Beverage markets have been disrupted by a plethora of influences in recent years. Leaving aside sugar taxes on soft drinks and burgeoning sales of bottled water, alcohol markets have been changing dramatically. Consider the following:

- The share of global production that is exported has risen hugely since 1990, roughly trebling in volume to 40% for wine, 12% for spirits, and 8% for beer.

- Asia’s share of global alcohol consumption has doubled since the mid-1980s, to 46%, while alcohol consumption in Western Europe has fallen by one-fifth since the 1970s.

- Wine’s share of global alcohol consumption has fallen from one-third in the early 1960s to less than one-seventh today.

- Taxes on alcohol consumption vary hugely across countries but have been rising in high-income and key emerging economies, by one-ninth for beer and by about one-quarter for both wine and spirits between 2008 and 2018.

- Many trade policy changes are making international trade more discriminatory and uncertain for beverages (as for other products).

Forces contributing to these market developments include globalisation, income growth in emerging economies, preferences changes including for personal health reasons, policy initiatives aimed at curbing socially harmful drinking, and trade policy shocks in the past three years such as Brexit and President Trump’s tariff wars.

The macroeconomic impacts of those two trade policy shocks, and the uncertainty they have generated for consumers and investors, are considerable. The Brexit vote in June 2016 had an immediate impact on the British pound that has persisted, its value having declined by more than 10% against all pertinent currencies, and UK income and household consumption growth have slowed. Moreover, uncertainty over how the UK will exit the EU has reduced business investment in the UK and its trading partners (Dhingra et al. 2017, Sampson 2017, Bloom et al. 2019, Hassan et al. 2019). Likewise, unilaterally imposed discriminatory tariffs imposed by the US on selected imports, and retaliation by targeted trading partners, have lowered living standards in those countries (Amiti et al. 2019, Redding et al. 2019).

Discerning the relative importance of the various forces affecting alcohol markets is not easy. However, we can start by assembling and scrutinising pertinent historical market and policy data.

Beverage consumption and international trade barriers

In the past when trade costs were high, consumers concentrated their alcohol consumption on those beverages that could be produced at lowest cost locally. Those patterns were amplified by taxes on beverage consumption and imports that vary greatly across beverage types (Anderson 2020a). Often taxes are in place to protect local producers, thereby reinforcing climate-induced differences across countries in the mix of beverages consumed.

The gradual fall in transport and communication costs, and of tariffs as part of general trade policy reforms, have reduced the dominance of spirits and beer consumption in countries where appropriate grains can be easily grown, and of wine in countries in the 30o to 50o latitude range where winegrapes grow best.

Those same globalisation forces have lowered the cost of consumer information and contributed to international tourism, altering preferences in favour of exotic products. Together, these have led to the rapid rise in the share not only of global alcoholic beverage consumption that is imported (Anderson and Pinilla 2018) but also of Asia’s fast-growing share of that consumption (Figure 1).

Figure 1 National shares of global volume of consumption of beer, spirits and wine, 2000 to 2018 (%)

Source: Anderson and Pinilla (2020).

Asia’s influence on wine’s relative decline in global alcohol consumption

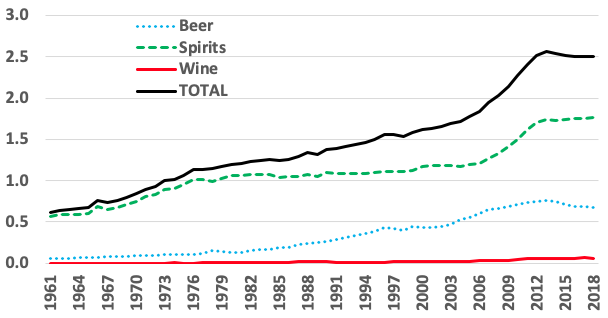

True, the coronavirus is putting a temporary dent in Asian sales of these (and other) products but, even with more-moderate income growth, Asia is projected to become more important globally as a beverage consumer (Anderson 2020b). Asia’s rising importance in global markets, together with the dominance of spirits and to a lesser extent beer in their beverage consumption (Figure 2), has contributed to the decline in wine’s share of global alcohol consumption (Figure 3).

Figure 2 Per capita consumption of beer, spirits, wine, and all alcohol, Asia, 1961 to 2018, (litres of alcohol)

Source: Anderson (2020b).

Figure 3 Share of wine, and of Asia, in global alcohol consumption volume, 1961 to 2018 (%)

Source: Based on data in Anderson and Pinilla (2020).

Rising excise taxes

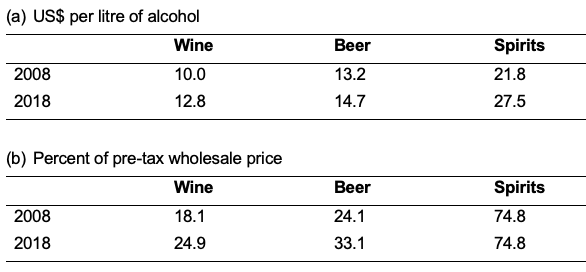

Meanwhile, excise taxes on all types of alcohol have been rising in high-income and key emerging economies. In a sample of 42 such countries, wine is taxed least and spirits most; but the unweighted average rate of tax in those countries has risen by one-ninth for beer and by about one-quarter for both wine and spirits between 2008 and 2018 (Table 1).

Table 1 Average excise taxes on wine, beer, and spirits, US$ per litre of alcohol and ad valorem (%) equivalent at average prices, 2008 and 2018

Note: This presents the unweighted average over 42 high-income and emerging economies.

Source: Anderson (2020a).

New discriminatory import taxes

Import taxes on alcohol have tended to fall over time as part of countries’ general trade policy reforms, but Brexit and unilaterally imposed discriminatory tariffs by the US are disrupting international trade in beverages.

Brexit

The withdrawal of the UK from the EU is non-trivial for the world’s beverage markets because the UK accounts for nearly 11% of the world’s wine imports, nearly 4% of global spirits imports, and 25% of global spirits exports in value terms. Half of UK wine imports and two-thirds of UK spirits imports come from other member countries of the EU, and around one-third of UK spirits exports go to other EU member countries.

Brexit has already had a non-trivial impact on markets as the pound has depreciated more than 10% since the referendum in June 2016 and growth in UK incomes, household consumption, and business investment have slowed. Further effects on beverage markets in the UK and elsewhere will depend on the UK’s post-Brexit policy choices, including its trade deals with numerous non-EU trading partners in addition to the EU.

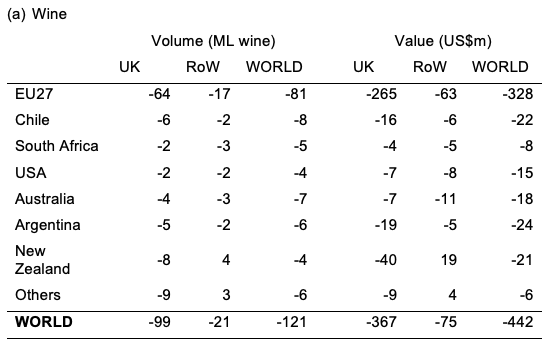

In a recent study, we use a new model of global beverage markets to provide projections of the possible effects of Brexit by 2025 (Wittwer and Anderson 2020). These effects depend not only on assumed changes in the UK’s currency and incomes but also on changes in various bilateral tariffs.

Our Brexit scenario assumes the UK will negotiate a free trade agreement (FTA) with the remaining 27 EU member countries (EU27) and then seek bilateral FTAs with others, including wine-exporting Australia, New Zealand, Chile, and South Africa. Such trade agreements would reduce the loss to wine exporters across the globe compared with a ‘hard’ Brexit involving no such follow-on FTA with the EU, but not by enough to offset the adverse effects of the depreciation of the pound and lowered UK incomes.

In this scenario, the rate of UK real GDP growth is assumed to be one-third lower over the projection period 2017–2025 (1.8% per year instead of 2.6%), and the pound is assumed to be 10% lower in real terms, than in the model’s core baseline ‘business-as-usual’ (without Brexit) projection to 2025. It is further assumed the UK applies the EU’s external tariffs on beverages imported from non-EU countries at the end of the agreed transition period but, because of an assumed new bilateral FTA, trade between the UK and EU27 remains duty-free.

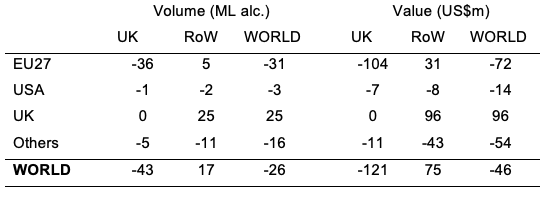

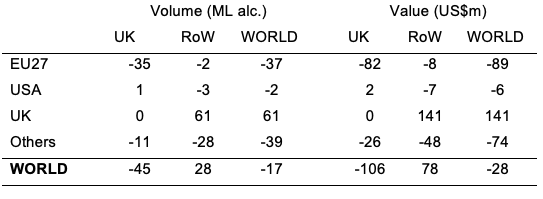

Table 2 suggests that, because of Brexit, the UK in 2025 would import less beverages from virtually all regions of the world including the EU27, thanks to the UK being less affluent and the pound’s depreciation following the Brexit vote – and despite an FTA with the EU27 in place of the UK being in the EU’s Single Market. The UK would export more spirits and beer thanks to declining domestic demand and devaluation of the pound. However, other countries export fewer beverages because, since their export prices are lowered, local sales expand. Their export decline is only partly offset by the UK’s export expansion, so Brexit lowers global beverage trade.

Table 2 Differences in 2025 bilateral beverage import volumes and values from key exporters by the UK and rest of the world (RoW) as a result of Brexit (megalitres [ML] and 2014 US$ million)

b) Spirits

(c) Beer

US tariff wars

After the WTO published rulings in October 2019 on a long-running dispute between the US and the EU over subsidies to aircraft manufacturing, the US has imposed an additional 25% tariff on still bottled wines from France, Germany, Spain, and the UK, thereby hurting countries that have enjoyed the benefits of EU subsidies to Airbus. Italy and other wine exporters not benefiting from those subsidies are exempt from these US tariff measures. Oddly, champagne and other sparkling wines, and bulk wines in containers greater than two litres, also are exempt even from the targeted countries.

Such specific targeting of products that have close substitutes is bound to lead to trade diversion within and across countries. Some firms may import bulk rather than bottled wine from targeted countries and bottle it on arrival in the US, but generally, US consumers will face higher wine prices on average and thus will lower the quantity they buy. Exporters in the targeted countries will not only sell smaller volumes but also receive lower prices for targeted products.

Whether this boosts exports of other countries, and of substitute products of targeted countries, depends on whether the dampening effect of this extra set of taxes on global alcohol consumption offsets the positive effects through trade diversion on consumption of non-targeted products and countries. Those effects depend on national shares of US wine imports and US shares of national wine exports.

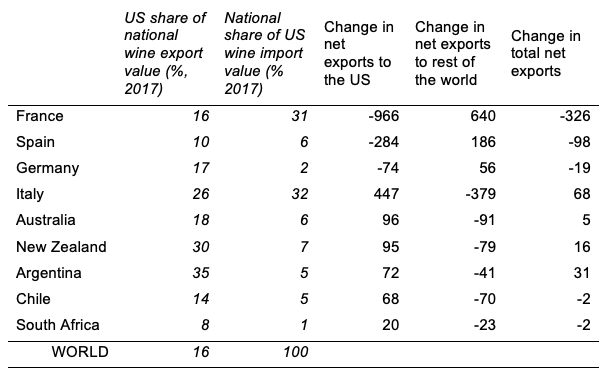

Table 3 shows that the targeted countries account for two-fifths of the value of US wine imports and that the US accounts for 16% of global wine imports. Since these new tariffs are percentage rather than volumetric ($/litre) taxes, they raise the price of affected imported products the higher their pre-tax selling price. Therefore, it also matters how important fine wines are in a country’s total still bottled wines.

Table 3 Impact of new 25% US wine import tariffs on the national value of wine exports net of imports, selected countries (US$ million per year)

Source: Wittwer and Anderson (2020).

We use a new empirical model of global alcohol markets to estimate the producer price, consumer volume, and international trade consequences of these new US tariffs on beverage trade (Wittwer and Anderson 2020). The model is based on data for 2016–18, just prior to the imposition of the additional 25% tariffs on selected US imports.

Raising those selected tariffs by 25% is estimated to raise US prices of winegrapes by an average of 2.6%, and producer prices of bottled still wines by 1.1%, while in the targeted wine countries of France, Germany, and Spain (the UK is only a tiny exporter of wine and mostly sparkling), prices move in the opposite direction. Domestic consumption of bottled still wines therefore also fall in these countries. In untargeted Italy, by contrast, winegrape prices rise and domestic consumption of still wines falls a little.

Among the New World countries, the estimated effects differ according to the importance of the US market to their exports and the quality of the wines they sell in that now-more-protected market. Australia’s average grape price and bottled still wine prices rise a little, while New Zealand’s grape and wine prices rise quite a bit more. The reason for the larger price rises in New Zealand is that its exports to the US are higher-priced than Australia’s and so are a closer substitute for those EU wines that are being hit most with higher tariffs.

The tariffs reduce world trade in wine by 1.6%, mostly because of a drop in US wine imports. US exports of wine fall as well, as US consumers substitute away from pricier imported wines in favour of domestic brands. Most of that loss in the global wine trade (over $300 million per year) is French fine still wine. Spain’s net export loss is $98 million, while Germany’s is $19 million. These targeted countries reduce their exports to the US by much more than these amounts but expand their exports to other countries, thereby adding to competition elsewhere.

Untargeted Italy, by contrast, enjoys a net export increase of $68 million, almost all fine wine, and it sells much more to the US but largely at the expense of sales to other countries.

As for New World wine exporters, they sell much less to the US and more to the rest of the world. However, only three of the five New World countries shown in Table 3 enjoy an increase in their total net exports of wine.

In short, even non-targeted countries can be worse off from targeted tariffs if those tariffs reduce global consumption sufficiently. In this case, it appears Australian wine exporters will be only slightly better off (selling US$96 million more to the US and $91 million less to other countries), New Zealand and Argentina will enjoy somewhat larger gains, and Chile and South Africa will lose slightly.

Author’s note: I thank Wine Australia for its financial support under research project PRJ002488, entitled ‘Australia’s Changing Competitiveness in Global Wine Markets’.

References

Amiti, M, S J Redding and D E Weinstein (2019), “The impact of the 2018 tariffs on prices and welfare”, Journal of Economic Perspectives 33(4): 187–210.

Anderson, K (2020a), “Consumer taxes on alcohol: An international comparison over time”, CEPR Discussion Paper 14388.

Anderson, K (2020b), “Asia’s emergence in global beverage markets: The rise of wine”, CEPR Discussion Paper 14389.

Anderson, K and V Pinilla (eds) (2018), Wine globalization: A new comparative history, Cambridge University Press.

Anderson, K and V Pinilla (2020), Annual database of global wine markets, 1835 to 2018, Wine Economics Research Centre, University of Adelaide, updated January.

Bloom, N, P Bunn, S Chen, P Mizen, P Smietanka and G Thwaites (2019), “The impact of Brexit on UK firms”, NBER Working Paper 26218.

Dhingra, S, H Huang, G Ottaviano, J P Pessoa, T Sampson and J Van Reenen (2017), “The costs and benefits of leaving the EU: Trade effects”, Economic Policy 32(92): 651–705.

Hassan, T, S Hollander, L van Lent and A Tahoun (2019), “The global impact of Brexit uncertainty”, CEPR Discussion Paper 14253.

Redding, S J, M Amiti and D E Weinstein (2019), “Who’s paying for the US tariffs? A longer-term perspective”, CEPR Discussion Paper 14229.

Sampson, T (2017), “Brexit: The economics of international disintegration”, Journal of Economic Perspectives 31(4): 163–84.

Wittwer, G and K Anderson (2020), “A model of global beverage markets”, CEPR Discussion Paper 14387.