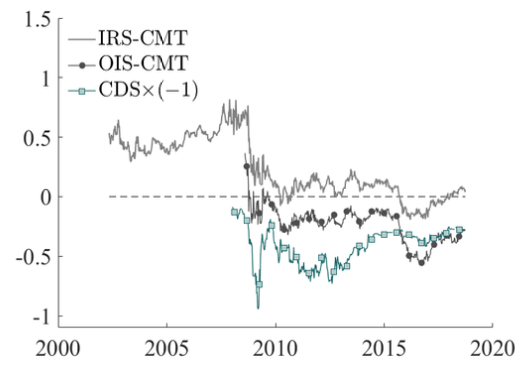

One particularly striking fixed-income puzzle that emerged during the Global Crisis is that the difference between interest rate swaps denominated in US dollars and maturity-matched US Treasury rates (also known as swap spreads) turned negative across multiple maturities. The US Treasury borrows on behalf of the government by issuing Treasury bills, notes, and bonds. Similarly, banks borrow from each other on an uncollateralised basis in the interbank market, and may peg their borrowing costs using a fixed-floating interest rate swap tied to the London Interbank Offered Rate (LIBOR) or the effective federal funds rate (EFFR). In Figure 1, we illustrate the behaviour of negative swap spreads using both swap rates tied to LIBOR (IRS) and swap rates tied to the EFFR rate (OIS).

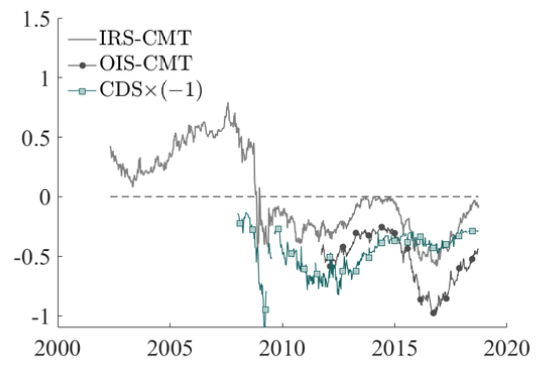

Figure 1 IRS-Treasury and OIS-Treasury spreads

a) 10-year maturity

b) 30-year maturity

Notes: In this figure, we report the time series of the USD denominated IRS-Treasury and OIS-Treasury swap spreads, defined as the difference between the interest rate swap (IRS) rate or the overnight indexed swap (OIS) rate and the maturity-matched constant maturity Treasury (CMT) rate. We overlay the (negative of the) USD maturity-matched US CDS premium, i.e., the CDS premium multiplied by (-1). The data frequency is weekly based on Wednesday rates. All spreads are expressed in percent. The sample period is 8 May 2002 to 26 September 2018. Source: Bloomberg (OIS, IRS, LIBOR), FRED (CMT), Markit (CDS).

Negative swap spreads across the maturity spectrum are conceptually puzzling, because they effectively suggest that the US government has higher borrowing costs than a presumably less safe AA-rated bank. More fundamentally, however, they suggest the existence of an arbitrage opportunity.

Indeed, an investor may setup a self-financing position by purchasing the comparatively cheap Treasury bond, financing that position using the Treasury as collateral in a repurchase agreement, and simultaneously selling an interest rate swap that receives the fixed leg and pays the floating LIBOR or EFFR rate. Because the costs of an uncollateralised loan are higher than those of a collateralised loan, negative swap spreads seem to imply an arbitrage opportunity. That such an opportunity has persisted for over ten years is puzzling.

Explanations based on limits to arbitrage

Several explanations have been proposed for the alleged anomaly. For example, Klingler and Sundaresan (2018) argue that long-term negative swap spreads tied to LIBOR may be explained by demand for duration from pension funds. Jermann (2019) proposes that the regulatory leverage caps imposed on dealers after the Global Crisis make it too costly for them to use their balance sheet to correct the mispricing. Klingler and Sundaresan (2019) further suggest that negative swap spreads tied to the EFFR rate may be explained at short-term maturities through a fading demand for US Treasuries that leads to a decline in convenience yields. While these explanations have their merits, they lack a unified explanation that is valid across maturities and across markets, and that explains positive swap spreads before, and negative swap spreads after, the Global Crisis.

An alternative risk-based explanation based on US default risk

The argument that negative swap spreads allow for riskless profit opportunities crucially depends on the absence of default risk by the US government. If, however, one considers the possibility of US default, the arbitrage trade is no longer riskless, because failure of the US government to honour its debt obligations would inflict a loss on an investor who holds the defaulted bond. This is the line of reasoning that we pursue in Augustin et al. (2019).

Despite the audacity of that argument, history suggests that the US did default when it abandoned the gold clause in 1933 (e.g. Edwards 2018, Gomes et al. 2019).1 Regardless of history, though, there exists an active insurance market for protection against US default, in the form of credit default swap (CDS) contracts. The premiums on these contracts have fluctuated on average between 20 and 40 basis points, but reached levels as high as 100 basis points during the Global Crisis. The mere fact that these contracts trade suggests that at least some investors perceive the probability of a US default to be non-zero, a point forcefully made in Chernov et al. (2019).

Purchasing a CDS contract allows hedging of the loss on the defaulted bond in case of default against the payment of the periodic CDS premium. While the insurance contract would thus make investors on the defaulted bond whole, allowing them to repay the loan in the repo market, the investor would also need to unwind the interest rate swap contract at market prices. Overall, these slightly adjusted cash flows, due to the possibility of US default, then suggest that the lower bound for swap spreads is negative, and approximately equal to the negative value of the CDS premium, without allowing for arbitrage opportunities. Indeed, the evidence in Figure 1 suggests that swap spreads are almost always above the negative CDS premium, and that swap spreads and CDS premiums fluctuate together. We confirm this evidence more formally by regressing changes in swap spreads on changes in CDS premiums. We find that they are significantly negatively related.

A quantitative equilibrium model to explain the evidence

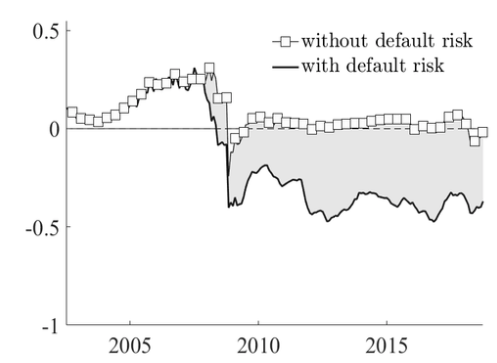

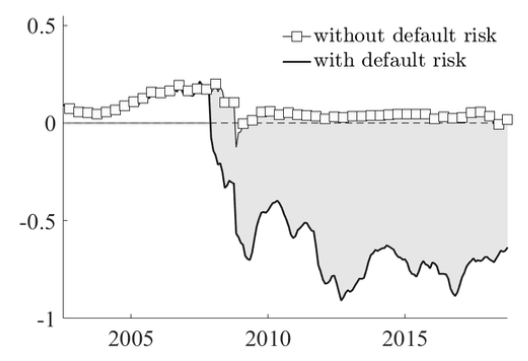

While the simple ‘no arbitrage’ argument provides a qualitative explanation of negative swap spreads due to US default risk, it is unclear whether this effect is quantitatively important. We therefore develop a model that captures the evidence. As there is no longer any riskless benchmark in the economy, and discounting shifted from LIBOR to OIS rates during the Crisis, we rely on an equilibrium approach. We specify a representative agent with recursive utility preferences, and an endowment economy that allows for interactions between consumption growth, inflation, output growth, government expenditures to output ratio, and consumption and inflation uncertainty. We estimate these dynamics independently from asset prices. In a second step, we fit the term structure of Treasury rates and CDS premiums, accounting for convenience yields in US Treasuries, interbank risk, and the cost of collateral. We do not fit the term structure of OIS and IRS rates, and validate their relation to US Treasury rates out of sample. In Figure 2, we provide the model-based counterfactual analysis of OIS-based swap spreads. The message is clear – the spreads would have been positive in the absence of US default risk.

Figure 2 Model-implied spread between OIS and CMT, counterfactual

a) 10-year maturity

b) 30-year maturity

Notes: In this figure, we compare the fitted OIS-CMT spreads (black line) with their counterfactual values when US credit risk is shut down (grey boxes). All rates are expressed on a par basis. The y-axis is expressed in annualised percentage terms. The sample period is May 2002 to September 2018. Source: Authors' computations.

Concluding remarks

In terms of credit risk, the US is arguably one of the safest countries in the world. Yet, prices for insurance protecting against the default of the US government soared during the Global Crisis, reaching levels as high as 100 basis points, and have fluctuated at high levels ever since. The US Treasury’s total federal public debt almost quadrupled over the last 20 years, ballooning from $5.526 trillion in the third quarter of 1998 to $21.516 trillion in the third quarter of 2018. Moreover, the Congressional budget office foresees large budget deficits in the years to come, with a central estimate of federal debt to GDP of 144% by 2049. These developments suggest that the US may no longer be perceived as entirely insulated from default risk. We argue that, as a result, there is an increase in the risk premium associated with US default, which can naturally explain why Treasuries appear cheap relative to interest rate swaps. Thus, despite the headlines about the arbitrage opportunities implied by negative swap spreads, we show that the law of one price still holds.

References

Augustin, P, M Chernov, L Schmid, and D Song (2019), “Benchmark Interest Rates When the Government is Risky”, CEPR Discussion Paper no. 14105.

Chernov, M, L Schmid, and A Schneider (2019), “A Macrofinance View of US Sovereign CDS premiums”, The Journal of Finance, forthcoming.

Edwards, S (2018), American Default, Princeton University Press.

Gomes, J F, M Kilic, and S Plante (2019), “Leverage Risk and Investment: The Case of Gold Clauses in the 1930s”, SSRN Working Paper no. 3342943.

Jermann, U J (2019), “Negative Swap Spreads and Limited Arbitrage”, Review of Financial Studies, forthcoming.

Klingler, S, and S Sundaresan (2019), “How Safe Are Safe Havens?”, Working Paper, Columbia University.

Klingler, S, and S M Sundaresan (2018), “An Explanation of Negative Swap Spreads: Demand for Duration from Underfunded Pension Plans”, The Journal of Finance, forthcoming.

Zivney, T L, and R D Marcus (1989), “The Day the United States Defaulted on Treasury Bills”, The Financial Review 24: 475-489.

Endnotes

[1] Zivney and Marcus (1989) describe another default episode by the US in 1979.