Central banks across the world are starting to experiment with digital currencies. A 2021 BIS Survey of central banks “has found that 86% are actively researching the potential for CBDCs, 60% were experimenting with the technology and 14% were deploying pilot projects” (BIS 2021). Just last year, the Bahamas became the first country to introduce a CBDC nationwide (the sand dollar) and in April, the Eastern Caribbean became the first currency union central bank to issue digital cash.1 Overall, the BIS reports that at least 46 central banks are currently actively designing or planning for the possible introduction of digital currencies (Auer et al. 2020). This year, the Bank of England and the Treasury announced the joint creation of a Central Bank Digital Currency (CBDC) Taskforce to explore a potential UK CBDC.2

Most transactions in the UK are already conducted ‘digitally’, and cash comprises only a small fraction of the money base issued by central banks. However, digital money is currently mostly in the form of private bank deposits. Furthermore, few households and non-financial corporations have direct access to central bank liabilities, except through physical bills and coins. The introduction of a CBDC can be seen simultaneously as a way to replace cash with a digital alternative and a way to give households less intermediated access to central bank liabilities.

Auer and Böhme (2021) provide a useful summary of current proposals regarding the implementation of CBDCs. These differ primarily in the extent to which the non-financial private sector is granted direct access to central bank liabilities. Current suggestions range from direct CBDC, where households have direct claims on the central bank, with the latter handling retail payments directly, through hybrid or intermediated solutions where private firms execute and keep track of payments (but with the CBDC remaining a direct household or firm claim on the central bank); to indirect architectures, where private financial institutions (including banks) provide payment services using liabilities that are fully backed by central bank reserves.

Walker (2020) enumerates the benefits a CDBC could bring. These include bringing ‘smart contracts’ and distributed ledger (blockchain) technologies to conventional units of account, expanding financial inclusion, reducing disease transmission linked to the use of bank notes and coins, and curtailing illegal uses of cash. It has also been argued that central banks’ seigniorage and ability to conduct countercyclical monetary policy would both increase with CBDCs. Barrdear and Kumhoff (2016) evaluate these last two economic benefits to the UK at 3% of GDP. The BIS (2021) qualifies that “[t]he ultimate benefits of adopting a new payment technology will depend on the competitive structure of the underlying payment system and data governance arrangements. The same technology that can encourage a virtuous circle of greater access, lower costs and better services might equally induce a vicious circle of data silos, market power and anti-competitive practices. CBDCs and open platforms are the most conducive to a virtuous circle.”

The main concern voiced regarding CBDCs is the harm they might cause to the banking system, and therefore potentially to the entire economy. The risk is that CBDCs could fully replace bank deposits, removing banks’ primary funding source. Banks will no longer intermediate savings to investment, which may deprive the non-financial sector of a major financing source. Fernández-Villaverde et al (2020) formalise this argument with a theoretical model of CBDCs in which private banks are still necessary because of their investment expertise. The model predicts that the central bank will become a monopolist depositary institution because of its capacity to deter bank runs. In contrast, Andolfato (2020) develops a model of CBDCs which shows that digital currencies need not reduce banks’ profitability or monopoly power and may even serve to increase them. Andy Haldane posits that “a widely-used digital currency could change the topology of banking fundamentally… the traditional model of banking familiar for over 800 years could be disrupted.” But Haldane sees opportunities, not only risks in this disruption: “This radically different topology, while not costless, would reduce at source the fragilities in the banking model that have been causing financial crises for over 800 years.” Lastly, Walker (2020) argues against CBDCs, stating that their benefits are limited and that the main motivation for their creation is a vague fear that the private sector will usurp central banks’ money-creation monopoly.

This month’s CfM survey asks its members about the desirability and risk of a Bank of England CBDC.

Question 1: How beneficial would it be to the UK economy for the Bank of England to introduce a central bank digital currency in some form in the upcoming decade?

Nineteen panel members responded to this question. 84% of panel members think a CBDC would benefit the UK economy, although none viewed a CBDC as “very beneficial”. The remainder of the panel thought a CBDC would neither be beneficial or harmful.

Roger Farmer (University of Warwick) sees CBDCs as the “logical” response to the threat posed to national currencies by private crypto-currencies. He believes that “National digital currencies, and the state monopolization of this function, are the logical next step in the evolution of money.” To Jagjit Chada (National Institute of Economic and Social Research), a CBDC would be helpful “to the extent that it increases participation in the financial system, efficiency in transactions and reduces illegal uses of cash.” Jumana Saleheen (CRU Group) similarly points towards a potential improvement in terms of monetary policy transmission. “At present”, she states, “monetary policy is implemented through repo transactions between the central bank and major high street banks, [… which can create] frictions in the transmission of monetary policy. CBDC removes those frictions.” Lastly, she claims that CBDCs may facilitate the implementation of negative interest rates and could increase the UK economy’s productivity.

On the other hand, some panellists believe that a CBDC would disrupt the UK banking sector but view this disruption favourably. Nicolas Oulton (London School of Economics) views greater competition in (and with) the UK banking sector as a good thing: “As far as retail customers are concerned banks only innovate when really pushed by forces outside the banking sector.” David Miles (Imperial College London) adds: “Substantially reducing the risk of bank runs by providing a safe means of payment and a default free home for funds for the risk averse would remove the need to have deposit protection schemes. It would also remove the need for so much bank regulation and supervision designed to stop banks with retail deposits owned by very risk averse households taking inappropriate risks.”

Some panellists think that the hype around CBDCs overstates the impact – positive or negative – they will have on the economy. In the likelihood that a British CBDC would operate under indirect infrastructures, David Cobham (Heriot Watt University) posits that its economic effects are likely to remain “marginal”. In a similar vein, Martin Ellison (University of Oxford) argues that “digital currencies will only be a sideshow in the next decade. Debit cards became available in the 1980s and 1990s, but it was not until 2018 that payments by debit card exceeded those by cash in the UK. Even if the Bank of England introduces a central bank digital currency in the next decade, it will take time before it becomes an accepted part of the financial market landscape.”

Finally, a few panel members stated that the devil is in the details of CBDC design. To Costas Milas (University of Liverpool), CBDCs are “beneficial provided that we do not rush into the project for the sake of it. Currently, the whole idea is more like a shot in the dark as there are too many unknowns. concerns regarding the ifs and hows of CBDC interest rate determination and its impact on “the value of the traditional sterling exchange rate.” Ricardo Reis (LSE) adds that “Given the current state of knowledge, [the] pros outweigh the cons. But we are still learning about it.” In turn, Panicos Demetriades (University of Leicester) lays a series of ground rules for optimal CBDC operation: “If CBDC is introduced by [the] BoE, […] it will likely be through financial intermediaries providing the interface, as central banks in general should not be aiming to displace intermediaries by taking deposits directly from the public. It will also likely come with relatively low limits, e.g. no higher than deposit insurance limits to prevent unfair competition with commercial banks. Additionally, there will have to be strict anti-money laundering (AML) checks […] at least at every entry point.” Ultimately, Demetriades concludes that CBDCs will only be introduced if the BoE finds ways to ensure effective regulation.

The panel was also asked about the potential effects of a Bank of England CBDC on the UK banking system.

Question 2: What effect will the introduction of a CBDC have on UK banks?

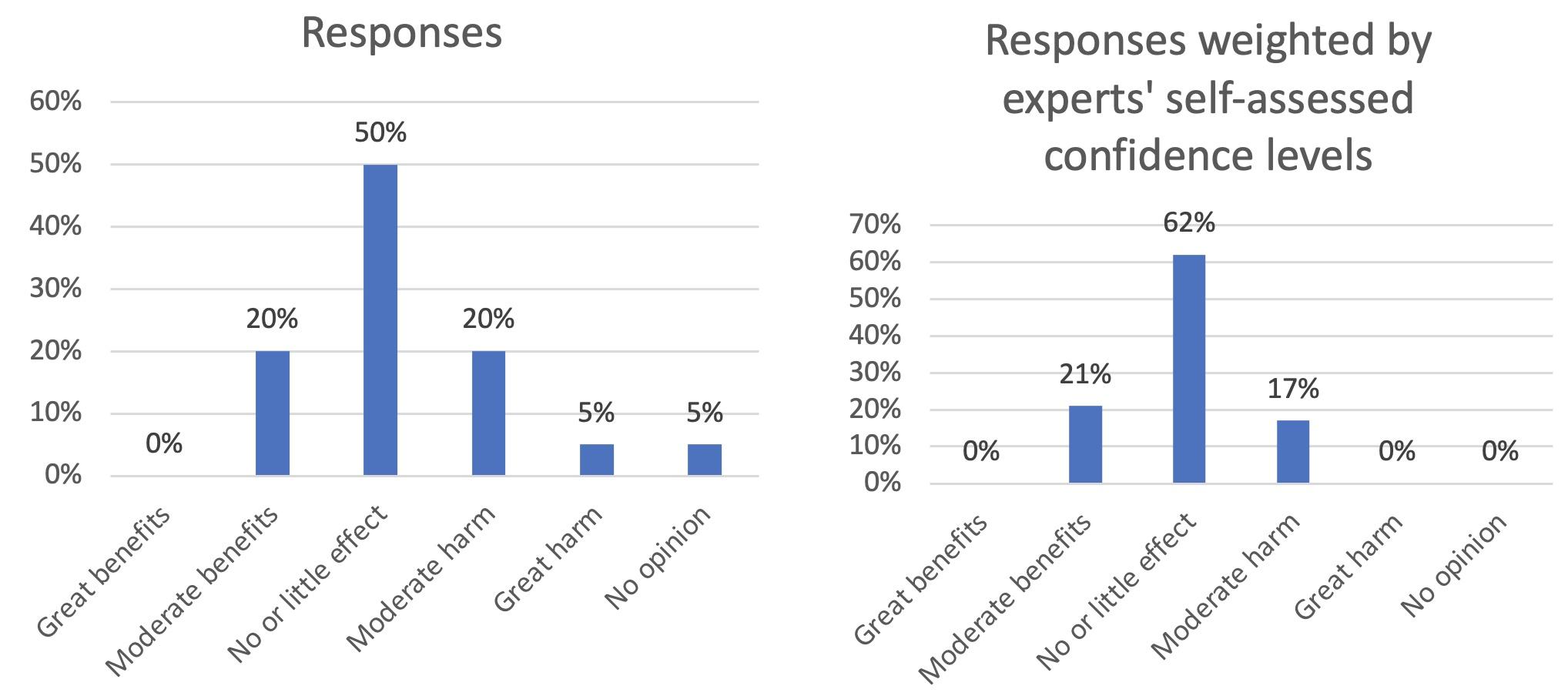

Twenty members of the panel answered this question. Half of the respondents think a CBDC would have no or little effect on the UK banking system. This share increases to 62% when weighting responses by the experts’ self-assessed confidence levels. The remainder of the panel is roughly equally divided between those thinking a CBDC would harm the British banking system (20% of respondents viewing the harm as moderate and 5% as great) and those thinking a CBDC would yield benefits, with 20% viewing these as moderate.

Respondents identified various potential adverse effects the introduction of a CBDC could have on the UK’s financial system. According to Salaheen, “central bank digital currencies will be the next big disrupter to the financial system”, and disruption levels will depend on the CBDC’s functioning. “At one extreme, if [one] can hold a central bank digital currency account, and undertake all transactions through that account, [one does] not need a high street bank account. This CBDC innovation has the potential to be the final nail in the coffin with respect to banks' traditional role as an intermediary between borrowers and savers. Some of that disruption is already underway with the growth of challenger banks (such as the Monzo app) and the availability of loans from non-bank financial institutions.” David Miles further argues that the introduction of a CBDC would potentially remove commercial banks’ insurance of their retail deposits. Finally, Nicolas Oulton predicts that “[a] CBDC would move the banks towards a greater reliance on equity financing.” He argues that while this would improve bank safety at the systemic level, this “is something they have resisted fiercely since the global financial crisis,” because it will erode banks’ profits.

Others noted that CBDCs are merely a sideshow to the greater upheavals in financial and payment technologies. Ricardo Reis writes: “Banks in the last few years have already suffered [from] great competition from fin-techs in the operation of payments. The counterfactual of no CBDC is not the status quo of ten years ago. Also, as the BIS excellent research output in this area has shown, the ultimate impact depends on which type of CBDC comes to life, and in some of them banks benefit greatly.”

Finally, some respondents pointed to the resilience of the banking system, its adaptability, and the likelihood that CBDCs will be designed to contain damages to banks. Roger Farmer suggests that “private banks will evolve, as they always have, to provide intermediation services in different ways. It is fallacious to believe that commercial banks need deposits to function. There are many other ways of providing the maturity transformation and risk intermediation services that characterize the activities of modern banks.” Martin Ellison adds that “outside of a financial crisis, there is limited appetite to “rock the boat” with financial innovation. This means that the role of a newly launched central bank digital currency will, by design, likely to be limited. Radical proposals are unlikely to fly, so it is difficult to see sufficient disruption to upend 800 years of traditional banking.” For similar reasons, Panicos Demetriades believes that CBDCs may well benefit private banks: “CBDC will not displace but complement financial intermediation and will not be a major source of competition for funds. CBDC could benefit banks, if they end up providing the infrastructure and clearing system of this new form of payment.”

References

Auer, R G Cornelli and J Frost (2020), “Rise of the Central Bank Digital Currencies: Drivers, Approaches and Technologies”, BIS Working Papers No 880.

Auer, R and R Böhme (2021), “Central Bank Digital Currency: the Quest for Minimally Invasive Technology”, BIS Working Papers No 948.

Bank of England (2021), “Bank of England Statement on Central Bank Digital Currency”, 19 April.

Bank of International Settlements (2021), Annual Report.

Barrdear, J and M Kumhoff (2016), “The Macroeconomics of Central Bank Issued Digital Currencies”, Bank of England Working Paper No. 605.

Boar, C and A Wehrli (2021), “Ready, steady, go? - Results of the Third BIS Survey on Central Bank Digital Currency”, Bank for International Settlements, 27 January.

Kiff, J, J Alwazir, S Davidovic et al. (2020), “A Survey of Research on Retail Central Bank Digital Currency”, IMF Working Paper 20/104.

Walker, M C (2020), “Central Bank Digital Currency – Nine Key Questions Answered”, LSE Blog, 15 December.

Endnotes

1 https://www.euronews.com/next/2021/05/04/what-are-central-bank-digital-currencies-and-could-they-take-on-cryptocurrencies

2 https://www.bankofengland.co.uk/news/2021/april/bank-of-england-statement-on-central-bank-digital-currency