Much has been achieved to address the EU financial crisis.1 Since 2011, EU banks have boosted their capital adequacy ratios, partly due to the second EU-wide stress-testing and recapitalisation exercise led by the European Banking Authority. Over two years, the tier 1 ratio of European banks (sample of 57 EU banks) increased by 1.2%, from 9% in December 2010 to 10.2% in June 2012. Unconventional monetary operations have enhanced liquidity, examples of which include longer-term refinancing operations from one to three years, a cover-bond purchase programme and outright monetary transactions. The bank-supervisory architecture has also been revamped, with an agreement reached last December to establish a Single Supervisory Mechanism for the Eurozone.

Vulnerabilities remain, as reliance on central-bank liquidity is still high especially for banks in peripheral countries (see also IMF 2012). Reflecting a combination of improved market conditions and collateral constraints (for some institutions), some banks have opted for early repayment of the long-term refinancing operation funds. In March 2013, EU banks had repaid €155bn out of €489bn provided through the first long-term refinancing operation and €69bn out of €529bn from the second long-term refinancing operation.

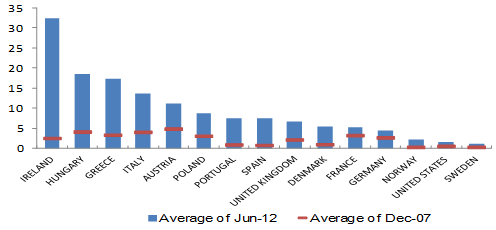

Assets continue deteriorating and remain on banks’ balance sheets, weighting on profitability. Non-performing loans in EU banks continue to rise, outpacing loan growth. Since 2007, loans to the economy have decreased by 3% while non-performing loans increased by almost 150%, i.e., €308 billion in absolute terms. This trend shows no sign of reversal, reflecting the continued macro deterioration in parts of the EU and the absence of restructuring (see figure below). When non-performing loans remain on balance sheets, they absorb management capacity, and continued losses can weaken banks’ profitability.

Figure 1. NPLs to total loans in the EU

Sources: Bloomberg, EBA 90 SIFI Banks, September 2012.

In several countries, independent asset quality reviews and stress tests have facilitated a diagnosis of the quality of banks’ assets, supporting prospects for private recapitalisation. For instance, countries under or near financial assistance (Cyprus, Greece, Ireland, Portugal, and Spain) have all carried out independent asset-quality reviews to regain market confidence in the system. Similarly, Slovenia has carried out an independent assessment for the three largest banks. National authorities and the single supervisory mechanism should undertake selective asset-quality reviews, coordinated at the EU level. This would add credibility to the stress tests envisaged being undertaken by the single supervisory mechanism and European Banking Authority (see also IMF 2013c).

Capital ratios have increased, but concerns have been expressed about the pace of deleveraging and the adoption of more sophisticated models. During the last European Banking Authority recapitalisation exercise, 30% of the increase in capital ratio was reached by reducing risk-weighted assets, of which one third came from risk-weighted asset ‘recalibrations’ (roll-out of models or changes to parameters). Several commentators have raised concerns about the risk of capital optimisation, considering the low degree of transparency and the difficulty to compare internal ratings-based models across banks. The recent Bank of England Financial Stability Report (November 2012) showed that banks’ risk-weighted asset calculations for the same hypothetical portfolio can be vastly different, with the most prudent banks calculating over twice the needed capital as the most aggressive banks. The European Banking Authority has published a recent study explaining the potential drivers in risk-weighted asset differences, some of them being explained by the riskiness of the underlying portfolio, while others may be driven by the choice of supervisory parameters (EBA 2013a).

Nonperforming loans restructuring

Several hurdles impair bank repair in Europe, and urgent progress needs to be made:

- First, restructuring of nonperforming loans should be facilitated.

The legal framework should not slow down restructuring and maximise asset recovery. In several EU countries, such as Italy, Greece and in eastern Europe, bankruptcy reforms lag behind in that, for instance, current practice does not allow the seizure of collateral in a reasonable timeframe. Banks should also manage more actively their nonperforming loans, possibly allowing a market for distress assets to emerge in Europe. The EU experience with Asset Management Companies is at an early stage, although they have been used widely in many other parts of the world (see Ingves and Hoelscher 2005 for an overview). A number of Asset Management Companies were established, including in Belgium, Denmark, Ireland, Spain, Switzerland, and the UK, while Asset Management Companies were considered but ruled out in Iceland.

Bank resolution

- Second, EU bank resolution tools need to be strengthened, aligning them with the Financial Stability Board Key Attributes for Effective Resolution.

Fast adoption of the EU resolution directive is welcome, but enhancements are warranted. For instance, the breadth and timing of the triggers for resolution should be enhanced by providing the authority with sufficient flexibility to determine the non-viability of the financial institution (including breaches of liquidity requirements and other serious regulatory failings, not just capital/asset shortfalls). There should be provision for mandatory intervention in the event a specified solvency trigger is crossed. The directive should afford more flexibility for using certain resolution powers or departing from pari passu – that is, of equal rank – treatment where necessary on grounds of financial stability or to maximise value for creditors as a whole. In addition, we also recommend that depositor preference should be established, with the right of subrogation for the deposit-guarantee scheme.

Transparency and disclosure

- Third, disclosure should be significantly enhanced and harmonised by the European Banking Authority, to restore market confidence.2

In particular, interpretable metrics regarding the quality of banks’ assets, in terms of nonperforming loans, collateral, probability of defaults and loan-recovery rates are key for assessing the strength of banks and restoring confidence in the banking system. The European Banking Authority should also enhance its work on supervisory convergence, to ensure the data quality and comparability. Current work on the consistency of risk-weighted assets should be a priority. In this regard, the European Banking Authority (2013b) recently published a public consultation on definitions and supervisory reporting for forbearance and nonperforming loans.

References

Bank of England (2012), “Financial Stability Report”, London, November.

European Banking Authority (2013a), “EBA interim report on the consistency of risk-weighted assets in the banking book”, London, 26 February.

European Banking Authority (2013b), “Consultation Paper on Draft Implementing Technical Standards on Supervisory reporting on forbearance and non- performing exposures under article 95 of the Draft Capital Requirements Regulation”, London, 26 March.

International Monetary Fund (2012), “Global Financial Stability Report”, October 2012.

International Monetary Fund (2013a), “European FSAP: Financial System Stability Assessment (FSSA),” IMF, Washington, March.

International Monetary Fund (2013b), “European FSAP: Technical Note on Progress with Bank Restructuring and Resolution in Europe,” IMF, Washington, March.

International Monetary Fund (2013c), “European FSAP: Technical Note on Stress Testing of Banks,” IMF, Washington, March.

International Monetary Fund (2013d), “European FSAP: Technical Note on European Banking Authority,” IMF, Washington, March.

Ingves, Stefan and David S Hoelscher (2005), ”The Resolution of Systemic Banking System Crises”, in Douglas Darrell Evanoff, George G Kaufman (eds.), “Systemic Financial Crises: Resolving Large Bank Insolvencies”, World Scientific Publishing.

1 See the IMF Financial System Stability Assessment (FSSA) of the European Union (2013a). This column draws on the IMF technical note (2013b) “Progress with Bank Restructuring and Resolution Europe” as part of the IMF European Union Financial Sector Assessment Program (FSAP).

2 See also the IMF technical note on EBA (2013d).