The banking crisis of ten years ago was a serious policy failure (Independent Commission on Banking 2011). Leverage increased dramatically from the late 1980s to the crisis while loss-absorbing equity capital was inadequate. Regulation that addressed these issues could have maintained financial stability at minimal cost to economic growth (Miles et al. 2013).

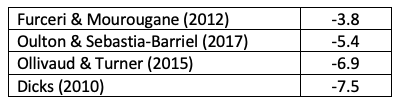

The banking crisis was damaging in many ways, most obviously through the output and fiscal costs of the recessionary shock that it imposed on the economy. The key point for the argument of this column is that it reduced the level of potential output in the economy and accordingly raised the structural budget deficit. This effect comes through decreases in capital, human capital and total factor productivity. A conventional estimate might be that the crisis of ten years ago probably reduced the level of potential output in the UK by somewhere between 3.8% and 7.5% (Table 1).

Table 1 Estimates of the impact of the banking crisis on the level of UK potential output (% GDP)

Note: the estimates in the first two rows are derived from econometric analysis of the average effects of past banking crises. The third and fourth rows are estimates for the UK in the context of the 2007-2009 crisis.

Sources: as listed above.

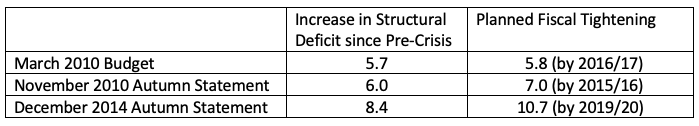

Plans for fiscal tightening were formulated in the context of contemporary estimates of the increase in the structural budget deficit since before the crisis (Table 2). Both the outgoing Labour government and the incoming Coalition government accepted the case for significant fiscal consolidation to restore fiscal sustainability, although the parties differed somewhat on its composition, size and timing. Austerity was a bi-partisan policy response to the fiscal implications of the banking crisis without which it would not have been instigated by either party.

Table 2 Fiscal implications of the banking crisis (% GDP)

Source: Emmerson and Tetlow (2015).

In the event, the austerity programme relied very heavily on cuts to public expenditure which comprised 89% of the fiscal consolidation. In turn, a substantial part of these cuts were implemented through reductions in grants to local authorities which fell by 36.3% on average between 2009/10 and 2015/16. Across local authorities the reductions in public spending per person ranged from 46.3% to 6.2% with the most deprived areas experiencing relatively large cuts (Innes and Tetlow 2015).

After 2010 support for UKIP in local elections surged to the extent that they became a serious electoral threat to the Conservatives who therefore promised a referendum on EU membership. In a difference-in-differences analysis, Fetzer (2018) shows that rising support for UKIP at the local level was strongly correlated over time with the impact of austerity in areas with weak socioeconomic fundamentals. The effects are sizeable: for a district experiencing the average austerity shock UKIP’s vote share would rise by 3.58 percentage points based on the pooled estimate for the post-2010 period and 11.51 percentage points based on the estimate for 2015. Given the tight relationship between the vote shares of UKIP in elections and Leave in the referendum, these results suggest that Remain would very probably have won in the absence of austerity.

Clearly, in principle, fiscal consolidation could have been designed differently; for example, increased taxation could have played a much bigger part. Also, the Conservatives winning a majority in 2015 and having to implement their referendum promise was something of a surprise especially as fiscal consolidation was still ongoing. As it turned out, however, the sequence of events seems clear – the financial crisis led to an austerity programme which boosted support for UKIP enough to make the Conservatives promise a referendum and antagonised left-behind voters whose protest votes were enough to tip the balance for Leave.

So, Brexit is a legacy of the banking crisis although it was not an inevitable consequence. With this analysis to build on, in a recent paper I calculated a total impact on potential output in which I added the indirect impact through Brexit to the direct impact of the banking crisis (Crafts 2019).

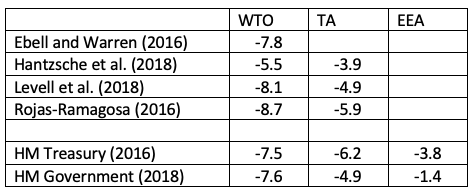

The general assumption in studies of the economic impact of Brexit is that it will entail an increase in trade costs for the UK. In turn, this will imply a reduction in trade volumes and, accordingly, an adverse impact on the level of productivity and thus on the level of GDP relative to the counterfactual of staying in the EU.1 The magnitudes of these effects depend on the details of the new trading arrangements that are assumed to supersede EU membership as well as on model specifications. A ‘soft Brexit’ – for example, the UK leaving the EU but staying in the European Economic Area – would be expected to have a smaller negative effect than a ‘hard Brexit’ – for example, leaving without a deal and trading on a WTO-rules basis – and a trade agreement with the EU would presumably have an intermediate effect.

Membership of the EEA seems unlikely under the present government. In that case, the TA and WTO columns of Table 3 can be seen as representative of mainstream estimates of the impact of Brexit on the level of UK potential output when adjustment is complete perhaps after 10 years or so. The range is from -3.9% to -8.7% of GDP.2

Table 3 Estimates of the long-term impact of Brexit on the level of UK potential output (% GDP)

Note: all estimates include long-term impact on level of productivity but do not take account of any impact from migration.

Sources: as listed above.

This implies that a new structural budget deficit would emerge even allowing for the ending of the UK’s net budgetary contribution to the EU. Based on the arithmetic in Emmerson et al. (2016) this would amount to about 5.7% of GDP if a hard (WTO) Brexit reduced potential GDP by 8.7%.3 This would bring a whole new dimension to the concept of ‘self-defeating austerity’. A quest to eliminate a structural deficit estimated by HM Treasury at around 5% of GDP in 2010 would have given rise to an even bigger one down the line.

The banking crisis and Brexit are usually seen as two unrelated setbacks. In fact, there is a close connection between them which runs through the fiscal consolidation that had to be undertaken in the wake of the financial crisis. The pain of austerity promoted the rise of UKIP, a referendum on EU membership, and a win for Leave. None of these outcomes was by any means certain ex ante but they were the realised results of the policy response to the banking crisis. If Brexit is seen as an outcome of the banking crisis, then the total loss of potential output from that debacle is approximately doubled and lies in the range 7.7% to 16.2% of GDP.

The implication is that, if the risks of unfortunate policy responses following a crisis are taken into account, there are even stronger reasons to regulate the banking system strictly, in particular to ensure that it has adequate levels of loss absorbing equity capital. Miles et al. (2013) show that the social benefit-cost ratio of reducing leverage substantially is high in any case. The events of the last ten years indicate that it is even higher than they thought.

References

Crafts, N (2018), “Industrial policy in the context of Brexit”, Fiscal Studies 39: 685-706.

Crafts, N (2019), “The fall in potential output due to the financial crisis: a much bigger estimate”, CEPR Discussion Paper No. 13428.

Dicks, M (2010), “The UK’s productive capacity: surveying the damage”, in R Chote, C Emmerson and J Shaw (eds.), The IFS Green Budget: February 2010, Institute for Fiscal Studies.

Ebell, M and J Warren (2016), “The long-term economic impact of leaving the EU”, National Institute Economic Review 236: 121-138.

Emmerson, C, P Johnson, I Mitchell and D Phillips. (2016), Brexit and the UK’s Public Finances, Report No. 116, Institute for Fiscal Studies.

Emmerson, C and G Tetlow (2015), “Public finances under the coalition”, in C Emmerson, P Johnson and R Joyce (eds.), IFS Green Budget 2015, Institute for Fiscal Studies.

Erken, H, R Hayat, C Prins, M Heijmerikx and I de Vreede (2018), “Measuring the permanent costs of Brexit”, National Institute Economic Review 244: R46-R55.

Fetzer, T (2018), “Did austerity cause Brexit?”, University of Warwick CAGE Working Paper No. 381.

Furceri, D and A Mourougane (2012), “The effect of financial crises on potential output: new empirical evidence from OECD countries”, Journal of Macroeconomics 34: 822-832.

Hantzche, A, A Kara and G Young (2018), The Economic Effects of the Government’s Proposed Brexit Deal, NIESR.

Independent Commission on Banking (2011), Final Report.

Innes, D and G Tetlow (2015), “Delivering fiscal squeeze by cutting local government spending”, Fiscal Studies 36: 303-325.

Levell, P, T Sampson, A Menon and J Portes (2018), The Economic Consequences of the Brexit Deal, UK in a Changing Europe.

HM Government (2018), EU Exit: Long-Term Economic Analysis. Cm 9742.

HM Treasury (2016), HM Treasury Analysis: the Long-Term Economic Impact of EU Membership and the Alternatives. Cm 9250.

Miles, D, J Yang and G Marcheggiano (2013), “Optimal bank capital”, Economic Journal 123: 1-37.

Minford, P (2015), Should Britain Leave the EU?, Edward Elgar.

Ollivaud, P and D Turner (2015), “The effect of the global financial crisis on OECD potential output”, OECD Journal: Economic Studies2014: 41-60.

Oulton, N and M Sebastia-Barriel (2017), “Effects of financial crises on productivity, capital and employment”, Review of Income and Wealth 63: S90-S112.

Rojas-Ramagosa, H (2016), Trade Effects of Brexit for the Netherlands, CPB.

Endnotes

[1] These are the assumptions made by the vast majority of studies. Erken et al. (2018) argue that Brexit would reduce the rate of growth (rather than the level) of GDP by 0.8% per year and thus have a much bigger long run impact. Minford (2015) predicts a positive impact on GDP largely because Brexit will mean escaping onerous future regulation which in due course would lower GDP substantially if the UK stayed in. I disregard both these estimates.

[2] No allowance is made in Table 3 for the effects of post-Brexit reforms to supply-side policies once freed from the constraints of EU membership. These could be positive but seem much more likely to be negative, see Crafts (2018).

[3] Emmerson et al. (2016) estimated that a decline of 1% in GDP due to Brexit would increase new public sector borrowing by 0.7% of GDP and that a reduction of 0.6% in GDP would approximately cancel out the improvement in the public finances from ending the UK’s net budgetary contribution. So, the net effect of ‘hard Brexit’ would be (8.7 – 0.6) x 0.7 = 5.67% of GDP.