Central bank independence (CBI) means that monetary policy is delegated to unelected officials and that the government’s influence on monetary policy is restricted. According to Willem Buiter (2016), central bank independence is under threat. In his view, this threat “comes both from the wider political and social climate – the rise of populism and of anti-establishment, anti-expert and anti- technocratic sentiment – and from developments specific to central banks. Since the start of the Global Crisis in mid-2007, central banks in most advanced economies have become more powerful and political. They have not become more accountable. Their mandates have expanded far beyond monetary policy narrowly defined.” (Buiter 2016, p. 3). In a new CEPR Policy Insight, we discuss in more detail why CBI matters and whether it has changed since the Global Crisis (de Haan and Eijffinger 2017). This column summarises our findings.

Has central bank independence changed since the crisis?

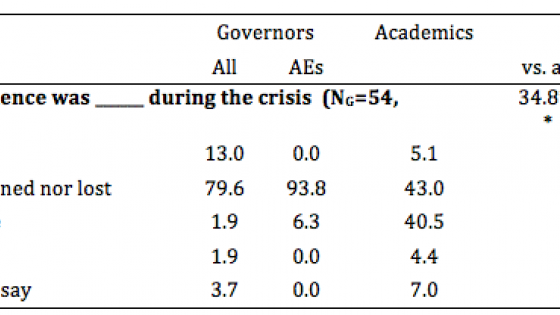

Blinder et al. (2017) asked both central bank governors and academics about their views on the extent to which central bank independence has changed due to the financial crisis. Table 1, which is taken from their paper, suggests that central bank governors felt that little had changed, but academics were slightly more worried.

Table 1. Has central bank independence changed during the crisis?

Notes: The question asked was: "How much independence do you believe your central bank either relinquished, saw taken away from it, or gained during the crisis?" Percentages of number of responding governors or academics. *** denotes significance at the 1% level, calculated using Chi-squared tests for the independence of responses of governors and academics. AEs is advanced countries. NG/NA denotes number of responding governors/academics.

Source: Blinder et al. (2017).

An important question, therefore, is whether these changes have made the pendulum swing in another direction. Has CBI decreased since the financial crisis? To examine CBI, one needs an indicator of the extent to which the monetary authorities are independent from politicians. Most empirical studies use either an indicator based on central bank laws in place, or the so-called turnover rate (TOR) of central bank governors. The most widely employed legal indicators of central bank independence are (updates of) the indexes of Cukierman et al. (1992) and Grilli et al. (1991). Even though these and other indicators are supposed to measure the same phenomenon and are all based on interpretations of the central bank laws in place, their correlation is sometimes remarkably low (Eijffinger and De Haan, 1996). Furthermore, legal measures of CBI may not reflect the true relationship between the central bank and the government. Especially in countries where the rule of law is less strongly embedded in the political culture, there can be wide gaps between the formal, legal institutional arrangements and their practical impact. This is particularly likely in many developing economies. Cukierman et al. (1992) argue that the TOR may therefore be a better proxy for CBI in these countries than measures based on central bank laws. The TOR is based on the presumption that, at least above some threshold, a higher turnover of central bank governors indicates a lower level of independence. There are, however, some theoretical objections against using governor turnover as a proxy for CBI. The most important objection is that a high tenure of the central bank governor could also reflect that the governor behaves in accordance with the wishes of the government.

Legal independence

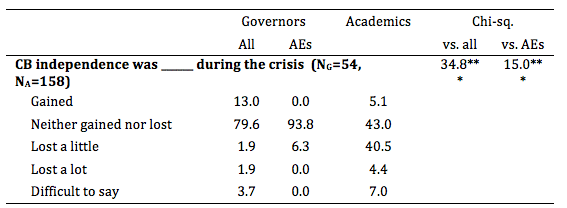

Bodea and Hicks (2015) have expanded Cukierman et al.’s (1992) index of central bank independence for 78 countries from the end of the Bretton Woods system until 2010. The result is an original dataset that codes independence annually and covers legislation changes in the last twenty-five years. Table 2 shows the average level of legal CBI before and after the start of the financial crisis for several groups of countries (based on IMF classifications). The table does not suggest that CBI has decreased after 2007.

Table 2. Legal central bank independence before and after the Global Crisis

Source: own calculations using the data of Bodea and Hicks (2015), which are available at: http://www.princeton.edu/~rhicks/data.html. The classification of countries follows that in the IMF’s World Economic Outlook.

Turnover rates

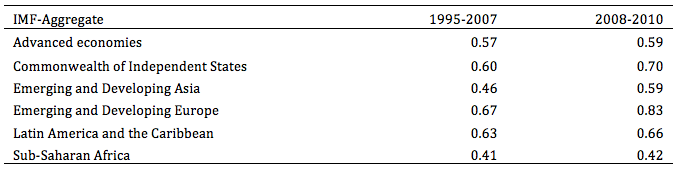

Even central banks that have a high degree of independence are not immune from political pressure. Politicians seeking to influence monetary policy may, for instance, choose to undermine CBI by filling important positions at central banks with individuals that they believe are favourably predisposed towards their preferred policies. The evidence in Klomp and de Haan (2010) suggests that governor turnover is lower following the implementation of central bank reform which strengthens CBI. Table 3 shows average turnover rates for different groups of countries before and after the Global Crisis. The results do not suggest that the number of central bank governor turnovers has changed since the Crisis. This holds for both the total number of turnovers and for irregular turnovers (when the governor is replaced before the end of his/her legal term in office).

Table 3. Central bank governor turnover rates before and after the Global Crisis

Notes: 1 Including ECB. 2 Including Macau. 3 Including Aruba, Bermuda and Cuba. 4 Including "Bank of Central African States" and "Central Bank of West African States".

Source: own calculations using Axel Dreher’s turnover data. The classification of countries follows that in the IMF’s World Economic Outlook. See Dreher et al. (2010) for details.

Conclusion

The traditional argument for central bank independence is based on the desire to counter inflationary biases. The recent financial crisis and the following European debt crisis have put much pressure on central banks and changed monetary policy. The altered role of modern central banks is evident in the large set of new unconventional monetary policy measures employed during the last decade. The new tools and responsibilities of the central banks come with new challenges for central bank independence.

First, in an environment of global debt hangover, the balance of power between fiscal and monetary policy changes. With high public debt levels, fiscal authorities may be tempted to rely on monetary policy to generate additional inflation to alleviate the debt burden. In contrast to previous decades, the threat of fiscal dominance might be particularly strong in the developed world, which has seen remarkably strong increases in sovereign debt levels.

The second risk to central bank independence stems from the consequences of central bank policies. The unprecedented size of the central bank balance sheets has far reaching implications for the financial dimension of independence. Theoretical studies differ in their assessment of the financial risk faced by central banks. Even if it is small, the financial risk should not be underestimated, as lack of financial independence and the reliance on government financing of the central bank would strongly undermine the credibility of a central bank. Credibility, in turn, is crucial for controlling inflation and inflation expectations. This calls for a very careful consideration and design of exit strategies by the central banks, i.e. policies aiming at the reduction of balance sheets to more conventional levels.

Finally, the last threat to central bank independence is also associated with the set of unconventional monetary policies employed during the crisis. Crucial for arguments in favour of central bank independence is the assumption that monetary policy has little or no redistributive consequences. The recent policies employed by central banks threaten, however, to undermine this argument, as they are far more redistributive than traditional monetary policy.

Although economists have expressed serious concerns that central bank independence is under threat, central bank governors are less worried. Our analysis of CBI indicators before and after the financial crisis suggests that, so far, little has changed. But it may be too early to put the worries outlined by Willem Buiter (2016) aside.

Editors' note: CEPR Policy Insight No 87 "Central bank independence under threat?" is available to download here.

References

Blinder, A, M Ehrmann, J de Haan and D Jansen (2017), “Necessity as the mother of invention: Monetary policy after the crisis”, Economic Policy 90 (forthcoming).

Bodea, C and R Hicks (2015), “Price Stability and Central Bank Independence: Discipline, Credibility and Democratic Institutions”, International Organization, 69(1), 35-61.

Buiter, W (2016), “Dysfunctional Central Banking. The End of Independent Central Banks or a Return to ‘Narrow Central Banking’ – or Both?”, Citi Research, 21 December.

Cukierman, A, S B Webb and B Neyapti (1992), “Measuring the Independence of Central Banks and Its Effects on Policy Outcomes”, The World Bank Economic Review, 6, 353–398.

Dreher, A, J Sturm and J de Haan (2010), “When Is a Central Bank Governor Replaced? Evidence Based on a New Data Set”, Journal of Macroeconomics, 32(3), 766–781.

de Haan, J and S C W Eijffinger (2017), “Central bank independence under threat?”, CEPR Policy Insight No. 87.

Eijffinger, S C W and J de Haan (1996) “The Political Economy of Central Bank Independence”, Special Papers in International Economics No. 19, Princeton.

Fischer, S (2015), “Central Bank Independence”, Remarks by Stanley Fischer, Vice Chairman

Board of Governors of the Federal Reserve System at the 2015 Herbert Stein Memorial Lecture, National Economists Club, Washington, D.C.

Grilli, V, D Masciandaro and G Tabellini (1991), "Political and Monetary Institutions and Public Financial Policies in the Industrial Countries", Economic Policy, 13, 341–392.

Klomp, J and J de Haan (2010), “Do Central Bank Law Reforms Affect the Term in Office of Central Bank Governors?”, Economics Letters, 106 (3), 219-222.