The foreign exchange (FX) market is enormous. Over $6.6 trillion is traded on average each day by a diverse mix of market participants, making it over ten times larger than the combined daily trading in global equity markets. Yet, despite being the largest financial market in the world, relatively little is known about foreign exchange volume due to the majority of trades taking place in the over-the-counter (OTC) market, which are not publicly broadcast. As a result, many important questions about the market remain unanswered. For example, how is foreign exchange trading volume related to asymmetric information concerning the drivers of currency returns? Does foreign exchange volume contain predictive information about future exchange rate returns? And can investors use information in foreign exchange volume when designing their asset allocation strategies?

Only partial answers to these questions are known for equity markets (Campbell et al. 1993, Llorente et al. 2002). But it is, in any case, unlikely that results from equity markets can be generalised to other financial markets. This is because the foreign exchange market has a very different, more segmented market structure and is populated by a more diverse set of market participants – including profit-oriented financial institutions, as well as central banks, retail investors, and commercial corporations. In this column, we highlight the core results from a recent research article (Cespa et al. 2021) that provides some answers to these questions. We begin by briefly stating the predictions from a simple model of foreign exchange volume developed in the paper. This model links foreign exchange volume to information asymmetry and currency returns. We then turn to the results from empirical tests of the model, which make use of a novel dataset that covers around 50% of all OTC foreign exchange market volume, and aligns well with the snapshot data reported by the BIS Triennial Survey (Rime and King 2010, Rime and Schrimpf 2013).

A simple model of foreign exchange volume, currency returns, and asymmetric information

A simple theory of exchange rates demonstrates a clear channel linking foreign exchange volume with future currency returns. Specifically, the theory shows that expected currency returns are a function of past currency returns both directly and through their interaction with unexpected (i.e. abnormal) volume. Importantly, the coefficient on the interaction (say ‘ϕ') can be increasing in the level of asymmetric information in the market. A key implication from the theory is that, armed with foreign exchange volume data, it is possible to study the relative level of asymmetric information in foreign exchange markets, since levels of interaction can be easily compared across currency pairs and foreign exchange market instruments (by comparing the 'ϕ’ term).

Information asymmetries in the foreign exchange market

To explore the empirical validity of the above theory, we use a novel dataset on foreign exchange volume, constructed by ‘CLS’ – the world’s largest foreign exchange settlement institution (which has effectively mitigated counterparty risk in the foreign exchange market since its inception in the early 2000s; see Levich 2009). The data cover aggregate OTC foreign exchange volume for 31 currency pairs, over six years, across spot, forward, and swap market instruments. It represents the most comprehensive dataset on foreign exchange volume currently available and is ideally suited for testing the implications of the theory.

Our paper estimates the interaction coefficient ('ϕ') across a series of panel regressions. Specifically, daily currency returns are regressed on the previous day’s (i) currency return, (ii) unexpected volume, and (iii) interaction of the two series – where unexpected volume is measured as the deviation of volume from its short-term (21-day) moving average.

Our results reveal that, across the aggregate market (the combination of spot, forward, and swap markets), the interaction coefficient is positive and highly statistically significant, indicating that a high level of information asymmetry exists across foreign exchange market participants. Further tests reveal that the coefficient is similar across individual currency pairs, indicating that information asymmetry is independent of currencies’ average level of liquidity, volatility, or volume.

The finding is important for industry regulators interested in the consequences of moving from the decentralised, dealer-driven foreign exchange market to a more centralised system. Indeed, the results contrast starkly with prior evidence from centralised markets. US equity market studies, for example, have found that the analogue of the interaction coefficient is, for most individual stocks, negative. This is consistent with participants in those markets facing lower levels of asymmetric information. Only for smaller, less liquid stocks are similar results observed (Campbell et al. 1993, Llorente et al. 2002).

The results provide guidance for how a market’s structure can influence the diffusion of information and its impact on prices. In foreign exchange markets, certain groups of participants (such as buy-side investors) are known to make foreign exchange trades that, on aggregate, forecast currency returns (Menkhoff et al. 2016, Ranaldo and Somogyi 2020). The evidence in our paper supports these findings by highlighting that asymmetric information is pervasive across currency pairs.

A second key insight from our analysis, is that the interaction coefficient (‘ϕ') is positive and highly statistically significant when estimated using spot and forward volume but is statistically indistinguishable from zero when estimated with swap volume. This finding suggests that more private information is revealed using spot and forward exchange rates. So, trading against informed counterparties is more likely to take place in these markets. It also highlights that adverse selection risk is possibly higher than faced by traders in most publicly listed US equities.

Implications for asset managers

The findings discussed above have direct implications for currency investors since they indicate that foreign exchange volume can help in forecasting currency returns. Specifically, when volume is abnormally low, we anticipate observing a strong return reversal over the following day, which weakens and flips to a return continuation when volume is particularly high. We build on this insight by taking the perspective of an investor interested in understanding whether foreign exchange volume is economically valuable once incorporated within a currency investment strategy.

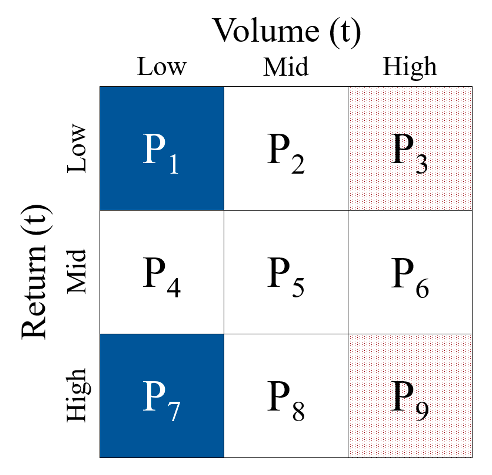

A cross-sectional strategy that incorporates information in both foreign exchange volume and past returns can be achieved via a conditional double sort. Specifically, currency pairs are sorted each day into three groups, conditional on their return over the prior 24-hours. Within these groups, the currency pairs are then allocated into three additional groups based on their abnormal volume over the previous day. Figure 1 provides a graphical depiction of this double-sort procedure.

We form reversal strategies by taking long positions in low return currencies and short positions in high return currencies, across the low (shown by (P1 – P7)) and high (shown by (P3 – P9)) volume groups, denoted as the low- and high-volume reversals (or ‘LVR’ and ‘HVR’). Given our empirical estimates of the interaction coefficient, the low-volume reversal strategy is predicted to generate stronger investment performance than the high-volume reversal strategy.

Figure 1 Conditional double sort

Investment performance

We find a low-volume reversal strategy generates an economically and statistically high return of 17.6% per annum, which translates into a ‘Sharpe ratio’ of 1.70 and is seen to remain profitable after incorporating trading costs. The average return and Sharpe ratio are statistically higher than those of the high-volume reversal strategy, indicating the importance of conditioning on foreign exchange volume. Figure 2 shows the cumulative returns of the two strategies. The returns of the low-volume strategy increase steadily, not appearing to be driven by isolated events, and thus providing reassurance that the returns are persistent over time.

The high returns to the low-volume reversal strategy raise the prospect that global currency investors can enhance their investment performance by including the low-volume reversal strategy within a broader portfolio. Indeed, the performance of a currency portfolio combining currency carry, value, and momentum strategies is enhanced substantially by adding this strategy, leading to higher Sharpe ratios and supporting the conclusion that large diversification gains could be achieved.

Figure 2 Cumulative returns to FX volume strategies

Note: The figure plots the cumulative returns to the low volume reversal (LVR) strategy and high-volume reversal strategy (HVR). The left-hand pane displays the returns using aggregate FX volume. The right-hand pane displays the returns for three LVR strategies constructed using spot, forward, and swap volume. The strategy returns are daily and run from December 2011 to December 2017.

Conclusions

Foreign exchange volume provides information about the relative amount of information asymmetry across foreign exchange markets. Higher levels of information asymmetry are found to be present in foreign spot and forward markets, relative to the swap market and US equity markets. The findings have important implications for those concerned with over-the-counter market design or the level of adverse selection risk they face when trading in foreign exchange markets.

References

Campbell, J Y, S J Grossman and J Wang (1993), “Trading volume and serial correlation in stock returns”, Quarterly Journal of Economics 108: 905-939.

Cespa, G, A Gargano, S J Riddiough and L Sarno (2021), “Foreign exchange volume”, CEPR Discussion Paper 16128 (forthcoming in Review of Financial Studies).

Levich, R (2009), “Why foreign exchange transactions did not freeze up during the global financial crisis: The role of the CLS bank”, VoxEU.org, !0 July.

Llorente, G, R Michaely, G Saar and J Wang (2002), “Dynamic volume-return relation of individual stocks”, Review of Financial Studies 15: 1005-1047.

Menkhoff, L, L Sarno, M Schmeling and A Schrimpf (2016), “Information flows in foreign exchange markets: Dissecting customer currency trades”, Journal of Finance 71: 601-634.

Ranaldo, A and F Somogyi (2020), “Asymmetric information risk in FX markets”, Journal of Financial Economics 140: 391-411.

Rime, D and M King (2010), “The $4 trillion question: What explains FX growth?”, VoxEU.org, 23 December.

Rime, D and A Schrimpf (2013), “The evolution of the global FX market”, VoxEU.org, 23 December.