The Covid-19 outbreak is leading to a steep decline in global economic activity as countries around the world use social distancing measures to avoid exposure to the coronavirus or to limit its spread. The pandemic has also led to a surge in uncertainty. The ‘VIX’ – a frequently used measure of uncertainty – spiked to levels surpassing even those experienced during the 2007-2008 global crisis (see Figure 1). While the VIX has declined since its March peak, its level remains elevated by historical standards, suggesting that households and businesses are still facing a highly uncertain environment.

Figure 1 The Chicago Board Options Exchange Volatility Index (VIX)

An important source of this uncertainty stems from the unknown evolution of the virus and the effectiveness of social distancing measures. Absent the discovery of an effective vaccine with widespread availability, additional waves of infections remain a possibility. Thus, social distancing measures and lockdowns may need to be periodically reintroduced to deal with future infection flare-ups, which may portend a ‘new normal’ in which viral infections become more pervasive and forceful. Such an uncertain environment is highly challenging for businesses that need employees to be on site, since workers may be exposed to potential health risks or have to stay home due to lockdowns. Thus, businesses may need to consider alternative strategies to minimise the impact of future production disruptions.

For some businesses, automation may be an attractive option (e.g. Kilic and Marin 2020). By reducing the need for on-site human interactions, investing in robots, for instance, could help address concerns about future viral outbreaks (and the associated production disruptions). On the other hand, businesses typically refrain from investing in the face of heightened uncertainty, preferring to wait for more clarity (e.g. Bloom 2009, Leduc and Liu 2016). As a result, while automation may provide one way to cope with the production uncertainty induced by the pandemic, it also necessitates investment spending that firms may be reluctant to actually make. Given the rarity of serious viral outbreaks in much of the world in recent decades, empirical results describing how firms adapt to such situations are limited. Ma et al. (2020) provide evidence for the impact of epidemics in Asia over the past 20 years, but their analysis does not apply to the rest of the world. In this context, estimated theoretical models can provide a useful alternative, complementing some of the emerging work on uncertainty and the pandemic. For some recent empirical studies on pandemic-induced uncertainty, see Baker et al. (2020), Leduc and Liu (2020a) and Dietrich et al. (2020). Further, the new eBook by Baldwin and di Mauro (2020) contains additional essays on a wide range of topics related to COVID-19 economics.

In a recent paper (Leduc and Liu 2020b), we develop a quantitative New Keynesian model of the labour market. In this model, firms face uncertainty about future labour productivity and have the ability to automate jobs. We focus on one channel of pandemic-induced uncertainty that we label job uncertainty, emphasising the impact that future outbreaks may have on worker productivity. For simplicity, we assume that productivity is impacted by labour-specific productivity shocks that are subject to ‘second-moment’ disturbances, capturing variations in uncertainty.

We build on our earlier work (Leduc and Liu 2019) and study the role of automation in an economy with ‘search and matching frictions’ in the labour market. Firms create, and post, job vacancies to hire workers and produce goods. Firms that are unsuccessful in finding a worker can decide to automate the job with a robot. Robots can perfectly substitute for workers, therefore differing from physical capital in standard macro models. In this sense, automation is a form of labour-saving technology.

Adopting a robot entails a fixed cost, and using a robot also incurs an operating cost. A firm’s decision to adopt a robot depends on the relative benefit of automating versus keeping a vacancy open. If a firm decides to keep a vacancy open, it can decide to fill it with a worker or a robot in the future. Importantly, in contrast to workers, robots and their productivity would not be susceptible to epidemics, since viruses do not impede their ability to produce. Hence, whether to automate or not will partly depend on current, and expected, future worker productivity, and pandemic-induced job uncertainty would be an important factor underlying automation decisions.

To assess the quantitative effects of job uncertainty, we first estimate our model to fit quarterly US time series data from 1985:Q1 to 2018:Q4. In addition to the unemployment and vacancy rates, we fit the model to the time series of real wages, labour productivity, inflation, and nominal interest rates. Since the rate of automation has important implications for productivity and wage growth, including these variables helps discipline the importance of automation. In our estimation, we do not consider pandemic-induced uncertainty, since pandemics are not observed in our sample. After we estimate the model, we introduce uncertainty shocks to worker productivity to examine its macroeconomic effects.

We show that an increase in pandemic-induced job uncertainty operates through two channels: a demand-reducing channel and a technology-switching channel. First, the job uncertainty raises precautionary saving and reduces household consumption. Since prices are sticky, firms cut production to meet the reduced demand for their products. All else being equal, the decline in economic activity reduces a firm’s incentive to invest in automation. However, through the technology-switching channel, the job uncertainty would incentivise a firm to automate, since robots are not susceptible to viruses and can continue to operate during epidemics.

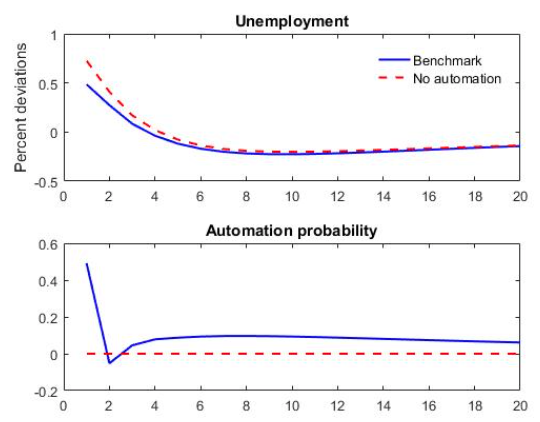

Figure 2 shows that a pandemic-induced uncertainty shock raises the unemployment rate whilst also boosts automation in the benchmark model (the blue solid lines). These impulse responses reflect that the technology-switching channel dominates the demand-reducing channel under our estimation.

In general, increased automation can have ambiguous impacts on employment. Since robots substitute for workers, increased automation tends to reduce employment. However, given the option of automation, a firm would have a stronger incentive to create new job vacancies because of the reduced risks associated with hiring workers. Under our estimated parameters, this latter channel boosts employment and outweighs the labour-substituting effects of automation.

To illustrate the interactions between automation and unemployment in our model, we consider a counterfactual model in which automation is kept constant at its steady-state value. Figure 2 shows that, with no fluctuations in automation, a pandemic-induced job uncertainty shock would have led to a deeper recession with a sharper increase in unemployment (the red dashed line). Therefore, endogenous automation decisions help alleviate the recessionary impact of the job uncertainty shock. An alternative way to interpret our results is that automation reduces some tasks done by workers, whereas it facilitates other tasks, which boosts overall employment (e.g. Acemoglu and Restrepo 2019).

Figure 2 Impulse responses to job uncertainty shock in the estimated model

In our model, the effects of an increase in job uncertainty differ markedly from a realised decline in labour productivity such as that occurring in the current pandemic. Since social distancing measures and health concerns during a pandemic can hinder a worker’s ability to work, the fall in labour productivity primarily acts as a negative supply shock that reduces potential output and increases inflation. As a result, firms automate less. In contrast, pandemic-induced job uncertainty leads to a recession by reducing aggregate demand, such that both output and inflation decline. Despite the decline in demand, firms still increase automation investment because of the positive technology-switching channel.

Overall, our finding suggests that pandemic-induced job uncertainty shocks can have a positive net effect on automation investment, despite its negative effects on aggregate demand. Although robots can substitute for workers, the increased automation (stemming from the technology-switching channel) can still mitigate job losses. The option of automating reduces the risk of hiring workers and thus boosts a firm’s incentive for creating new positions.

Authors’ note: Opinions expressed are the views of the authors and not necessarily those of the Federal Reserve Bank of San Francisco or the Federal Reserve Board.

References

Acemoglu, D and P Restrepo (2018), “The Race between Man and Machine: Implications of Technology for Growth, Factor Shares, and Employment”, American Economic Review 108: 1488–1542.

Baker, S, N Bloom, S Davis and S Terry (2020), “COVID-induced Economic Uncertainty and its Consequences”, VoxEu.org, 13 April. Available at:

Baldwin, R and B Weder di Mauro (2020), Economics in the time of COVID-19: A new eBook, VoxEU eBook, CEPR.

Bloom, N (2009), “The Impact of Uncertainty Shocks”, Econometrica 77: 623–685.

Dietrich, A M, K Kuester, G J Müller and R S Schoenle (2020), “News and Uncertainty about COVID-19: Survey Evidence and Short-Run Economic Impact”, Federal Reserve Bank of Cleveland, working paper No. 20-12.

Kilic, K and D Marin (2020), “How COVID-19 is Transforming the World Economy”, VoxEU.org, 10 May.

Leduc, S and Z Liu (2016), “Uncertainty Shocks Are Aggregate Demand Shocks”, Journal of Monetary Economics 82: 20–35.

Leduc, S and Z Liu (2019), “Robots or Workers? A Macro Analysis of Automation and Labor Markets”, Federal Reserve Bank of San Francisco, working paper No. 2019-17.

Leduc, S and Z Liu (2020a), “The Uncertainty Channel of the Coronavirus,” FRBSF Economic Letters, 2020-07: 1–4.

Leduc, S and Z Liu (2020b), “Can Pandemic-Induced Job Uncertainty Stimulate Automation?”, Federal Reserve Bank of San Francisco, working paper No. 2020-19.

Ma, C, J Rogers and S Zhou (2020), “Global Economic and Financial Effects of 21st Century Pandemics and Epidemics”, unpublished manuscript.