An inflation target too close to zero risks pushing the economy into a negative inflation territory when even mild shocks occur. During periods of deflation the nominal interest rate is likely to hit the lower zero bound (ZLB). When this happens, the real interest rate cannot decline further. In such a scenario, the central bank loses its capacity to stimulate the economy in a recession, thereby risking prolonging recessions that do occur (Eggertson and Woodford 2003, Aruoba and Schorfheide 2013, Blanchard et al. 2010, Ball 2014).

In a new paper, we use a behavioural macroeconomic model to shed new light on the nature of this risk (De Grauwe and Ji 2016). This model is characterised by the fact that agents experience cognitive limitations preventing them from having rational expectations, and forcing them to use simple rules of thumb to forecast the output gap and the rate of inflation. It is a model that produces endogenous waves of optimism and pessimism (animal spirits) that, in a self-fulfilling way, drive the business cycle (De Grauwe 2012). The use of this model leads to three key findings.

First, our behavioural model predicts that with an inflation target of 2% (and assuming standard Taylor rule parameters), the probability of hitting the ZLB is about 20%. This finding is in contrast to standard linear DSGE models, which have tended to underestimate the probability of hitting the ZLB (Chung et al. 2012). Most of these models have led to the prediction that when the central bank keeps an inflation target of 2%, it is very unlikely that the economy will be pushed into the ZLB (Reifschneider and Williams 2000, Coenen 2003, Schmitt-Grohe and Uribe 2007).

Second, we find that when the inflation target is too close to zero, the economy can get gripped by ‘chronic pessimism’ that leads to a dominance of negative output gaps and recessions, and in turn feeds back on expectations, producing long waves of pessimism. The mechanism that produces this chronic pessimism can be described as follows. Endogenous movements in animal spirits regularly produce recessions and negative inflation rates. When that happens, the central bank cannot use its interest rate to boost the economy and to raise inflation as the nominal interest rate cannot become (sufficiently) negative. When inflation becomes negative, this also implies that the real interest rate increases during the recession, aggravating the latter and increasing pessimism. The economy can get stuck for a long time in this cycle of pessimism and a negative output gap.

Not surprisingly, when the inflation target is close to zero, the output gap and the rate of inflation will be pushed more often into negative territory than when the target is set farther away from zero, thereby producing more periods of chronic pessimism. Put differently, when the inflation target is set too close to zero the distribution of the output gap is skewed towards the negative territory.

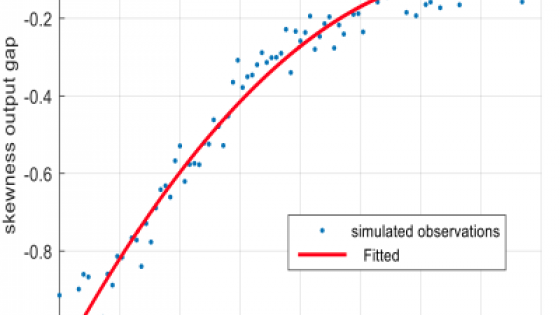

The question then is what ‘too close to zero’ means. The simulations of our model, using parameter calibrations that are generally found in the literature, suggests that a level of 2% is too low, i.e. it produces negative skewness in the distribution of the output gap. Figure 1 presents the skewness of the output gap as a function of the inflation target. We find that for inflation targets below 3% the skewness is negative, i.e. the distribution of the output gap is skewed towards the left with more negative output gaps than positive. An inflation target in the range of 3% to 4% comes closer to producing a symmetric distribution of the output gap.

The negative skewness of the output gap is related to the asymmetry of animal spirits when the inflation target is low. In our model we measure animal spirits by an index reflecting the fractions of agents that make a positive or negative forecast of the output gap. When all agents make a positive forecast the index is 1, and when they all make a negative forecast the index is -1. When positive and negative forecasts balance out, the index is 0. Thus, our index measures optimism and pessimism about the future output gap. In Figure 2 we show the relation between the mean animal spirits and the level of the inflation target. We observe that when the inflation target is low, agents are pessimistic on average. In this sense, low inflation targets create chronic pessimism about future economic conditions.

Figure 1. Inflation target and skewness (output gap)

Figure 2. Inflation target and animal spirits (mean)

Source: De Grauwe and Ji (2016)

A third result concerns credibility of the inflation target. Our model gives a precise definition of credibility as the fraction of agents that use the announced inflation target as their rule of thumb to forecast inflation. It turns out that an inflation target of 3% or 4% has more credibility than a target of 2%. The reason has to do with what we said earlier – with an inflation target of 2%, the output gap and inflation are more often pushed into negative territory than when the inflation target is 3% or 4%. Once these variables are in the negative territory the power of the central bank to affect the output gap and inflation is weakened. As a result, the observed inflation rate will deviate more often from the target, thereby undermining the credibility of the central bank.

Our analysis leads to the conclusion that central banks should raise the inflation target from 2% to a range between 3% to 4% (see also Blanchard et al. 2010 and Ball 2014 on this). One issue that we have not analysed here is how periods of prolonged pessimism, produced by an inflation target that is set too low, affect long-term growth. It is not unreasonable to believe that chronic pessimism lowers investment in a persistent way, thereby lowering long-term growth. As we have not incorporated these long-term growth effects in our model, it is difficult to come to precise conclusions. We leave this issue for further research.

References

Aruoba, S B, and F Schorfheide (2013), “Macroeconomic dynamics near the ZLB: A tale of two equilibria”, papers.ssrn.com

Ball, L (2014), “The Case for a Long-Run Inflation Target of Four Percent”, IMF Working Paper 14/92

Blanchard, O, G Dell’Ariccia, and P Mauro (2010), “Rethinking Macroeconomic Policy”, IMF Staff Position Note, February 12

Chung, H, J P Laforte, D Reifschneider, and J C Williams (2012), “Have we underestimated the likelihood and severity of zero lower bound events?”, Journal of Money, Credit and Banking, 44 (s1), 47-82

Coenen, G (2003), “Zero Lower Bound: Is It a Problem in the Euro Area?” ECB Working Paper, No. 269

De Grauwe, P (2012), Lectures on Behavioral Macroeconomics, Princeton University Press

De Grauwe, P, and Y Ji (2016), “Inflation Targets and the Zero Lower Bound in a Behavioral Macroeconomic Model”, CEPR Discussion Paper No. 11320

Eggertsson, G B, and M Woodford (2003), “The Zero Bound on Interest Rates and Optimal Monetary Policy”, Brookings Papers on Economic Activity, 2, 139–211

Reifschneider, D, and J C Williams (2000), “Three Lessons for Monetary Policy in a Low-Inflation Era,” Journal of Money, Credit, and Banking, 32, 936–966

Schmitt-Grohe, S, and M Uribe (2007), “Optimal Inflation Stabilization in a Medium-Scale Macroeconomic Model”, In K Schmidt-Hebbel and R Mishkin (eds.), Monetary Policy Under Inflation Targeting, 125–86. Santiago, Central Bank of Chile.