Editor’s Note: This is the first of a two-part series.

The introduction of European Monetary Union in 1999 was intended as a fundamental and permanent change to the economic and political systems of member countries. It was designed to promote economic growth, price stability, full employment, and political integration. So far it has achieved none of these. To the contrary, it has made them all worse; it has resulted in major policy conflicts between member countries, fiscal crises, unsustainable sovereign debt, large current account imbalances, unstable and near insolvent banks, a volatile financial system, and the ECB adopting highly controversial monetary policies outside its original remit which border on fiscal policy.

The Five Presidents' Report, Completing Europe's Economic and Monetary Union, contains a set of proposals aimed at remedying all of this and, in the process, making the single currency sustainable (European Commission 2015). It suggests giving up even more national independence and introducing a fiscal union supervised by unelected EU officials, a banking union, and a capital markets union. I ask whether the Report provides a viable solution to the problems of the Eurozone and whether, by pricing risk correctly, future crises might be avoided through market forces without the need for the sort of procrustean proposals in the Report.

In this first in a two-column series, I examine the causes of the Crisis; in the second column I will discuss whether the Five Presidents’ Report is likely to avoid another crisis and the additional burdens it imposes on Eurozone countries in terms of a further loss of independence.

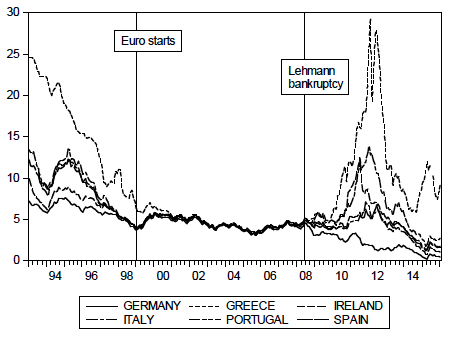

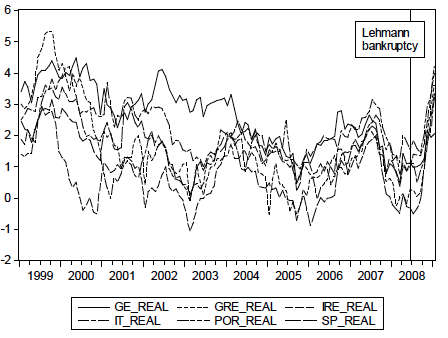

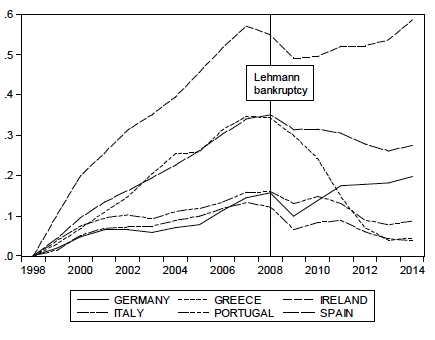

The key to both the Eurozone Crisis and to a possible market solution is the cost of credit. Prior to the Eurozone Crisis, the single currency, with its one-size-fits-all monetary stance, set interest rates that were too low for high-inflation countries, i.e. the main Eurozone Crisis countries (see Figure 1). As a result, these countries were able to borrow at negative real interest rates (see Figure 2) and so accumulated too much private debt (Ireland, Portugal and Spain) and sovereign debt (Greece, Italy and Portugal). The countries with low real interest rates received a huge stimulus to economic activity, causing their GDP and price levels to rise sharply (see Figures 3 and 4). Over the period 1999-2007, Ireland’s GDP grew by 57%, Greece’s and Spain’s grew by 35%, while Germany’s only grew by 20%. The price level in Ireland increased over the period 1999-2008 by 32%, Greece’s by 31%, Portugal’s by 28% and Spain’s by 30%; Germany's price level only increased by 16%. This entailed a significant loss of competitiveness compared to Germany for the Crisis countries and brought about either a banking crisis, a fiscal crisis, or both in these countries.

Figure 1 Selected Eurozone 3-month interest rates, 1993.1 to 2016.1

Figure 2 Selected Eurozone real interest rates, 1999.1 to 2009.1

Figure 3 Selected Eurozone log GDP, 1999 to 2001.4

(base 1999=0)

Figure 4 Selected Eurozone log prices, 1999.1 to 2016.1

(base 1999.1=0)

Critically, financial markets failed to identify the Crisis or the risks that were building up prior to the Crisis, and continued to lend to the Crisis countries at interest rates appropriate for Germany, a low-risk country. Only after the Crisis did borrowing rates reflect the true risk of lending to the Crisis countries, which, of course, only made the risk of default in these countries greater and the Crisis deeper. The ECB is still pursuing this policy; its aggressive and highly expansionary monetary policy is aimed at propping up Eurozone banks and restoring the rate of Eurozone inflation to its pre-Crisis level. In the process, it is offsetting any pricing discipline provided by financial markets.

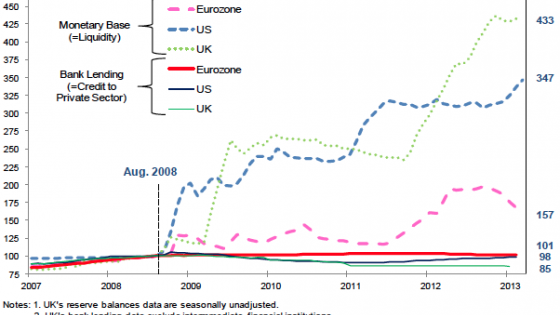

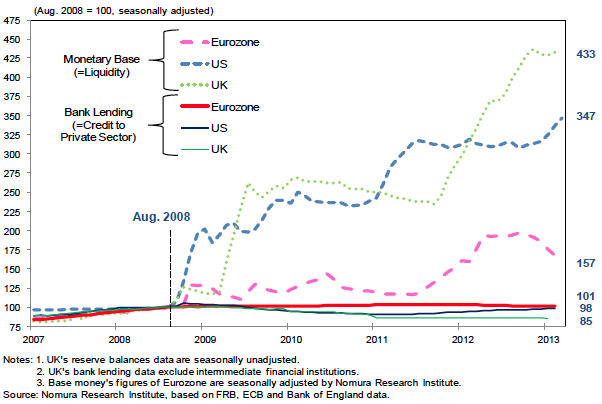

Although monetary policy was an important cause of the Crisis, given its inflation mandate, in one sense the ECB is not to blame as it was very successful in keeping average Eurozone inflation close to target. However, in its official publications it showed no awareness of the increasing divergence of Eurozone economies and the impending problems this might cause. After a delay, since 2012 the ECB has sought to alleviate the crisis through monetary policy through unconventional monetary policies designed to expand credit creation in the private sector. It announced the Outright Monetary Transactions (OMT) scheme, a government bond purchasing programme. Even more controversial was its Public Sector Purchase Programme (PSPP), under which the ECB committed itself to buying on the secondary market without sterilisation at the rate of €50 billion per month sovereign bonds (88%) and bonds of supra-national institutions (12%). There were objections to both programmes in Germany, but the European Court of Justice ruled that the ECB's bond purchasing programmes were legal as they might be capable of contributing to the stability of the Eurozone. However, like the unconventional monetary policies of the US and the UK, that of the ECB does not appear to have been successful in bringing about an increase in credit (see Figure 5 taken from Richard Koo). Although, as a result of quantitative easing, the monetary base has expanded hugely since 2008 in all three monetary jurisdictions, bank credit has, if anything, declined.

Figure 5 Massive quantitative easing failed to increase credit to private sector

The official reason given by the ECB for its unconventional monetary policy is to raise the rate of Eurozone inflation from close to zero back up to its 2% target level. In theory, monetary policy based on inflation targeting is designed to offset demand shocks by manipulating demand via interest rates. The low inflation in the Eurozone after the Crisis, like that in the UK and the US, is due not to negative demand shocks, however, but to positive supply shocks brought about by externally determined falling commodity prices, notably the price of oil. Low inflation brought about in this way is broadly beneficial for the EU and not harmful, and so does not need to be counteracted by expansionary monetary policy.

The Five Presidents’ Report recognises the limitations of a common monetary policy in dealing with the causes of the crisis and preventing another. I discuss its proposals and their drawbacks in the second column in this series, and ask whether there might be an alternative solution that is market-based and does not need the additional central control envisaged in the Report.

References

European Commission (2015), "Completing Europe's Economic and Monetary Union", The Five Presidents’ Report.