The financial crisis of 2007-2008 made it clear that widespread failures and losses of financial institutions impose a negative externality on the real economy. Curbing such ‘systemic risk’ has become a key objective for policymakers across the world. As a result of this, an early literature has focused on understanding the impact of policy interventions on various measures of systemic risk. For instance, Berger et al. (2018) investigate whether the TARP – the bailout of the US financial system – was successful in terms of reducing the systemic risk of the affected institutions and hence contributed to stabilising the US economy.

An alternative to recapitalising banks directly as in the TARP is to increase capital requirements for banks. This has indeed been a route followed by many policymakers after the crisis. For example, the European introduction of Basel III (CRD IV/CRR) proposes a specific ‘systemic risk buffer’. However, there is yet limited evidence on how successful capital requirements are in terms of reducing systemic risk.

In a recent paper, we try to shed light on this question (Bostandzic et al. 2018). Specifically, we look at a rich set of systemic risk measures prior to, during, and after the EBA capital exercise of 2011. The EBA capital exercise was aimed at shoring up confidence in the European banking sector in the midst of the sovereign debt crisis. It lead to an increase in the Tier 1 capital requirement to 9% for a subset of European banks (‘EBA banks’).

In our paper, we compare the evolution of systemic risk measures for EBA banks with similar outcomes with other, comparable European banks. Since systemic risk is hard to measure, we rely on several different measures. One popular measure is SRISK (Acharya et al. 2012), which is meant to capture an institution’s estimated capital shortfall conditional on a market downturn. Intuitively, SRISK measures how much capital would be needed in order to restore the capital ratio of a financial institution should there be a downturn in financial markets. In our paper, we focus on SRISK as a measure of systemic risk, in conjunction with three other popular measures.

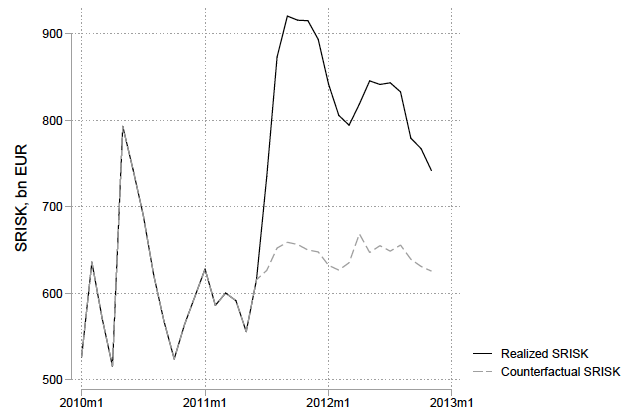

The main take-away from our empirical analysis is that the increase in capital requirements for EBA banks lead to heightened measures of systemic risk. This is the opposite of what was intended. To see this, consider Figure 1 where we plot the SRISK of the European banking sector, together with a counterfactual series based on our estimates.

Figure 1 Aggregate SRISK, realised vs counterfactual

SRISK for our sample of banks increases initially to approximately €900 billion at the onset of the capital exercise. It remains elevated also after the capital exercise has ended. In contrast, our counterfactual SRISK remains relatively stable throughout the reform-period.

What is causing this increase in the estimated capital shortfall? In our paper, we investigate the underlying reasons for why we observe an increase in the various systemic risk measures. Benoit et al. (2014) show that the different systemic risk measures we consider can be expressed as transformations of market risk measures and balance sheet items of banks. Specifically, the variation in systemic risk measures across institutions are driven by a bank's systematic risk, its Value-at-Risk (VaR), its return volatility, the correlation coefficient between bank and market equity returns, book debt, and market capitalisation. We therefore analyse how higher capital requirements affect these fundamental institution-specific drivers of systemic risk.

Our empirical analysis reveals that capital requirements primarily lead to a decline in the expected returns of EBA bank stocks and an increase in the covariance with market returns. In turn, these factors lead to an increase in the estimated exposure to systemic risk. This leads to an increase in systematic risk, and reduces VaR (i.e. increases a bank's tail risk) as well as the market value of capital.

Recapitalising weak banks

The empirical analysis in our paper documents that an increase in capital requirements leads to an increase in systemic risk. From a policy perspective, a crucial question is therefore whether there are other policies that are more efficient in terms of reducing banks' systemic risk. Answering this question requires estimates of how other policy interventions affect systemic risk. Two papers are especially relevant for this purpose.

Berger et al. (2018) analyse the effect of participation in the US TARP on systemic risk measures. Relatedly, Mutu and Ongena (2018) analyse the effects on systemic risk for a set of international episodes of recapitalisations, liquidity injections, and public guarantees. A broad conclusion from both papers is that pure recapitalisations decrease systemic risk. Hence, a tentative conclusion from these papers and the analysis we present is that directed recapitalisation is a better policy tool if the objective is to reduce systemic risk. This provides novel support for the key principles of bank capital regulation outlined in Greenwood et al. (2017) which emphasise the need to regulate capital rather than capital ratios, especially after adverse shocks.

Welfare implications

As a final note, it is worth highlighting that this does not imply that capital requirements are welfare decreasing. First, capital requirements are likely to be more efficient in terms of achieving other goals from a social planner perspective, such as reducing the cost of bank over-lending associated with deposit insurance. Hence, it is likely that policymakers should keep both tools in the toolbox, each addressing different concerns. Second, this increase in capital requirements happened during a major economic downturn where the marginal cost of equity is potentially high. Hence, it is unclear whether similar increases in systemic risk in response to increased capital requirements would take place during normal economic times.

References

Acharya, V, R F Engle and M Richardson (2012), “Capital shortfall: A new approach to ranking and regulating systemic risk,” American Economic Review: Papers and Proceedings 102: 59–64.

Benoit, S, J-E Colliard, C Hurlin and C Perignon (2014), “A theoretical and empirical comparison of systemic risk measures,” Working paper.

Berger A N, R A Roman and J Sedunov (2018), “Did TARP reduce or increase systemic risk? The effects of government aid on financial system stability,” Journal of Financial Intermediation, in press.

Bogdanova, B, I Fender and E Takats (2018), “The ABCs of bank PBRs,” BIS Quarterly Review 81.

Bostandzic, D, F Irresberger, R E Juelsrud and G N F Weiss (2018), “Capital requirements and systemic risk: Evidence from a quasi-natural experiment,” Working paper.

Chousakos, K and G Gorton (2017), “Bank health post-crisis,” NBER, Working paper 23167.

Greenwod, R, S G Hanson, J C Stein and A Sunderam (2017), “Strengthening and streamlining bank capital regulation,” Brooking Papers on Economic Activity.