Financial stability initially served as one of the principal motivations for the creation of a centralised monetary authority (along with providing stability in the value of money). However, the definition of financial stability has changed significantly over time. In the 18th and 19th centuries, it meant avoiding or managing banking panics – that is, serving as a lender of last resort to the banking system and the payments system. This changed in the 20th century with the adoption of the real bills doctrine (Meltzer 2004), followed by the Federal Reserve in its early years, which implied that the central bank should head off asset price booms.

Our recent study blends the quantitative with narrative explanations of the evolution of central banks (Bordo and Siklos 2017). Our quantitative analysis covers the period from 1870 to 2015. We provide an overview of the evolution of monetary policy regimes, taking note of the changing role of different meanings of financial stability over time. We quantify the similarities and idiosyncrasies for ten central banks.1 We also consider some counterfactuals that ask what inflation (and real GDP performance) might have looked like in select economies, had central banks been created earlier than was actually the case, and what course inflation would take if inflation targeting had not been introduced in some of the countries that eventually adopted this monetary policy strategy.

Small open economies are especially useful harbingers of reform and change in central banking, especially during the second half of the 20th century, particularly following the Bretton Woods system – which arguably represents the last gasp of large economies dictating the monetary policy strategy of small open economies. The latter evince greater responsiveness to global shocks emanating from dominant economies over time. They also often experience crises whose duration is less persistent but happen frequently enough to prompt changes in how monetary policy is carried out.

Policymakers continue to search for ways to cooperate across the many financial crises that have plagued the global economy over the centuries. Unfortunately, this kind of strategy does not bode well for the future of central banking for at least four reasons. First, financial crises are not alike except insofar as they all create significant to severe economic costs. Second, the central bank remains a critical institution within government. Autonomy or independence cannot prevent governments from eventually getting the monetary policy they want. Third, unless the pendulum swings back to greater sharing of sovereignty across countries, domestic imperatives will ultimately dictate central banks’ behaviour. Finally, even if financial crises of the global variety are a thing of the past, political economy considerations are unlikely to relegate to history booms and busts in financial and business cycles. In particular, central banks may lose their prominence among the institutions responsible for carrying out stabilisation policies (e.g. see Geithner 2016).

Annual data from an earlier paper (Bordo and Siklos 2016) were updated to 2015. The data represent the accumulation of data disseminated over the years by many scholars, including from some individual central banks.

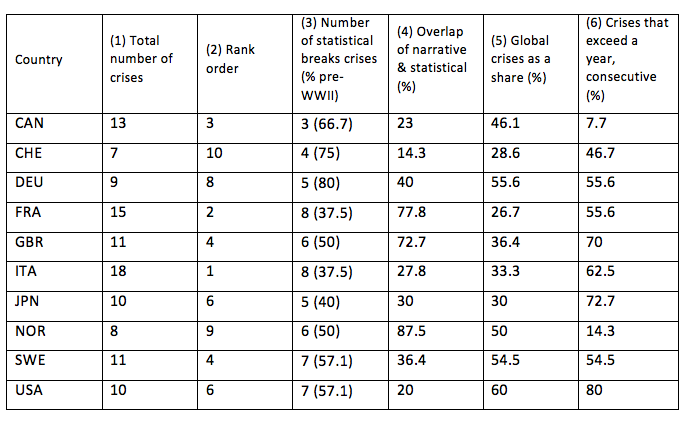

To illustrate some of our findings, consider Table 1, which provides some perspective on the importance of financial crises based on both narrative and statistical approaches. The small open economies (SOEs) in the sample do comparatively well across the various indicators of crisis conditions, especially Norway and Switzerland (see column 3, for example). Although this result does not exclusively reflect the quality of monetary policy in these economies, it is likely one of the factors at play in the relatively small number of statistical breaks in inflation. Most of the breaks for SOEs are observed before WWII. The extent to which global crises, based on the narrative approach, dominate the landscape of crises in the individual countries sampled varies. Global crises are least frequent in Switzerland (two of seven crises identified) while half, or a slightly higher proportion of the total, accounts for crises in four of the ten economies examined (the US, Germany, Norway, and Sweden). There is also considerable variation in the fraction of crises that exceed a year in duration. There are differences in the degree of agreement between the statistical and narrative dating of financial crises. The overlap between the quantitative and narrative interpretations of history is not small. The results suggest that both approaches are essential for a proper understanding of the determinants of crises and the potential role of central banks.

Table 1 The anatomy of financial crises

Note: see Table 7, Bordo and Siklos (2017) for sources and other calculation details.

Another illustration comes from counterfactual experiments. The basic premise of our counterfactuals is that there exist common factors that drive economic variables of interest, whether or not there is some treatment or intervention (Hsaio et al. 2012). Therefore, we can use information in the cross-section of inflation and real economic growth performance in countries that had a central bank, to ask how these two variables would have behaved had a central bank existed in a country that did not have one over the same period. We also use the Hsiao et al. (2012) approach to ask about macroeconomic performance if targeting had not been adopted.

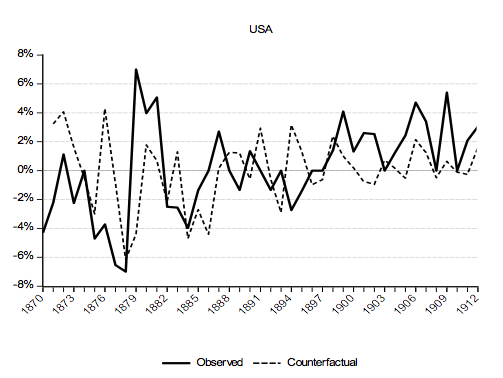

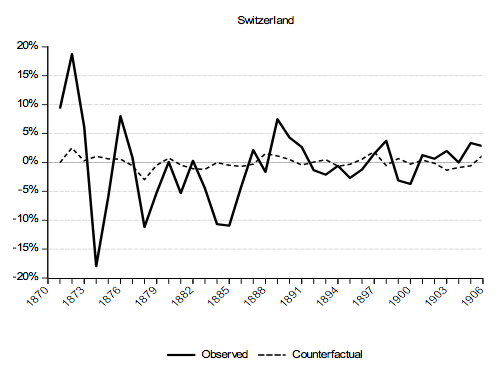

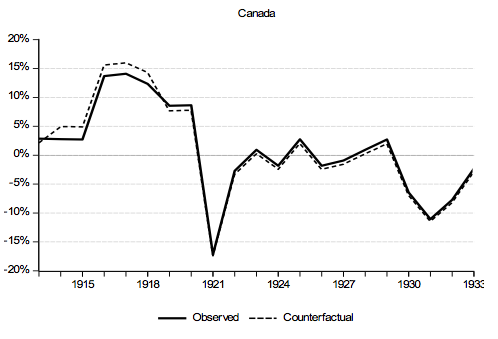

Figures 1 and 2 display some of the counterfactuals. Figure 1 plots what inflation would have been like if the Swiss National Bank (middle), the US Federal Reserve (top), and the Bank of Canada (bottom) had been in existence before they were actually created. The smallest impact from the late introduction of central banking is observed for Canada. The observed and counterfactual lines are almost on top of each other. Thanks to the Finance Act of 1907, Canada arguably had a quasi-central bank before the Bank of Canada’s creation. In the case of Switzerland, inflation would have been not much different, on average, but considerably less volatile. Finally, in the US case, it is difficult to see any impact on inflation and inflation volatility had the Fed been in place in 1870. It should be pointed out that the raison d’être of the Fed lies in the search for financial stability, not inflation stability, and the series of financial crises that hit the US throughout the period shown testifies to the real problem with the monetary regime in the US.

Figure 1 Counterfactual experiment: Inflation had the Swiss National Bank, Federal Reserve, and Bank of Canada been created earlier

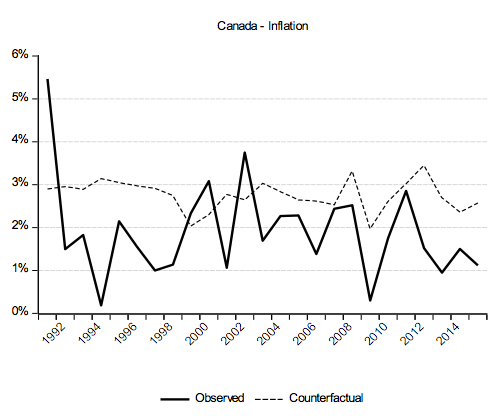

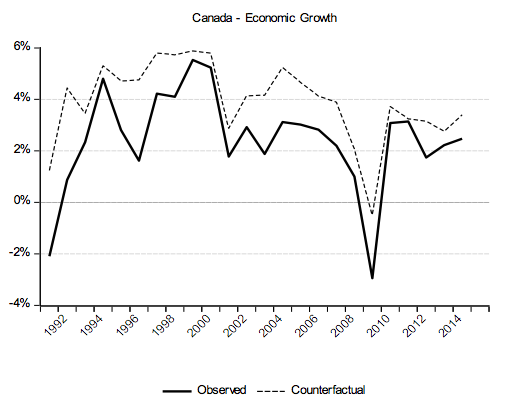

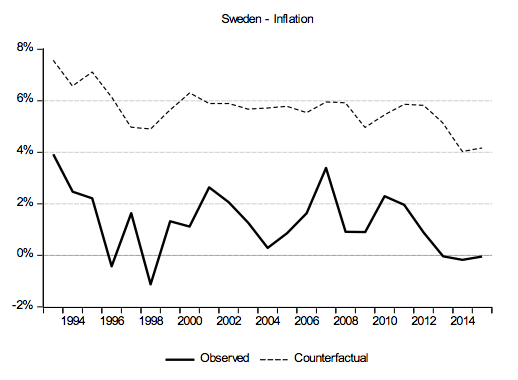

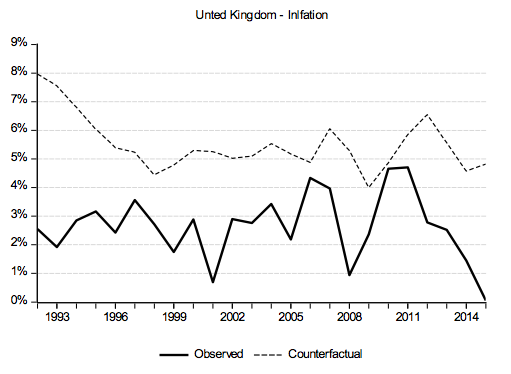

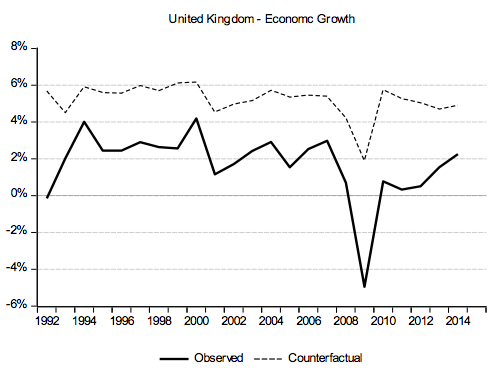

Figure 2 considers the inflation consequences of inflation targeting. We ask what inflation and growth would have been if Canada (1991), Sweden (1993), and the UK (1992) had not adopted an inflation-targeting strategy (adoption years in parenthesis). The US, Japan, and Switzerland did not adopt inflation targeting, so these economies act as the controls in estimating the treatment effect of the strategy. We define the treatment period as the period since Bretton Woods until inflation targeting is adopted. It is immediately clear that inflation is almost always higher in the absence of an inflation target. Other than for Canada, differences between observed and counterfactual inflation rates show that the improvement in inflation performance is considerable. For real economic growth, the evidence is more mixed with real economic growth lower under inflation targeting than in the counterfactual case.

Figure 2 Counterfactual experiments: Inflation and real economic growth with and without inflation targeting

There are few indications that price stability is no longer a desirable objective, but central banks are being asked to widen the scope of their mandate to include evincing a concern for financial stability. Long before some central banks were given a macroeconomic stability mandate, their task was, for a time, largely centred on the maintenance of financial stability. This took place at a time when little thought was given about whether the monetary authority should be autonomous from government. Since we now accept central bank autonomy is useful, it is less clear how this principle is squared with an expectation that financial stability and monetary stability are both tasks that a central bank ought to carry out.

We have not seen the last of attempts to improve how monetary policy is conducted, nor in how central banks are governed. Just as the pendulum has swung back to the monetary authorities evincing a concern for financial stability, the same forces will lead to a rewriting of the ‘contract’ between the central bank and the government. Whether this means a loss of autonomy or the development of a contingent contract between the central bank and government remains to be seen. Clearly, crisis times require a different approach to policy than normal times.

References

Bordo, M D, and P L Siklos (2017), “Central Banks: Evolution and Innovation in Historical Perspective”, NBER working paper 23847.

Bordo, M D, and P L Siklos (2016), “Central Bank Credibility: An Historical and Quantitative Exploration”, in M D Bordo, Ø Eitrheim, M Flandreau, and J Qvigstad (eds.) Central Banks At A Crossroads, Cambridge, MA: Cambridge University Press, 62-144.

Geithner, T (2016), “Are We Safer? The Case for Updating Bagehot”, Per Jacobsson Lecture, October 8, Washington, DC.

Hsiao, C, H S Ching, and S K Wan (2012), “A Panel Data Approach for Program Evaluation: Measuring the Benefits of Political and Economic Integration of Hong Kong With Mainland China”, Journal of Applied Econometrics, 27, 705-740.

Meltzer, A H (2004), A History of the Federal Reserve, vol 1: 1913-1951, Chicago: University of Chicago Press.

Endnotes

[1] They are: Canada, France, Germany, Italy, Japan, Norway, Sweden, Switzerland, the UK, and the US.