Zucman (2014) estimates that tax havens concentrate 8% of global private financial wealth and that this reduces global tax revenues by about $200 billion annually. Several scandals have highlighted the role of banking secrecy in tax evasion. The international agenda against banks secrecy has favoured exchange of information by offshore places (and blacklisting if they do not cooperate). However, empirical studies find limited impact of such soft practices: blacklisting leads to the transfer of funds from tax havens under a transparency program to non-participating offshore places (Masciandaro et al. 2016). Indeed, it looks like a few offshore places can resist high levels of international pressure (see Konrad and Stolper 2016).

On the other hand, recent evidence suggests that investors value information about tax havens. Scandals have negative effects on the market value of firms (Johannesen and Stolper 2017, O’Donovan et al. 2016). In this vein, the EU has adopted an original and complementary approach in the transparency agenda. Since 1 January 2015, the EU Capital Requirements Directive IV (Article 89) requires all member-state banks with a consolidated turnover above €750 million to publicly disclose the activity of all their affiliates (subsidiaries and branches) regarding the allocation of their income, profit, and taxes.

In a recent study (Bouvatier et al. 2018), we dissect hand-collected data of the 37 global and local systemically important banks in the EU. Descriptive statistics reveal that their foreign affiliates are located in a total of 138 countries, including about 30 tax haven jurisdictions (depending on the list we consider). Tax havens represent 1% of the total sample’s population and 2% of GDP, while EU banks record 18% of their foreign turnover and 29% of their foreign profit in these countries.1

Such striking statistics suggest abnormalactivity of banks in tax havens and motivate our investigation: What is the contribution of EU banks to tax evasion? Which banks are the most active in tax evasion? Which countries are the major hosts of EU tax evasion? Has the EU transparency requirement had an impact on the geographical location of banks yet?

Banks activity in tax havens is three times larger than gravity predictions

Some tax havens are large economies and financial hubs (think Luxembourg, Singapore, or Hong Kong). Therefore, a rigorous assessment of the specific role of banks in intermediating tax evasion needs to disentangle the ‘natural’ from business motivated by non-standard factors such as tax evasion. We use the well-documented result of gravity models – that bilateral financial transactions rise proportionately with the economic size of both countries (‘mass’) and are negatively correlated with frictions (‘resistance’) – to quantify the amount of foreign affiliates’ activity predicted by standard factors (Blonigen 2005). We then look at the level of activity not predicted by the model to assess the abnormal activity of banks in tax havens. We obtain consistent and robust evidence that, conditioned on gravity factors, tax havens attract extracommercial presence of multinational banks compared to non-tax haven countries. We find that bank activity in tax havens is, on average, three times larger than predicted by the gravity model.

Which banks are the most active in intermediating tax evasion?

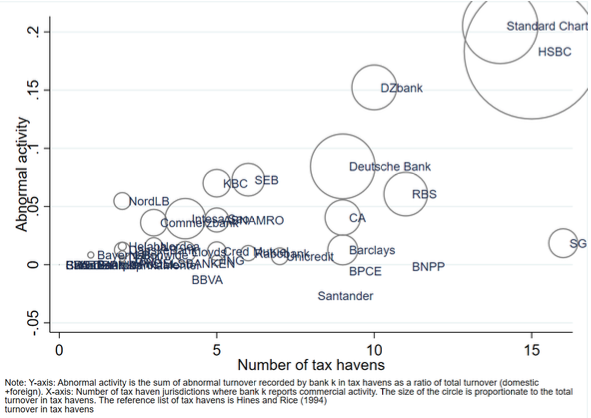

By our estimate, British and German banks are particularly present in tax havens: Standard Chartered, HSBC, DZBank, and Deutsche Bank have abnormal activity in havens equal to 20.5%, 18.3%, 15.2%, and 8.4% of their global activity, respectively (Figure 1). In comparison, the abnormal activity of banks from Denmark, Sweden, Italy, the Netherlands, and France in tax havens represent less than 3% of their global activity. In total, tax evasion intermediation averages 1.7% of banks’ global activity outside Germany and the UK.

Figure 1

Some unpleasant geography

Figure 2 plots the destination countries along the level of abnormal banking activity: the higher on the vertical axis the bubble of a country is, the larger the abnormal activity of banks in this country. Luxembourg (LUX) and Monaco (MCO) clearly stand out. In these countries, tax evasion intermediated by EU banks represent 9% and 8.5% of their GDP, respectively (for comparison’s sake, the size of the bubble is the absolute volume in euros). Luxembourg is also the most diversified offshore place with 27 out of 37 banks inour sample reporting a foreign presence there. Curacao (CUR), the Channel Islands (GGY and JEY), and Hong Kong (HKG) are also substantial hosts of tax evasion intermediated by EU banks, although to a lesser extent.2

We compared our findings on the destination of tax evasion with previous empirical works that have documented tax evasion geography using different data than ours. Our findings are consistent with Alstadsaeter et al. (2018) on household wealth tax evasion, but not consistent with the work of Bennedsen and Zeume (2017) on the destination of corporate evasion. It suggests that the country-by-country data on the foreign presence of banks are more informative of the role of banks for household tax evasion than for the corporate tax evasion.

Figure 2

What is the banks’ contribution to tax evasion intermediation?

Applying the income-to-deposit ratio of major tax haven jurisdictions taken from a World Bank database, we estimate that the banks in our sample contribute to intermediating €550 billion of offshore money, i.e. 4.9% of the eight contributing countries’ GDP. Again, British banks stand out: offshore deposits intermediated by British banks represent 13.8% of the UK GDP. In fact, British banks contribute more to intermediating tax evasion than banks in other countries, a fact likely due to their status as global banks with global clients.

Alstadsaeter et al. (2018) estimate that the offshore wealth of individuals from continental Europe represents 15% of the country’s GDP, suggesting that banks intermediate about one-third of tax evasion by households (albeit with a significant caveat due to data limitations). It is likely that our estimate is a lower bound, as banks probably record in the origin country a part of the fees and commission for tax evasion facilitating services.

Has country-by-country reporting had an impact on the geographical location of banks?

The country-by-country reporting requirements were a last-minute extension of the Capital Requirements Directive IV adopted in July 2013, with first published data concerning the year 2015. This one-and-a-half-year process suggests that the banks’ decisions on location can have changed only marginally before the requirement was enforced. Thus, we test whether banks have made any location changes since the regulation came into effect, using the 2016 data over the same sample of banks. Descriptive statistics reveal that data are very similar over the two years. At the bank level, 2015 turnover predicts 2016 turnover with an R2= 0.99%. To be sure, we re-estimate the model by allowing the estimated coefficients to differ for 2015 and 2016 observations. Our results indicate that the coefficients are similar, suggesting no substantial location changes in 2016. This approach will be useful to track changes with future data.

Implications for the policy agenda

Our first takeaway is that only a few banks in our sample have substantial abnormal activity in tax havens, which suggests acting granularly through policy. For example, the Brexit negotiations regarding European passports for British financial institutions could be leveraged to revise and mitigate the role of British banks in tax evasion (Delatte and Toubal 2017). More generally, shedding light on the abnormal activity of specific banks in tax havens can contribute to a ‘name and shame’ approach, which has in the past proved impactful oninvestors and customers.

Second, our results unambiguously emphasise the central role of Luxembourg in tax evasion intermediated by banks. Not only is the activity of banks in Luxembourg not explained by standard factors substantial (amounting to €4.7 billion), but almost all banks of our sample report activity in Luxembourg. In other words, Luxembourg’s contribution to tax evasion is a pan-European issue that needs a collective answer. This is obviously at odds with the EU’s decision to exclude Luxembourg from their blacklisting in December 2017.

Third, on the financial regulation front, one could imagine using the existing Supervisory Review and Evaluation Process (SREP) to address tax avoidance intermediation. The first component of the SREP is the Business Model Analysis, which assesses the viability and sustainability of the business model. Including a measure in the Business Model Analysis framework of excessive presence in tax havens would be quickly operable.

Finally, but importantly, we identify ways to improve the quality and accessibility of the reporting. Currently, one needs to collect the data manually and separately for each bank. Banks disclose the data in financial reports, which are not readily available and have notable differences across banks. We also spot potential data misreporting, including different interpretations of the consolidation scope and of the definition of establishment. Providing the data via a central portal managed by the ECB or the European Banking Authority in open, multiple, and standardised formats would make it possible for the reports to be more easily processed and used by a wide range of parties (e.g. scholars, journalists, NGOs). Additional information could be reported without additional costs: the number and names of affiliates, total assets, and, more generally, some aggregate items of the balance sheet to better reflect the affiliates’ underlying activity.

References

Alstadsæter, A, N Johannesen and G Zucman (2018), “Who owns the wealth in tax havens? Macro evidence and implications for global inequality”, Journal of Public Economics.

Balakina, O, A D’Andrea and D Masciandaro (2017),“Bank secrecy in offshore centres and capital flows: Does blacklisting matter?”, Review of Financial Economics 32(1): 30-57.

Bennedsen, M and S Zeume (2017), “Corporate tax havens and transparency”, The Review of Financial Studies 31(4): 1221-1264.

Blonigen, BA (2005), “A review of the empirical literature on FDI determinants”, Atlantic Economic Journal 33(4): 383-403.

Bouvatier, V, G Capelle-Blancard and AL Delatte (2018), “Banks defy gravity”, CEPR Discussion Paper 12222.

Delatte, AL and F Toubal (2017), “Brexit: Seizing opportunities and limiting risks in the finance sector”, Notes du conseil d’analyse économique (9): 1-12.

Johannesen, N and T Stolper (2017), “The deterrence effect of whistleblowing: An event study of leaked customer information from banks in tax havens”, Cesifo working paper.

Konrad, KA and TBM Stolper (2016), “Coordination and the fight against tax havens”, Journal of International Economics 103: 96–107.

O’Donovan, J, HF Wagner and S Zeume (2016), “The value of offshore secrets–Evidence from the Panama Papers”, working paper.

Zucman, G (2014), “Taxing across borders: Tracking personal wealth and corporate profits”, Journal of Economic Perspectives 28 (4): 121–148.

Endnotes

[1] The NGO Oxfam publishes an annual report on the activity of EU banks in tax havens based on these data. We are thankful to them for sharing with us their original database, including the 2015 data of 20 banks.

[2] It is interesting to note that Switzerland does not stand out on the graph despite a longstanding tax evasion tradition, which is due to a very low foreign penetration.