“Financial inclusion is not an end in itself but a means to an end…”

—The Global Findex Database 2017 (Demirgüç-Kunt et al. 2017: 80)

The two leading financial trends of our time are the integration of digital technology and the advance of financial inclusion. The latter involves both provision of accessto those who have no account (the ‘unbanked’) and increased usageof financial services by those with a tenuous link to the formal system (the ‘underbanked’). A combination of swift technological change and government promotion is speeding the rise of inclusion.

Six years ago, the World Bank estimated that roughly 2.5 billion adults (aged 15 or older) had no bank deposit, no formal credit, and no means of payment other than cash or barter. Stunningly, in its new Global Findex Database 2017, the Bank now estimates that the number of unbanked adults has plummeted to 1.7 billion. Over the past six years, more than 1.2 billion adults have gained at least basic financial access through a financial institution or their mobile phone.

Few consumer products have ever diffused so rapidly, especially among the world’s poor. The rise of financial inclusion rivals the remarkable diffusion of mobile phone subscriptions: as of 2017, 79% of adults in developing economies own mobile phones, including 93% in China, 85% in Brazil and 69% in India (Demirgüç-Kunt et al. 2018). Aside from technology, India’s government-led financial inclusion program has been the second key factor in the recent advance of inclusion. By our estimate, the gains in India account for more than one-half of the 515 million persons who acquired access globally between 2014 and 2017 (Cecchetti and Schoenholtz 2017)!

In the remainder of this column, we describe the benefits of financial inclusion, highlight key trends regarding access since 2011, and briefly discuss the means for achieving the World Bank’s goal of universal financial access. We conclude with a short discussion of Africa, where the largest gains still lie ahead.

The benefits of financial inclusion

Financial access enhances welfare, improves equality and promotes economic growth.

People without access to banks or other financial intermediaries typically pay with cash or in kind. This is inconvenient and risky. In some poverty-stricken parts of the world, families hoard cash or acquire livestock, but face calamity if their cash is lost or their cattle perish.

Financial institutions lower transactions costs for people who wish to make payments, to save, and to borrow. They safeguard customers’ funds and provide convenient accounting for transactions and balances, with most electronic transfers fast, safe, and traceable.

Mobile phone companies also provide access to the payments system, competing actively in various parts of the emerging world, especially where bank branches are few and distant. In sub-Saharan Africa, one of the world’s poorest regions, mobile access in 2017 reached 21 adults out of 100, up from 12 in 2014, helping to transform the payments system.

Financial institutions also reward customers with interest on their savings. Economists since Robert Solow have emphasised saving as a key to economic growth in developing economies with limited capital per worker. In addition to mobilizing savings on a large scale, financial institutions help allocate resources to the most efficient uses: when the system functions properly, financial institutions screen and monitor investment projects to support the best ones.

Banks also allow people with attractive income prospects to borrow—say, to invest in a business, to pay for education, or to smooth consumption when income varies. Yet, in the emerging world, nearly two-thirds of the 44% of adults who borrowed in the past year obtained funds from family and friends. In theory, as access and usage expand, banks will become better able to judge the creditworthiness of the unbanked and the underbanked, making it easier for households and businesses to obtain financing.

Increasing access at a given income

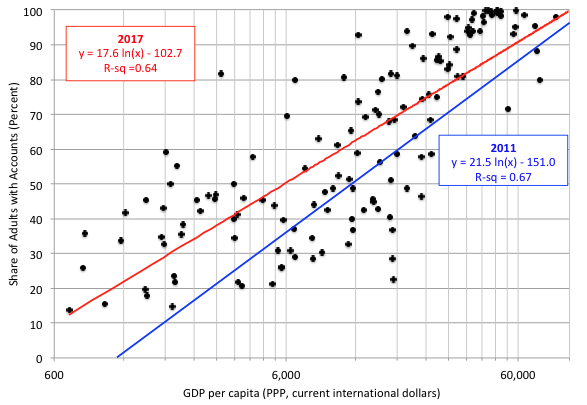

Not surprisingly, the correlation across countries between financial access and log per capita income has been and remains high (see Figure 1). As of 2017, 94 of 100 adults in high-income countries are banked, compared to 63 in developing countries.

However, the key development over recent years is the rapid increase of financial access for low-income countries. Consider, for example, the fitted lines in Figure 1 for 2017 and 2011. Compared to 2011, the 2017 fit is both higher up and flatter. This shift is both statistically and economically significant. For example, at $1,800 per capita—roughly the level in Haiti and Uganda—the 2017 fit is consistent with access for 29% of adults, up by nearly a factor of three since 2011!

Figure 1 Financial access (2017) and GDP per capita (PPP, current international US dollars, 2016)

Notes: Financial access means having an account at a financial institution or a mobile phone payments account. An adult is at least 15 years old. The red line is the fit for the 2017 sample that includes 140 countries (black dots). The blue line is the fit for the 2011 data (not shown). The horizontal scale is logarithmic.

Sources: Demirgüç-Kunt et al. (2018), World Bank development database, and authors’ calculations.

Increasing inclusion in developing countries

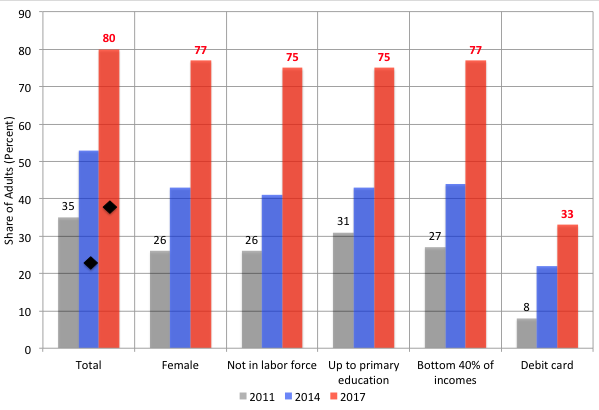

Within the developing world, the increase of access over the past six years has been stunning. Overall, the share of banked adults rose from 42% in 2011 to 55% in 2014, and to 63% in 2017 (see Figure 2). Remarkably, in the 31 countries designated ‘low-income’ by the World Bank, the shares rose from 13% in 2011 to 35% in 2017. And, together with increased access, there is evidence of broadening use: as of 2017, 53% of developing-country adults had active accounts, up from 48% in 2014. Electronic access—especially through debit cards—is rising rapidly as well.

While substantial disparities persist across demographic groups, some of the most disadvantaged are witnessing rapid gains. Between 2011 and 2017, the access shares for women, for those in the bottom 40% of incomes, for those not in the labour force, and for those with no more than primary education remained lower than the average. Yet, each of these groups experienced large increases over the past six years. As a result, by 2017, the banked share for each group exceeded 50%―well above the 2011 banked share of adult males (47%, not shown).

Figure 2 Financial access in developing economies: Share of adults in various categories (2011, 2014 and 2017)

Note: The black diamonds represent the share of adults with accounts that are inactive(no deposits or withdrawals over the past year).

Source: World Bank Findex

As previously noted, India accounts for a disproportionate share of recent gains in access (see Figure 3). One way to measure India’s achievement is to recognize its outlier status: at India’s 2016 per capita income of $6,571, the average relationship shown as the red line in Figure 1 is consistent with a banked adult share of 52%. India’s actual share reached 80% last year. That is, the dot representing India is far above the red line.

The Indian government’s push for universal adult financial access is unique in both scale and breadth (Cecchetti and Schoenholtz 2017). Taking advantage of technological advances (like low-cost biometric identification) and a state banking system, since 2014, India’s access program has led to more than 315 million new accounts with a total of $12 billion in deposits (see pmjdy.gov.in/account for the most recent information).The 2017 Findex confirms this extraordinary progress and, once again, highlights that it is broadly shared across disadvantaged groups (see Figure 3). Compared to Indian government data, the Findex shows a relatively larger increase in inactive accounts (the black diamonds in the chart) and a smaller gain in accounts used for saving. However, we suspect that these gaps will erode over time as transactions costs decline further and Indians gain experience in using their accounts (e.g. Agarwal et al. 2017, Chopra et al. 2017).

Figure 3 Financial access in India: Share of adults in various categories (2011, 2014 and 2017)

Note: The black diamonds represent the share of adults in India with accounts that are inactive(no deposits or withdrawals over the past year).

Source: Demirgüç-Kunt et al. (2018)

Toward universal access and increased usage

The World Bank has called for universal adult access by 2020 and is engaged in ‘targeted interventions’ to realize this objective. While the schedule remains aggressive, the Findex highlights key opportunities for further large gains in coming years. Of the estimated 1.7 billion unbanked adults, some 1.1 billion have mobile phones (Demirgüç-Kunt et al. 2018:10). That means that a large majority of the unbanked already has the technology needed to gain access. Moreover, about two-thirds of the unbanked live in just 15 countries, with China and India accounting for one-fourth of the total (see Figure 4). Consequently, a government-led push in just a few countries could go a long way to achieving universal access.

Figure 4 Unbanked adults (and those with mobile phones) by country (millions)

Note: Red diamonds indicate those with mobile phones.

Source: Demirgüç-Kunt et al. (2018)

The Findex also highlights key ways to promote greater account use in the developing world. At the top of that list, nearly two-thirds (64%) of those paying utility bills―that is 1.6 billion adults―pay in cash. Of these, roughly two-thirds live in 10 countries (see next chart). Facilitating these utility payments digitally would likely lead to a large increase in account use. Keep in mind that a large portion of some payments already go through the formal financial system. For example, of those receiving payments from their government, nearly two-thirds (64%) do it through a financial account. This reduces the opportunity for corruption and ‘leakage’ that accompanies cash transfers (e.g. Banerjee et al. 2016). Similarly, only about one-fourth (27%) of those sending or receiving domestic remittances still do so in person using cash.

Figure 5 Adults with an account who pay utility bills in cash (millions), 2017

Source: Demirgüç-Kunt et al. (2018)

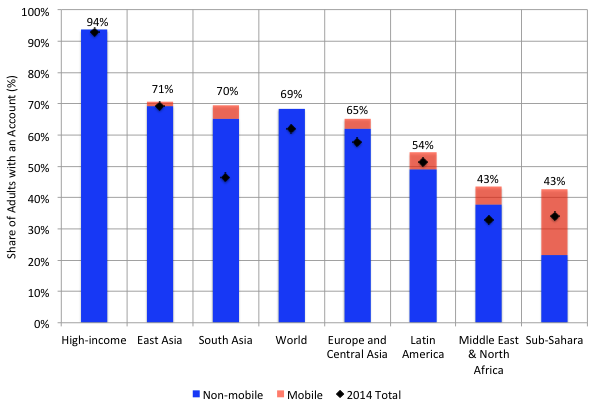

The challenge in Africa

Africa lags behind other regions in terms of financial access (see Figure 6). Yet, aside from a few countries in Asia and Latin America, sub-Saharan Africa is the only region where financial access through mobile phone firms is similar in scale to access through more traditional intermediaries. In recent years, mobile phone access has spread well beyond Kenya (73%) and Uganda (51%). But this progress is uneven so far. Of the 41 sub-Saharan African nations surveyed in the Findex database, 11 (including Kenya and Uganda) now have mobile access of 30% or more (see map O.2 on page 3 of Demirgüç-Kunt et al. 2018). By contrast, in a dozen others, fewer than 15% have access.

Figure 6 Financial access by region and type of account, 2017

Notes: Data on mobile accounts are not available for ‘high-income’ or ‘world.’

Source: Demirgüç-Kunt et al. (2018)

Why should Africa matter so much? The answer is demographics. According to the latest UN population projections, over the remainder of this century, nearly 90% of the increase in global population—from 7.6 billion persons today to 11.2 billion in 2100 (see Figure 7)―will be in Africa. And, more than 120% of the increase in the working-age population will occur there as well. Indeed, by 2100, the working-age population in Africa is expected to top that in Asia. Africa is also the only continent where the dependency ratio (the ratio of the young and the elderly to the working-age population) is set to decline—from a whopping 80% in 2015 to 57% in 2100 (while the aging population boosts the world ratio from 53% to 67%).

Figure 7 Population projections by region: Total and working age (billions of persons), 2017-2100

Note: These projections are based on the medium fertility variant.

Source: United Nations Population Division World Population Prospects 2017

Put differently, if the nations of Africa develop institutions to support strong, stable and balanced growth—including the necessary financial apparatus—they will become the primary drivers of global expansion in the remainder of the 21st century. Mobilising African savings and providing African entrepreneurs access to global capital could be key elements of this process, with the benefits spilling over to consumers everywhere in the world.

Financial access can’t come soon enough.

Editors' note: This column first appeared on moneyandbanking.com on 7 May 2018.

References

Agarwal, S, S Alok, P Ghosh, SK Ghosh, T Piskorski and A Seru (2017), “Banking the unbanked: What do 255 million new bank accounts reveal about financial access?”, Columbia Business School Research PaperNo. 17-12, October.

Banerjee, A, E Duflo, C Imbert, S Mathew and R Pande (2016), "E-governance, accountability, and leakage in public programs: Experimental evidence from a financial management reform in India,” NBER Working Paper 22803.

Cecchetti, S G and K L Schoenholtz (2017), “Banking the unbanked: The Indian revolution,” www.moneyandbanking.com, 6 November.

Chopra, Y, N Prabhala and P L Tantri (2017), “Bank accounts for the unbanked: Evidence from a Big Bangexperiment,” Robert H. Smith School Research Paper No. RHS 2919091, August.

Demirgüç-Kunt, A, L Klapper, D Singer, S Ansar and J Hess (2018), The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution, World Bank Group, April.