Editors' note: This column was updated on 3 December 2020.

Differences in productivity across countries account for most cross-country differences in income (Caselli 2005). The pioneering work of Restuccia and Rogerson (2008) and Hsieh and Klenow (2009) suggests that the misallocation of inputs, and in particular capital, may explain these large disparities in productivity. Yet, despite the potential importance of misallocation for explaining incomes, quantifying its aggregate effects and identifying the best policy tools to reduce it are complicated by two challenges.

First, on the policy side, there is limited evidence on what policy tools can reduce misallocation, and therefore the literature provides policymakers with little guidance on what levers to pull to reduce misallocation (Syverson 2011). Yet, in low-income countries, where there may be large frictions in the allocation of resources, policies that reduce misallocation could prove to be a powerful tool to foster economic growth.

Second, on the measurement side, a growing body of work has criticised standard methods that use the cross-sectional dispersion of the marginal revenue products of inputs to quantify the aggregate effects of misallocation. When using these methods, measurement error and model misspecification may inflate estimates of the effects of misallocation on aggregate productivity. For example, Rotemberg and White (2017) show that standard measurement error corrections can account for all the observed differences in misallocation in cross-sectional data between the US and India. Similarly, Bils et al. (2020), who develop a method to correct for measurement error, estimate substantially lower gains from reducing misallocation in India to US levels relative to Hsieh and Klenow’s (2009) original estimate that eliminating misallocation would increase manufacturing productivity by 40-60%.

This measurement challenge has important implications outside of academia. If measurement problems inflate estimates of the gains from pursuing certain policies, these estimates may lead policymakers and organisations to pursue costly policies with relatively little benefit.

The Indian experiment

In a recent paper (Bau and Matray 2020), we leverage an unusual policy experiment to make progress on both these challenges. To quantify the effects of foreign capital liberalisation on misallocation and aggregate productivity in treated industries, we study a foreign capital liberalisation policy that took place in India in the early 2000s using detailed firm-balance sheet microdata. In 2001 and 2006, India removed restrictions on foreign investments in specific industries, introducing automatic approval of foreign direct investments up to 51% of domestic firms’ equity. This reform may have reduced capital market frictions. The staggered introduction of the policy across industries and over time allows us to compare the changes in the outcomes of firms in industries that did and did not liberalise and estimate the effects of foreign capital liberalisation on the growth of firms facing the greatest constraints on their access to capital.

To measure the effects of foreign capital liberalisation, we combine this policy experiment with firm-level data from Prowess compiled by the Centre for Monitoring the Indian Economy (CMIE). The dataset contains information from the income statements and balance sheets of companies comprising more than 70% of the economic activity in the organized industrial sector of India. Thus, it is representative of large and medium-sized Indian firms.

Better capital allocation

To estimate the effect of opening up to foreign investment on capital allocation, we first determine whether a firm is ex-ante capital-constrained by ranking firms based on their pre-reform marginal revenue product to capital (MRPK). MRPK is the measure of the output per additional unit of capital used by a firm. It is often used to measure the degree of the capital constraints faced by a firm since capital should flow to the firms with the highest returns. Therefore, a firm ‘stuck’ with a large return on investment is likely to be prevented from growing because it faces a high cost of capital, leading to misallocation.

As a result of the liberalisation policies, we find that capital-constrained firms (those with MRPKs above the median in their disaggregated industry) differentially expanded their assets by 57%, spent more on labour (+27%), and increased their revenue by 25%. Overall, the MRPKs of capital-constrained firms fell by 35%. This indicates that the cost of capital fell for firms with initially high costs of capital and indicates that capital misallocation also fell. In contrast, firms that we identify as capital-unconstrained in the deregulated industries did not expand relative to similar firms in non-deregulated industries.

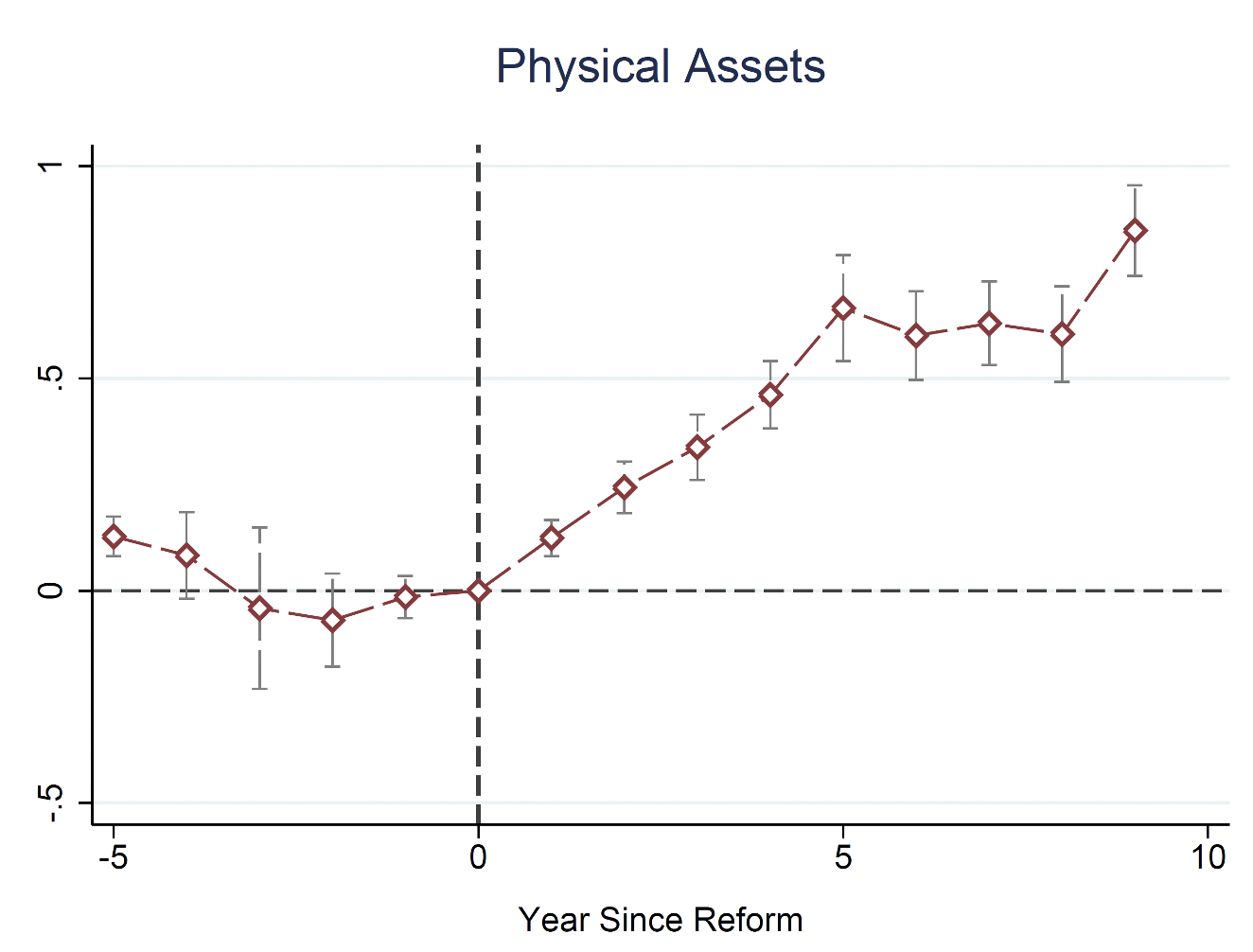

One natural concern is that these results are driven by changes in misallocation over time that would have happened in the absence of the reforms. To evaluate if this is the case, we examine whether the timing of the increase in capital for constrained firms and the decrease in MRPK lines up with the timing of the reforms. We find no evidence that capital increased and MRPK decreased for initially high MRPK firms in liberalised industries prior to the reform. In contrast, exactly following the reform episodes, there is a progressive and continuous increase in physical capital (Figure 1). This lack of pre-reform correlation is reassuring, as it suggests that our results are not biased by time trends, while the progressive increase in capital post reform implies that reforms such as the opening-up to foreign investors can take time (several years) to bear fruit.

Figure 1

Notes: This figure plots the yearly coefficient capturing the differential effect of capital liberalisation on ex ante capital constrained firms from a difference-in-differences estimator, where the dependent variable is the natural logarithm of the total of firm property, plant, and equipment. “0” is normalised to be the first year an industry opens up to foreign capital.

The importance of local capital markets

The main motivation for opening up to foreign capital to reduce misallocation is that the local capital market is unable to allocate domestic capital efficiently. Thus, we might expect that the policy would have greater effects in less-developed domestic credit markets.

To see if this is the case, we explore heterogeneity in the effects of the policy based on the development of state-level banking markets prior to the reforms. Since India is a federal country, with much of the regulation of its banks and bankruptcy procedure decentralised at the state level, we can exploit the vast geographic disparities in how easily firms can access bank credit.

We find that local capital markets play an important role in determining the policy’s effects. When we compare firms located in states at the first quartile of the domestic financial development distribution with firms located in states in the top quartile, we find that the effect of opening up to foreign investment on capital constrained firms’ capital is 50% greater.

Quantifying the aggregate effect of the liberalisation

While the reduced-form results described above show that opening up to foreign capital reduces misallocation, they do not tell us to what degree this increased aggregate productivity in treated industries. To quantify the policy’s aggregate effects, we develop a method, based on a decomposition of changes in the Solow residual introduced by Petrin and Levinsohn (2012) and Baqaee and Farhi (2019), to translate our quasi-experimental microeconomic estimates into a measure of bounds on the policy’s aggregate effects. Importantly, this decomposition is general and makes no assumptions about returns to scale, cross-good aggregation, or input-output networks.

The key components of this decomposition are the firm-level changes in inputs due to the policy – which our reduced-form strategy allows us to estimate – and the baseline level of misallocation, which cannot be directly estimated with the natural experiment. However, from the decomposition, we observe that the aggregate effect of a policy that strictly reduces misallocation is increasing in the baseline amount of misallocation. The minimum amount of baseline misallocation must be the amount of misallocation the policy eliminated, and we can estimate this using our natural experiment. Thus, our natural experiment estimates allow us to put a lower bound on the baseline misallocation. The same approach can be easily implemented in other settings where researchers have access to firm-level data and are studying exogenous policy variation.

On the other hand, attributing all of the pre-treatment cross-sectional variation in marginal revenue products of inputs to misallocation provides us with an upper bound for baseline misallocation. This is because this measure is likely to be inflated by measurement error and model misspecification error. With this upper bound measure in hand, we can also use the decomposition to produce an upper bound on the aggregate effects of the policy.

We find that the liberalisation of access to foreign capital led to an increase in the Solow residual of the treated industries in the manufacturing sector of 4-17%. Even at a lower bound, the policy substantially increased the aggregate productivity of treated industries.

Thus, we show that exploiting variation from a natural experiment can allow researchers to estimate aggregate effects from reducing misallocation that – unlike cross-sectional or time series comparisons – are less sensitive to measurement or model misspecification error.

References

Baqaee, D, and E Farhi (forthcoming), “Productivity and Misallocation in General Equilibrium”, Quarterly Journal of Economics.

Bau, N and A Matray (2020), “Misallocation and Capital Market Integration: Evidence from India”, Working Paper

Caselli, F (2005), "Accounting for Cross-Country Income Differences," in P Aghion and S Durlauf (eds), Handbook of Economic Growth.

Hsieh, C-T and P J Klenow (2009), “Misallocation and manufacturing TFP in China and India”, Quarterly Journal of Economics 124(4): 1403–1448.

Nishida, M, A Petrin, M Rotemberg, and T K White (2017), “Are We Undercounting Reallocation’s Contribution to Growth?”, working paper.

Petrin, A, and J Levinsohn (2012), “Measuring aggregate productivity growth using plant-level data”, The RAND Journal of Economics 43(4): 705–725.

Restuccia, D, and R Rogerson (2008), “Policy distortions and aggregate productivity with heterogeneous establishments”, Review of Economic Dynamics 11(4): 707–720.

Rotemberg, M and T K White (2017), “Measuring Cross-Country Differences in Misallocation,” working paper.

Syverson, C (2011), “What Determines Productivity?”, Journal of Economic Literature 49(2): 326–365.