The foreign exchange market is the largest and most liquid financial market in the world. Its average daily turnover exceeded $3 trillion as of April 2007. Currency trading is very important for individuals, firms, and governments that buy foreign goods and services, invest abroad, and seek profit or protection through speculation. Market supply and demand drive exchange rates up and down every day, imposing risks on participants of the foreign exchange markets. Predicting exchange rates would allow businesses, investors, and policymakers to make wise decisions when conducting international business and economic policies. Unfortunately, that has been a daunting task for a long time.

The steep, prolonged depreciation of the US dollar against the euro and other major currencies over the last year, along with its recent rally, has brought a renewed interest in understanding the factors that move exchange rates. Although it has been a long-standing challenge to tie exchange rates to economic fundamentals, several theories have been offered to explain the disconnect between the two. Some recent research supports the idea that exchange rates behave like the prices of financial assets, whose movements are primarily driven by changes in expectations about future economic fundamentals, rather than by changes in current fundamentals. Before discussing these studies, I offer a brief review of the exchange rate disconnect puzzle and why it’s important.

The disconnect puzzle

In a seminal paper, Richard Meese and Kenneth Rogoff (1983) found that economic fundamentals – such as the money supply, trade balance and national income – were of little use in forecasting exchange rates, at least over short to medium time horizons. They compared existing models to an alternative in which fundamentals are excluded and any exchange rate changes are purely random. They found the “random walk” model to be just as good.

This finding is very puzzling. Economic fundamentals have long been considered critical determinants of exchange rates. These fundamentals have been widely used in the literature to model exchange rate fluctuations. Meese and Rogoff’s finding casts serious doubt on these models. Indeed, their finding suggests that exchange rates may be determined by something purely random rather than economic fundamentals. If this is true, forecasting exchange rates becomes a mission impossible. There is more depressing news for economists. If this is true, all exchange-rate-related economic analysis derived from these fundamental-based models is very likely to be completely wrong.

In defending fundamental-based exchange rate models, various combinations of economic variables and econometric methods have been tried in an attempt to overturn Meese and Rogoff’s finding. There have been some impressive advances, but most results are, at best, fragile. Forecasts from economic fundamentals may work well for some currencies during certain sample periods but not for other currencies or sample periods.

Instead of probing the relationship between economic fundamentals and exchange rates, some researchers recently considered a different line of attack. Given the empirical results, should we decide that exchange rates are not determined by fundamentals? Probably not. There are reasons fundamentals aren’t very helpful in forecasting exchange rates, even if currency values are determined by these fundamentals. One recent explanation for the disconnect puzzle lies in understanding exchange rates through the asset-pricing approach.

The asset-pricing approach

Engel and West (2005) argue that the exchange rate disconnect is consistent with exchange rates being determined by fundamental variables. They show that existing exchange rate models can be written in a present-value asset-pricing format. In these models, exchange rates are determined not only by current fundamentals but also by expectations of what the fundamentals will be in the future. Current fundamentals receive very little weight in determining the exchange rate. Not surprisingly, they aren’t useful in forecasting.

Under the Engel-West explanation, judging exchange rate models by their ability to forecast is too harsh a standard: If exchange rates are determined by fundamentals in the same way as other asset prices, current fundamentals can’t forecast exchange rates better than a random walk, even if the asset-pricing model correctly captures the relation between economic fundamentals and exchange rates. In this case, fundamental-based models are still appropriate for economic analysis, such as exchange rate and trade policy analysis – they are just useless in forecasting.

How do we know the asset-pricing model is applicable? Are there other ways to test fundamental-based exchange rate models if beating the random walk in forecasting exchange rates is too harsh? While the asset-pricing approach doesn’t allow us to predict short-term exchange rates, it does lead to an interesting implication. If the exchange rate is determined by expected future fundamentals, today’s currency values should contain information about tomorrow’s fundamentals.

Engel and West (2005) find empirical evidence that supports this prediction, although it’s not uniformly strong. Additional support can be found in Chen, Rogoff, and Rossi (2008), who look at exchange rates in Australia, Canada, Chile, New Zealand, and South Africa – countries where commodities account for a large portion of exports. After allowing for parameter instability, the study finds that exchange rates help predict an economic fundamental – world commodity prices.

The asset-pricing approach gains further support from research that compares currency markets to other financial markets. Lustig, Roussanov, and Verdelhan (2008) examine opportunities arising from the carry trade – borrowing in low interest rate currencies while lending in high interest rate ones. The return is positive if exchange rates don’t move to offset the gains from the interest rate differential. The results show excess returns are the only compensation for the risks investors undertake in the carry trade, suggesting that in some ways exchange rates behave like the prices of other assets.

Long- and short-horizon predictability under the asset-pricing approach

While most detected exchange rate predictability in empirical studies is fragile, a relatively robust finding is that exchange rates are more predictable at long horizons. This result was first formally shown by Mark (1995) and recently confirmed by Engel, Mark, and West (2007). Can the asset-pricing approach also explain the long-horizon predictability of exchange rates? To answer this question, Charles Engel, Jason Wu, and I examine under what conditions exchange rates exhibit greater predictability as time horizons lengthen in present-value asset-pricing models (Engel, Wang, and Wu, 2008).

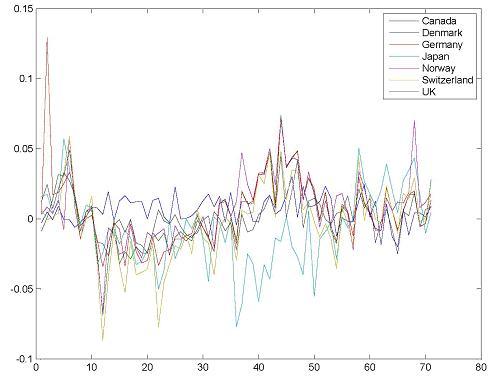

We argue that exchange rate movements may be driven by both a permanent long-term trend and some transitory noise. These noisy terms can drive exchange rates away from their long-run levels in the short run. As time passes, exchange rates gradually move back to their long-run levels, exhibiting long-horizon predictability. In several models, such as the monetary model and the Taylor rule model in Engel and West (2005), the short-term noise is related to a fundamental that isn’t observable – the risk premium for holding a currency, for example. Given market expectations about the future exchange rate, the risk premium can be calculated from uncovered interest rate parity. In our exercise, we calculate the risk premium from survey data (Consensus Forecasts) by assuming the data correctly measure market expectations about the exchange rate. The calculated risk premium between the US dollar and seven other major currencies exhibits strong stationarity (see Figure 1).

Figure 1. Risk Premium between US dollar and other currencies

With the risk premium and other fundamentals, we simulate exchange rates with the monetary model and the Taylor rule model. In our simulations, exchange rates can be better predicted in the long run than in the short run. In short, our exercise shows that with some stationary fundamentals, such as the risk premium, the asset-pricing approach may also be able to explain the long-horizon predictability of exchange rates.

Concluding remarks

Several recent studies support interpreting exchange rates as prices of long-lasting financial assets. The asset-pricing approach shows promise, even though empirical work hasn’t yet fully solved the exchange rate disconnect puzzle Meese and Rogoff introduced more than a quarter century ago. Other factors such as parameter instability and misspecification (for instance, Rossi 2005) may also play important roles in understanding the puzzle.

References

Chen, Yu-chin, Kenneth Rogoff, and Barbara Rossi, 2008, “Can Exchange Rates Forecast Commodity Prices?” Working Paper, University of Washington, Harvard University and Duke University, February.

Engel, Charles and Kenneth D. West, 2005, “Exchange Rates and Fundamentals” Journal of Political Economy, vol. 113, June, pp. 485–517.

Engel, Charles, Nelson C. Mark, and Kenneth D. West, 2007, “Exchange Rate Models Are Not as Bad as You Think” NBER Macroeconomics Annual 2007.

Engel, Charles, Jian Wang, and Jason Wu, 2008, “Can Long Horizon Data Beat a Random Walk Under the Engel–West Explanation?” Working Paper, University of Wisconsin, Federal Reserve Bank of Dallas and Federal Reserve Board, June.

Lustig, Hanno, Nick Roussanov, and Adrien Verdelhan, 2008, “Common Risk Factors in Currency Markets,” Working Paper, University of California, Los Angeles, Wharton School and Boston University, June.

Mark, Nelson C., 2005, “Exchange Rates and Fundamentals: Evidence on Long-Horizon Predictability,” American Economic Review, vol. 85, March, pp. 201–18.

Meese, Richard A., and Kenneth Rogoff, 1983, “Empirical Exchange Rate Models of the Seventies: Do They Fit Out of Sample?” Journal of International Economics, vol. 14, February, pp. 3–24.

Rossi, Barbara, 2005, “Testing Long-Horizon Predictive Ability with High Persistence, and the Meese–Rogoff Puzzle,” International Economic Review, vol. 46, February, pp. 61–92.