The results of the UK’s EU referendum and the US presidential election came as a surprise to most analysts and reflect fundamental shifts in the political landscape. With a series of important elections and votes in the EU going forward, the surprises may well continue. A key factor behind this shifting political landscape is increased concern about the rapid pace of globalisation—including concerns about the increased movement of people, capital, and trade across borders2. A better understanding of these concerns—and finding ways to address them—should be a top priority for policymakers.

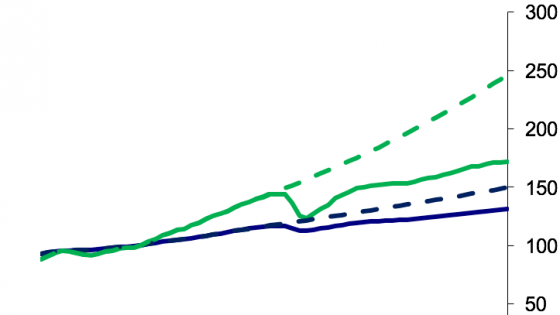

But by some measures, globalisation is already in retreat. For example, the growth in world trade has slowed sharply from more than twice as fast as that of world GDP over the pre-crisis decade (1998-2007), to more than 0.5% weaker in 2016. Figure 1 shows the much sharper decline in global trade relative to that of global GDP—such that the volume of world trade is now 30% below its pre-crisis trend. Trade as a share of GDP has been stagnating since 2011. Hoekman (2015) discusses possible explanations for this slower growth in global trade3.

Figure 1. Global trade and GDP

Source: DataStream, IMF WEO and Bank calculations. Note: dotted lines show pre-crisis trend. Country data are weighted by market exchange rates to calculate the aggregate.

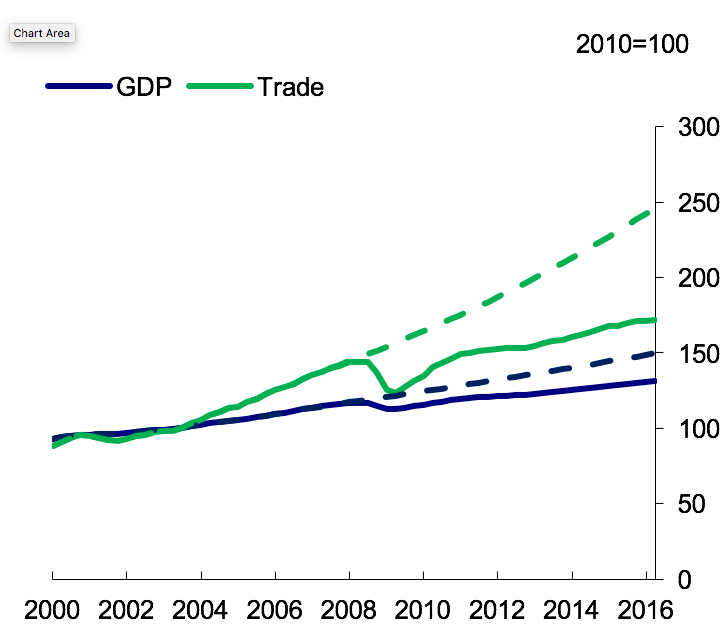

The collapse in global capital flows is even more striking and has received less attention. Figure 2 shows that global capital flows contracted sharply during the crisis, and have since recovered to only about one quarter of their pre-crisis peak. Global capital flows as a share of GDP are now at a level comparable to where they were in the mid-1990s. Forbes (2014) describes this sharp decline in global capital flows—not only relative to their pre-crisis trend but on an absolute basis—as “financial deglobalisation”.

Figure 2. Contraction in global capital flows

Sources: IMF International Finance Statistics and World Economic Outlook Database. Note: For each quarter, flows are summed over all available country data, divided by an estimate of quarterly GDP, and then smoothed by averaging over the current and previous quarter.

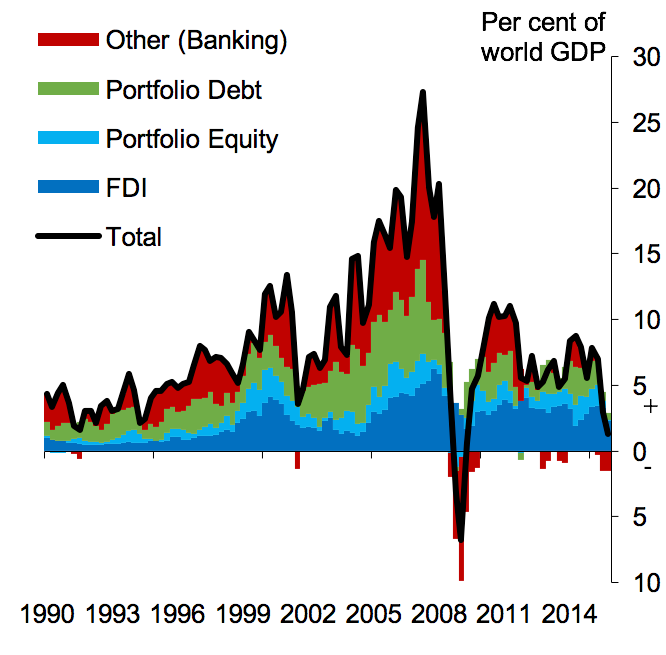

What is behind this financial deglobalisation? In Forbes et al. (2016), we show that this financial deglobalisation is actually “banking deglobalisation”. Figure 3 shows that the reduction in global capital flows is primarily driven by a reduction in international bank lending. In contrast, FDI and international portfolio flows have bounced back since the 2008 crisis (Cerutti and Claessens 2014 also reach the same conclusion and describe this as “the great cross-border bank deleveraging”).

Figure 3. Contraction in global capital flows by instrument

Sources: IMF International Finance Statistics and World Economic Outlook Database. Note: For each quarter, flows are summed over all available country data, divided by an estimate of quarterly GDP, and then smoothed by averaging over the current and previous quarter.

Deglobalisation in banking can be divided into two stages – the sharp initial contraction that occurred during the crisis, and a more recent decline that began in 2012. Figure 4 shows that this “second phase of banking deglobalisation” was caused by a decline in international bank-to-bank (but not bank-to-nonbank) lending. It also stands in stark contrast to the greater stability in domestic bank lending.

Figure 4. Bank-to-Bank vs. Bank-to Nonbank lending (all BIS Reporters)

Source: BIS. Note: Gross bank-to-bank and bank-to-nonbank lending is the cumulated (exchange-rate adjusted) USD bn change in cross-border lending since 2002 Q1 summed across the BIS reporters for which data was available and then added to 2001 Q4 stocks. Domestic credit is the USD value of credit to the non-bank private sector summed across all BIS reporter (after converting into USD).

What explains this banking deglobalisation? Proposed explanations for the initial phase of banking deglobalisation include government intervention in the banking system (Rose and Wieladek 2014), increased home bias (Giannetti and Laeven 2012), reduced demand for loans, and reduced availability of wholesale funding for banks following the Global Crisis4.

In Forbes et al. (2016), we provide an alternative explanation for banking deglobalisation, especially for the second phase—namely, the spillovers and interactions of monetary and regulatory policies. More specifically, we show that in the UK, policies designed to support domestic lending (such as the UK’s Funding for Lending scheme) appear to have had the unintended consequence of shifting the impact of increased microprudential capital requirements towards external lending. The combined impact of these policies generated a significant decline in UK cross-border bank lending and a meaningful share of the slowdown in global bank flows. Moreover, if similar policies undertaken by other countries at this time had similar effects, the spillovers from these unconventional monetary and regulatory policies could have had even larger implications for global capital flows.

Changes in bank regulatory and unconventional monetary policy

Many countries adjusted their financial policies during and since the crisis in ways that could affect international bank lending. For example, bank regulations were significantly tightened to strengthen the resilience of domestic financial systems. Typically, this would lead banks to reduce domestic and international lending to a similar degree5. At the same time, many central banks pursued unconventional monetary policies (such as quantitative easing and targeted lending policies) aimed at stimulating aggregate demand. Even though these policies were not directly targeted at international bank intermediation, they may have had substantive effects by changing the relative risk weights attached to international relative to domestic lending.

While these policies could play an important role in explaining the contraction in cross-border bank lending, it is difficult to verify this empirically for several reasons. First, distinguishing between cross-border loan supply and demand is difficult. Second, the temporal clustering of these different policies, in direct response to the financial crisis in most countries, makes disentangling their individual effects challenging. Finally, it is difficult to obtain the necessary data on all the relevant policies in most countries.

The UK as an ideal case study—with global implications

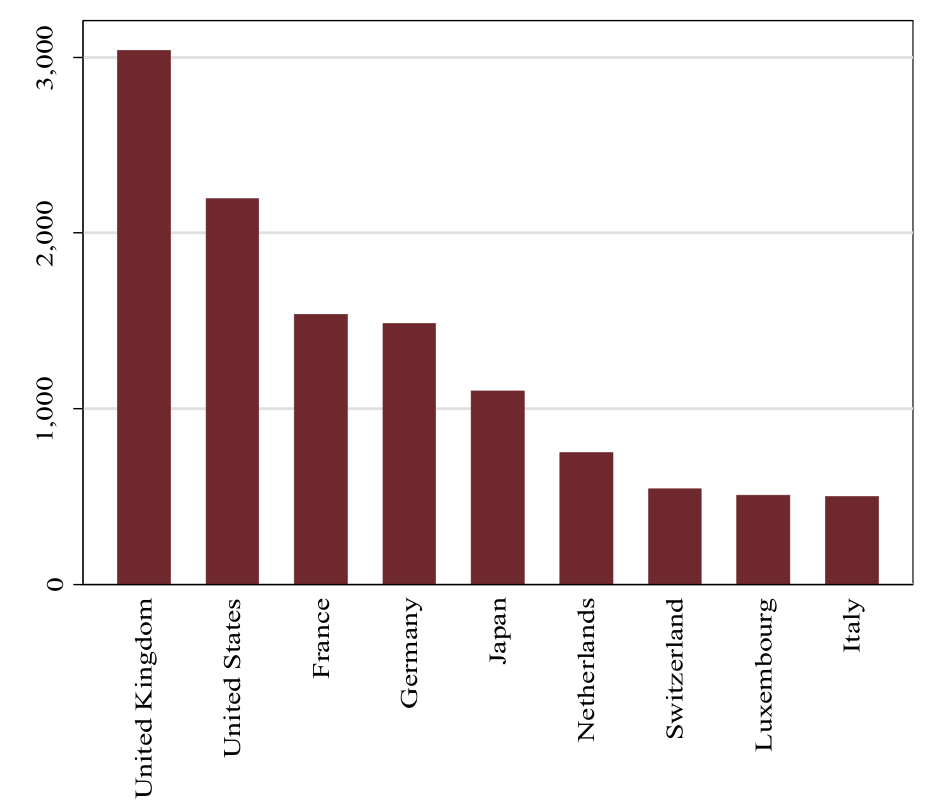

A unique UK data set, combined with the policy decisions and structure of the British banking system, however, allow us to address these challenges and test whether changes in regulatory and monetary policy were a significant factor in the second phase of banking deglobalisation. The UK is also an ideal case study due to its structure and recent policy actions. UK-resident banks are at the heart of the global financial system and have played a major role in the deglobalisation of bank flows. Figure 5 shows that UK banks provide more international loans than any other country in the world, with around 15% of international interbank activity booked in the UK and the average UK bank lending to 53 countries. The UK actively used different regulatory and monetary policies after the peak of the financial crisis – UK quantitative easing was conducted from 2009 onwards, micro-prudential regulatory requirements were adjusted regularly, and the Funding for Lending Scheme (FLS), a policy designed to stimulate domestic lending, was introduced in July 2012.

Figure 5. The largest cross-border banking centres at the onset of the 2nd phase of banking deglobalisation.

Source: BIS Banking Statistics. Note: Data refer to 2012 Q2 and cross-border bank-to-bank lending.

The FLS plays a key role in our analysis, so merits a brief explanation. The programme was designed to increase bank lending by ensuring that high bank funding costs and capital constraints within the British banking system did not impede lending to the UK’s real economy. This scheme provided funding to participating institutions for an extended period at below market rates. This likely led to lower interbank funding costs, and hence lower effective interest rates on mortgage and PNFC loans in the UK. The programme also provided preferential capital treatment for specific FLS-eligible lending in order to stimulate domestic lending.

Key Results

Our results suggest that changes in capital requirements, and their interactions with certain types of monetary policies, have led to significant reductions in international bank lending. We find that an increase in a UK bank’s capital requirement of 100 basis points leads to a contraction in external lending growth of about 3.4%. For banks that specialised in FLS-eligible lending (before the policy was introduced), the effects of increased capital requirements on external lending were amplified by a significant amount—an amplification effect that was substantial for the average bank. These results are robust to different data cleaning techniques, the inclusion of various control variables, and an alternative estimation framework aimed at addressing any potential endogeneity between capital requirements and international bank lending.

While these results suggest that certain forms of unconventional monetary policy—namely the FLS—can have important effects on international bank lending when combined with changes in bank regulations, other types of unconventional monetary policy may or may not have the same impact. For example, a similar analysis for Quantitative Easing suggests that it may also have magnified the impact of increased capital regulations on external lending, but any such amplification effects were insignificant, smaller in magnitude, and not robust to perturbations of our baseline model. A granular analysis of the different FLS components (focusing on when the programme covered different types of lending and its impact on different types of bank flows) supports these main findings and provides more detail on precisely how this form of unconventional monetary policy interacted with and amplified the impact of capital regulations.

To assess if the estimates based on UK microeconomic data can explain a meaningful amount of the aggregate contraction in international bank lending, we perform a simulation based on conservative assumptions. Figure 6 shows the results of this counterfactual exercise, which suggests that the interaction between microprudential regulations and the FLS can explain roughly 30% of the contraction in aggregate UK cross-border bank lending between mid-2012 and end-2013. This corresponds to around 10% of the global contraction in cross-border lending.

The size of this effect is striking, especially since our calculation is only based on the estimated effects of these policies in one country. Yet many other countries were simultaneously increasing bank regulations and adopting various programmes aimed at supporting domestic lending and the real economy around the same time. The combined effects of these policies and their interactions across countries could explain a significantly larger share of the reduction in international lending that occurred not only in the UK, but also in many other countries.

Figure 6. Aggregation exercise: International bank lending without increased capital requirements and the FLS

Source: Forbes et al. (2016). Note: KR refers to capital requirement tightening. FLS to the UK’s Funding for Lending Scheme.

Conclusions

Our results suggest that certain types of unconventional monetary policy, and their interactions with regulatory policy, can have important global spillovers. Policies designed to support domestic lending, such as the UK’s Funding for Lending scheme, may have had the unintended consequence of amplifying the impact of microprudential capital requirements on external lending. We do not explicitly test for the domestic effects of these policies, instead focusing on the spillover effects to other countries. Nor do we consider the welfare implications of these effects, which would require a much more detailed cost-benefit analysis. Such an analysis would need to consider a broad range of issues, such as the links between cross-border lending and: lending to the real economy, domestic financial vulnerabilities, resilience to domestic and international shocks, other forms of international and domestic financing (including shadow banking), trade spillovers, and, the implications of other countries engaging in similar types of policies (For a discussion of the types of issues that would need to be considered for a fuller assessment, see Mallaby 2016). But we do find that the magnitude of these types of spillovers can be substantial—even for a single country that is a relatively small share of global GDP. The global implications are likely to be substantially bigger.

Authors’ note: The views expressed in this column are those of the authors, and not any institutions with which they are affiliated.

References

Aiyar, S, C Calomiris, and T Wieladek (2014), “Does Macro-Prudential Leak? Evidence from a UK Policy Experiment”, Journal of Money, Credit and Banking, 46 (s1), 181-214.

Aiyar, S, C Calomiris, J Hooley, G Korniyenko, and T Wieladek, T (2014), “The International Transmission of Bank Minimum Capital Requirements”, Journal of Financial Economics, 113 (3), 368-382.

Avdjiev, S, L Gambacorta, L Goldberg, and S Schiaffi (2016), “The Shifting Drivers of International Capital Flows”, unpublished manuscript.

Bridges, J, D Gregory, M Nielsen, S Pezzini, A Radia, and M Spaltro (2014), “The Impact of Capital Requirements on Bank Lending,” Bank of England WP 486.

Cerutti, E, and S Claessens (2014), “The Great Cross-Border Bank Deleveraging: Supply Constraints and Intra-Group Frictions”, IMF Working Paper WP/14/180.

Colantone, I, and P Stanig (2016), “Globalisation and Brexit”, VoxEU.org, 23 November.

Coyle, D (2016), “Brexit and Globalisation”, VoxEU.org, 5 August.

Forbes, K (2014), “Financial deglobalization?: Capital flows, banks and the Beatles”, Speech given at Queen Mary University, November.

Forbes, K, D Reinhardt and T Wieladek (2016), “The Spillovers, Interactions, and (Un)Intended Consequences of Monetary and Regulatory Policies”, NBER Working Papers No. 22307, (Forthcoming in Journal of Monetary Economics).

Giannetti, M, and L Laeven (2012), “The flight home effect: Evidence from the syndicated loan market during financial crises”, Journal of Financial Economics, Vol. 104, No 1, 23-43.

Haschimi, A, M Gachter, D Lodge and W Steingress (2016), “The great normalisation of global trade”, VoxEU.org, 14 October.

Mallaby, S (2016), “Globalization Resets”, Finance & Development, December, 7-10.

Persaud, A (2016), “Brexit and other harbingers of a return to the dangers of the 1930s”, VoxEU.org, 26 August.

Rose, A and T Wieladek (2014), “Financial Protectionism? First Evidence”, The Journal of Finance, Vol. LXIX, No. 5, 2127-2149.

Endnotes

[1] Forbes is an external member of the Bank of England’s MPC, the Jerome and Dorothy Lemelson Professor of Management and Global Economics at MIT, NBER Research Associate and CEPR Research Affiliate. Reinhardt is senior economist in the international directorate at the Bank of England. Wieladek is Senior International Economist at Barclays and CEPR Research Affiliate and was formerly at the Bank of England. The views expressed in this paper are those of the authors, and not any institutions with which they are affiliated.

[2] For example, see Colantone and Stanig (2016), Coyle (2016), and Persaud (2016).

[3] See the collection of papers here on VoxEU.org, and Al-Haschimi et al. (2016).

[4] See Cerutti and Claessens (2014) and Forbes (2014) for more detailed discussion of various potential causes. See Avdjiev et al. (2016) for a discussion of how the drivers of international capital flows have changed since the crisis, with an increase in the sensitivity of banking flows to US monetary policy but a decrease in their sensitivity to global risk conditions.

[5] For example, in the UK after a 100 basis point increase in capital requirements, Aiyar, et al. (2014) find a contraction of 5.6% in domestic PNFC lending while Aiyar et al. (2014) find a contraction of about 5.4% in cross-border loan supply. Bridges et al. (2014) also find a quantitatively similar impact on domestic lending.