Editor’s note: This is the second of a two-part series.

In the first column of this two-part series, I argued that a significant cause of the Eurozone Crisis was its one-size-fits all common monetary policy. In this second column I examine The Five Presidents’ Report, Completing Europe's Economic and Monetary Union (European Commission 2015), which sets out new proposals for Eurozone fiscal and financial policy that are designed to supplement the common monetary policy and deal with its limitations. I also argue that a major contributory factor to the Eurozone Crisis was a failure of financial markets to price risk correctly and that the ECB, through its recent unconventional monetary policies, continues to undermine financial market discipline. Finally, I ask whether there might be an alternative solution that is market-based and does not need the additional control to be exercised by the Commission that is envisaged in the Report.

The central idea of the Maastricht Treaty was that the EC countries should move towards an economic and monetary union, with a single currency managed by an independent central bank. As this was the only new institution proposed, the implication is that either the system would be self-regulating or could be managed by independent national governments. The recent Five Presidents' Report is a fundamental rejection of this idea and an attempt to overcome the flaws in the Treaty. The report envisages far greater convergence of national economies and shifting "from a system of rules and guidelines for national economic policy-making to a system of further sovereignty sharing within common institutions", hence the proposal for Fiscal, Banking and Capital Markets Unions and much closer political integration among Eurozone countries.

The Fiscal Union is designed to control excessive public sector borrowing and prevent a sovereign debt crisis and Eurozone bailouts that transfer resources between countries. It envisages responsible national fiscal policies which guarantee sustainable public debt and allows automatic fiscal stabilisers to cushion country-specific economic shocks. Current surveillance activity through the Macroeconomic Imbalance Procedure would be strengthened by a Eurozone-wide fiscal stabilisation function supervised by an advisory European Fiscal Board which is able to veto national fiscal policies.

The proposed Fiscal Union, with its focus on controlling deficits and the level of government debt, is in direct conflict with the use of fiscal policy as a stabilisation tool. Eurozone countries would then have neither monetary nor fiscal policy instruments to stabilise their economies. This is a recipe for prolonged stagnation of a country. Even worse, it is not clear how a recession affecting the whole Eurozone could be alleviated, as the Report, having constrained what individual member countries can do, has left the formulation of proposals for dealing with this for the future.

The Banking and Capital Markets Unions aim to provide a larger and more mutualised bailout fund for the banking system that would help financial markets to spread the risk of holding government debt. The Banking Union seeks a recovery and resolution mechanism for private banks supported by bridge financing. Its aim is to transfer risk and the cost of bailouts from the public to the private sector. It envisages a credit line from the European Stability Mechanism to a Single Resolution Fund that would be fiscally neutral over the medium term by ensuring that public assistance is recouped by means of ex post levies on the financial industry. It also proposes a common deposit insurance scheme privately funded through ex ante risk-based fees paid by all the participating banks in the member states and devised in such a way that would prevent moral hazard.

By giving companies access to capital markets and other sources of non-bank finance in addition to bank credit, the Capital Markets Union, through a single European capital markets supervisor, aims to strengthen private sector risk-sharing across countries by deepening the integration of bond and equity markets and providing a buffer against systemic shocks in the financial sector. Taken together, the Banking and Capital Markets Unions aim to provide a larger and more mutualised bailout fund for the banking system and would help financial markets to spread the risk of holding government debt.

A Capital Markets Union is sought so that companies can gain access to capital markets and other sources of non-bank finance in addition to bank credit. It is argued that this would strengthen cross-border risk-sharing through deepening integration of bond and equity markets and it would provide a buffer against systemic shocks in the financial sector and would strengthen private sector risk-sharing across countries. A single European capital markets supervisor is proposed. This greater regulation is designed to avoid the insolvency of the private sector banks and financial intermediaries that bear these risks. Taken together, the Banking and Capital Markets Unions aim to provide a larger and more mutualised bailout fund for the banking system and would help financial markets to spread the risk of holding government debt.

The aim of all three Unions would be to share the burden of economic and financial distress more widely and to impose common rules on member countries. All three Unions entail a considerable loss of national independence and transfer of responsibilities to an unelected and largely unaccountable body, the Commission. Democratic controls would therefore be greatly weakened and the current democratic deficit increased. The likelihood of conflict between the Commission and national governments would be considerable and its method of resolution is unclear.

Even with such centrally imposed rules, it is not clear that the Report's proposals are viable. First, they do not deal with the existing causes of the crisis. If, for whatever reason, member countries have different rates of inflation, then the existing problem with a one-size-fits-all monetary policy remains. Moreover, if the ECB continues to squeeze interest rate spreads, then the discipline provided by financial markets will be undermined as risks will still not be priced correctly. Second, the proposed rules for fiscal policy, which focus on avoiding debt default, constrain the use of fiscal policy as a stabilisation instrument in recession. And it remains unclear how the Eurozone as a whole could deal with a Eurozone-wide recession.

The Report states that "in a monetary union the financial system must be truly single or else the impulses from monetary policy (e.g. changes in policy interest rates) will not be transmitted across its Member states". Does this mean that interest rates should be the same in all Eurozone countries, or that the response to changes in the policy rate should be the same in each country? One of the problems has been that the ECB has sought to create a uniform interest rate across member countries irrespective of their different financial risks. It would be far better if borrowing rates reflected country risk rather than being uniform. Financial markets should be fully integrated – i.e. capital movements should be free – but monetary and financial policy should not aim to set a single interest rate.

Under current arrangements, markets are expected to provide the necessary fiscal discipline. If a fiscal stance is deemed unsustainable then this should be reflected in the country's sovereign credit rating and the size of the sovereign risk premium. The evidence prior to the Eurozone Crisis is that financial markets failed to do this – neither credit ratings nor sovereign risk premia anticipated the ensuing crisis.

This can be seen in Figure 1 in my previous column. Prior to the collapse of Lehmann Brothers, all of the Crisis countries were able to borrow at the same interest rates as Germany. It was only after the Crisis arose that rates diverged, reflecting differences in country riskiness. The rate for Greece rose to 28%, for Ireland to 13% and for Portugal to 14%. After 2012 these rates began to fall sharply, reaching less than 2%. Even for Greece rates fell to 9%. As the threat of default was still present for some of these countries, especially for Greece, an explanation for this is required. The most likely explanation is ECB monetary easing and its asset purchasing policy, which reduced the cost of borrowing. This was the intention of the policy. Unfortunately, by reducing the cost of borrowing, even for countries with a strong risk of default, the ECB is also directly undermining market discipline.

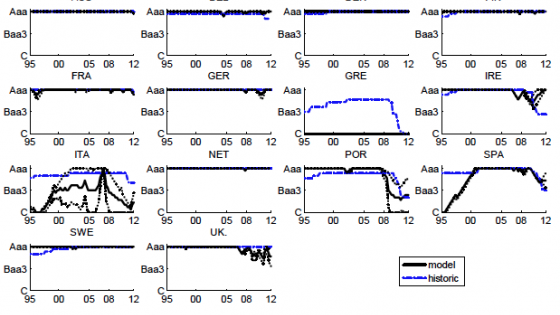

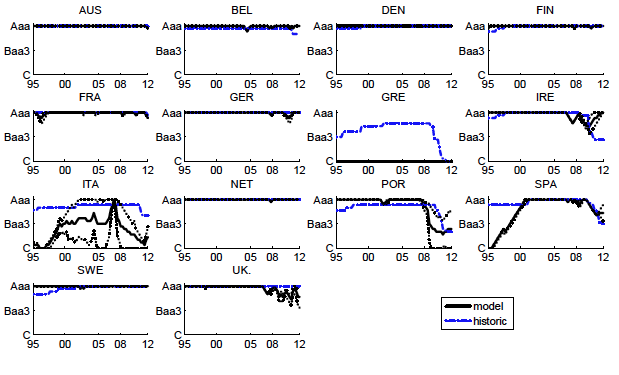

Figure 1. EU credit Ratings (five years ahead)

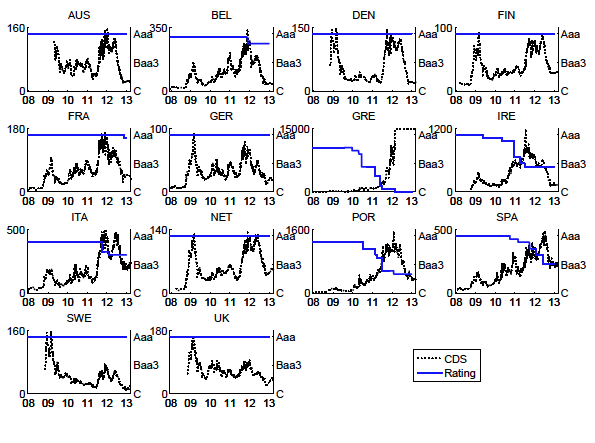

Figure 2. Credit Ratings and CDS prices

Further evidence on the failure of financial markets to price risk correctly prior to the Eurozone Crisis is provided by sovereign credit ratings (Figure 1) and CDS prices (Figure 2). It is only after the Crisis that Greek debt is downgraded to junk bond status. Irish, Spanish, and Portuguese bonds were also downgraded, but to non-investment status. Polito and Wickens (2015) have calculated sovereign credit ratings based solely on the fiscal stance. They find that the ratings for the Crisis countries are lower than the official ratings and differently timed. The credit rating for Greece is calculated to have junk bond status throughout the whole period 1995-2013, and even before Greece was admitted to the Eurozone in 2002. Italy is given a much lower credit rating than the official rating since the start of EMU. The ratings for Ireland, Portugal, and Spain are similar to the official ratings, with downgrades not occurring until after the start of the Crisis. Whereas the debt crises in Greece and Italy are due to unsustainable fiscal policies, those in Ireland and Spain are due to the private, and not the public, sectors; Portugal's seems to be due to both. These results suggest that the official credit ratings failed to anticipate the harmful effects of the fiscal stances of Greece and Italy.

Starting near zero at the beginning of 2008, CDS prices for all Eurozone countries rose in 2009 and again in 2011-12 before falling in 2013, whereas the credit ratings remained largely unaffected until 2010 and 2011. Even for Greece CDS prices did not rise much until 2010.

The question, therefore, is whether, by pricing risks better, financial markets could provide the discipline required to avoid future Eurozone crises and the need for greater political interference in national fiscal policy-making that is proposed in the Five Presidents’ Report.

References

European Commission (2015), Completing Europe's Economic and Monetary Union, The Five Presidents’ Report.

Polito, V. and M.R. Wickens (2015), "Sovereign credit ratings in the European Union: a model-based fiscal analysis", European Economic Review 78, 220-247.