On 11 September 2001, US money markets unexpectedly closed. Foreign banks with significant dollar investments funded by rolling over financing from US money markets found themselves in a crisis. The Federal Reserve resolved the problem with a novel emergency liquidity facility – the Fed would lend the Bank of Canada, the Bank of England, and the ECB up to $90 billion through a swap line against their local currency, which these central banks would then lend out to banks in their own jurisdictions. One month later, when money markets had reopened, the swap line was closed and a liquidity crisis was averted.

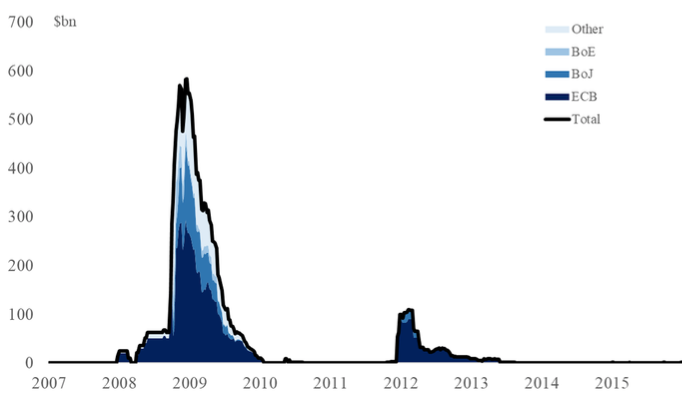

When the financial crisis erupted, central banks revived this tool. In 2007, European banks which had become reliant on US money markets needed liquidity assistance. In December, a $20 billion swap line was arranged with the ECB, and within one year a dozen other central banks too. The lines were heavily used between September 2008 and January 2009, with volumes peaking at $586 billion (Figure 1). In October 2013, the swap lines were made into permanent standing arrangements of unstated sizes between the Fed and five advanced country central banks: the Bank of Canada, Bank of England, Bank of Japan, ECB, and Swiss National Bank.

Figure 1 Federal Reserve dollar lending through its swap line

In a recent paper, we provide an analysis of the role played by these swap lines along three dimensions: in central bank operations; in financial markets; and in the macroeconomy (Bahaj and Reis 2018). For concreteness, we focus on the dollar swap lines provided by the Fed. These accounted for the bulk of activity during and after the crisis. Swap lines are not limited to dollars. For example, the Swiss National Bank has established swap lines with the Polish and Hungarian central banks, and the People’s Bank of China has established a network of swap lines involving more than 40 countries. Today, there are an estimated 160 bilateral swap lines between central banks around the world and they are a significant part of the global financial architecture (di Mauro and Zettlemeyer 2017).

Central bank operations

The typical features of the swap line are that the Fed gives dollars to the recipient central bank for an equivalent amount of their currency at today's exchange rate. The two central banks agree that, after a period (typically one week to three months), they will resell to each other their respective currencies at the initial exchange rate. The Fed sets and charges an interest rate on the dollars. The recipient central bank lends the dollars out to financial institutions in its jurisdiction at the same maturity and rate. It requires the same collateral as with its own currency liquidity facilities. If the financial institutions default, the recipient-central bank either buys dollars to honour the swap or, if it misses payment, it loses the currency held at the Fed.

Drawing on the swap line increases the dollar money supply. Because this meets an increase in demand for dollars by recipient country banks, it is in principle consistent with controlling inflation. The recipient central bank’s currency never enters circulation, and is held instead by the Fed, so there are no direct monetary policy implications. Both central banks face no exchange-rate or interest-rate risk. For the Fed, credit risk arises solely from the recipient central bank. For the recipient central bank there is credit risk, but no more than with its other liquidity facilities.

Swap lines are not exchange rate interventions, they are not needed to address current account imbalances, nor do they require the participating central banks to take abnormal risks. They are a liquidity facility, providing dollars to recipient-country banks. The presence of the recipient central bank is novel – doing the monitoring, picking the collateral, and enforcing repayment. This division of tasks is justified as this liquidity operation involves the dollar monetary base, but the banks that are borrowing are regulated by the recipient central bank, which will have superior information on their solvency, and so on.

There are alternatives to swap lines. First, major foreign banks are likely to be able to directly access the Fed’s lending facilities. Yet for the bank, the swap line is advantageous in that usage is confidential and does not require the transfer of collateral to a US branch or subsidiary. The Fed benefits from the outsourcing of the monitoring function; indeed, the Fed was hesitant to lend to foreign banks through its discount window (FOMC 2011).

Second, the recipient central bank could lend FX reserves. If these are insufficient they could be supplemented by borrowing dollars in private markets. However, private borrowing would not increase the dollar monetary base and would occur at a time when intermediaries are distressed, potentially increasing the expense.

The third option is for recipient-country banks to borrow local currency from the recipient central bank and use a derivative contract to remove the FX risk. If covered interest parity (CIP) holds, this ‘synthetic’ dollar borrowing would come at no additional cost. But CIP broke down with the crisis (Du et al. 2018), so, for example, borrowing in euros and converting the funding into dollars via a private FX swap is more expensive than borrowing dollars directly. Further, a swap line means that recipient-central banks become lenders in two different currencies. As we discuss next, this has consequences for CIP.

Financial markets

Consider the following trade. A recipient-country bank borrows dollars from its central bank through the swap line. The bank then buys domestic currency with the dollars at today's spot rate and signs a forward contract to exchange it back for dollars when the loan matures. It deposits this domestic currency at its central bank's deposit facility, earning the interest on reserves.

All lending and borrowing involves the central bank. This trade is riskless (ignoring negligible counterparty risk in the forward). From no arbitrage, banks should not be able to make money. However, the CIP deviation is the difference between the spot and forward rate plus the difference between the domestic and dollar interest rates. If the CIP deviation exceeds the difference between the swap line rate and dollar interest rate plus the difference between the domestic interest rate and the interest on reserves, then the trade is in the money.

The swap line therefore places a ceiling on CIP deviations. This aligns with the standard result that a central bank’s domestic lending facility puts a ceiling on interbank rates. And it relies on similar no-arbitrage logic. There are details regarding maturities, collateral, and regulation that can add additional wedges. Nonetheless, the ceiling result remains.

Does the ceiling hold in the data? Figure 2 plots US dollar-CIP deviations and the swap line ceiling for pounds and euros. The shock to CIP deviations from the Lehman failure is clearly visible, as well as persistent deviations over the sample period. From September 2008, when the swap lines became heavily used, the ceiling holds well. The only exceptions are around year-end, when markets are less liquid and swap line auctions cease.

Figure 2 CIP deviations and the swap line ceiling

As a more direct test, consider CIP deviations before and after the Fed lowered the spread charged on swap lines from 100 to 50 basis points on 30 November 2011. We compare the behaviour of currencies where the central bank had access to the swap line to those without. Figure 3 gives a graphical representation of this difference-in-differences approach, in the form of histograms. In line with the notion of a ceiling, there is a clear impact of the lower swap rate on the right tail of CIP deviations for swap line currencies.

Figure 3 CIP deviation for currencies with and without dollar swap lines before and after the swap line rate change

The macroeconomy

What are the macroeconomic implications? Swap lines provide dollar liquidity insurance and lower banks’ funding costs. We can form two predictions:

- a lower swap rate makes dollar assets more attractive for banks in swap line jurisdictions; and

- by lowering funding costs, a cheaper swap line increases the profitability of banks that have dollar funding needs.

To test these two predictions, again consider the November 2011 change. To test the first, we use data from the UK Financial Conduct Authority on trading in individual corporate bonds. We compare net purchases of dollar bonds versus bonds in other currencies by banks headquartered in jurisdictions with access to the swap line versus in jurisdictions without (and the US) before and after the rate change. Figure 4 summarises the findings graphically by showing the difference between the daily net flow into the average dollar bond and the average non-dollar bond for swap line banks versus other banks. Banks located in swap line jurisdictions increased their purchases of dollar denominated assets relative to other banks and to other denominations when the swap line became cheaper. To test the second, Figure 5 plots the excess returns of banks in swap line countries that have operations in the US versus those that do not and those not in swap line countries. The swap rate cut generated excess returns in the banks most likely to benefit.

Figure 4 Excess flows into USD bonds averaged across banks and bonds around the rate swap line rate change

Figure 5 Cumulative bank excess returns averaged across different banks after the swap line rate change

Conclusion

Combined, the theory and evidence support an important role for swap lines in the global economy:

- they perform a basic function of liquidity provision based around cooperation between central banks;

- they have significant effects on deviations from CIP; and

- they incentivise cross-border gross capital flows.

References

Bahaj, S and R Reis (2018), “Central bank swap lines,” CEPR Discussion Paper 13003.

di Mauro, B W and J Zettelmeyer (2017), “The new global financial safety net: Struggling for coherent governance in a multipolar system," CIGI Essays in International Finance 4.

Du, W, A Tepper and A Verdelhan (2018), “Deviations from covered interest rate parity," Journal of Finance 73(3).

FOMC (2011), “Conference call of the Federal Open Market Committee on November 28, 2011".