foreign Relations Corporate Conference, New York City

Myers, Stewart C. (1977) Determinants of Corporate Borrowing, Journal of Financial Economics, 5(2), 147-175.

Scharfstein, David S. and Jeremy C. Stein (2008) This Bailout Doesn’t Pay Dividends, The New York Times, 20 October 2008.

Wessel, David (2008) “Brainstorming about Bailouts” Wall Street Journal, 13 March 2008