Recently the CEO of Black Rock, Larry Fink, made headlines by predicting that climate policies could lead to a large inflation shock.1 This is of first order importance for all central banks, in particular in light of the ECBs’ new strategy focus on climate risks. Will a secular increase in the price of carbon (and carbon equivalents) put upward pressure on the price level? How large is this effect likely to be? How much does this effect depend on the reaction of monetary policy? Should central banks take such risks into account in their strategies?

Modelling studies on the effect of carbon taxation point to sizeable effects on inflation, based on the assumption that higher energy prices are largely passed on to consumers and the central bank follows a Taylor rule. For instance, McKibbin et al. (2014) consider a US$15 carbon tax implemented in the US and find that it causes a rise in inflation of 0.8% during the first year of the policy. In practice, the effect of a carbon tax on inflation will depend on many factors, including the tax rate, coverage, and incidence, as well as the fiscal and monetary policy responses.

In a new study (Konradt and Weder di Mauro 2021), we use the experience of three decades of carbon taxation in Canada and Europe to explore the effect empirically.

We find that carbon taxes do not have to be inflationary, and may even be deflationary. Our evidence suggests that the increase in energy prices was more than offset by a fall in the prices of services and other non-tradables. Our results are consistent across Canadian provinces and European countries, and survive various robustness checks. At least in case of British Columbia, a contraction in household incomes and expenditures, in particular among the richer households, could explain the deflationary effect.

Our findings

a) Deflationary effects

Our analysis builds on two separate empirical methods, the synthetic control method (Abadie et al. 2010), and local projections (Jordà 2005) to identify the effects on the consumer price index (CPI) and its components on the intensive margin, as well as the extensive margin.

Following Metcalf and Stock (2020), we consider a $40 carbon tax implementation that remains flat over time and accrues on 30% of total GHG emissions. We estimate dynamic impulse responses based on three provincial carbon taxes in Canada and 15 national carbon taxes in Europe, respectively.

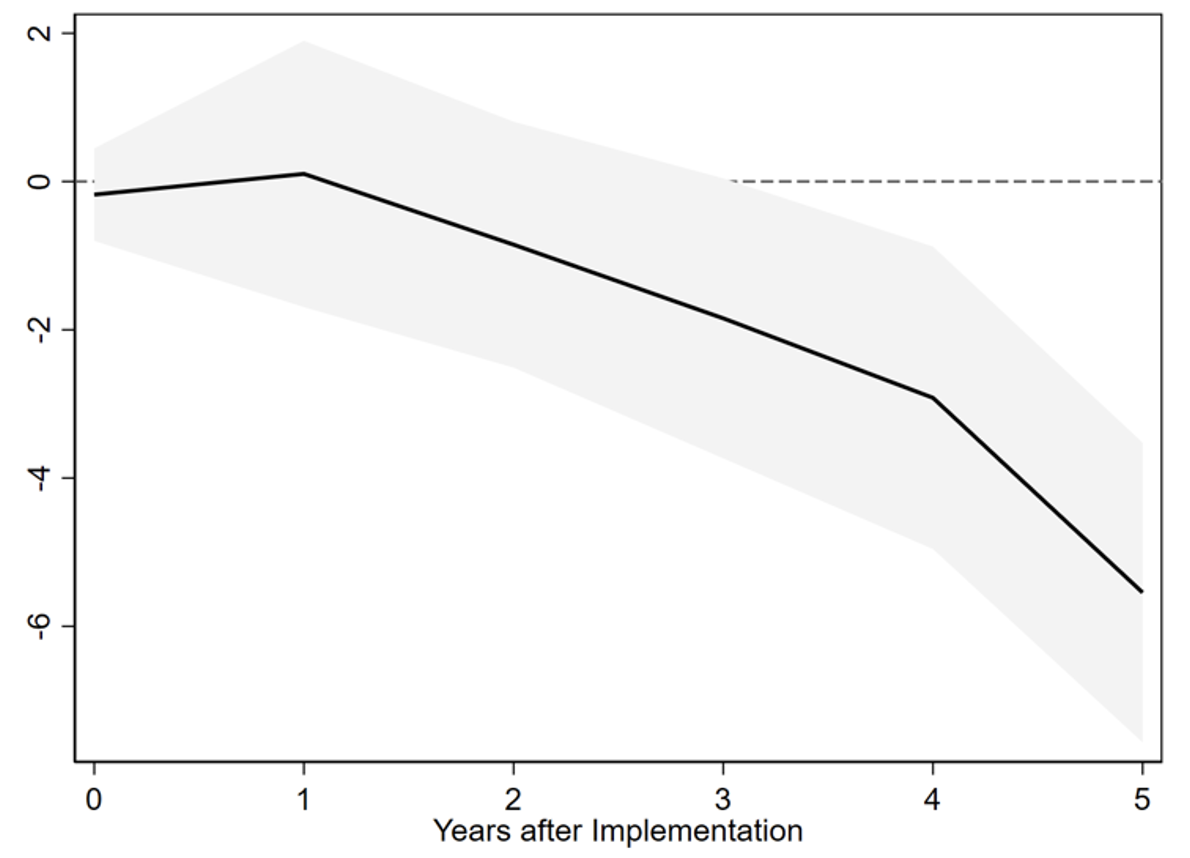

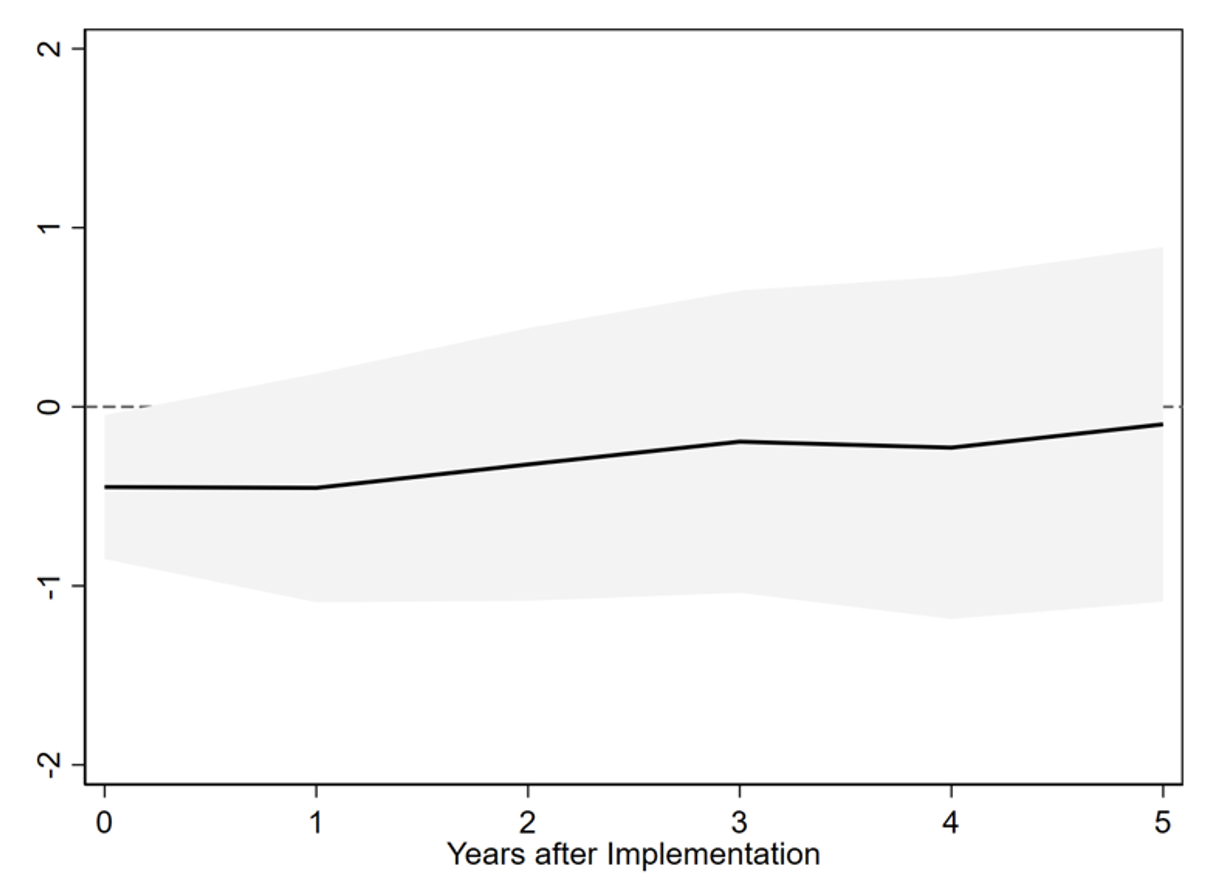

Figure 1 plots the cumulative impulse response (assuming a parallel trends assumption) for the Canadian (Panel A) and European sample (Panel B), including country (or province) and year fixed effects. The shaded grey bounds denote 95% confidence bands.

The impulse response of CPI in Canadian provinces following a carbon tax implementation is economically sizeable and statistically significant. Five years removed, CPI falls by a total of 6 points following the enactment of a $40 tax on 30% of GHG emissions. For European countries we estimate a contemporaneous negative response of about –0.5 index points, which is statistically significant at the 5% confidence level. In the following years, the impulse response trends upwards. After five years, the estimates point to a small, negative cumulative effect on CPI, which is, however, not statistically significant.

Figure 1 Cumulative impulse responses of CPI

A. Canada

B. Europe

Note: This figure shows the cumulative impulse response of CPI to a $40 carbon tax with 30% emission coverage, estimated for Canada (panel A) and Europe (panel B), respectively. Shaded grey bounds show 95% confidence bands.

Next, we check whether relative (final) prices for energy versus other goods changed in response to the tax enactments, as intended. On this front, carbon taxes seem to have ‘worked’. In most cases, energy prices rose in the period after carbon taxes were implemented (compared to a synthetic control group). At the same time, prices of other components of the CPI basket, mostly non-tradables, fell. Again, this result holds for both Canadian and European jurisdictions.

Our main finding that carbon taxes do not lead to an inflationary response is remarkably robust. For Europe, it holds for early as well as late carbon tax adopters, although the deflationary effect is smaller for the latter group. Moreover, the result is robust for countries with ‘high’ carbon taxes. The finding also overwhelmingly holds across jurisdictions that manage their own monetary policy and those that do not (provinces in Canada or countries in the euro area). Finally, deflationary effects also dominate regardless of whether or not countries are ‘recycling’ carbon tax revenues.

We cannot fully control for other factors driving our results. Most of the carbon taxes in our sample were implemented during the Great Moderation or secular stagnation decades. However, these forces would apply equally to the non-carbon tax jurisdictions, which are in our control group. The same is true for the various financial crisis in the last three decades.

b) Falling household income and expenditure in British Columbia, mostly among the rich

Finally, we turn to the macroeconomic and distributional effects of the carbon taxes in Canada in order to understand what is driving our muted price responses. One hypothesis is that carbon taxes put downward pressure on wages (consistent with Yamazaki 2017) and aggregate income. Lower real income could lead households to cut expenditure and consume fewer goods and services at the margin, akin to a negative demand shock.

We also explore heterogeneous effects on households across the income distribution. With the experience of the ‘yellow vest’ movement in France in mind, our suspicion was that the carbon tax may have been regressive, reducing the incomes and expenditures of the poorest the most.

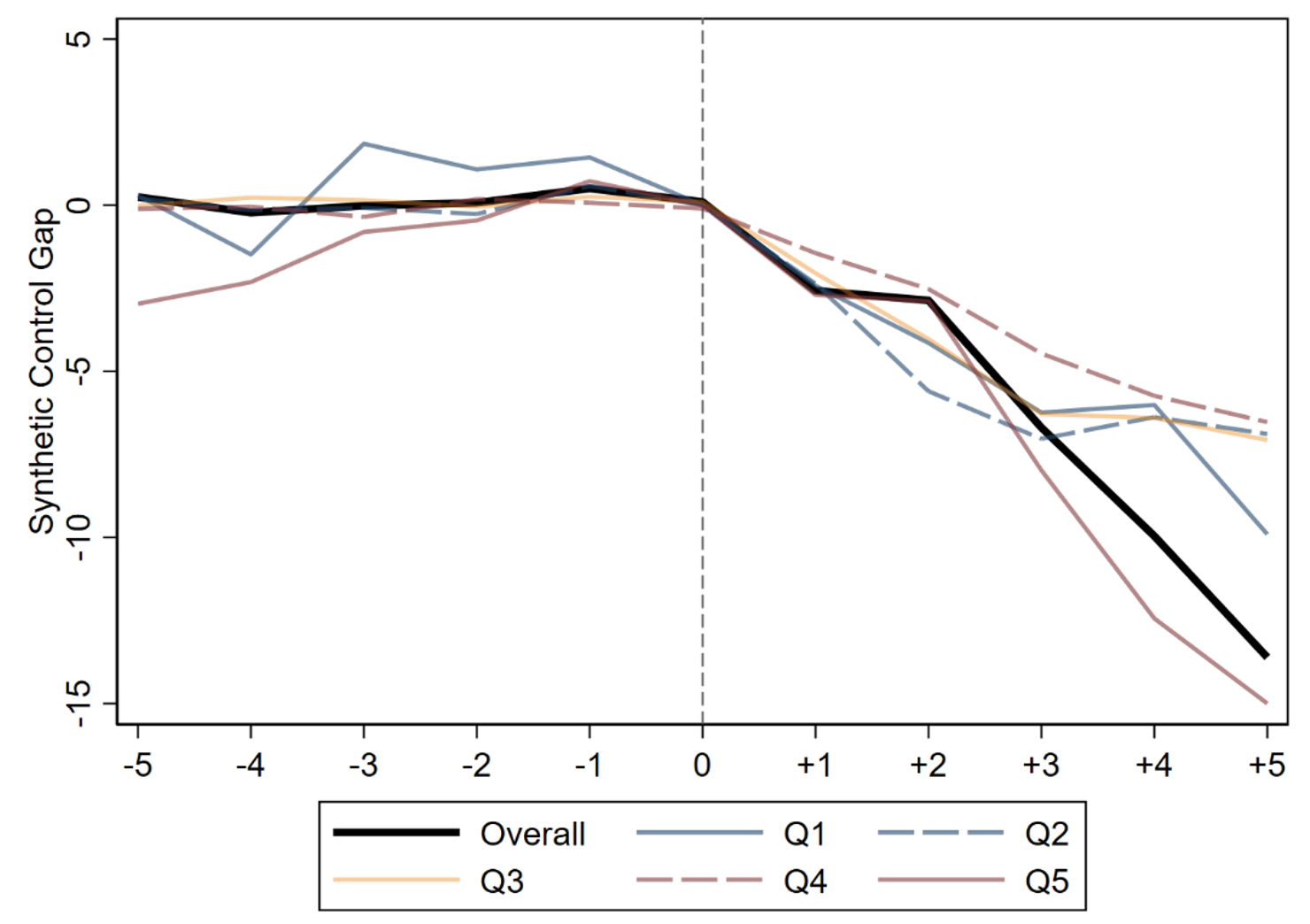

Our results suggest that following the carbon tax introduction, (real) household income and consumption expenditure fell in British Columbia compared to the rest of Canada. Along the lines of prior studies (e.g. Metcalf 2019), we find no negative effect of the carbon tax on GDP. We illustrate the effect graphically in Figure 2 by comparing households of different income in British Columbia to a plausible counterfactual (synthetic control).

Panel A highlights the fall in household income on average (dark solid line) and across income groups (coloured lines) in British Columbia after the introduction of the tax. After five years, the cumulative difference of average real household income in British Columbia is 10 percentage points below that of the counterfactual economy.

The same pattern holds for household expenditures (panel B) and is most pronounced for high-income households (red line). By contrast, the lowest income group increased expenditures following the taxation, potentially related to the progressive redistribution scheme in British Columbia.

In addition to the income channel, we find some support that the tax, through permanently higher energy prices, put downward pressure on the net present value of real estate and energy-intensive durable goods. Both the price of shelter and passenger vehicles fell in British Columbia after the enactment of the tax.

Figure 2 Income and expenditure, synthetic control gap

A. Income

B. Consumption expenditure

Note: This figure shows the synthetic control gap for household income (panel A) and household consumption expenditure (panel B). All series are in real terms and were smoothed using a symmetric moving average. Solid dark line is the total response, coloured lines correspond to the 5 different income quintiles (Q1: bottom, Q5: top).

Conclusions: No angst

Our initial intuition was in line with that of Larry Finks; we expected to find a positive effect of carbon taxes on inflation and mostly wondered about its size. Our findings, instead, point the other way. In both Canada and Europe, the evidence suggests that introducing carbon taxes had deflationary, rather than inflationary, effects. We explored several possible avenues to explain these findings. The most promising candidate explanation is that the carbon taxes may have reduced household income and expenditures, thus depressing non-energy prices.

Even though our analysis provides no support for an inflationary effect, deflation is equally undesirable and central banks still have to pay close attention to carbon pricing and taxation. Moreover, the absent reaction of monetary policy in most jurisdictions that introduced carbon taxes might have contributed to the deflationary outcome in the first place. No doubt, further research will be needed to draw the broader implications of carbon price shocks for optimal monetary policy responses.

References

Abadie, A, A Diamond, and J Hainmueller (2010), “Synthetic control methods for comparative case studies: Estimating the effect of California’s tobacco control program”, Journal of the American Statistical Association 105(490): 493–505.

Jordà, Ò (2005), “Estimation and inference of impulse responses by local projections”, American Economic Review 95 (1): 161–182.

Konradt, M and B Weder di Mauro (2021), “Carbon Taxation and Inflation: Evidence from Canada and Europe”, CEPR Discussion Paper 16396.

McKibbin, W J, A C Morris, and P J Wilcoxen (2014), “The economic consequences of delay in US climate policy”, Brookings Climate and Energy Economics Discussion Paper.

Metcalf, G E (2019), “On the economics of a carbon tax for the United States”, Brookings Papers on Economic Activity 2019(1): 405–484.

Metcalf, G E and J H Stock (2020), “Measuring the macroeconomic impact of carbon taxes.” AEA Papers and Proceedings 110: 101–06.

Yamazaki, A (2017), “Jobs and climate policy: Evidence from British Columbia’s revenue-neutral carbon tax”, Journal of Environmental Economics and Management 83: 197–216.

Endnotes

1 See https://www.bloomberg.com/news/articles/2021-06-18/the-climate-change-fight-is-adding-to-the-global-inflation-scare