Anxiety about Spain and Italy’s bond spreads has returned with a vengeance. In this dangerous race to the bottom, Italy was in lead position back in November but Spain has now overtaken and is once again at the epicentre of the crisis. Spain’s macroeconomic imbalances are much larger than Italy’s, but, to grow again, both countries confront an enormous challenge in reorienting their economies towards export- and import-competing sectors.

There is no lack of ideas about what a growth policy for Spain, Italy, and other troubled countries in the European periphery would look like (see for instance Alcidi and Gros 2012 on Spain). But most of these ideas misdiagnose the cause of the crisis as one of shortage of credit or of excessive austerity. The Eurozone crisis is at its root not a fiscal or banking crisis, but a crisis of competitiveness hatched over about 15 years, and reflected in large differences in labour cost, export performance, and balance of payments between the periphery and the core, notably Germany (Dadush et al. 2010). Accordingly, fiscal and banking remedies, while badly needed, will not – by themselves – durably resolve the crisis.

Fixing the competitiveness problem is essential for sustained growth.

- First, extra-European markets and more specifically emerging markets are where the big sources of growth are today, and the ability to compete in those markets is crucial.

While domestic demand in the periphery is expected to shrink by over 2% this year, and to be flat in the rest of Europe, it is likely to grow by over 5% in emerging markets and by over 2% in the US and other advanced countries (IMF 2012).

- Second, given the current line-up of cost competitiveness, domestic demand in the periphery cannot grow without increased foreign borrowing (a wider current-account deficit), which markets are unlikely to provide.

- Third, failure to regain competitiveness against Germany, Europe’s largest exporter by a huge margin, signifies that the euro will remain simply too high for the periphery.

Movement towards a fiscal union, the most widely touted solution to the Eurozone crisis, would be a wise choice for many reasons, but will do nothing to resolve the competitiveness problem except buy time.

Comparing the adjustment in Spain and Italy

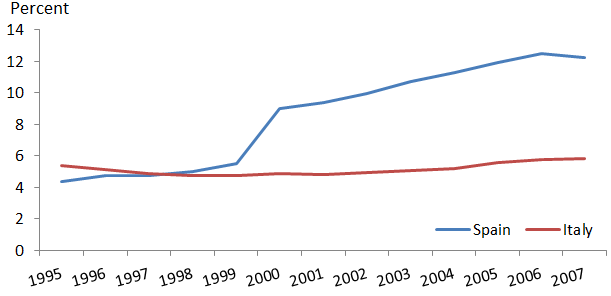

Spain grew well over twice as fast as Italy in the decade before the financial crisis, but largely on the back of a huge housing bubble (see Figure 1). Italy’s productivity and demographics are also less propitious to growth than in Spain. Spain’s subsequent housing bust has been as dramatic as its huge boom, and its macroeconomic imbalances – unemployment and fiscal deficit – as well as (probably) its banking troubles are now much worse than Italy’s. Even though Italy has a larger government debt, Spain is much more externally indebted than Italy because of its large private sector debt, partly a result of the housing bubble. One implication of all this is that, to reignite sustainable growth, Spain has to make a bigger adjustment towards the traded sector than Italy does.

Figure 1. Housing as a share of GDP

Source: Eurostat

Both countries, however, have a lot of catching up to do on the trade front. Between 1997 and 2007, their real effective exchange rate, based on unit labour costs in dollars, appreciated by 11% and 9% in Spain and Italy, respectively, while Germany saw a depreciation of over 14%. This competitiveness loss was reflected in a shift away from exports and deteriorating current-account balances, with Spain’s deterioration much more pronounced than Italy’s. For example, over the pre-crisis decade, exports as a share of GDP fell by 3.4 percentage points and one percentage point in Spain and Italy, respectively, but increased by an extraordinary 20 percentage points in Germany. Meanwhile, Germany’s current-account balance improved by 8 percentage points, while Spain and Italy’s deteriorated by ten and four percentage points, respectively.

How important is the widening competitiveness gap between Spain and Italy, respectively, and Germany? Shifts in the cost of doing business across regions of the US are instructive. For decades, firms have preferred the American South because of its relatively low level of taxes, lower labour and real estate costs, and sparse unionization. In 2000 this cost difference was 5%. Over the past decade the American Midwest has largely closed this gap. This relatively small change is now significantly affecting firms’ location decisions (Dougherty 2012).

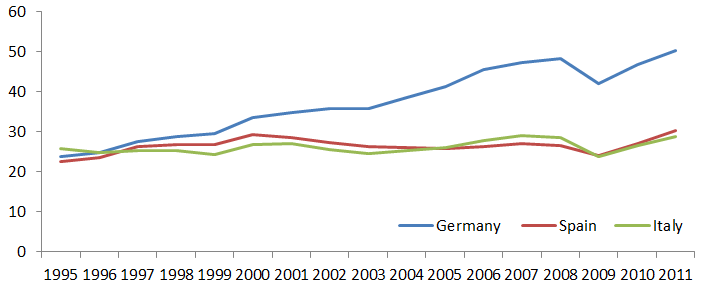

Unfortunately, there is little sign that extraordinarily divergent trends in competitiveness within Europe are being reversed (see Table 1). Spain, which has suffered an even deeper recession than Italy, is showing some signs of adjustment. Between 2007 and 2011, Spain’s real effective exchange rate based on unit labour costs depreciated by 4.4%, while Italy’s actually appreciated further, by 2.2%. Meanwhile, Germany’s real exchange rate was more or less stable even though domestic demand there held up much better. Not surprisingly, exports as a share of GDP increased by 3.2 percentage points in Spain, but hardly budged in Italy (see Figure 2). Spain’s current-account balance, moreover, improved by six percentage points of GDP, while Italy’s deteriorated further, by a percentage point.

Table 1. Is there rebalancing?

|

Real domestic demand (% growth) |

Real effective exchange rate based on unit labour costs in US$ (% growth) |

Current account/share of GDP (%-point change) |

Exports/share of GDP (%-point change) |

Government debt/share of GDP (%-point change) |

Fiscal deficit/share of GDP (%-point change) |

Net international investment position/share of GDP (%-point change) |

Net international investment position, 2011 level (millions of US$) |

|

| Germany |

3.4 |

0.1 |

-2.4 |

2.9 |

16 |

-1.2 |

9.3 |

1,189,558.8 |

| Italy |

-4.5 |

2.2 |

-1 |

-0.1 |

17 |

-2.3 |

2.2 |

-455,831.5 |

| Spain |

-8.6 |

-4.4 |

6.2 |

3.2 |

32.3 |

-10.4 |

-14.4 |

-1,284,088.7 |

Source: European Commission AMECO database, Eurostat, IMF Stat

Note: All figures cumulative 2007-2011

Figure 2. Exports as a share of GDP

Source: Eurostat

Various surveys tend to confirm that the competitive adjustment in Spain and Italy is sluggish to say the least, though Spain does a little better. The World Bank’s latest Doing Business report, for example, ranked Spain 24 out of 31 advanced countries and Italy ranked 30th – just above Greece (World Bank 2011). These rankings score Germany much higher and have not changed much since the crisis hit. The World Economic Forum’s Global Competitiveness Index, also shows little change. Italy continues to receive very low marks for its infrastructure and macroeconomic environment, and both Spain and Italy rank abysmally low on labour-market efficiency – 96 and 126 out of 134 countries, respectively (World Economic Forum 2011).

Looking at trends over a longer period suggests that Spain is on a stronger export trajectory than Italy, though starting from a lower level. Spain (whose labour force and capital stock has expanded rapidly) has held on to its export share in world markets better than Italy. Between 1995 and 2011, Spain’s exports as a share of world trade fell from 1.9% to 1.6%, while Italy’s share declined much more sharply from 4.5% to 2.9%. As a share of total EU exports, Spain’s share has stayed steady since 2001 at just under 5%, but Italy’s dropped sharply from 10.1% to 8%.

Exports in both Spain and Italy are less oriented towards Asia and China than they could be and less than that of Germany. But Spain’s exports remain even more Europe-centric than Italy’s. In 2011, roughly 3% of Italy’s exports went to China, while only 1.6% of Spain’s did. Asia as a whole (excluding Japan), moreover, accounted for 15% of Italy’s exports, but only a little over 9% of Spain’s. Spain’s exports are also less concentrated in manufactures, including high value-added manufactures, than Italy’s. In 2011, 61% of Spain’s exports consisted of machinery, transport equipment, and other manufactured goods, while 74% of Italy’s did, the same share as Germany.

Conclusion

In sum, neither Spain nor Italy look particularly well positioned to embark on an export-led recovery. Spain’s export prospects look better than Italy’s, but Spain also needs a much bigger adjustment towards tradables to correct its macroeconomic imbalances. This rather gloomy assessment is consistent with the latest IMF forecast, which shows Italy’s exports growing at just 1% in 2012, a little less than Germany’s and Spain’s, though all three countries are expected to continue rapidly losing share in world trade to emerging markets (IMF 2012).

What to do? Spain and Italy can no longer devalue nor use independent monetary policy or trade policy (at least in goods). But they can undertake domestic reforms that make them more attractive as an export base and help them attract foreign investment. These range from easing regulations, increasing competition among domestic suppliers in all sectors, encouraging lower wage settlements beginning in the public sector, shifting the tax burden from payrolls onto consumption, facilitating trade through infrastructure investments, reduction of red tape, export credit, export promotion, and encouraging inward foreign investment. Some of these measures take a long time to work, but there is no realistic alternative to their determined pursuit. Tough austerity policies over many years are also an inevitable part of containing domestic demand and moderating wages and prices but can be progressively eased as competitiveness and growth are re-established. Failure to re-establish competitiveness in the periphery means either a catastrophic euro exit, or accepting decades of deindustrialisation, depopulation, and decline.

References

Alcidi, Cinzia and Daniel Gros (2012), “What’s wrong with Spain?”, VoxEU.org, 15 April.

Dadush, Uri et al. (2010), “Paradigm Lost: The euro in Crisis”, Carnegie Endowment for International Peace.

Dougherty, Conor (2012), “Midwest Closes a Cost Gap”, Wall Street Journal, 20 May.

International Monetary Fund (IMF). (2012), World Economic Outlook, April.

World Bank. (2011), “Doing Business”, October.

World Economic Forum (2011), “Global Competitiveness Report 2011-2012”, September.