News about monetary policy strongly affect asset prices in financial markets. The transmission of policy news to asset prices mostly occurs through changes in risk premia rather than changes in expectations about fundamentals. Among others, Bernanke and Kuttner (2005) provide such evidence for stocks, Bekaert et al. (2013) for stock market volatility, and Gertler and Karadi (2015) for credit spreads.

Policy actions as well as quantitative releases by central banks are typically accompanied by information that comes in the form of verbal communication. Central banks use such communication to explain their policy decisions, the economic outlook, and to shape market expectations. Central bank communication is thus closely followed by market participants, who do not only pay attention to the content but also to the tone of central bank statements, i.e. to how the central bank frames its policy decisions and the economic outlook. Thus, a natural question is whether and how the tone of communication matters for asset prices. In our recent work (Schmeling and Wagner 2019), we show that tone matters for asset prices through a risk-based channel, beyond policy actions and economic fundamentals.

Measuring the tone of central bank communication

We measure the tone of the ECB president in press conferences held after meetings of the ECB Governing Council. The ECB holds scheduled monetary policy meetings on Thursdays, announces its interest rate decision at 13:45 CET, and holds a press conference at 14:30 CET. Since press conferences take place during trading hours, financial markets can react to new information instantaneously, and the staggered timing of rate announcement and press conferences allows us to disentangle market reactions to news about policy rates and communication (e.g. Ehrmann and Fratzscher 2009).

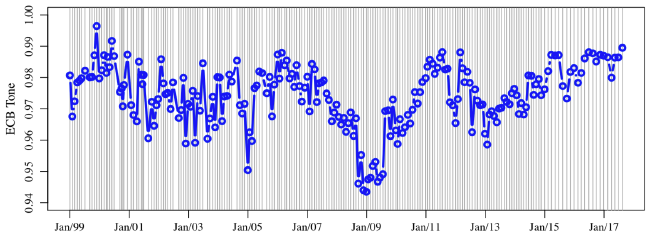

To quantify tone, we use the financial dictionary developed by Loughran and McDonald (2011) to identify negative words. We evaluate each statement's tone by assessing the prevalence of negative words in the text and construct a tone measure such that a higher value implies a more positive tone. Figure 1 plots the time series of ECB tone for the 209 press conferences between 1999 and 2017 and shows that ECB tone was most negative at the end of 2008/beginning of 2009.

Figure 1 Time series of ECB tone

More specifically, the press conference held on 15 January 2009 exhibits the most negative tone during our sample period, and we use it to illustrate the words and word sequences that drive our measure of tone. In the excerpt below, we highlight word sequences involving negative words that the ECB frequently uses and we mark the negative words according to Loughran and McDonald’s dictionary (by asterisks). From this statement, the sentence with the largest impact on our tone measure is from the discussion of economic risks, stating that:

“They relate mainly to the potential for a stronger impact on the real economy of the *turmoil* in financial markets, as well as to *concerns* about the emergence and intensification of protectionist pressures and to possible *adverse* developments in the world economy stemming from a *disorderly* *correction* of global *imbalances*”.

This example supports the view that tone captures the ECB's framing of economic and financial conditions as well as the economic outlook. In our paper, we provide a detailed analysis of the words driving our measure of tone and present additional evidence that tone conveys generic information about the (future) economy and monetary policy.

Changes in ECB tone and equity returns

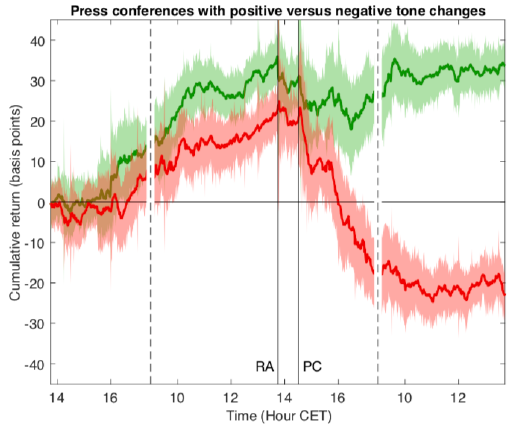

To identify the effects of changes in ECB tone on Eurozone stock returns, we exploit the staggered timing of policy rate announcements and press conferences. The top panel of Figure 2 shows cumulative (high-frequency) Eurostoxx 50 stock returns in the 48 hours around rate announcements, i.e. from 13:45 CET on the day before a council meeting until 13:45 CET on the day after a council meeting. The dashed lines indicate the start of a new trading day and the vertical lines indicate the policy rate announcement and the start of the press conference, respectively. On average, stock prices tend to increase before rate announcement but this rise is not permanent and is quickly reversed after the start of the press conference.1 The bottom panel of Figure 2 shows the effect of conditioning on the change in tone compared to previous press conferences – the green (red) line shows average cumulative returns for press conferences with a more positive (negative) tone. While there is almost no difference between these two lines before the start of the press conference, the two lines start to significantly diverge after the press conference has started and there is a large spread of about 60 basis points which is not reversed subsequently. In a battery of tests, we find similar tone effects in daily data, for a broader euro area index, as well as for EMU member country indices.

Figure 2 Stock returns around ECB press conferences

Note: ‘RA’ refers to the timing of the policy rate announcement, and ‘PC’ to the start of the press conference.

Evidence for a risk-based channel of central bank tone

A natural question is why the tone of central bank communication matters for asset prices. Does tone proxy for changes in expectations about current or future fundamentals, the stance of monetary policy, or for changes in risk aversion by market participants? Our analysis shows that changes in central bank tone are indeed significantly related to changes in the ECB’s macroeconomic projections and that tone changes tentatively forecast future policy rate changes and macro fundamentals. However, we also find that controlling for changes in expected fundamentals, measures of policy actions, as well as for other communication features (such as complexity or readability) does not eliminate the significant effect of tone changes on stock returns. Similarly, measures of fundamentals and the monetary policy stance leave a large chunk of movements in tone unexplained. This finding suggests that tone matters for stocks because it affects the risk appetite of market participants.

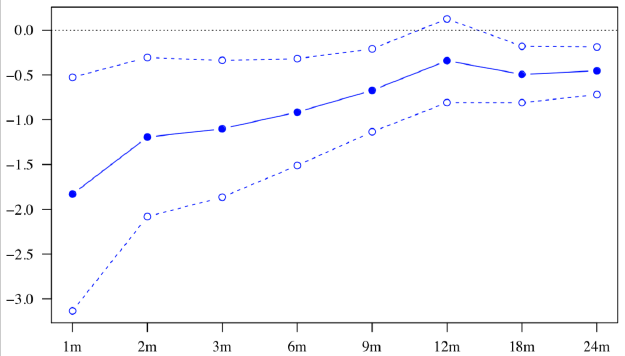

Consistent with such a risk-based channel, we find, first, that stocks with a higher exposure to systematic risk are also more sensitive to tone changes. Second, we test for a relation between tone changes and stock market volatility. On the one hand, we find that tone changes do not matter for (expected) realised volatility. On the other hand, we show that there is a significantly negative relation between changes in tone and changes in options-implied volatility measured by changes in the VSTOXX (a volatility index similar to the Chicago Board Options Exchange Volatility Index (VIX) in the US). To illustrate this relation, Figure 3 plots the tone sensitivities of VSTOXX indices with maturities ranging from one month to two years, controlling for policy actions and other communication features, along with 95% confidence intervals.

Figure 3 Tone sensitivities in the VSTOXX term structure

These results show that positive tone changes are associated with significant decreases of the VSTOXX, with the effect being more pronounced for shorter maturities. Since realised volatility is unrelated to tone changes, the VSTOXX results imply that a more positive ECB tone is associated with a lower price for volatility insurance due to lowered risk premia required by investors in excess of expected volatility. This, in turn, implies that a more positive ECB tone is associated with market participants lowering their risk aversion.

As a further robustness check, we show that yield spreads between BBB- and AAA-rated corporate bonds decrease when ECB tone becomes more positive, in particular for financial firms. Since the variation in credit spreads is mostly driven by risk premia, these results provide further evidence for a risk-based channel of central bank tone.

Conclusion

Central bank tone moves asset prices, even after controlling for policy actions and economic fundamentals. Our results are consistent with the idea that central bank tone is a generic policy tool that supplements other instruments of monetary policy. Similar to the risk-taking channel of policy actions (see the survey of Adrian and Liang 2018), our results suggest that tone affects the risk appetite of market participants and the risk premia they require. In this study, we have focused on the ECB, because it provides the longest history of press conferences to study tone effects on asset prices. More recently, several other central banks (including the Fed) have started to hold press conferences very similar to those of the ECB, with the aim to improve their communication with the public. It will be interesting to see how their tone matters for asset prices and our results may serve as a benchmark to gauge such communication effects.

References

Bekaert, G, M Hoerova and M Lo Duca (2013), “Risk, uncertainty, and monetary policy”, Journal of Monetary Economics 60: 771-788.

Bernanke, B S (2016), The courage to act: A memoir of a crisis and its aftermath, New York: W. W. Norton & Company.

Bernanke, B S and K N Kuttner (2005), “What explains the stock market's reaction to Federal Reserve policy?”, Journal of Finance 60: 1221-1257.

Ehrmann, M and M Fratzscher (2009), “Explaining monetary policy in press conferences”, International Journal of Central Banking 5: 41-84.

Gertler, M and P Karadi (2015), “Monetary policy surprises, credit costs and economic activity”, American Economic Journal: Macroeconomics 7: 44-76.

Loughran, T and B McDonald (2011), “When is a liability not a liability? Textual analysis, dictionaries, and 10-Ks”, Journal of Finance 66: 35-65.

Lucca, D O and E Moench (2015), “The pre-FOMC announcement drift”, Journal of Finance 70: 329-371.

Schmeling, M and C Wagner (2019), “Does central bank tone move asset prices?”, CEPR Discussion Paper 13490.

Endnotes

[1] Note that the reversal of average returns across all press conferences illustrated in the left panel of Figure 2 is qualitatively different from the pre-announcement drift documented for the US Federal Reserve in Lucca and Moench (2015).