In recent decades, both monetary theory and monetary policymakers have come to emphasise the importance of expectations for the transmission of monetary policy.1 The New Keynesian model – more particularly the Phillips curve embedded in it – explains current inflation by the output gap and expected future inflation. Monetary policy can directly only influence a very short term interest rate and its impact on the current output gap is relatively limited. Thus, in the New Keynesian model, expectations matter for monetary policy.

Inflation targeting and transparency

Inflation targeting has been the most popular monetary policy regime of recent decades. Under this policy, central banks effectively target inflation forecasts. To a large extent these forecasts are determined by expectations of economic agents. Communicating information is the central bank’s major instrument for managing expectations. It is therefore logical that the issue of central bank transparency came to the fore when inflation targeting became the dominant monetary policy strategy, often studied in the context of a New Keynesian model.

The early literature focused on how to define transparency and its different aspects. Several indices for measuring transparency were developed (e.g. De Haan et al. 2004 and Eijffinger and Geraats 2006). It was shown how increased transparency could contribute to more effective monetary policy, more anchored inflation expectations, and lower interest rates. Most of the theoretical and empirical literature concluded that more transparency is better (see van der Cruijsen and Eijffinger 2007 for a recent literature review). More recently, the potential negative effects of higher transparency have attracted attention (see Ellen Meade’s Vox column).

Since transparency has positive and negative aspects, the obvious next step is to investigate the notion of an optimal degree of central bank transparency. Our recent research contributes to this literature by investigating whether there is an optimal degree of overall transparency.2

Reasons for optimal central bank transparency

In our view, central bank transparency mainly matters in so far as it influences the quality of private sector expectations on inflation. Up to a point, providing additional information improves the basis for those expectations. This information has several dimensions, e.g. information about central bank objectives, models, procedures, forecasts, etc. This sort of information helps economic agents better understand how the economy works, thus moving the inflation expectation-formation process in the direction of rational expectations conditional on as much information as available.

Information overload and central bank credibility

Beyond a certain point, however, two negative effects of providing more information become dominant, eroding the quality of private sector inflation expectations:

- Economic agents may become overloaded with information (Rabin 1998).

As a result they may no longer see the big picture or they may not use the most important parts of the information provided. It is well known that people sometimes neglect important information when it is supplied with a lot of other information. People also fall back to simple rules of thumb if the content of the information becomes too complicated.

- By providing more and more information, paradoxically central banks show how little they actually know.

This risk is especially relevant when the central bank provides information on all the uncertainties surrounding forecasts and analyses. By doing so, it may also convey how dependent the central bank ultimately is on the relatively powerless instrument that is the very short-term interest rate. Thus result may be a drop in the central bank’s credibility.

In our view, protecting the reputation of the central bank was an important argument behind the culture of secrecy that surrounded central banks before inflation targeting became popular. Relevant for our argument is that economic agents may no longer follow guidance from the central bank in forming their expectations if the perceived message they get from their central bank is: “we do not really know”.

Too much transparency can be bad

Our hypothesis is that up to a certain point, more transparency increases the proportion of private sector expectations that are formed rationally. Beyond that point, the proportion drops.

People who do not form their expectations rationally can in principle do so in an infinite number of ways. We take a shortcut by assuming that all expectations that are not formed rationally are formed in a backward looking manner.

In a standard New Keynesian model, inflation will ceteris paribus be less persistent after a shock the more economic agents form their expectations rationally. It is therefore optimal for the central bank to be as transparent as is required to maximise the proportion of economic agents forming their expectations rationally.

Empirical evidence

We do not have information about the proportion of economic agents who form their inflation expectations rationally. Therefore, we exploit the fact that in the New Keynesian model inflation persistence is related to the share of agents with rational versus backward-looking expectations.

We estimate inflation persistence for the 100 countries for which Dincer and Eichengreen (2007) have calculated transparency indices. The estimation period is 1998-2005. Inflation persistence is measured as the sum of the coefficients of lagged inflation in an autoregressive explanation of inflation in this panel.

We introduce interaction terms – lagged inflation times the transparency index and lagged inflation times the squared transparency index. Thereby, we test for the existence of a quadratic relationship between transparency and inflation persistence. Finding such a relation would be consistent with the existence of an optimal intermediate level of transparency.

The empirically optimal level of transparency

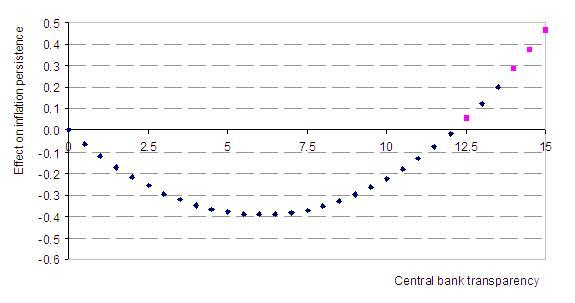

We do indeed find the hypothesised relation between transparency and inflation persistence in our panel. As can be seen in Figure 1, the optimal level of transparency for all countries is around 6 on a scale of between 0 and 15.

Figure 1 Effect of central bank transparency on inflation persistence

Note: Transparency levels of 12.5 and exceeding 13.5 are not observed in our sample.

This is a relatively low level. However, it should be noted that the maximum measured level of transparency in our sample is 13.5 and that many central banks in emerging economies have a relatively low level of transparency.

It is also likely that the optimal level may differ from country to country. To illustrate this, we have also estimated optimal transparency for the OECD countries in our panel. It turns out to be 7.5. Because optimal transparency depends on the capacity of the private sector to process information, it makes sense to observe a higher optimal transparency for OECD countries since their inhabitants are better able to process information.

Conclusion

Our results indicate that an optimal level of central bank transparency exists. Many central banks, in emerging economies in particular, are still likely to benefit from increasing transparency. This is far less evident for major central banks in the world like the Federal Reserve System, the European Central Bank and the Bank of England.

Our research also indicates that it may be fruitful to further study the links between information provision, communication and expectations formation. This may require a shift in focus from looking at the quantity of information to its quality.

References

Cruijsen, Carin A.B. van der, Sylvester C W Eijffinger, and Lex H Hoogduin (2008). ‘Optimal Central Bank Transparency’, CEPR Discussion Papaer 6889.

Cruijsen, Carin A.B. van der, and Sylvester C.W. Eijffinger (2007). "The Economic Impact of Central Bank Transparency: A Survey." CEPR Discussion Paper No. 6070.

Cukierman, Alex (2007). "The Limits of Transparency." CEPR Discussion Paper No. 6475.

Dincer, N. Nergiz, and Barry Eichengreen. "Central Bank Transparency: Why, Where, and with What Effects?." NBER Working Paper No. w13003, 2007.

Ehrmann, Michael, and Marcel Fratzscher (2008). "Purdah. On the Rationale for Central Bank Silence Around Policy Meetings." ECB Working Paper No. 868.

Eijffinger, Sylvester C.W., and Petra M. Geraats (2006). "How Transparent are Central Banks?" European Journal of Political Economy 22(1),1-21.

Haan, Jakob De, Fabian Amtenbrink, and Sandra Waller (2004). "The Transparency and Credibility of the European Central Bank." Journal of Common Market Studies 42(4), 775-794.

Rabin, Matthew (1998). "Psychology and Economics." Journal of Economic Literature 36(1) (1998), 11-46.

1 The views in this column do not necessarily reflect the views of the institutions with which we are affiliated.

2 Also see Ehrmann and Fratzscher (2008) and Cukierman (2007).