Capital taxation has been widely debated among academics and policymakers alike. The discussion revolves around several factors, ranging from the complex nature of capital to different assessments of inequality, the theoretical validity of optimal tax results, and how to tackle the restrictions imposed by capital mobility (Mirrlees et al. 2011, Piketty 2014, Straub and Werning 2020, Jacobsen et al. 2020).

In a new study (Bastani and Waldenström, 2020), we survey the recent theoretical and empirical research on capital taxation and discuss the implications for the design of taxes on wealth and capital income in advanced economies.

New results on optimal capital taxation

The research on optimal capital taxation has undergone large changes. For a long time, the conventional wisdom was that capital income should not be taxed, mainly due to the influential studies of Atkinson and Stiglitz (1976), Judd (1985), and Chamley (1986). These studies emphasised the costly distortions imposed by capital income taxation on individual savings decisions. In the last decades, however, several notable contributions have challenged these studies, noting that such distortions can be useful to counter other distortions, or to promote equity objectives.

The main argument for taxing capital income, and capital more generally, in this new generation of studies, is that labour income taxation can be a blunt instrument for redistribution when there is substantial heterogeneity in wealth and capital income among individuals with the same labour income. Such heterogeneity arises when one, realistically, assumes that taxpayers differ not only in terms of their labour earning ability (as emphasised by the traditional literature), but also in terms of other characteristics, such as inheritances received, their achievable rates of return on their investments, and their preferences for saving. The combination of labour and capital taxes is therefore able to achieve potentially more efficient redistribution than if labour income were taxed alone.

Other arguments for taxing capital also exist. In countries with high marginal tax rates on labour income, capital taxes can be a way to reduce distortions in labour supply (if high savings and low labour supply go hand-in-hand) and human capital (by increasing the tax symmetry between physical investment and investment in human capital). What causes people to have high capital income can also, in many cases, be the outcome of luck and circumstance, rather than hard work. Thus, taxing capital income is, to some extent, taxing economic rents.

Capital taxation in advanced economies

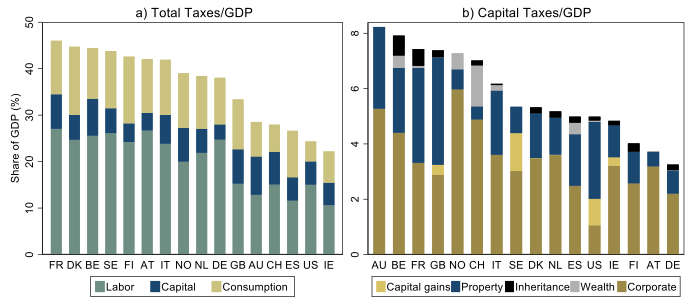

How important are capital taxes relative to other taxes? Which of the different capital taxes generate the largest revenue? Our survey discusses how capital is taxed today. Figure 1 shows tax revenue as a share of GDP in 2018 for 16 OECD countries. The panel on the left shows that capital tax revenue represents between three and eight percent of GDP and between ten and thirty percent of total taxes.

The panel on the right decomposes capital tax revenue across different tax bases and shows that corporate taxation generates the largest capital tax revenue, followed by property taxes. Other capital taxes, such as taxes on inheritance and wealth, generate only a tiny fraction of overall capital tax revenue.

Figure 1 Tax revenues in OECD countries 2018 (percent of GDP)

Source: OECD tax revenues. For Australia, year is 2017. See Bastani and Waldenström (2020) for details on sources and definitions. The figure has been updated with 2018 data for the purpose of this column.

Could capital taxes become the major source of tax revenue? Probably not. With a net capital share of GDP between 15 and 30%, which is the relevant range among OECD countries since the 1980s, and an effective capital income tax rate between 20 and 30%, capital tax revenue as a share of GDP would lie between four and nine percent. Thus, in order for capital taxes to become the major source of tax revenue, either tax rates or capital shares would need to drastically increase, which is unlikely.

Specific capital taxes: What does the research literature say?

Our survey analyses the five most important capital tax schemes employed by countries today. We review theoretical arguments and recent empirical evidence for each of these taxes. The main conclusions are the following:

- Personal capital income should be taxed. Interest income and dividends should be taxed for reasons already mentioned above (heterogeneity in inheritances, investment returns, and preferences for saving, reducing distortions in labour supply and human capital accumulation, and taxing economic rents).

- Property should be taxed. There are strong economic reasons for a property tax. Land is inelastically supplied, housing provides consumption benefits and is also an investment with the same properties as a business asset. In addition, property taxes can be motivated on distributional grounds, as valuable real estate is concentrated in the top of the income distribution.

- Inheritances should possibly be taxed. Taxes on bequests and gifts are administratively complicated and can lead to substantial avoidance costs and tax evasion. In addition, they do not generate much revenue. At the same time, inheritance taxes are equitable as they reduce disparities in life opportunities and could also promote work effort among heirs.

- Wealth taxation should be avoided. We find little support for a tax on the stock of net household wealth. The main attractiveness of the wealth tax is the broad base, which minimises tax-driven investment decisions. Proponents also emphasise its usefulness in targeting large business fortunes. However, many assets are difficult to value appropriately for tax purposes, which implies that the broad base is hard to maintain in practice. In the case of business assets, valuation is particularly difficult, and taxing imputed cash flows leads to liquidity problems. Past experiences of wealth taxation also indicate widespread tax avoidance and tax evasion.

- Corporate income should be taxed. The corporate income tax base is a large and important source of tax revenue. It enables taxing individuals with low labour income and large fortunes derived from inventions, patents or other intellectual property, fortunes that otherwise would avoid taxation by being kept inside corporations. The corporate tax also offers a way to tax foreign investors who do not pay residence-based taxes. However, capital mobility and tax competition erode the corporate income tax base. Hence, international coordination is required.

Concluding remarks

Making a full account of the economic role of capital taxation in advanced economies is an extremely demanding task. Our survey brings together the state of the art in both the theoretical and empirical literature on capital taxation and discusses concrete lessons for the design of capital taxes. It is our hope that the complex issue of capital taxation will continue to attract interest of researchers in the future.

References

Atkinson, A B and J E Stiglitz (1976), “The design of tax structure: direct versus indirect taxation”, Journal of Public Economics 6(1-2): 55-75.

Bastani, S, D Waldenström (2020),“How Should Capital Be Taxed?”, Journal of Economic Surveys 34(4), 812-846.

Chamley, C (1986), “Optimal taxation of capital income in general equilibrium with infinite lives”, Econometrica 54(3): 607-622.

Judd, K L (1985), “Redistributive taxation in a simple perfect foresight model”, Journal of Public Economics 28(1): 59-83.

Mirrlees, J, S Adam, T Besley, R Blundell, S Bond, R Chote, M Gammie, P Johnson, G Myles, and J Poterba (2011), Tax by Design: The Mirrlees Review, Oxford University Press.

Straub, L and I Werning (2020), “Positive Long-Run Capital Taxation: Chamley-Judd Revisited”, American Economic Review 110(1): 86-119.

Piketty, T (2014), Capital in the Twenty-First Century, Belknap, Harvard University Press.