Under the proposal by Feld et al. (2018), which is shaped by the German ‘debt brake’ model, the fiscal framework of the euro area would be fundamentally transformed. An interesting alternative to this rules-based approach is provided by the recent proposal by Darvas et al. (2018). Their model is based on an expenditure rule which is derived from a medium-term target for the debt-to-GDP ratio. While both proposals entail an expenditure rule, they differ fundamentally. Feld et al. prefer a mechanistic balanced budget rule as an anchor for the expenditure rule. The French proposal elegantly downgrades the balanced budget rule by anchoring the expenditure rule with a medium-term debt target, which is to be defined in a discretionary way. While this flexibility can be criticised, one can argue that it is better to rely on discretion than on a mechanical rule which lacks a sound theoretical basis.

No evidence for a “notorious government deficit bias”

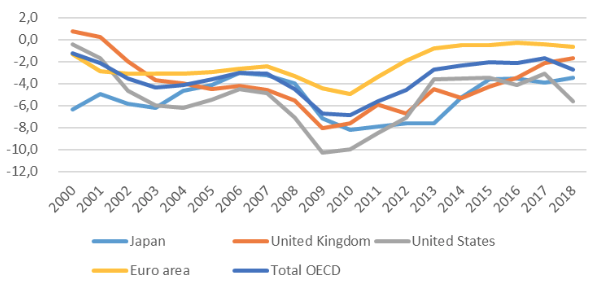

There is no doubt that the rules of the Stability and Growth Pact (SGP) are very complex and opaque. However, this does not necessarily mean that the fiscal policy framework for the euro area "was not sufficiently effective in confining the deficit bias of governments” (Feld et al. 2018) and that it was poorly implemented. An international comparison of structural fiscal balances shows no ‘deficit distortion’ for the euro area. On the contrary, for many years the structural balance in the euro area has been significantly higher than in other major countries (Figure 1).

Figure 1 General government cyclically adjusted balances (% of potential GDP)

Source: OECD, Economic Outlook 103 database

This is especially true after the Great Recession. The very weak fiscal response compared to Japan, the UK, the US, and the entire OECD area can be considered as a key explanation for the very poor macroeconomic performance of the euro area during those years. Since 2014, the structural balance of the euro area has remained more or less constant, reflecting that the consolidation process has since been halted. One could criticise this development, as the deficits in France or Spain, for example, have since been close to or even above the 3% threshold of the Maastricht Treaty. But in retrospect, it can be seen that the combination of the ECB's expansionary policy with a more relaxed fiscal stance has led to a continued economic recovery in the euro area. In other words, the flexibility offered by the Stability and Growth Pact, especially since 2014, is not a negative but a positive feature.

Therefore, it is not self-evident that the main problem of the euro area fiscal framework is a “notorious government deficit bias" (Feld et al. 2018). As evidenced by post-Great Recession developments, the main shortcoming is a lack of fiscal policy coordination, which leads to an inappropriate fiscal stance in the aggregate fiscal policy of the 19 member states during a severe recession. This issue was identified in the Five Presidents' Report (Juncker et al. 2015) and led to the establishment of the European Fiscal Board, which advises the European Commission on the adequacy of the fiscal stance in both the national and the euro area.

Differences and similarities with the Stability and Growth Pact

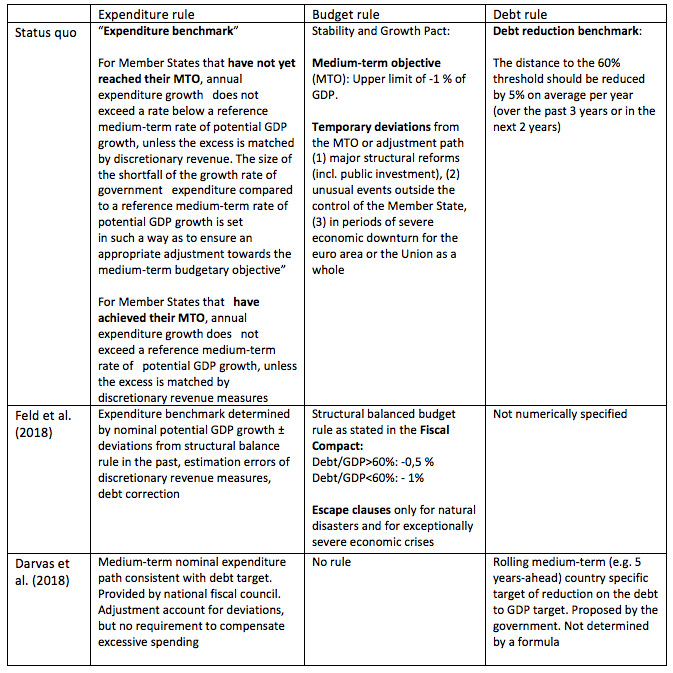

The expenditure rule and the reform of the budgetary framework foreseen under the proposal by Feld et al. differ from other recent proposals for reform (Bénassy-Quéré et al. 2018, Andrle et al. 2015, Claeys et al. 2016) and also the recent proposal by Darvas et al. (2018) from the French Conseil d'analyse économique, as they retain as "a key element the structural balanced budget rule as stated in the Fiscal Compact" (Feld et al. 2018). In this respect, the basic mechanisms of their proposal are not different from the status quo of the euro area fiscal framework (Table 1), which entails an expenditure benchmark since the 2011 reforms (the ‘six-pack’). This benchmark is designed to meet the medium-term structural balance target:

“for Member States that have not yet reached their medium-term budgetary objective, annual expenditure growth does not exceed a rate below a reference medium-term rate of potential GDP growth, unless the excess is matched by discretionary revenue measures. The size of the shortfall of the growth rate of government expenditure compared to a reference medium-term rate of potential GDP growth is set in such a way as to ensure an appropriate adjustment towards the medium-term budgetary objective.”

Regulation (EU) No 1175/2011 of the European Parliament and the Council of 16 November 2011.

Thus, compared with the Stability and Growth Pact, the core innovation of the German proposal is not the expenditure rule. It is the introduction of a ‘memory’ within the SGP. So far, there exists no obligation for member states to compensate deficits from the past with corresponding surpluses; it is enough that the actual deficit and the expected path of the deficit meet the requirements of the Pact. The second major innovation is the removal of exemptions for deviations from the MTO (or the adjustment path towards it) in the case of structural reforms which also includes public investments.

Thus, the proposal by Feld et al. is not mainly about “simplicity and transparency”. With the introduction of a memory, it fundamentally transforms the SGP into a framework that is more or less identical to the German debt brake. This would have far-reaching consequences. As the simulations by Feld et al. show, above all France would be obliged to balance the excess of its structural deficit over the 0.5% benchmark since the year 2013 with major expenditure cuts. The requirement to balance deviations from the past could not only lead to a procyclical policy stance, it could also become a severe burden for a new government that has to pay for the mistakes of its predecessor.

Table 1 A comparison of the three fiscal frameworks

Differences between the French and the German proposals

At first glance, one might think that the German proposal is very similar to a proposal from the Conseil d'analyse économique (Darvas et al. 2018), which was published simultaneously. In fact, an expenditure rule is propagated in both concepts. But on closer inspection, fundamental differences are apparent. In essence, the French economists propose a model based on discretionary policy decisions, while their German counterparts propose a largely rules-based approach. This difference is due to the fact that the French proposal completely refrains from providing a rule for the structural deficit. Their concept thus lacks the quantitative anchoring implied by the obligation to reach a balanced budget. The anchor for this framework is instead provided by the debt reduction target. The authors explicitly point out that the target value should not be determined by a formula, but by the discretionary decision of the government. The expenditure path is then derived from the debt target. It is to be determined by the national fiscal council. Deviations of expenditures from their target path should be recorded in an adjustment account. If this account exceeds a reference value, a violation of the rule will be detected. However, an ex-post compensation through minor expenditures is not foreseen.

‘Golden rule’ versus ‘black zero’

Thus, for the further development of the fiscal rules in the euro area, two completely different concepts are available. The German proposal is characterised by the simple idea that optimal fiscal policy is characterised by a balanced budget. From this ideal, which is known to the German public as ‘black zero’, then results the expenditure path. The French proposal assumes that the medium-term goals of fiscal policy must be determined in a complex decision-making process and cannot be determined by simple formulas. Overall, the French proposal is thus closer to the status quo than the German concept.

Simple rules can have their advantages, but they must be well-founded. However, this is not the case for the German debt brake, which Feld at al. want to be transferred to the entire euro area. In the traditional theory of public finance, one can find only the ‘golden rule’ as a guideline for the optimum level of public debt. Thereafter, it makes sense to finance public investment by borrowing. In fact, many years ago the German Council of Economic Experts published a report on fiscal rules where it explicitly endorsed the ‘golden rule’ and argued that “the requirement of a general debt prohibition would be economical as absurd as banning private individuals or companies from borrowing” (GCEE 2007).1

One may criticise the discretionary scope in the French proposal, but it has the potential for the target values for debt to be determined in a broad discourse between science and politics, between national and foreign economists, and on the basis of economic theory and available scientific evidence. Above all, it could provide at least some space for investment that is debt-financed. In this case, the chances for good fiscal policy in the member states would be much greater than from entrusting it to a simple mechanical rule.

References

Andrle, M, J Bluedorn, L Eyraud, T Kinda, P K Brooks, G Schwartz, and A Weber (2015), “Reforming fiscal governance in the European Union”, IMF Staff Discussion Note, SDN/15/09.

Bénassy-Quéré, A, M Brunnermeier, H Enderlein, E Farhi, M Fratzscher, C Fuest, P-O Gourinchas, P Martin, F Pisani, H Rey, I Schnabel, N Véron, B Weder Di Mauro, and J Zettelmeyer (2018), “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insight No. 91.

Claeys, G, Z M Darvas and A Leandro (2016), “A proposal to revive the European Fiscal Framework", Bruegel Policy Contribution 2016/07.

Darvas, Z, P Martin and X Ragot (2018), “European fiscal rules require a major overhaul”, Les notes du conseil d’analyse économique, no. 47.

European Commission (2015), “Making the best use of the flexibility within the existing rules of the stability and growth pact”, 13.1.2015 COM(2015) 12

Feld, L, C M Schmidt, I Schnabel and V Wieland (2018), “Refocusing the European fiscal framework”, VoxEU.org, 12 September.

Juncker, J-C, in close cooperation with D Tusk, J Dijsselbloem, M Draghi and M Schulz (2015), Completing Europe’s Economic and Monetary Union, The Five Presidents’ Report, European Commission.

Sachverständigenrat zur Begutachtung der gesamtwirtschaftlichen Entwicklung (2007), Staatsverschuldung wirksam begrenzen. Expertise im Auftrag des Bundesministers für Wirtschaft und Technologie.

Endnotes

[1] The original German text reads “(…) die Forderung eines generellen Verschuldungsverbots (…) wäre ökonomisch ähnlich unsinnig, wie Privatleuten oder Unternehmen die Kreditaufnahme zu verbieten.“